Noticias del mercado

-

17:41

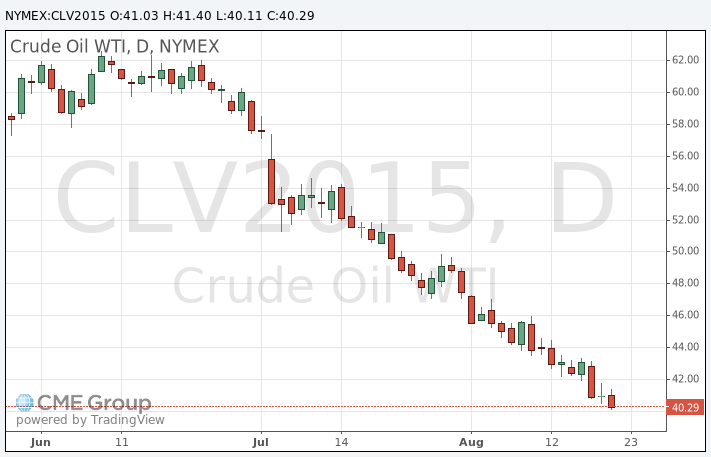

Oil trades lower on the Chinese economic data

Oil traded lower on the Chinese economic data. The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) decreased to 47.1 in August from 47.8 in July, missing expectations for a decline to 47.7, and hitting a 77-month low.

Concerns over the global oil oversupply also weighed on oil prices.

Market participants are awaiting the release of the number of active U.S. rigs later in the day. The number of U.S. active oil rigs rose last week. The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 2 rigs to 672 last week. It was the fourth consecutive increase.

WTI crude oil for October delivery declined to $40.11 a barrel on the New York Mercantile Exchange.

Brent crude oil for October decreased to $45.88 a barrel on ICE Futures Europe.

-

17:23

Gold price rises due to higher demand for safe-haven assets

Demand for safe-haven assets increased as worries over a slowdown in the Chinese economy grew. The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) decreased to 47.1 in August from 47.8 in July, missing expectations for a decline to 47.7, and hitting a 77-month low.

It is also unclear when the Fed plans to raise its interest rate. Fed officials agreed at the July monetary policy meeting that the economy is approaching the point when the central bank needs to increase interest rates, but they were concerned about the weak inflation and a slowdown in the global economy.

October futures for gold on the COMEX today increased to 1167.00 dollars per ounce.

-

10:35

North Korean leader Kim Jong-un orders the army to be combat ready

The geopolitical situation escalated after North Korean leader Kim Jong-un ordered the army to be combat ready. He gave South Korea 48 hours to stop propaganda broadcasts across the demilitarized zone.

In turn, South Korea has said it does not intend to stop broadcasting.

Tensions on the Korean peninsula have flared in recent weeks.

The two Koreas are still officially at war.

-

10:22

Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index falls to 47.1 in August

The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) decreased to 47.1 in August from 47.8 in July, missing expectations for a decline to 47.7, and hitting a 77-month low.

A reading below 50 indicates contraction of activity.

The output index fell to 46.6 in August from 47.1 in July, reaching a 45-month low. New export orders also declined.

Dr. He Fan, Chief Economist at Caixin Insight Group, said that the index indicates that China's economy "is still in the process of bottoming out".

"But overall, the likelihood of a systemic risk remains under control and the structure of the economy is still improving. There is still pressure on the front of maintaining growth rates, and to realize the goal set for this year the government needs to fine tune fiscal and monetary policies to ensure macroeconomic stability and speed up the structural reform. This will lead the market to confidence and renew the vigour of the economy," he added.

-

09:07

Oil prices declined

West Texas Intermediate futures for September delivery, which expires today, plunged to $40.82 (-1.21%), while Brent crude fell to $46.15 (-1.01%) after China (world's second biggest consumer of oil) added to demand concerns amid disappointing data from Markit Economics. The flash China Manufacturing PMI came in at 47.1 in August compared to July final reading of 47.8. The index missed analysts' expectations for a modest decline to 47.7. This is the fastest pace of declines in six and a half years.

Meanwhile oversupply persisted.

-

08:46

Gold continued recovering

Gold advanced to $1,161.20 (+0.69%) after investors revised their forecasts for a rate increase by the Federal Reserve based on minutes of the latest policy meeting of the central bank. Market participants took the minutes for a sign that there will be no changes to interest rates in September.

"What's supporting gold is that from unrelentingly bad news, which we saw until late July-early August. The news flow has been more bullish to gold after the Chinese central bank currency devaluation," Macquarie analyst Matthew Turner said.

The U.S. dollar, bullion's traditional opponent, fell 0.4% against a basket of major currencies.

-

01:04

Commodities. Daily history for Aug 20’2015:

(raw materials / closing price /% change)

Oil 40.94 -0.49%

Gold 1,152.60 -0.05%

-