Noticias del mercado

-

21:00

DJIA 16610.37 -380.32 -2.24%, NASDAQ 4754.56 -122.93 -2.52%, S&P 500 1989.05 -46.68 -2.29%

-

18:12

WSE: Session Results

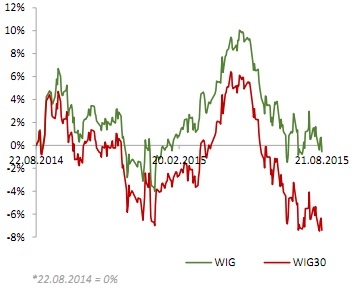

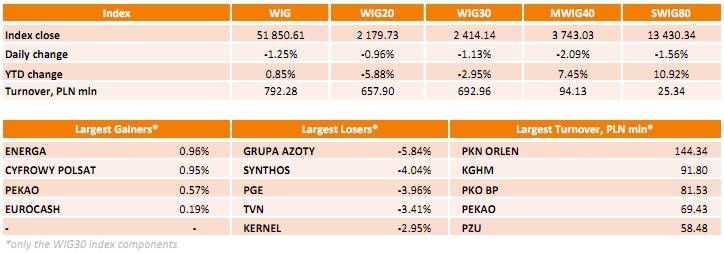

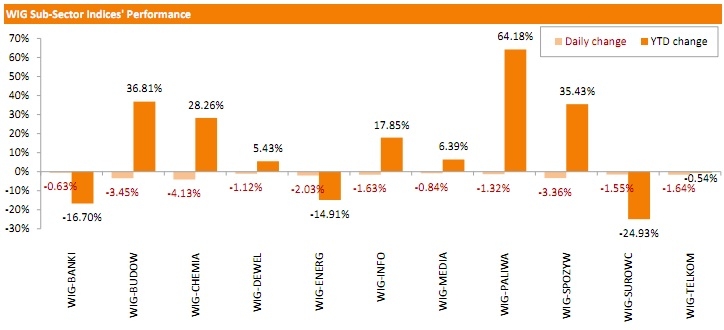

Polish equity market retreated on Friday. The broad market measure, the WIG Index, fell by 1.25%. All sectors in the WIG Index were down. Chemicals (-4.13%) fared the worst, followed by constructions (-3.45%) and food sector (-3.36%).

The large-cap stocks' measure, the WIG30 Index, lost 1.13%. There were only a few gainers among the Index components. ENERGA (WSE: ENG) and CYFROWY POLSAT (WSE: CPS) benefited the most, advancing 0.96% and 0.95% respectively. They were followed by PEKAO (WSE: PEO) and EUROCASH (WSE: EUR), adding a respective 0.53% and 0.19%. On the other side of the ledger, GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS), were the weakest performers, dropping 5.84% and 4.04% respectively. Other major decliners included PGE (WSE: PGE), TVN (WSE: TVN), KERNEL (WSE: KER) and LOTOS (WSE: LTS), slumping 2.29%-3.96%.

-

18:01

European stocks closed: FTSE 6187.65 -180.24 -2.83%, DAX 10124.52 -307.67 -2.95%, CAC 40 4630.99 -152.56 -3.19%

-

18:00

European stocks close: stocks closed lower on worries over a slowdown in the Chinese economy

Stock indices closed lower on worries over a slowdown in the Chinese economy. The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) decreased to 47.1 in August from 47.8 in July, missing expectations for a decline to 47.7, and hitting a 77-month low.

Greek Prime Minister Alexis Tsipras has submitted his resignation on Thursday evening and called for early elections. He is seeking a mandate to implement reforms.

The election is expected to be held on September 20.

Meanwhile, the economic data from the Eurozone was mostly positive. Eurozone's preliminary consumer confidence index rose to -6.8 in August from -7.1 in July, beating expectations for a gain to -6.9.

Eurozone's preliminary manufacturing PMI remained unchanged at 52.4 in August. Analysts had expected index to decline to 52.2.

Eurozone's preliminary services PMI rose to 54.3 in August from 54.0 in July. Analysts had expected the index to remain unchanged at 54.0.

Markit's Senior Economist Rob Dobson said that Eurozone's economy "is still experiencing one of its best periods of economic growth and job creation during the past four years".

"GDP growth is tracking close to 0.4% so far in the third quarter, slightly above the 0.3% seen in quarter 2, highlighting the resilience of the economy through last month's rollercoaster events of the Greek debt crisis and the ongoing negotiations to tie up the full details surrounding the third bailout," he added.

Germany's preliminary manufacturing PMI climbed to 53.2 in August from 51.8 in July, exceeding forecasts of a decline to 51.7.

Germany's preliminary services PMI was down to 53.6 in August from 53.8 in July. Analysts had expected index to climb to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by higher output and new orders.

"Based on PMI data available for the third quarter so far, we should expect German GDP to increase at a similar rate to the 0.4% seen in the three months to June," he noted.

France's preliminary manufacturing PMI dropped to 48.6 in August from 49.6 in July, missing forecasts of a rise to 49.7.

France's preliminary services PMI fell to 51.8 in August from 52.0 in July. Analysts had expected the index to remain unchanged at 52.0.

"Output growth in France's private sector economy cooled to a four-month low in August, suggesting that third-quarter GDP may disappoint again following stagnation in Q2. An improvement in service providers' business expectations to a near three-and-a-half year high provided some rare positive news, but manufacturing continued to struggle amid a sharper drop in new orders," the Senior Economist at Markit Jack Kennedy said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,187.65 -180.24 -2.83 %

DAX 10,124.52 -307.67 -2.95 %

CAC 40 4,630.99 -152.56 -3.19 %

-

17:29

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes slumped on Friday, falling for the fourth straight session, as more grim data from China spooked investors already worried about the pace of global growth. The Dow Jones industrial average was poised to for its sharpest weekly fall since November, 2011. The Nasdaq composite and the S&P 500 were on track for their steepest weekly fall since May 2012. Data from China showed its giant manufacturing sector shrank at the fastest pace since the depths of the financial crisis in 2009, exacerbating worries about its health that have been preying on economist's minds for months.

All Dow stocks in negative area (30 of 30). Top looser - NIKE, Inc. (NKE, -3.93%).

All S&P index sectors also in negative area. Top looser - Conglomerates (-2.4%).

At the moment:

Dow 16679.00 -238.00 -1.41%

S&P 500 1996.75 -28.75 -1.42%

Nasdaq 100 4284.50 -81.75 -1.87%

10 Year yield 2,06% -0,03

Oil 40.36 -0.96 -2.32%

Gold 1156.90 +3.70 +0.32%

-

16:22

Eurozone’s preliminary consumer confidence index rises to -6.8 in August

The European Commission released its preliminary consumer confidence figures for the Eurozone on Friday. Eurozone's preliminary consumer confidence index rose to -6.8 in August from -7.1 in July, beating expectations for a gain to -6.9.

European Union's consumer confidence index increased to -4.6 in August from -4.9% in July.

-

16:05

Swiss National Bank: M3 money supply climbs 1.9% in July

The Swiss National Bank (SNB) released its money supply data on Friday. M3 money supply climbed at an annual rate of 1.9% in July, after a 2.1% in June.

M1 money supply was up 0.7% year-on-year in July, after a 0.8% gain in June.

Official reserves rose to $600.6 billion in June from $599.8 billion in May.

-

15:53

U.S. preliminary manufacturing purchasing managers' index declines to 52.9 in August

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) declined to 52.9 in August from 53.8 in July, missing expectations for an increase to 54.0. It was the lowest level since October 2013.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a slower expansion in output, new orders and employment.

"According to survey respondents, the strong dollar continued to put pressure on export sales and competitiveness, while heightened global economic uncertainty appeared to have dampened client spending both at home and abroad. Alongside this, manufacturers of investment goods widely cited growth headwinds from the slump in capital spending across the energy sector," Markit Senior Economist Tim Moore.

-

15:35

U.S. Stocks open: Dow -0.96%, Nasdaq -1.63%, S&P -0.98%

-

15:29

Before the bell: S&P futures -0.43%, NASDAQ futures -0.45%

U.S. Stock futures fell on a global stock selloff sparked by world growth concerns showed no signs of relenting.

Global Stocks:

Nikkei 19,435.83 -597.69 -2.98%

Hang Seng 22,409.62 -347.85 -1.53%

Shanghai Composite 3,509.98 -154.31 -4.21%

FTSE 6,274.97 -92.92 -1.46%

CAC 4,718.46 -65.09 -1.36%

DAX 10,302.19 -130.00 -1.25%

Crude oil $40.83 (-1.16%)

Gold $1154.80 (+0.15%)

-

15:12

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

8.41

+2.06%

107.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.68

-0.31%

11.2K

McDonald's Corp

MCD

99.40

-0.36%

18.7K

Procter & Gamble Co

PG

73.61

-0.41%

2.6K

Johnson & Johnson

JNJ

97.62

-0.43%

4.7K

ALCOA INC.

AA

8.99

-0.44%

14.9K

AT&T Inc

T

33.78

-0.50%

39.8K

E. I. du Pont de Nemours and Co

DD

52.14

-0.52%

3.5K

Pfizer Inc

PFE

34.37

-0.52%

19.3K

Wal-Mart Stores Inc

WMT

68.06

-0.54%

0.6K

International Business Machines Co...

IBM

151.81

-0.56%

1.4K

Home Depot Inc

HD

119.85

-0.57%

4.2K

Cisco Systems Inc

CSCO

26.88

-0.59%

68.9K

Exxon Mobil Corp

XOM

74.13

-0.59%

13.5K

Verizon Communications Inc

VZ

46.60

-0.60%

2.2K

Google Inc.

GOOG

642.98

-0.60%

5.7K

Microsoft Corp

MSFT

45.38

-0.61%

17.9K

Chevron Corp

CVX

78.75

-0.62%

4.0K

FedEx Corporation, NYSE

FDX

159.45

-0.62%

0.1K

3M Co

MMM

142.40

-0.66%

2.5K

American Express Co

AXP

78.24

-0.66%

2.6K

The Coca-Cola Co

KO

40.27

-0.69%

12.9K

Ford Motor Co.

F

14.33

-0.69%

39.1K

ALTRIA GROUP INC.

MO

54.35

-0.69%

1K

Nike

NKE

111.50

-0.71%

4.8K

Amazon.com Inc., NASDAQ

AMZN

512.00

-0.73%

31.5K

Intel Corp

INTC

27.32

-0.76%

19.3K

United Technologies Corp

UTX

95.02

-0.83%

0.4K

International Paper Company

IP

45.60

-0.91%

3.6K

Yandex N.V., NASDAQ

YNDX

Лис.34

-1.05%

12.8K

Yahoo! Inc., NASDAQ

YHOO

33.73

-1.09%

14.3K

AMERICAN INTERNATIONAL GROUP

AIG

61.01

-1.13%

0.2K

Merck & Co Inc

MRK

56.30

-1.14%

1.7K

Boeing Co

BA

135.45

-1.15%

21.6K

General Electric Co

GE

24.90

-1.15%

56.5K

Twitter, Inc., NYSE

TWTR

25.70

-1.15%

86.6K

JPMorgan Chase and Co

JPM

65.15

-1.20%

103.8K

General Motors Company, NYSE

GM

30.45

-1.26%

11.5K

Caterpillar Inc

CAT

75.41

-1.31%

6.2K

Goldman Sachs

GS

194.13

-1.33%

2.6K

UnitedHealth Group Inc

UNH

118.12

-1.39%

3.3K

Citigroup Inc., NYSE

C

54.56

-1.39%

54.2K

Walt Disney Co

DIS

98.53

-1.49%

124.1K

Apple Inc.

AAPL

110.83

-1.62%

599.6K

Tesla Motors, Inc., NASDAQ

TSLA

238.24

-1.63%

36.8K

Hewlett-Packard Co.

HPQ

26.87

-1.76%

30.3K

Visa

V

72.53

-1.92%

40.4K

Starbucks Corporation, NASDAQ

SBUX

54.68

-2.02%

15.8K

Facebook, Inc.

FB

87.92

-2.91%

664.0K

Deere & Company, NYSE

DE

86.25

-4.85%

22.4K

-

15:07

Head of the Eurogroup Jeroen Dijsselbloem urges the Greek government to hold the elections

The head of the Eurogroup, Jeroen Dijsselbloem, on Thursday urged the Greek government to hold the elections.

"I hope that they are as quick as possible so that the least possible amount of time is wasted. I think the intention of Prime Minister Tsipras is to get a more stable government," he said.

-

15:05

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Walt Disney (DIS) target lowered to $89 from $98 at Cowen

-

14:57

Canadian retail sales gain 0.6% in June

Statistics Canada released retail sales data on Friday. Canadian retail sales rose by 0.6% in June, exceeding expectations for a 0.2% gain, after a 0.9% increase in May. May's figure was revised down from a 1.0% gain.

The rise was driven by higher sales at gasoline stations and at electronics and appliance stores. Sales at gasoline stations climbed 2.6% in June, while sales at electronics and appliance stores jumped 9.4%.

Sales at food and beverage stores were flat in June, while motor vehicle and parts sales were down 0.1%.

Sales rose in 8 of 11 subsectors.

Canadian retail sales excluding automobiles were up 0.8% in June, beating expectations for a 0.5% rise, after a 0.8% gain in May. May's figure was revised down from a 0.9% rise.

-

14:42

Canadian consumer price inflation rises 0.1% in July

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation increased 0.1% in July, in line with expectations, after a 0.2% gain in June.

On a yearly basis, the consumer price index rose to 1.3% in July from 1.0% in June, missing expectations for a 1.4% increase.

The consumer price index was partly driven by higher food and automobiles prices.

Food prices climbed 3.2% in July, while automobiles prices increased 2.5%.

Gasoline prices dropped 12.2% in July from the same month a year earlier.

The Canadian core consumer price index, which excludes some volatile goods, was flat in July, after a flat reading in June.

On a yearly basis, core consumer price index in Canada was up to 2.4% in July from 2.3% in June, in line with expectations.

The Bank of Canada's inflation target is 2.0%.

-

14:33

Company News: Deere’s (DE) revenue fell more than 20%

Company reported Q3 profit of $1.53 per share versus $1.44 consensus. Revenues fell 21.6% y/y to $6.84 bln versus $7.2 bln consensus.

Company expected Q4 equipment sales down 24% y/y, current consensus represents a 19% y/y decline.

Company lowered FY15 net income outlook to $1.8 bln from $1.9 bln; FY15 equipment sales outlook lowered to -21% from -19% (consensus -19%).

DE fell to $86.71 (-4.35%) on the premarket.

-

14:22

Preliminary Markit/Nikkei manufacturing purchasing managers' index for Japan increases to 51.9 in August

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan increased to 51.9 in August from 51.2 in July.

A reading below 50 indicates contraction of activity.

The index was partly driven by a rise in output, new orders and employment.

"Latest survey data indicated a further improvement in operating conditions in the Japanese manufacturing sector. New order growth accelerated to the second fastest this year so far, while production increased at a similar pace to July's five-month record," economist at Markit, Amy Brownbill, said.

-

12:00

European stock markets mid session: stocks traded lower on worries over a slowdown in the Chinese economy

Stock indices traded lower on worries over a slowdown in the Chinese economy. The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) decreased to 47.1 in August from 47.8 in July, missing expectations for a decline to 47.7, and hitting a 77-month low.

Greek Prime Minister Alexis Tsipras has submitted his resignation on Thursday evening and called for early elections. He is seeking a mandate to implement reforms.

The election is expected to be held on September 20.

Meanwhile, the economic data from the Eurozone was mostly positive. Eurozone's preliminary manufacturing PMI remained unchanged at 52.4 in August. Analysts had expected index to decline to 52.2.

Eurozone's preliminary services PMI rose to 54.3 in August from 54.0 in July. Analysts had expected the index to remain unchanged at 54.0.

Markit's Senior Economist Rob Dobson said that Eurozone's economy "is still experiencing one of its best periods of economic growth and job creation during the past four years".

"GDP growth is tracking close to 0.4% so far in the third quarter, slightly above the 0.3% seen in quarter 2, highlighting the resilience of the economy through last month's rollercoaster events of the Greek debt crisis and the ongoing negotiations to tie up the full details surrounding the third bailout," he added.

Germany's preliminary manufacturing PMI climbed to 53.2 in August from 51.8 in July, exceeding forecasts of a decline to 51.7.

Germany's preliminary services PMI was down to 53.6 in August from 53.8 in July. Analysts had expected index to climb to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by higher output and new orders.

"Based on PMI data available for the third quarter so far, we should expect German GDP to increase at a similar rate to the 0.4% seen in the three months to June," he noted.

France's preliminary manufacturing PMI dropped to 48.6 in August from 49.6 in July, missing forecasts of a rise to 49.7.

France's preliminary services PMI fell to 51.8 in August from 52.0 in July. Analysts had expected the index to remain unchanged at 52.0.

"Output growth in France's private sector economy cooled to a four-month low in August, suggesting that third-quarter GDP may disappoint again following stagnation in Q2. An improvement in service providers' business expectations to a near three-and-a-half year high provided some rare positive news, but manufacturing continued to struggle amid a sharper drop in new orders," the Senior Economist at Markit Jack Kennedy said.

Current figures:

Name Price Change Change %

FTSE 100 6,335.28 -32.61 -0.51 %

DAX 10,430.13 -2.06 -0.02 %

CAC 40 4,772.98 -10.57 -0.22 %

-

11:41

Public sector net borrowing in the U.K. declines to -£2.07 billion in July

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. declined to -£2.07 billion in July from £8.64 billion in June, beating expectations for a drop to -£2.4 billion. June's figure was revised up from £8.58 billion.

Public sector net borrowing excluding public sector banks fell by £1.4 billion to a surplus of £1.29 billion.

The increase was driven by the tax receipts.

-

11:25

France's preliminary PMIs decline in August

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Friday. France's preliminary manufacturing PMI dropped to 48.6 in August from 49.6 in July, missing forecasts of a rise to 49.7.

France's preliminary services PMI fell to 51.8 in August from 52.0 in July. Analysts had expected the index to remain unchanged at 52.0.

"Output growth in France's private sector economy cooled to a four-month low in August, suggesting that third-quarter GDP may disappoint again following stagnation in Q2. An improvement in service providers' business expectations to a near three-and-a-half year high provided some rare positive news, but manufacturing continued to struggle amid a sharper drop in new orders," the Senior Economist at Markit Jack Kennedy said.

-

11:14

Germany's preliminary manufacturing PMI rises in August, while services PMI declines

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Friday. Germany's preliminary manufacturing PMI climbed to 53.2 in August from 51.8 in July, exceeding forecasts of a decline to 51.7.

Germany's preliminary services PMI was down to 53.6 in August from 53.8 in July. Analysts had expected index to climb to 53.9.

Markit's economist Oliver Kolodseike noted that the German economy was driven by higher output and new orders.

"Based on PMI data available for the third quarter so far, we should expect German GDP to increase at a similar rate to the 0.4% seen in the three months to June," he noted.

-

10:57

Eurozone's preliminary manufacturing PMI remains unchanged in August, preliminary services PMI rises

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Friday. Eurozone's preliminary manufacturing PMI remained unchanged at 52.4 in August. Analysts had expected index to decline to 52.2.

Eurozone's preliminary services PMI rose to 54.3 in August from 54.0 in July. Analysts had expected the index to remain unchanged at 54.0.

Markit's Senior Economist Rob Dobson said that Eurozone's economy "is still experiencing one of its best periods of economic growth and job creation during the past four years".

"GDP growth is tracking close to 0.4% so far in the third quarter, slightly above the 0.3% seen in quarter 2, highlighting the resilience of the economy through last month's rollercoaster events of the Greek debt crisis and the ongoing negotiations to tie up the full details surrounding the third bailout," he added.

-

10:45

German Gfk consumer confidence index declines to 9.9 in September

Market research group GfK released its consumer confidence index for Germany on Friday. German Gfk consumer confidence index fell to 9.9 in September from 10.1 in August.

Analysts had expected the index to remain unchanged at 10.1.

The decrease was driven by declines in economic and income expectations and the willingness to buy.

The economic expectations index plunged to 16.6 points in August to 18.4 in July, while the willingness to buy index fell 3.4 points to 52.0.

The income expectations index dropped by 5.1 points in September and is now at 53.5.

"Despite the decline, it cannot be said that the economic motor will stutter or even stall. As before, the indicator level is high, suggesting that private consumption can fulfil its ascribed role as an important pillar of economic development this year. Since it can be assumed that conditions for a good consumer economy in Germany will remain favourable in the coming months, such as employment, income and inflation, there is a good chance that the consumer climate will stabilize again. Possible risks and burdens first and foremost are justified in the unstable international situation, especially in the Far and Middle East," Gfk noted.

-

10:35

North Korean leader Kim Jong-un orders the army to be combat ready

The geopolitical situation escalated after North Korean leader Kim Jong-un ordered the army to be combat ready. He gave South Korea 48 hours to stop propaganda broadcasts across the demilitarized zone.

In turn, South Korea has said it does not intend to stop broadcasting.

Tensions on the Korean peninsula have flared in recent weeks.

The two Koreas are still officially at war.

-

10:22

Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index falls to 47.1 in August

The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) decreased to 47.1 in August from 47.8 in July, missing expectations for a decline to 47.7, and hitting a 77-month low.

A reading below 50 indicates contraction of activity.

The output index fell to 46.6 in August from 47.1 in July, reaching a 45-month low. New export orders also declined.

Dr. He Fan, Chief Economist at Caixin Insight Group, said that the index indicates that China's economy "is still in the process of bottoming out".

"But overall, the likelihood of a systemic risk remains under control and the structure of the economy is still improving. There is still pressure on the front of maintaining growth rates, and to realize the goal set for this year the government needs to fine tune fiscal and monetary policies to ensure macroeconomic stability and speed up the structural reform. This will lead the market to confidence and renew the vigour of the economy," he added.

-

10:12

Greek Prime Minister Alexis Tsipras submits his resignation

Greek Prime Minister Alexis Tsipras has submitted his resignation on Thursday evening and called for early elections.

"I will shortly meet with the president of the republic and present my resignation and that of my government. I want to submit to the Greek people everything I have done so that they can decide once more," he said.

Tsipras is seeking a mandate to implement reforms.

The election is expected to be held on September 20.

-

08:27

Global Stocks: U.S. and Asian indices declined further

Concerns over global economic growth and uncertainties over prospects of Fed interest rates weighed on U.S. stock indices.

The Dow Jones Industrial Average dropped 358.04, or 2.1%, to 16990.69 (the lowest level since October). The S&P 500 lost 43.88, or 2.1%, to 2035.73 (all of its sectors declined). The Nasdaq Composite fell 141.56, or 2.8%, to 4877.49.

The leading indicators index from the Conference Board fell unexpectedly by 0.2% in July for the first time in almost two years. In June the index rose by 0.6%. Economists expected a 0.2% increase in July.

This morning in Asia Hong Kong Hang Seng dropped 2.32%, or 527.41 points, to 22,230.06. China Shanghai Composite Index lost 3.04%, or 111.47 points, to 3,552.82. The Nikkei fell 2.65%, or 530.19 points, to 19,503.33.

Preliminary data from Markit Economics showed that China Manufacturing PMI declined to 47.1 in August from July final reading of 47.8. Any reading below 50 indicates contraction. These data added to concerns over economic growth of the world's second-biggest economy.

-

04:00

Nikkei 225 19,606.61 -426.91 -2.13%, Hang Seng 22,425.37 -332.10 -1.46%, Shanghai Composite 3,609.96 -54.33 -1.48%

-

01:03

Stocks. Daily history for Aug 20’2015:

(index / closing price / change items /% change)

HANG SENG 22,675.3 -492.55 -2.13%

S&P/ASX 200 5,288.6 -91.59 -1.70%

TOPIX 1,623.88 -24.60 -1.49%

SHANGHAI COMP 3,692.55 -101.56 -2.68%

FTSE 100 6,367.89 -35.56 -0.56%

CAC 40 4,783.55 -100.55 -2.06%

Xetra DAX 10,432.19 -249.96 -2.34%

S&P 500 2,035.73 -43.88 -2.11%

NASDAQ Composite 4,877.49 -141.56 -2.82%

Dow Jones 16,990.69 -358.04 -2.06%

-