Noticias del mercado

-

23:59

Schedule for today, Tuesday, Aug 25’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia Conference Board Australia Leading Index June 0.2%

03:00 New Zealand Expected Annual Inflation 2y from now Quarter III 1.9%

06:00 Germany GDP (YoY) (Finally) Quarter II 1.1% 1.6%

06:00 Germany GDP (QoQ) (Finally) Quarter II 0.3% 0.4%

07:15 Switzerland Employment Level Quarter II 4.23 4.24

08:00 Germany IFO - Business Climate August 108 107.8

08:00 Germany IFO - Current Assessment August 113.9 113.9

08:00 Germany IFO - Expectations August 102.4 102

13:00 Belgium Business Climate August -4.1 -3.6

13:00 U.S. Housing Price Index, m/m June 0.4%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y June 4.9% 5%

13:45 U.S. Services PMI (Preliminary) August 55.7 56

14:00 U.S. Richmond Fed Manufacturing Index August 13

14:00 U.S. New Home Sales July 482 510

14:00 U.S. Consumer confidence August 90.9 92.5

16:25 Canada BOC Deputy Governor Lawrence Schembri Speaks

20:30 U.S. API Crude Oil Inventories August -2.3

22:45 New Zealand Trade Balance, mln July -60

-

16:55

The People’s Bank of China plans to use a mix of innovative monetary policy tools

According to the newspaper the Financial News, the People's Bank of China (PBoC) plans to use a mix of innovative monetary policy tools to inject liquidity into the financial system. The central bank wants to make "flexible use" of the new tools.

The new tools should replace foreign-exchange purchases.

-

16:24

Reserve Bank of New Zealand Deputy Governor Grant Spencer: the interest rate hike is off the table for some time

The Reserve Bank of New Zealand (RBNZ) Deputy Governor Grant Spencer said on Monday that the interest rate hike is off the table for some time.

Spencer also said that low interest rates are contributing to housing demand pressures.

-

16:12

Japanese Prime Minister Shinzo Abe: it would ok if the Bank of Japan will miss its inflation target

Japanese Prime Minister Shinzo Abe said on Monday that it would ok if the Bank of Japan (BoJ) will miss its inflation target.

"I understand the BoJ's explanation that achieving the target has, as a matter of fact, become difficult under these circumstances," he said.

The central bank wants to achieve its 2% inflation target by September next year.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1325(E227mn)

USD/JPY: Y121.50($380mn), Y122.00($666mn), Y123.00($1.0bn)

EUR/GBP: Gbp0.7160(E223mn)

USD/CAD: C$1.3125($190mn), C$1.3250($413mn)

-

15:23

Standard & Poor's affirms its sovereign ratings of European Financial Stability Facility at 'AA/A-1+'

Standard & Poor's Ratings Services has affirmed its sovereign ratings of European Financial Stability Facility at 'AA/A-1+' on Friday. The outlook is negative.

-

15:08

Japan‘s final leading index climbs to 106.5 in June

Japan's Cabinet Office released its final leading index data for Japan on Monday. The leading index for Japan climbed to 106.5 in June from 106.0 in June. It was the highest level since March 2014.

May's figure was revised down from 106.2.

The coincident index rose to 112.3 in June from 111.3 in May. May's figure was revised up from 109.0.

-

14:45

Chicago Fed National Activity Index rises to 0.34 in July

The Federal Reserve Bank of Chicago released its National Activity Index on Monday. The index rose to 0.34 in July from -0.07 in June. June's figure was revised down from 0.08.

The production-related indicator increased to +0.28 in July from -0.14 in June.

The employment-related indicator remained unchanged at +0.11 in July.

The personal consumption and housing indicator rose to -0.06 in July from -0.10 in June.

-

14:30

U.S.: Chicago Federal National Activity Index, July 0.34

-

14:13

Foreign exchange market. European session: the Japanese yen traded higher against the U.S. dollar due to increasing demand for the safe-haven currency

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Leading Economic Index (Finally) June 106.0 Revised From 106.2 106.5

05:00 Japan Coincident Index (Finally) June 111.3 Revised From 109.0 112.3

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. Chicago Federal National Activity Index data.

Concerns over a slowdown in the Chinese economy weighed on the greenback. The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) (released on Friday) decreased to 47.1 in August from 47.8 in July, missing expectations for a decline to 47.7, and hitting a 77-month low.

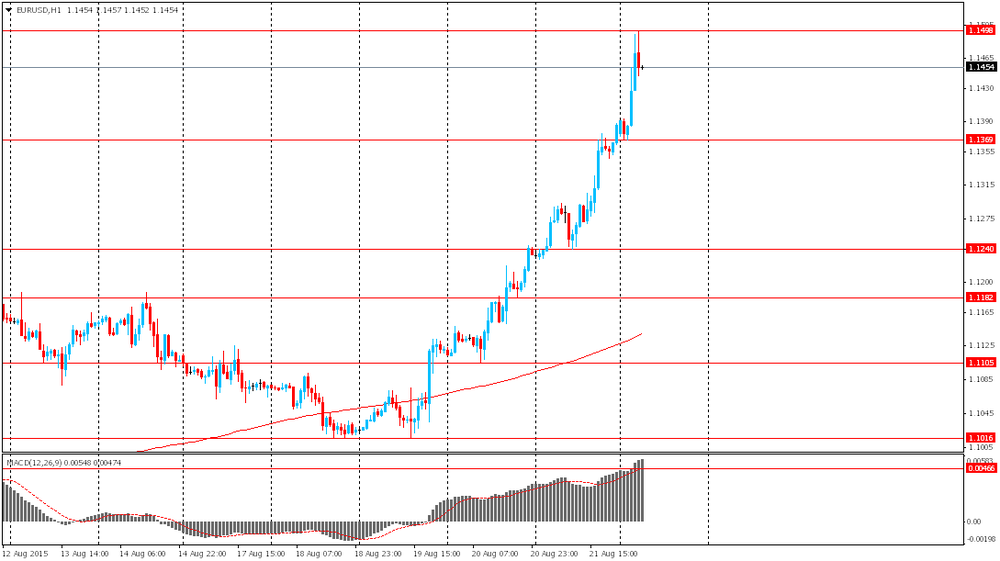

The euro traded higher against the U.S. dollar in the absence of any major economic report from the Eurozone. The currency pair was supported by a weaker U.S. dollar.

The British pound traded higher against the U.S. dollar in the absence of any major economic report from the Eurozone. The currency pair was supported by a weaker U.S. dollar.

The Confederation of British Industry (CBI) released its economic growth forecasts for the U.K. The CBI expects Britain's economy to expand 2.6% this year, up from the previous estimate of 2.4%, and 2.8% in 2016, up from the previous estimate of 2.5%.

The upgrade was driven by higher increase in in productivity and household spending.

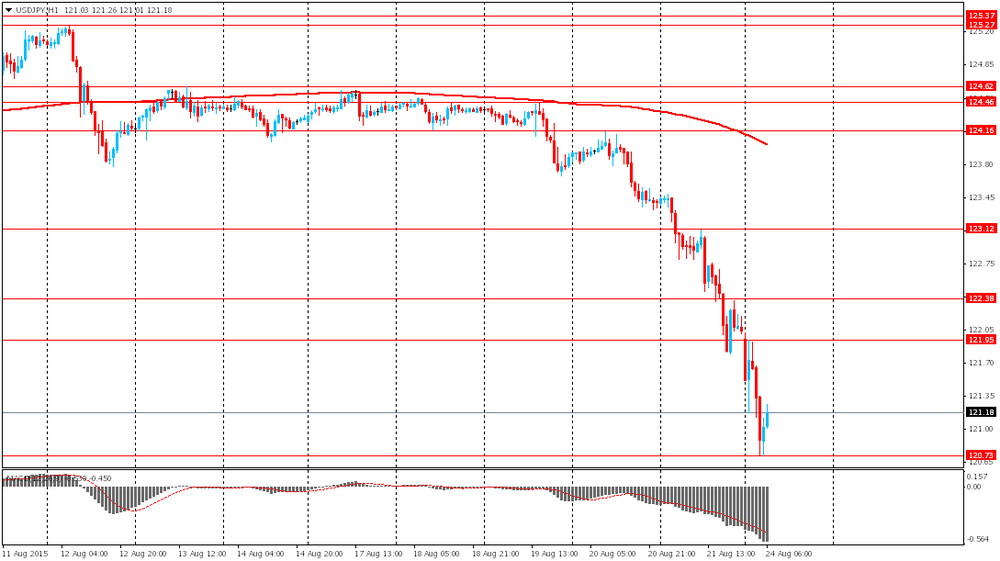

The Japanese yen traded higher against the U.S. dollar due to increasing demand for the safe-haven currency.

EUR/USD: the currency pair rose to $1.1541

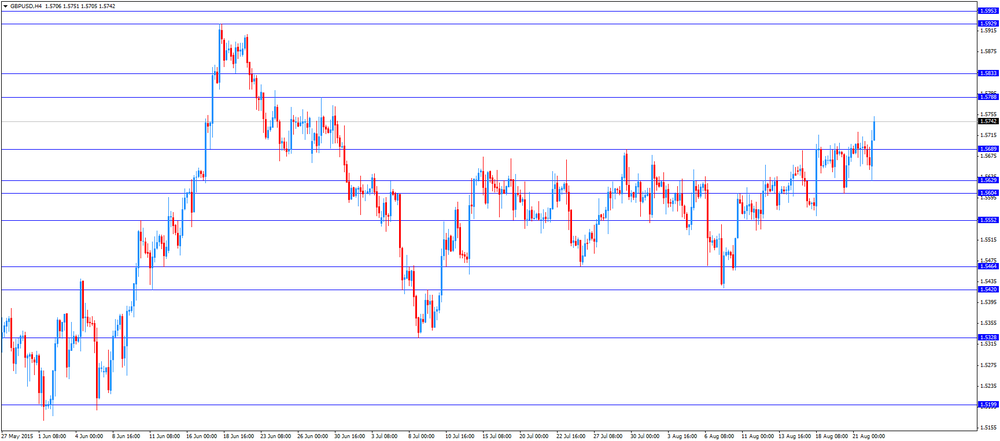

GBP/USD: the currency pair increased to $1.5751

USD/JPY: the currency pair fell to Y119.53

The most important news that are expected (GMT0):

12:30 U.S. Chicago Federal National Activity Index July 0.08

19:55 U.S. FOMC Member Dennis Lockhart Speaks

-

13:48

Orders

EUR/USD

Offers 1.1480-85 1.1500 1.1525 1.1550 1.1565 1.1580 1.1600

Bids 1.1440 1.1420-25 1.1400 1.1380 1.1350 1.1300 1.1300 1.1285 1.1265 1.1250

GBP/USD

Offers 1.5685 1.5700 1.5725-30 1.5735 1.5750 1.5780 1.5800 1.5830 1.5850

Bids 1.5630-35 1.5625 1.5600 1.5580 1.5565 1.5545-50 1.5525-30 1.5500

EUR/GBP

Offers 0.7350 0.7365 0.7380-85 0.7400 0.7420 0.7445-50

Bids 0.7300-05 0.7285 0.7265-70 0.7250 0.7230 0.7200

EUR/JPY

Offers 138.85 139.00 139.35 139.50 140.00

Bids 138.20 138.00 137.75-80 137.50 137.25-30 137.00 136.80 136.50

USD/JPY

Offers 121.25-30 121.50 121.65 121.85 122.00 122.20 122.50

Bids 120.70-75 120.50 120.40 120.20 120.00 119.85 119.50

AUD/USD

Offers 0.7265 0.7285 0.7300 0.7330 0.7350 0.7380 0.7400

Bids 0.7200 0.7185 0.7170 0.7150 0.7125-30 0.7100

-

11:37

China allows pension funds to invest in domestic stocks

China allowed pension funds to invest in domestic stocks. Pension funds are now able to invest up to 30% of their net assets in domestic stocks.

China hopes with this decision to boost the liquidity on the stock market and to stop a massive selloff.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1325(E227mn)

USD/JPY: Y121.50($380mn), Y122.00($666mn), Y123.00($1.0bn)

EUR/GBP: Gbp0.7160(E223mn)

USD/CAD: C$1.3125($190mn), C$1.3250($413mn)

-

11:18

The Confederation of British Industry upgrades its economic growth forecasts for the U.K.

The Confederation of British Industry (CBI) released its economic growth forecasts for the U.K. The CBI expects Britain's economy to expand 2.6% this year, up from the previous estimate of 2.4%, and 2.8% in 2016, up from the previous estimate of 2.5%.

The upgrade was driven by higher increase in in productivity and household spending.

"Strong domestic demand and upbeat official data since our last forecast has boosted our outlook for 2015. We expect this strength to continue into next year," the CBI's director of economics, Rain Newton-Smith, said.

-

10:44

U.S. Treasury Secretary Jacob Lew: China should reduce a dependence on exports

U.S. Treasury Secretary Jacob Lew said on Friday that China should reduce a dependence on exports and move the economy toward a dependence on consumption. Lew spoke with Chinese Vice Premier Wang Yang, pointing to the progress on China's commitments to "move towards a more flexible, market-determined exchange rate, limit foreign exchange intervention to disorderly market conditions, and increase the transparency of its exchange rate policies".

-

10:32

A former Greek Energy Minister Panagiotis Lafazanis and at least 25 Syriza lawmakers create new party

A group of at least 25 Syriza lawmakers led by Panagiotis Lafazanis, a former Energy Minister, abandoned the party to create a new movement called Popular Unity. The party is now the third-largest party in the Greek parliament, and could form a new administration.

Greek Prime Minister Alexis Tsipras has submitted his resignation on Thursday evening and called for early elections. Tsipras is seeking a mandate to implement reforms.

-

10:20

Fitch Ratings: the snap election in Greece could have a negative impact on the success of the third bailout programme

Fitch Ratings said on Friday that the snap election in Greece could have a negative impact on the success of the third bailout programme.

"A September election would occur before the first programme review in October and may well hamper and delay the technical work and political decisions necessary for its completion. Relations with creditors appear to have improved in the run-up to the bailout agreement on 14 August. But the likely pause in legislating for reforms during the election campaign coming so soon after the agreement was concluded may rekindle or reinforce some creditors' concerns about Greece's ability to meet the programme's requirements," the agency said.

-

10:13

European Commission: Greece should fulfil its promise made to its international lenders

The European Commission said on Friday that Greece should fulfil its promise made to its international lenders.

"It is crucial that Greece maintains its commitments to the euro zone. I recall the broad support in the Greek parliament for the new program and reform package and I hope the elections will lead to even more support in the new Greek parliament. Hopefully these elections will take place relatively soon so Greece can take important next steps in October, as foreseen," the head of the Eurogroup Jeroen Dijsselbloem said on Friday.

-

08:06

Foreign exchange market. Asian session: the euro and the yen gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan Leading Economic Index (Finally) June 106.2 106.5

05:00 Japan Coincident Index (Finally) June 109.0 112.3

The yen and the euro continued rising against the U.S. dollar amid weak global growth and inflation outlook. Low inflation expectations affected investors' forecasts of a rate hike in the U.S. Now market participants expect the Federal Reserve to start tightening its monetary policy in December or in 2016.

The yen got some additional support as a safe-haven asset due to declines in Asian stocks.

Such commodity currencies as the Australian and New Zealand dollars fell amid lower oil prices and concerns over China's economy. These concerns were generated by weak manufacturing data from the world's second-biggest economy and the unexpected devaluation of the yuan on August 11.

EUR/USD: the pair rose to $1.1495 in Asian trade

USD/JPY: the pair fell to Y120.75

GBP/USD: the pair traded within $1.5660-95

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

12:30 U.S. Chicago Federal National Activity Index July 0.08

19:55 U.S. FOMC Member Dennis Lockhart Speaks

-

07:16

Japan: Leading Economic Index , June 106.5

-

07:16

Japan: Coincident Index, June 112.3

-

07:00

Options levels on friday, monday 24, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1580 (3755)

$1.1542 (2476)

$1.1507 (1927)

Price at time of writing this review: $1.1455

Support levels (open interest**, contracts):

$1.1343 (541)

$1.1281 (1345)

$1.1229 (1865)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 84404 contracts, with the maximum number of contracts with strike price $1,1300 (6407);

- Overall open interest on the PUT options with the expiration date September, 4 is 116684 contracts, with the maximum number of contracts with strike price $1,0500 (7815);

- The ratio of PUT/CALL was 1.38 versus 1.37 from the previous trading day according to data from August, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.6001 (1617)

$1.5902 (2248)

$1.5804 (2546)

Price at time of writing this review: $1.5685

Support levels (open interest**, contracts):

$1.5595 (999)

$1.5498 (2748)

$1.5399 (2155)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30590 contracts, with the maximum number of contracts with strike price $1,5600 (2793);

- Overall open interest on the PUT options with the expiration date September, 4 is 35116 contracts, with the maximum number of contracts with strike price $1,5500 (2748);

- The ratio of PUT/CALL was 1.15 versus 1.17 from the previous trading day according to data from August, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:46

Currencies. Daily history for Aug 21’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1386 +1,34%

GBP/USD $1,5691 +0,08%

USD/CHF Chf0,946 -1,33%

USD/JPY Y122,04 -1,11%

EUR/JPY Y138,96 +0,24%

GBP/JPY Y191,44 -1,13%

AUD/USD $0,7312 -0,29%

NZD/USD $0,6684 +0,87%

USD/CAD C$1,3186 +0,79%

-

00:01

Schedule for today, Monday, Aug 24’2015:

(time / country / index / period / previous value / forecast)

05:00 Japan Leading Economic Index (Finally) June 106.2

05:00 Japan Coincident Index (Finally) June 109.0

12:30 U.S. Chicago Federal National Activity Index July 0.08

19:55 U.S. FOMC Member Dennis Lockhart Speaks

-