Noticias del mercado

-

16:22

Eurozone’s preliminary consumer confidence index rises to -6.8 in August

The European Commission released its preliminary consumer confidence figures for the Eurozone on Friday. Eurozone's preliminary consumer confidence index rose to -6.8 in August from -7.1 in July, beating expectations for a gain to -6.9.

European Union's consumer confidence index increased to -4.6 in August from -4.9% in July.

-

16:05

Swiss National Bank: M3 money supply climbs 1.9% in July

The Swiss National Bank (SNB) released its money supply data on Friday. M3 money supply climbed at an annual rate of 1.9% in July, after a 2.1% in June.

M1 money supply was up 0.7% year-on-year in July, after a 0.8% gain in June.

Official reserves rose to $600.6 billion in June from $599.8 billion in May.

-

16:01

Eurozone: Consumer Confidence, August -6.8 (forecast -6.9)

-

15:53

U.S. preliminary manufacturing purchasing managers' index declines to 52.9 in August

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) declined to 52.9 in August from 53.8 in July, missing expectations for an increase to 54.0. It was the lowest level since October 2013.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a slower expansion in output, new orders and employment.

"According to survey respondents, the strong dollar continued to put pressure on export sales and competitiveness, while heightened global economic uncertainty appeared to have dampened client spending both at home and abroad. Alongside this, manufacturers of investment goods widely cited growth headwinds from the slump in capital spending across the energy sector," Markit Senior Economist Tim Moore.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E830mn), $1.1110(E451mn), $1.1140-60(E525mn), $1.1200(E676mn), $1.1220(E526mn), $1.1260(E392mn), $1.1300(E429mn), $1.1367(E352mn)

USD/JPY: Y123.25($330mn), Y123.50($240mn), Y123.75-80($300mn), Y124.05($392mn), Y125.00($418mn)

AUD/USD: $0.7225(A$264mn)

NZD/USD: $0.6600(NZ$403.2mn), $0.6650(NZ$605mn)

USD/CAD: C$1.2950($200mn), C$1.2995($750mn), C$1.3005($750mn), C$1.3100($285mn), C$1.3250($484mn)

-

15:45

U.S.: Manufacturing PMI, August 52.9 (forecast 54)

-

15:07

Head of the Eurogroup Jeroen Dijsselbloem urges the Greek government to hold the elections

The head of the Eurogroup, Jeroen Dijsselbloem, on Thursday urged the Greek government to hold the elections.

"I hope that they are as quick as possible so that the least possible amount of time is wasted. I think the intention of Prime Minister Tsipras is to get a more stable government," he said.

-

14:57

Canadian retail sales gain 0.6% in June

Statistics Canada released retail sales data on Friday. Canadian retail sales rose by 0.6% in June, exceeding expectations for a 0.2% gain, after a 0.9% increase in May. May's figure was revised down from a 1.0% gain.

The rise was driven by higher sales at gasoline stations and at electronics and appliance stores. Sales at gasoline stations climbed 2.6% in June, while sales at electronics and appliance stores jumped 9.4%.

Sales at food and beverage stores were flat in June, while motor vehicle and parts sales were down 0.1%.

Sales rose in 8 of 11 subsectors.

Canadian retail sales excluding automobiles were up 0.8% in June, beating expectations for a 0.5% rise, after a 0.8% gain in May. May's figure was revised down from a 0.9% rise.

-

14:42

Canadian consumer price inflation rises 0.1% in July

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation increased 0.1% in July, in line with expectations, after a 0.2% gain in June.

On a yearly basis, the consumer price index rose to 1.3% in July from 1.0% in June, missing expectations for a 1.4% increase.

The consumer price index was partly driven by higher food and automobiles prices.

Food prices climbed 3.2% in July, while automobiles prices increased 2.5%.

Gasoline prices dropped 12.2% in July from the same month a year earlier.

The Canadian core consumer price index, which excludes some volatile goods, was flat in July, after a flat reading in June.

On a yearly basis, core consumer price index in Canada was up to 2.4% in July from 2.3% in June, in line with expectations.

The Bank of Canada's inflation target is 2.0%.

-

14:31

Canada: Retail Sales YoY, June 1.4%

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, July 2.4% (forecast 2.4%)

-

14:30

Canada: Retail Sales, m/m, June 0.6% (forecast 0.2%)

-

14:30

Canada: Consumer price index, y/y, July 1.3% (forecast 1.4%)

-

14:30

Canada: Retail Sales ex Autos, m/m, June 0.8% (forecast 0.5%)

-

14:30

Canada: Consumer Price Index m / m, July 0.1% (forecast 0.1%)

-

14:22

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan increases to 51.9 in August

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan increased to 51.9 in August from 51.2 in July.

A reading below 50 indicates contraction of activity.

The index was partly driven by a rise in output, new orders and employment.

"Latest survey data indicated a further improvement in operating conditions in the Japanese manufacturing sector. New order growth accelerated to the second fastest this year so far, while production increased at a similar pace to July's five-month record," economist at Markit, Amy Brownbill, said.

-

14:08

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the mostly positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:45 China Markit/Caixin Manufacturing PMI (Preliminary) August 47.8 47.7 47.1

06:00 Germany Gfk Consumer Confidence Survey September 10.1 10.1 9.9

07:00 France Services PMI (Preliminary) August 52 52 51.8

07:00 France Manufacturing PMI (Preliminary) August 49.6 49.7 48.6

07:30 Germany Services PMI (Preliminary) August 53.8 53.9 53.6

07:30 Germany Manufacturing PMI (Preliminary) August 51.8 51.7 53.2

08:00 Eurozone Manufacturing PMI (Preliminary) August 52.4 52.2 52.4

08:00 Eurozone Services PMI (Preliminary) August 54 54 54.3

08:30 United Kingdom PSNB, bln July 8.64 Revised From 8.58 -2.4 -2.07

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. preliminary manufacturing PMI data. The U.S. preliminary manufacturing PMI is expected to rise to 54.0 in August from 53.8 in July.

Concerns over a slowdown in the Chinese economy weighed on the greenback. The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) decreased to 47.1 in August from 47.8 in July, missing expectations for a decline to 47.7, and hitting a 77-month low.

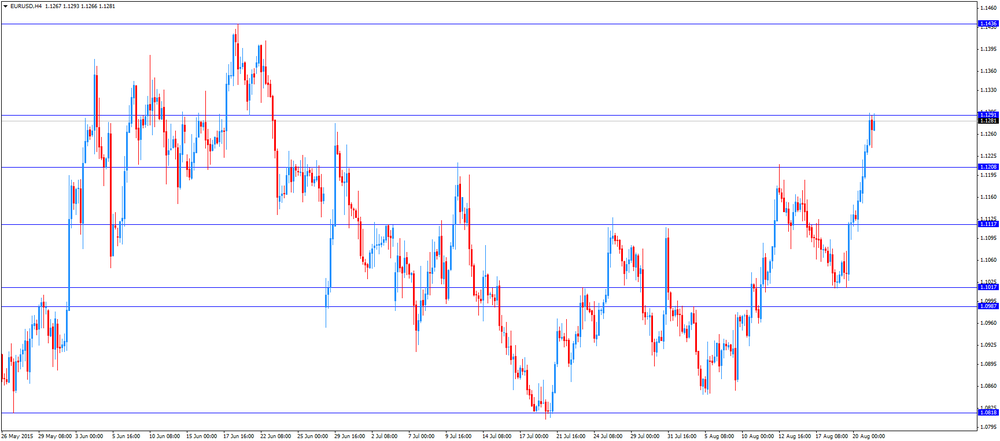

The euro traded mixed against the U.S. dollar after the mostly positive economic data from the Eurozone. Eurozone's preliminary manufacturing PMI remained unchanged at 52.4 in August. Analysts had expected index to decline to 52.2.

Eurozone's preliminary services PMI rose to 54.3 in August from 54.0 in July. Analysts had expected the index to remain unchanged at 54.0.

Markit's Senior Economist Rob Dobson said that Eurozone's economy "is still experiencing one of its best periods of economic growth and job creation during the past four years".

"GDP growth is tracking close to 0.4% so far in the third quarter, slightly above the 0.3% seen in quarter 2, highlighting the resilience of the economy through last month's rollercoaster events of the Greek debt crisis and the ongoing negotiations to tie up the full details surrounding the third bailout," he added.

Germany's preliminary manufacturing PMI climbed to 53.2 in August from 51.8 in July, exceeding forecasts of a decline to 51.7.

Germany's preliminary services PMI was down to 53.6 in August from 53.8 in July. Analysts had expected index to climb to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by higher output and new orders.

"Based on PMI data available for the third quarter so far, we should expect German GDP to increase at a similar rate to the 0.4% seen in the three months to June," he noted.

France's preliminary manufacturing PMI dropped to 48.6 in August from 49.6 in July, missing forecasts of a rise to 49.7.

France's preliminary services PMI fell to 51.8 in August from 52.0 in July. Analysts had expected the index to remain unchanged at 52.0.

"Output growth in France's private sector economy cooled to a four-month low in August, suggesting that third-quarter GDP may disappoint again following stagnation in Q2. An improvement in service providers' business expectations to a near three-and-a-half year high provided some rare positive news, but manufacturing continued to struggle amid a sharper drop in new orders," the Senior Economist at Markit Jack Kennedy said.

Greek Prime Minister Alexis Tsipras has submitted his resignation on Thursday evening and called for early elections. He is seeking a mandate to implement reforms.

The election is expected to be held on September 20.

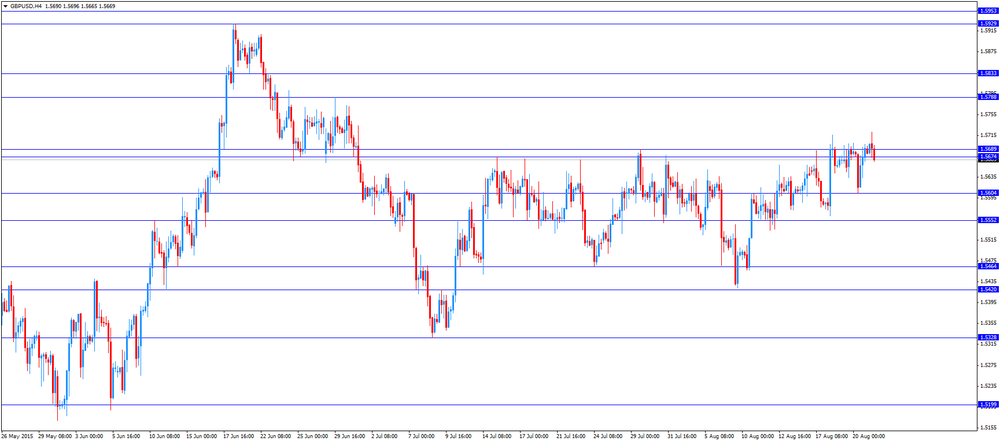

The British pound traded lower against the U.S. dollar. The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. declined to -£2.07 billion in July from £8.64 billion in June, beating expectations for a drop to -£2.4 billion. June's figure was revised up from £8.58 billion.

Public sector net borrowing excluding public sector banks fell by £1.4 billion to a surplus of £1.29 billion.

The increase was driven by the tax receipts.

The Canadian dollar traded mixed against the U.S. dollar ahead the release of the Canadian economic data. The consumer price index in Canada is expected to rise to 1.4% in July from 1.0% in June.

The core consumer price index in Canada is expected to climb to 2.4% in July from 2.3% in June.

Canadian retail sales are expected to increase 0.2% in June, after a 1.0% rise in May.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair declined to $1.5665

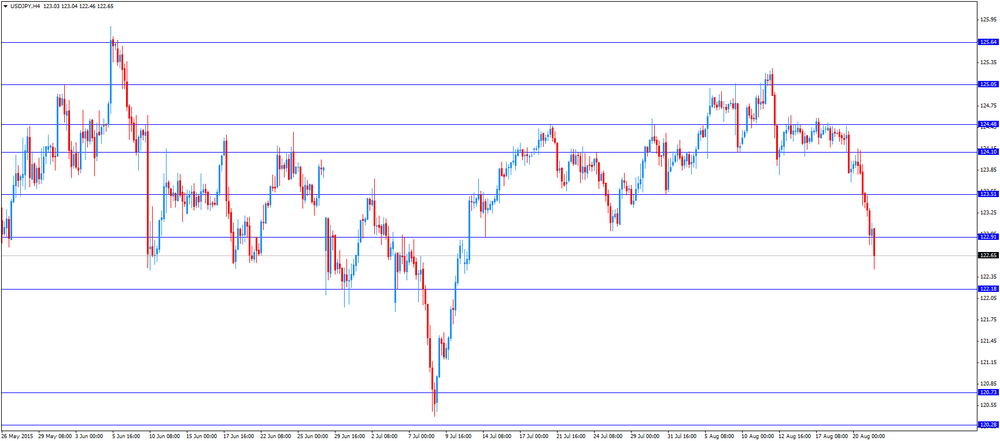

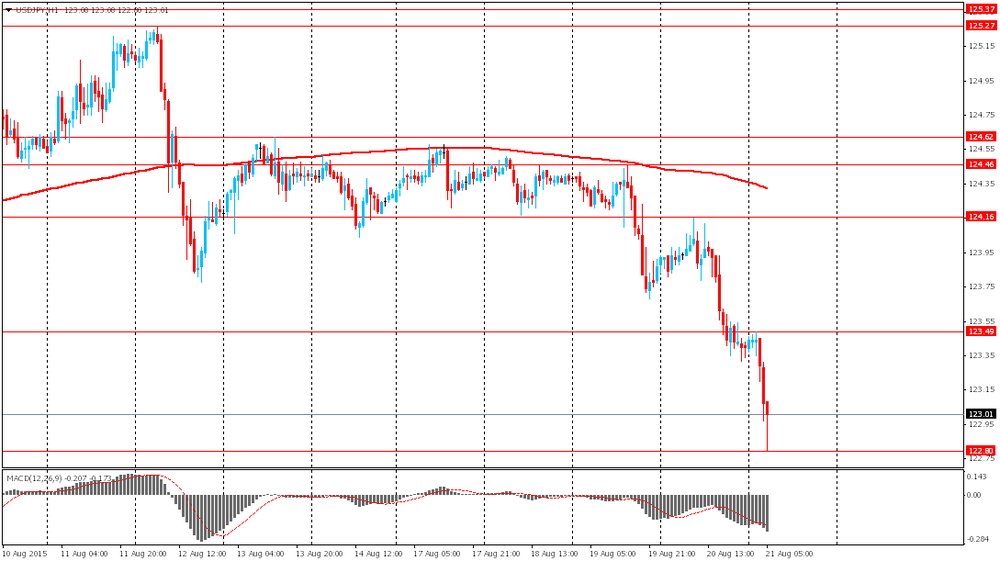

USD/JPY: the currency pair fell to Y122.46

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m June 1.0% 0.2%

12:30 Canada Retail Sales YoY June 2.7%

12:30 Canada Retail Sales ex Autos, m/m June 0.9% 0.5%

12:30 Canada Consumer Price Index m / m July 0.2% 0.1%

12:30 Canada Consumer price index, y/y July 1% 1.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y July 2.3% 2.4%

13:45 U.S. Manufacturing PMI (Preliminary) August 53.8 54

14:00 Eurozone Consumer Confidence (Preliminary) August -7.1 -6.9

-

13:45

Orders

EUR/USD

Offers 1.1265 1.1285 1.1300 1.1325-30 1.1350 1.1380 1.1400

Bids 1.1225-30 1.1200 1.1180 1.1150 1.1130 1.1100 1.1080 1.1065 1.1050 1.1020-25 1.1000

GBP/USD

Offers 1.5725-30 1.5735 1.5750 1.5780 1.5800 1.5830 1.5850

Bids 1.5680-85 1.5665 1.5650 1.5635 1.5625 1.5600 1.5545-50 1.5525-30 1.5500

EUR/GBP

Offers 0.7180-85 0.7200 0.7220-25 0.7250 0.7265 0.7280 0.7300

Bids 0.7150 0.7135-40 0.7120 0.7100 0.7085 0.7065 0.7050 0.7030-35 0.7020 0.7000

EUR/JPY

Offers 138.50 138.85 139.00 139.35 139.50 140.00

Bids 138.20 138.00 137.75-80 137.50 137.25-30 137.00 136.80 136.50

USD/JPY

Offers 123.15 123.30 123.45-50 123.80 124.00 124.25 124.50

Bids 122.80 122.50 122.30 122.00 121.75 121.50

AUD/USD

Offers 0.7330 0.7350 0.7370 0.7385 0.7400 0.7425 0.7450

Bids 0.7285 0.7265 0.7250 0.7220 0.7200

-

11:41

Public sector net borrowing in the U.K. declines to -£2.07 billion in July

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. declined to -£2.07 billion in July from £8.64 billion in June, beating expectations for a drop to -£2.4 billion. June's figure was revised up from £8.58 billion.

Public sector net borrowing excluding public sector banks fell by £1.4 billion to a surplus of £1.29 billion.

The increase was driven by the tax receipts.

-

11:25

France's preliminary PMIs decline in August

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Friday. France's preliminary manufacturing PMI dropped to 48.6 in August from 49.6 in July, missing forecasts of a rise to 49.7.

France's preliminary services PMI fell to 51.8 in August from 52.0 in July. Analysts had expected the index to remain unchanged at 52.0.

"Output growth in France's private sector economy cooled to a four-month low in August, suggesting that third-quarter GDP may disappoint again following stagnation in Q2. An improvement in service providers' business expectations to a near three-and-a-half year high provided some rare positive news, but manufacturing continued to struggle amid a sharper drop in new orders," the Senior Economist at Markit Jack Kennedy said.

-

11:18

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E830mn), $1.1110(E451mn), $1.1140-60(E525mn), $1.1200(E676mn), $1.1220(E526mn), $1.1260(E392mn), $1.1300(E429mn), $1.1367(E352mn)

USD/JPY: Y123.25($330mn), Y123.50($240mn), Y123.75-80($300mn), Y124.05($392mn), Y125.00($418mn)

AUD/USD: $0.7225(A$264mn)

NZD/USD: $0.6600(NZ$403.2mn), $0.6650(NZ$605mn)

USD/CAD: C$1.2950($200mn), C$1.2995($750mn), C$1.3005($750mn), C$1.3100($285mn), C$1.3250($484mn)

-

11:14

Germany's preliminary manufacturing PMI rises in August, while services PMI declines

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Friday. Germany's preliminary manufacturing PMI climbed to 53.2 in August from 51.8 in July, exceeding forecasts of a decline to 51.7.

Germany's preliminary services PMI was down to 53.6 in August from 53.8 in July. Analysts had expected index to climb to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by higher output and new orders.

"Based on PMI data available for the third quarter so far, we should expect German GDP to increase at a similar rate to the 0.4% seen in the three months to June," he noted.

-

10:57

Eurozone's preliminary manufacturing PMI remains unchanged in August, preliminary services PMI rises

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI remained unchanged at 52.4 in August. Analysts had expected index to decline to 52.2.

Eurozone's preliminary services PMI rose to 54.3 in August from 54.0 in July. Analysts had expected the index to remain unchanged at 54.0.

Markit's Senior Economist Rob Dobson said that Eurozone's economy "is still experiencing one of its best periods of economic growth and job creation during the past four years".

"GDP growth is tracking close to 0.4% so far in the third quarter, slightly above the 0.3% seen in quarter 2, highlighting the resilience of the economy through last month's rollercoaster events of the Greek debt crisis and the ongoing negotiations to tie up the full details surrounding the third bailout," he added.

-

10:45

German Gfk consumer confidence index declines to 9.9 in September

Market research group GfK released its consumer confidence index for Germany on Friday. German Gfk consumer confidence index fell to 9.9 in September from 10.1 in August.

Analysts had expected the index to remain unchanged at 10.1.

The decrease was driven by declines in economic and income expectations and the willingness to buy.

The economic expectations index plunged to 16.6 points in August to 18.4 in July, while the willingness to buy index fell 3.4 points to 52.0.

The income expectations index dropped by 5.1 points in September and is now at 53.5.

"Despite the decline, it cannot be said that the economic motor will stutter or even stall. As before, the indicator level is high, suggesting that private consumption can fulfil its ascribed role as an important pillar of economic development this year. Since it can be assumed that conditions for a good consumer economy in Germany will remain favourable in the coming months, such as employment, income and inflation, there is a good chance that the consumer climate will stabilize again. Possible risks and burdens first and foremost are justified in the unstable international situation, especially in the Far and Middle East," Gfk noted.

-

10:35

North Korean leader Kim Jong-un orders the army to be combat ready

The geopolitical situation escalated after North Korean leader Kim Jong-un ordered the army to be combat ready. He gave South Korea 48 hours to stop propaganda broadcasts across the demilitarized zone.

In turn, South Korea has said it does not intend to stop broadcasting.

Tensions on the Korean peninsula have flared in recent weeks.

The two Koreas are still officially at war.

-

10:30

United Kingdom: PSNB, bln, July 2.07 (forecast 2.4)

-

10:22

Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index falls to 47.1 in August

The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) decreased to 47.1 in August from 47.8 in July, missing expectations for a decline to 47.7, and hitting a 77-month low.

A reading below 50 indicates contraction of activity.

The output index fell to 46.6 in August from 47.1 in July, reaching a 45-month low. New export orders also declined.

Dr. He Fan, Chief Economist at Caixin Insight Group, said that the index indicates that China's economy "is still in the process of bottoming out".

"But overall, the likelihood of a systemic risk remains under control and the structure of the economy is still improving. There is still pressure on the front of maintaining growth rates, and to realize the goal set for this year the government needs to fine tune fiscal and monetary policies to ensure macroeconomic stability and speed up the structural reform. This will lead the market to confidence and renew the vigour of the economy," he added.

-

10:12

Greek Prime Minister Alexis Tsipras submits his resignation

Greek Prime Minister Alexis Tsipras has submitted his resignation on Thursday evening and called for early elections.

"I will shortly meet with the president of the republic and present my resignation and that of my government. I want to submit to the Greek people everything I have done so that they can decide once more," he said.

Tsipras is seeking a mandate to implement reforms.

The election is expected to be held on September 20.

-

10:00

Eurozone: Services PMI, August 54.3 (forecast 54)

-

10:00

Eurozone: Manufacturing PMI, August 52.4 (forecast 52.2)

-

09:30

Germany: Manufacturing PMI, August 53.2 (forecast 51.7)

-

09:30

Germany: Services PMI, August 53.6 (forecast 53.9)

-

09:00

France: Manufacturing PMI, August 48.6 (forecast 49.7)

-

09:00

France: Services PMI, August 51.8 (forecast 52)

-

08:24

Foreign exchange market. Asian session: the euro gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:45 China Markit/Caixin Manufacturing PMI (Preliminary) August 47.8 47.7 47.1

06:00 Germany Gfk Consumer Confidence Survey September 10.1 10.1 9.9

The yen and the euro rose against the U.S. dollar as investors continued revising forecasts for an increase in Federal Reserve's interest rates. The minutes of July meeting showed that the central bank had not come closer to a liftoff in rates, which was expected in September. Investors revised their expectations after China unexpectedly devalued the yuan harming risky assets including commodity currencies and currencies of developing countries. This move intensified concerns over China's economic growth and global inflation. A weaker outlook for the global economy also lowered chances of monetary policy tightening in the U.S.

The Australian dollar fell to yesterday's low amid disappointing data on Australia's key trading partner China. The flash China Manufacturing PMI came in at 47.1 in August compared to July final reading of 47.8. The index missed analysts' expectations for a modest decline to 47.7.

EUR/USD: the pair rose to $1.1290 in Asian trade

USD/JPY: the pair fell to Y122.80

GBP/USD: the pair traded within $1.5680-95

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 France Services PMI (Preliminary) August 52 52

07:00 France Manufacturing PMI (Preliminary) August 49.6 49.7

07:30 Germany Services PMI (Preliminary) August 53.8 53.9

07:30 Germany Manufacturing PMI (Preliminary) August 51.8 51.7

08:00 Eurozone Manufacturing PMI (Preliminary) August 52.4 52.2

08:00 Eurozone Services PMI (Preliminary) August 54 54

08:30 United Kingdom PSNB, bln July -8.58 2.4

12:30 Canada Retail Sales, m/m June 1.0% 0.2%

12:30 Canada Retail Sales YoY June 2.7%

12:30 Canada Retail Sales ex Autos, m/m June 0.9% 0.5%

12:30 Canada Consumer Price Index m / m July 0.2% 0.1%

12:30 Canada Consumer price index, y/y July 1% 1.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y July 2.3% 2.4%

13:45 U.S. Manufacturing PMI (Preliminary) August 53.8 54

14:00 Eurozone Consumer Confidence (Preliminary) August -7.1 -6.9

-

08:23

Options levels on friday, August 21, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1383 (5614)

$1.1347 (6427)

$1.1316 (3355)

Price at time of writing this review: $1.1279

Support levels (open interest**, contracts):

$1.1192 (687)

$1.1136 (1549)

$1.1085 (2223)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 84773 contracts, with the maximum number of contracts with strike price $1,1200 (7047);

- Overall open interest on the PUT options with the expiration date September, 4 is 115835 contracts, with the maximum number of contracts with strike price $1,0500 (7830);

- The ratio of PUT/CALL was 1.37 versus 1.37 from the previous trading day according to data from August, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.6001 (1027)

$1.5902 (2279)

$1.5804 (2574)

Price at time of writing this review: $1.5703

Support levels (open interest**, contracts):

$1.5595 (1036)

$1.5497 (2750)

$1.5399 (2155)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30314 contracts, with the maximum number of contracts with strike price $1,5600 (2801);

- Overall open interest on the PUT options with the expiration date September, 4 is 35326 contracts, with the maximum number of contracts with strike price $1,5500 (2750);

- The ratio of PUT/CALL was 1.17 versus 1.16 from the previous trading day according to data from August, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Gfk Consumer Confidence Survey, September 9.9 (forecast 10.1)

-

03:45

China: Markit/Caixin Manufacturing PMI, August 47.1 (forecast 47.7)

-

01:02

Currencies. Daily history for Aug 20’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1233 +1,00%

GBP/USD $1,5679 -0,01%

USD/CHF Chf0,9586 -0,66%

USD/JPY Y123,40 -0,38%

EUR/JPY Y138,62 +0,62%

GBP/JPY Y193,61 -0,32%

AUD/USD $0,7333 -0,20%

NZD/USD $0,6626 +0,42%

USD/CAD C$1,3082 -0,26%

-

00:45

New Zealand: Visitor Arrivals, July 5.7%

-

00:02

Schedule for today, Friday, Aug 21’2015:

(time / country / index / period / previous value / forecast)

01:45 China Markit/Caixin Manufacturing PMI (Preliminary) August 47.8 47.7

05:00 Japan Leading Economic Index (Finally) June 106.2

05:00 Japan Coincident Index (Finally) June 109.0

06:00 Germany Gfk Consumer Confidence Survey September 10.1 10.1

07:00 France Services PMI (Preliminary) August 52 52

07:00 France Manufacturing PMI (Preliminary) August 49.6 49.7

07:30 Germany Services PMI (Preliminary) August 53.8 53.9

07:30 Germany Manufacturing PMI (Preliminary) August 51.8 51.7

08:00 Eurozone Manufacturing PMI (Preliminary) August 52.4 52.2

08:00 Eurozone Services PMI (Preliminary) August 54 54

08:30 United Kingdom PSNB, bln July -8.58 1.9

12:30 Canada Retail Sales, m/m June 1.0% 0.2%

12:30 Canada Retail Sales YoY June 2.7%

12:30 Canada Retail Sales ex Autos, m/m June 0.9% 0.5%

12:30 Canada Consumer Price Index m / m July 0.2% 0.1%

12:30 Canada Consumer price index, y/y July 1% 1.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y July 2.3% 2.4%

13:45 U.S. Manufacturing PMI (Preliminary) August 53.8 54

14:00 Eurozone Consumer Confidence (Preliminary) August -7.1 -6.9

-