Noticias del mercado

-

23:59

Schedule for today, Tuesday, Aug 25’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia Conference Board Australia Leading Index June 0.2%

03:00 New Zealand Expected Annual Inflation 2y from now Quarter III 1.9%

06:00 Germany GDP (YoY) (Finally) Quarter II 1.1% 1.6%

06:00 Germany GDP (QoQ) (Finally) Quarter II 0.3% 0.4%

07:15 Switzerland Employment Level Quarter II 4.23 4.24

08:00 Germany IFO - Business Climate August 108 107.8

08:00 Germany IFO - Current Assessment August 113.9 113.9

08:00 Germany IFO - Expectations August 102.4 102

13:00 Belgium Business Climate August -4.1 -3.6

13:00 U.S. Housing Price Index, m/m June 0.4%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y June 4.9% 5%

13:45 U.S. Services PMI (Preliminary) August 55.7 56

14:00 U.S. Richmond Fed Manufacturing Index August 13

14:00 U.S. New Home Sales July 482 510

14:00 U.S. Consumer confidence August 90.9 92.5

16:25 Canada BOC Deputy Governor Lawrence Schembri Speaks

20:30 U.S. API Crude Oil Inventories August -2.3

22:45 New Zealand Trade Balance, mln July -60

-

21:00

Dow -3.48% 15,886.23 -573.52 Nasdaq -3.67% 4,533.11 -172.93 S&P -3.97% 1,892.74 -78.15

-

19:15

Wall Street. Major U.S. stock-indexes pares losses

U.S. stock-indexes staged a dramatic recovery off their lows on Monday, helped by a turnaround in Apple's shares, but the three main indexes remained in or within spitting distance of correction territory amid fears China's growth is slowing. The Dow Jones industrial average - which fell into the correction zone on Friday - briefly slumped more than 1,000 points, its biggest point-drop ever. At midday, the Dow was down about 243 points or 1.48 percent as bargain hunters stepped in. The Dow has never lost more than 800 points in a day.

Almost all of Dow stocks in negative area (27 of 30). Top looser - The Coca-Cola Company (KO, -2.45%). Top gainer - Intel Corporation (INTC, +2.90).

All S&P index sectors in negative area. Top looser - Financial (-1.7%).

At the moment:

Dow 16302.00 -165.00 -1.00%

S&P 500 1947.25 -24.25 -1.23%

Nasdaq 100 4186.00 -14.75 -0.35%

10 Year yield 2,04% -0,02

Oil 39.29 -1.16 -2.87%

Gold 1154.80 -4.80 -0.41%

-

18:25

WSE: Session Results

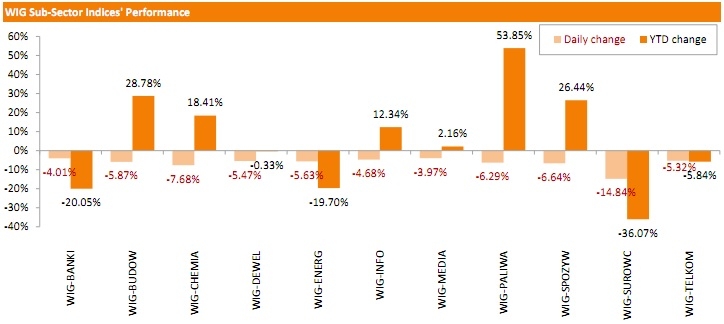

Polish Equity market tumbled on Monday amid collapse in global markets. The broad market measure, the WIG Index, went down by 5.66%. Materials sector (-14.84%) was the biggest drag on the index, followed by chemicals (-7.68%), food (-6.64%) and oil and gas sectors (-6.29%).

The large-cap stocks' measure, the WIG30 Index, fell by 5.87%. All index components generated losses. BOGDANKA (WSE: LWB) was the poorest performer, plunging 29.66% on news that the company's key client ENEA (WSE: ENA; -8.84%) terminated a long-term coal supply contract. KGHM (WSE: KGH) emerged as the second worst-performing stock in the index basket, slumping by 12.76% as copper prices continued to crumble. GRUPA AZOTY (WSE: ATT) and JSW (WSE: JSW) also posted double-digit losses, dropping by 11.71% and 10.32%.

-

18:00

European stocks closed: FTSE 100 5,898.87 -288.78 -4.67% CAC 40 4,383.46 -247.53 -5.35% DAX 9,648.43 -476.09 -4.70%

-

18:00

European stocks close: stocks closed lower on concerns over the global slowdown

Stock indices closed lower as a selloff on markets around the world continued. The Japanese Nikkei stock index fell almost 4%, while China's Shanghai Composite declined more than 8%.

Concerns over a slowdown in the Chinese economy weighed on markets.

China allowed pension funds to invest in domestic stocks. Pension funds are now able to invest up to 30% of their net assets in domestic stocks.

China hopes with this decision to boost the liquidity on the stock market and to stop a massive selloff.

According to the newspaper the Financial News, the People's Bank of China (PBoC) plans to use a mix of innovative monetary policy tools to inject liquidity into the financial system. The central bank wants to make "flexible use" of the new tools.

The new tools should replace foreign-exchange purchases.

The Confederation of British Industry (CBI) released its economic growth forecasts for the U.K. The CBI expects Britain's economy to expand 2.6% this year, up from the previous estimate of 2.4%, and 2.8% in 2016, up from the previous estimate of 2.5%.

The upgrade was driven by higher increase in in productivity and household spending.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,898.87 -288.78 -4.67 %

DAX 9,648.43 -476.09 -4.70 %

CAC 40 4,383.46 -247.53 -5.35 %

-

17:41

Oil prices drop more than 4.5%

Oil prices hit 6-1/2-year lows on Monday on concerns over the global oil oversupply and on worries over the global slowdown. The Japanese Nikkei stock index fell almost 4%, while China's Shanghai Composite declined more than 8%. European and U.S. sticks are also trading lower.

Concerns over a slowdown in the Chinese economy weighed on markets.

China allowed pension funds to invest in domestic stocks. Pension funds are now able to invest up to 30% of their net assets in domestic stocks.

China hopes with this decision to boost the liquidity on the stock market and to stop a massive selloff.

According to the newspaper the Financial News, the People's Bank of China (PBoC) plans to use a mix of innovative monetary policy tools to inject liquidity into the financial system. The central bank wants to make "flexible use" of the new tools.

The new tools should replace foreign-exchange purchases.

The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 2 rigs to 674 last week. It was the fifth consecutive increase.

Combined oil and gas rigs remained unchanged at 884.

WTI crude oil for October delivery declined to $38.61 a barrel on the New York Mercantile Exchange.

Brent crude oil for October decreased to $43.10 a barrel on ICE Futures Europe.

-

17:24

Gold price declines due to a selloff in commodities

Gold price increased on concerns over the global slowdown, but declined later due to a selloff in commodities. The Japanese Nikkei stock index fell almost 4%, while China's Shanghai Composite declined more than 8%. European and U.S. sticks are also trading lower.

Concerns over a slowdown in the Chinese economy weighed on markets.

China allowed pension funds to invest in domestic stocks. Pension funds are now able to invest up to 30% of their net assets in domestic stocks.

China hopes with this decision to boost the liquidity on the stock market and to stop a massive selloff.

According to the newspaper the Financial News, the People's Bank of China (PBoC) plans to use a mix of innovative monetary policy tools to inject liquidity into the financial system. The central bank wants to make "flexible use" of the new tools.

The new tools should replace foreign-exchange purchases.

September futures for gold on the COMEX today decreased to 1156.20 dollars per ounce.

-

16:55

The People’s Bank of China plans to use a mix of innovative monetary policy tools

According to the newspaper the Financial News, the People's Bank of China (PBoC) plans to use a mix of innovative monetary policy tools to inject liquidity into the financial system. The central bank wants to make "flexible use" of the new tools.

The new tools should replace foreign-exchange purchases.

-

16:24

Reserve Bank of New Zealand Deputy Governor Grant Spencer: the interest rate hike is off the table for some time

The Reserve Bank of New Zealand (RBNZ) Deputy Governor Grant Spencer said on Monday that the interest rate hike is off the table for some time.

Spencer also said that low interest rates are contributing to housing demand pressures.

-

16:12

Japanese Prime Minister Shinzo Abe: it would ok if the Bank of Japan will miss its inflation target

Japanese Prime Minister Shinzo Abe said on Monday that it would ok if the Bank of Japan (BoJ) will miss its inflation target.

"I understand the BoJ's explanation that achieving the target has, as a matter of fact, become difficult under these circumstances," he said.

The central bank wants to achieve its 2% inflation target by September next year.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1325(E227mn)

USD/JPY: Y121.50($380mn), Y122.00($666mn), Y123.00($1.0bn)

EUR/GBP: Gbp0.7160(E223mn)

USD/CAD: C$1.3125($190mn), C$1.3250($413mn)

-

15:34

U.S. Stocks open: Dow -5.95%, Nasdaq -7.87%, S&P -4.83%

-

15:29

Before the bell: S&P futures -3.84%, NASDAQ futures -4.96%

U.S. index futures signaled losses will cascade in the world's biggest stock market as the Nasdaq 100 Index contract hit its daily loss limit of 5%.

Global Stocks:

Nikkei 18,540.68 -895.15 -4.61%

Hang Seng 21,251.57 -1,158.05 -5.17%

Shanghai Composite 3,210.9 -296.85 -8.46%

FTSE 5,922.2 -265.45 -4.29%

CAC 4,391.62 -239.37 -5.17%

DAX 9,676.64 -447.88 -4.42%

Crude oil $38.98 (-3.81%)

Gold $1156.00 (-0.32%)

-

15:23

Standard & Poor's affirms its sovereign ratings of European Financial Stability Facility at 'AA/A-1+'

Standard & Poor's Ratings Services has affirmed its sovereign ratings of European Financial Stability Facility at 'AA/A-1+' on Friday. The outlook is negative.

-

15:13

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

International Paper Company

IP

43.89

-0.95%

3.6K

Barrick Gold Corporation, NYSE

ABX

7.88

-1.59%

50.0K

United Technologies Corp

UTX

91.40

-1.73%

12.6K

AT&T Inc

T

32.50

-2.64%

146.7K

Verizon Communications Inc

VZ

44.85

-2.71%

67.5K

American Express Co

AXP

74.90

-2.77%

19.5K

Wal-Mart Stores Inc

WMT

64.70

-2.77%

32.3K

McDonald's Corp

MCD

94.42

-2.79%

34.6K

UnitedHealth Group Inc

UNH

113.00

-2.82%

23.0K

Procter & Gamble Co

PG

69.75

-2.91%

42.3K

Merck & Co Inc

MRK

54.11

-2.98%

31.1K

Johnson & Johnson

JNJ

92.70

-2.99%

51.0K

3M Co

MMM

137.65

-3.12%

22.3K

Goldman Sachs

GS

181.56

-3.29%

21.0K

Travelers Companies Inc

TRV

99.50

-3.33%

2.3K

Home Depot Inc

HD

112.00

-3.58%

18.0K

International Business Machines Co...

IBM

143.50

-3.59%

17.0K

Boeing Co

BA

126.80

-3.73%

18.7K

Pfizer Inc

PFE

32.24

-3.88%

60.3K

Nike

NKE

102.63

-3.97%

28.4K

Caterpillar Inc

CAT

72.00

-4.00%

34.1K

Intel Corp

INTC

25.48

-4.07%

100.2K

Walt Disney Co

DIS

94.80

-4.09%

115.1K

The Coca-Cola Co

KO

37.90

-4.12%

129.3K

E. I. du Pont de Nemours and Co

DD

49.80

-4.23%

15.9K

ALCOA INC.

AA

8.35

-4.35%

138.2K

Microsoft Corp

MSFT

41.19

-4.36%

202.9K

General Electric Co

GE

23.48

-4.51%

279.3K

Hewlett-Packard Co.

HPQ

26.23

-4.51%

138.3K

AMERICAN INTERNATIONAL GROUP

AIG

57.00

-4.57%

5.4K

Google Inc.

GOOG

584.50

-4.57%

43.6K

JPMorgan Chase and Co

JPM

60.63

-4.67%

115.9K

Cisco Systems Inc

CSCO

25.22

-4.72%

162.2K

Deere & Company, NYSE

DE

79.00

-5.15%

12.8K

FedEx Corporation, NYSE

FDX

148.00

-5.15%

2.0K

Ford Motor Co.

F

13.13

-5.27%

88.1K

Apple Inc.

AAPL

100.09

-5.36%

4.5M

ALTRIA GROUP INC.

MO

51.00

-5.44%

48.8K

Exxon Mobil Corp

XOM

68.20

-5.45%

213.6K

Amazon.com Inc., NASDAQ

AMZN

466.10

-5.74%

45.4K

Yandex N.V., NASDAQ

YNDX

10.37

-5.81%

31.7K

HONEYWELL INTERNATIONAL INC.

HON

92.77

-6.18%

2.3K

Facebook, Inc.

FB

80.70

-6.23%

890.1K

Citigroup Inc., NYSE

C

50.20

-6.34%

163.2K

General Motors Company, NYSE

GM

27.55

-6.93%

226.3K

Visa

V

65.89

-7.44%

168.6K

Chevron Corp

CVX

70.08

-7.50%

58.1K

Twitter, Inc., NYSE

TWTR

23.91

-7.58%

341.6K

Starbucks Corporation, NASDAQ

SBUX

48.71

-7.82%

157.3K

Yahoo! Inc., NASDAQ

YHOO

30.28

-8.05%

72.6K

Tesla Motors, Inc., NASDAQ

TSLA

211.50

-8.35%

85.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.70

-9.19%

140.6K

-

15:08

Japan‘s final leading index climbs to 106.5 in June

Japan's Cabinet Office released its final leading index data for Japan on Monday. The leading index for Japan climbed to 106.5 in June from 106.0 in June. It was the highest level since March 2014.

May's figure was revised down from 106.2.

The coincident index rose to 112.3 in June from 111.3 in May. May's figure was revised up from 109.0.

-

15:06

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Neutral from Underperform at BofA/Merrill

Bank of America (BAC) upgraded from Mkt Perform to Outperform at Keefe Bruyette

NIKE (NKE) upgraded from Market Perform to Outperform at Telsey Advisory Group, target raised from $115 to $122

Downgrades:

Other:

Deere (DE) reiterated at Sector Perform at RBC Capital Mkts, target lowered from $90 to $85

-

14:45

Chicago Fed National Activity Index rises to 0.34 in July

The Federal Reserve Bank of Chicago released its National Activity Index on Monday. The index rose to 0.34 in July from -0.07 in June. June's figure was revised down from 0.08.

The production-related indicator increased to +0.28 in July from -0.14 in June.

The employment-related indicator remained unchanged at +0.11 in July.

The personal consumption and housing indicator rose to -0.06 in July from -0.10 in June.

-

14:30

U.S.: Chicago Federal National Activity Index, July 0.34

-

14:13

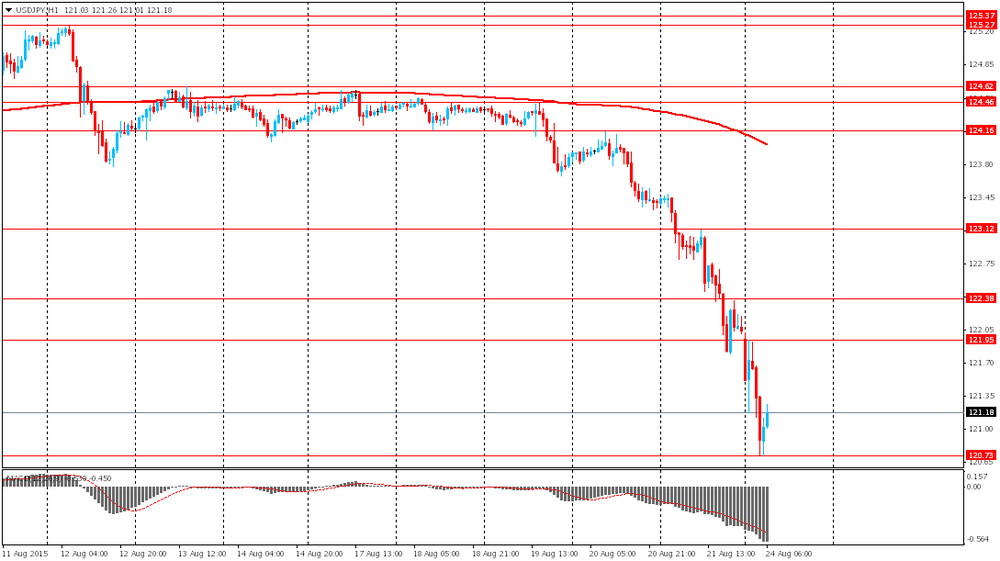

Foreign exchange market. European session: the Japanese yen traded higher against the U.S. dollar due to increasing demand for the safe-haven currency

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Leading Economic Index (Finally) June 106.0 Revised From 106.2 106.5

05:00 Japan Coincident Index (Finally) June 111.3 Revised From 109.0 112.3

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. Chicago Federal National Activity Index data.

Concerns over a slowdown in the Chinese economy weighed on the greenback. The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) (released on Friday) decreased to 47.1 in August from 47.8 in July, missing expectations for a decline to 47.7, and hitting a 77-month low.

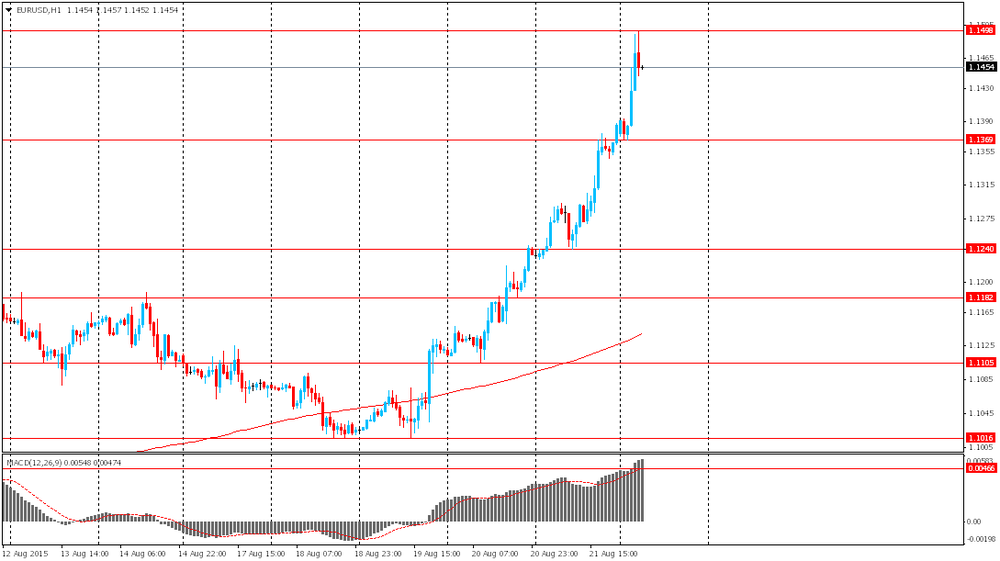

The euro traded higher against the U.S. dollar in the absence of any major economic report from the Eurozone. The currency pair was supported by a weaker U.S. dollar.

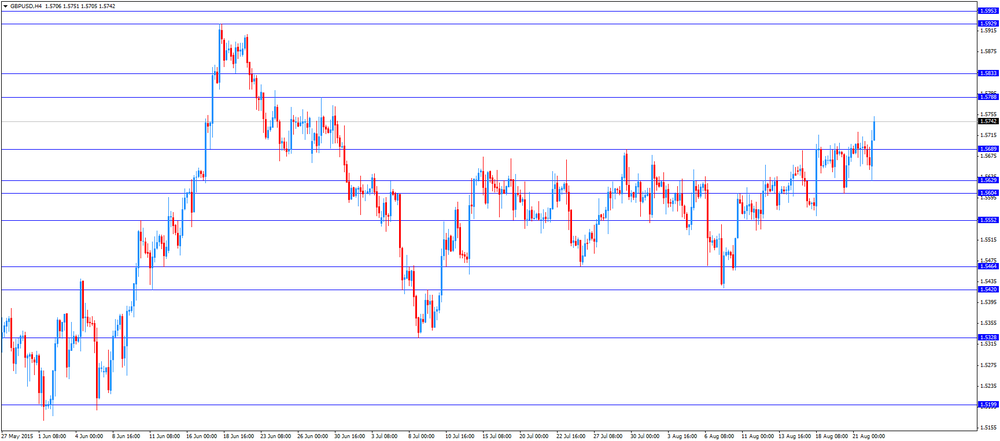

The British pound traded higher against the U.S. dollar in the absence of any major economic report from the Eurozone. The currency pair was supported by a weaker U.S. dollar.

The Confederation of British Industry (CBI) released its economic growth forecasts for the U.K. The CBI expects Britain's economy to expand 2.6% this year, up from the previous estimate of 2.4%, and 2.8% in 2016, up from the previous estimate of 2.5%.

The upgrade was driven by higher increase in in productivity and household spending.

The Japanese yen traded higher against the U.S. dollar due to increasing demand for the safe-haven currency.

EUR/USD: the currency pair rose to $1.1541

GBP/USD: the currency pair increased to $1.5751

USD/JPY: the currency pair fell to Y119.53

The most important news that are expected (GMT0):

12:30 U.S. Chicago Federal National Activity Index July 0.08

19:55 U.S. FOMC Member Dennis Lockhart Speaks

-

13:48

Orders

EUR/USD

Offers 1.1480-85 1.1500 1.1525 1.1550 1.1565 1.1580 1.1600

Bids 1.1440 1.1420-25 1.1400 1.1380 1.1350 1.1300 1.1300 1.1285 1.1265 1.1250

GBP/USD

Offers 1.5685 1.5700 1.5725-30 1.5735 1.5750 1.5780 1.5800 1.5830 1.5850

Bids 1.5630-35 1.5625 1.5600 1.5580 1.5565 1.5545-50 1.5525-30 1.5500

EUR/GBP

Offers 0.7350 0.7365 0.7380-85 0.7400 0.7420 0.7445-50

Bids 0.7300-05 0.7285 0.7265-70 0.7250 0.7230 0.7200

EUR/JPY

Offers 138.85 139.00 139.35 139.50 140.00

Bids 138.20 138.00 137.75-80 137.50 137.25-30 137.00 136.80 136.50

USD/JPY

Offers 121.25-30 121.50 121.65 121.85 122.00 122.20 122.50

Bids 120.70-75 120.50 120.40 120.20 120.00 119.85 119.50

AUD/USD

Offers 0.7265 0.7285 0.7300 0.7330 0.7350 0.7380 0.7400

Bids 0.7200 0.7185 0.7170 0.7150 0.7125-30 0.7100

-

12:03

European stock markets mid session: stocks drop more than 2%

Stock indices dropped more than 2% in the morning trading session, following Asian stock indices. The Japanese Nikkei stock index fell almost 4%, while China's Shanghai Composite declined more than 8%.

Concerns over a slowdown in the Chinese economy weighed on markets.

China allowed pension funds to invest in domestic stocks. Pension funds are now able to invest up to 30% of their net assets in domestic stocks.

China hopes with this decision to boost the liquidity on the stock market and to stop a massive selloff.

The Confederation of British Industry (CBI) released its economic growth forecasts for the U.K. The CBI expects Britain's economy to expand 2.6% this year, up from the previous estimate of 2.4%, and 2.8% in 2016, up from the previous estimate of 2.5%.

The upgrade was driven by higher increase in in productivity and household spending.

Current figures:

Name Price Change Change %

FTSE 100 6,045.23 -142.42 -2.30 %

DAX 9,882.13 -242.39 -2.39 %

CAC 40 4,525.13 -105.86 -2.29 %

-

11:37

China allows pension funds to invest in domestic stocks

China allowed pension funds to invest in domestic stocks. Pension funds are now able to invest up to 30% of their net assets in domestic stocks.

China hopes with this decision to boost the liquidity on the stock market and to stop a massive selloff.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1325(E227mn)

USD/JPY: Y121.50($380mn), Y122.00($666mn), Y123.00($1.0bn)

EUR/GBP: Gbp0.7160(E223mn)

USD/CAD: C$1.3125($190mn), C$1.3250($413mn)

-

11:18

The Confederation of British Industry upgrades its economic growth forecasts for the U.K.

The Confederation of British Industry (CBI) released its economic growth forecasts for the U.K. The CBI expects Britain's economy to expand 2.6% this year, up from the previous estimate of 2.4%, and 2.8% in 2016, up from the previous estimate of 2.5%.

The upgrade was driven by higher increase in in productivity and household spending.

"Strong domestic demand and upbeat official data since our last forecast has boosted our outlook for 2015. We expect this strength to continue into next year," the CBI's director of economics, Rain Newton-Smith, said.

-

11:04

The number of active U.S. rigs rose by 2 rigs to 674 last week

The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 2 rigs to 674 last week. It was the fifth consecutive increase.

Combined oil and gas rigs remained unchanged at 884.

-

10:44

U.S. Treasury Secretary Jacob Lew: China should reduce a dependence on exports

U.S. Treasury Secretary Jacob Lew said on Friday that China should reduce a dependence on exports and move the economy toward a dependence on consumption. Lew spoke with Chinese Vice Premier Wang Yang, pointing to the progress on China's commitments to "move towards a more flexible, market-determined exchange rate, limit foreign exchange intervention to disorderly market conditions, and increase the transparency of its exchange rate policies".

-

10:32

A former Greek Energy Minister Panagiotis Lafazanis and at least 25 Syriza lawmakers create new party

A group of at least 25 Syriza lawmakers led by Panagiotis Lafazanis, a former Energy Minister, abandoned the party to create a new movement called Popular Unity. The party is now the third-largest party in the Greek parliament, and could form a new administration.

Greek Prime Minister Alexis Tsipras has submitted his resignation on Thursday evening and called for early elections. Tsipras is seeking a mandate to implement reforms.

-

10:20

Fitch Ratings: the snap election in Greece could have a negative impact on the success of the third bailout programme

Fitch Ratings said on Friday that the snap election in Greece could have a negative impact on the success of the third bailout programme.

"A September election would occur before the first programme review in October and may well hamper and delay the technical work and political decisions necessary for its completion. Relations with creditors appear to have improved in the run-up to the bailout agreement on 14 August. But the likely pause in legislating for reforms during the election campaign coming so soon after the agreement was concluded may rekindle or reinforce some creditors' concerns about Greece's ability to meet the programme's requirements," the agency said.

-

10:13

European Commission: Greece should fulfil its promise made to its international lenders

The European Commission said on Friday that Greece should fulfil its promise made to its international lenders.

"It is crucial that Greece maintains its commitments to the euro zone. I recall the broad support in the Greek parliament for the new program and reform package and I hope the elections will lead to even more support in the new Greek parliament. Hopefully these elections will take place relatively soon so Greece can take important next steps in October, as foreseen," the head of the Eurogroup Jeroen Dijsselbloem said on Friday.

-

09:13

Oil prices fell further

West Texas Intermediate futures for October delivery plunged to $39.14 (-3.24%), while Brent crude fell to $44.29 (-2.57%) as investors took China's slowing economy for a sign of weaker demand amid ongoing oversupply. However data suggest that China's demand remains firm: the country's crude-oil imports rose 1.7 million barrels a day in July from a year earlier to 7.4 million barrels a day.

Iran's Oil Minister Bijan Zanganeh said that his country intends to raise oil output. Meanwhile the number of active drilling rigs in the U.S. rose in seven weeks out of eight and it currently stands at 674.

-

08:51

Gold declined slightly

Gold slid to $1,155.60 (-0.34%) on Monday morning. However concerns over a slowing Chinese economy and massive declines in stocks around the globe are likely to persuade investors to pay more attention to this safe-haven asset.

Bullion advanced to $1,168.40 on Friday, its highest level since July, and gained more than 4% last week, the most since the middle of January.

Expectations for a rate hike in the U.S. shifted to December or even the beginning of 2016 from September when Fed policymakers meet next.

-

08:11

Global Stocks: indices declined worldwide

On Friday U.S. stock indices dropped sharply as weak manufacturing data intensified concerns about China's economy.

The Dow Jones Industrial Average dropped 530.94 points, or 3.1%, to 16459.75. The S&P 500 fell 64.84 points, or 3.19%, to 1,970.89. The Nasdaq Composite plunged 171.45 points, or 3.52%, to 4,706.04.

About three quarters of the Dow Jones industrial average stocks and almost 70% of S&P 500 components were in correction territory, meaning their session lows were at least 10% below their 52-week highs. Energy stocks fell most among S&P's components.

This morning in Asia Hong Kong Hang Seng dropped 4.64%, or 1,039.92 points, to 21,369.70. China Shanghai Composite Index tumbled 8.45%, or 296.55 points, to 3,211.20. The Nikkei fell 3.63%, or 706.20 points, to 18,729.63.

China's Shanghai Composite dropped to a five-month low despite an official permission granted over the weekend for pension funds managed by local governments to invest in the stock market.

In Japan a stronger yen weighed on stocks. Officials were also cautious about weakness of China's economy.

-

08:06

Foreign exchange market. Asian session: the euro and the yen gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan Leading Economic Index (Finally) June 106.2 106.5

05:00 Japan Coincident Index (Finally) June 109.0 112.3

The yen and the euro continued rising against the U.S. dollar amid weak global growth and inflation outlook. Low inflation expectations affected investors' forecasts of a rate hike in the U.S. Now market participants expect the Federal Reserve to start tightening its monetary policy in December or in 2016.

The yen got some additional support as a safe-haven asset due to declines in Asian stocks.

Such commodity currencies as the Australian and New Zealand dollars fell amid lower oil prices and concerns over China's economy. These concerns were generated by weak manufacturing data from the world's second-biggest economy and the unexpected devaluation of the yuan on August 11.

EUR/USD: the pair rose to $1.1495 in Asian trade

USD/JPY: the pair fell to Y120.75

GBP/USD: the pair traded within $1.5660-95

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

12:30 U.S. Chicago Federal National Activity Index July 0.08

19:55 U.S. FOMC Member Dennis Lockhart Speaks

-

07:16

Japan: Leading Economic Index , June 106.5

-

07:16

Japan: Coincident Index, June 112.3

-

07:00

Options levels on friday, monday 24, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1580 (3755)

$1.1542 (2476)

$1.1507 (1927)

Price at time of writing this review: $1.1455

Support levels (open interest**, contracts):

$1.1343 (541)

$1.1281 (1345)

$1.1229 (1865)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 84404 contracts, with the maximum number of contracts with strike price $1,1300 (6407);

- Overall open interest on the PUT options with the expiration date September, 4 is 116684 contracts, with the maximum number of contracts with strike price $1,0500 (7815);

- The ratio of PUT/CALL was 1.38 versus 1.37 from the previous trading day according to data from August, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.6001 (1617)

$1.5902 (2248)

$1.5804 (2546)

Price at time of writing this review: $1.5685

Support levels (open interest**, contracts):

$1.5595 (999)

$1.5498 (2748)

$1.5399 (2155)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30590 contracts, with the maximum number of contracts with strike price $1,5600 (2793);

- Overall open interest on the PUT options with the expiration date September, 4 is 35116 contracts, with the maximum number of contracts with strike price $1,5500 (2748);

- The ratio of PUT/CALL was 1.15 versus 1.17 from the previous trading day according to data from August, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:05

Nikkei 225 18,944.46 -491.37 -2.53 %, Hang Seng 21,555.17 -854.45 -3.81 %, Shanghai Composite 3,374.04 -133.70 -3.81 %

-

00:59

Commodities. Daily history for Aug 21’2015:

(raw materials / closing price /% change)

Oil 40.29 -0.40%

Gold 1,159.50 -0.01%

-

00:51

Stocks. Daily history for Aug 21’2015:

(index / closing price / change items /% change)

Nikkei 225 19,435.83 -597.69 -2.98 %

Hang Seng 22,409.62 -347.85 -1.53 %

S&P/ASX 200 5,214.6 -73.98 -1.40 %

Shanghai Composite 3,509.98 -154.31 -4.21 %

FTSE 100 6,187.65 -180.24 -2.83 %

CAC 40 4,630.99 -152.56 -3.19 %

Xetra DAX 10,124.52 -307.67 -2.95 %

S&P 500 1,970.89 -64.84 -3.19 %

NASDAQ Composite 4,706.04 -171.45 -3.52 %

Dow Jones 16,459.75 -530.94 -3.12 %

-

00:46

Currencies. Daily history for Aug 21’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1386 +1,34%

GBP/USD $1,5691 +0,08%

USD/CHF Chf0,946 -1,33%

USD/JPY Y122,04 -1,11%

EUR/JPY Y138,96 +0,24%

GBP/JPY Y191,44 -1,13%

AUD/USD $0,7312 -0,29%

NZD/USD $0,6684 +0,87%

USD/CAD C$1,3186 +0,79%

-

00:01

Schedule for today, Monday, Aug 24’2015:

(time / country / index / period / previous value / forecast)

05:00 Japan Leading Economic Index (Finally) June 106.2

05:00 Japan Coincident Index (Finally) June 109.0

12:30 U.S. Chicago Federal National Activity Index July 0.08

19:55 U.S. FOMC Member Dennis Lockhart Speaks

-