Noticias del mercado

-

17:44

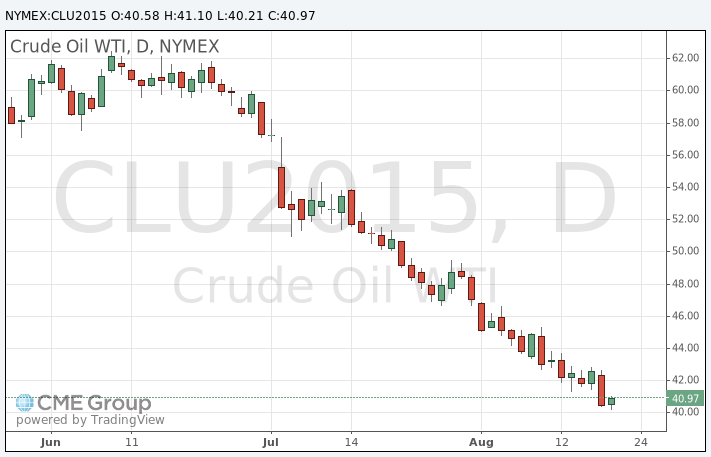

Oil trades lower as the U.S. crude oil inventories data still weighed on oil prices

Oil traded lower as the U.S. crude oil inventories data still weighed on oil prices. U.S. crude inventories increased by 2.62 million barrels to 456.2 million in the week to August 14.

Analysts had expected U.S. crude oil inventories to decline by 0.6 million barrels.

Crude stocks at the Cushing, Oklahoma, rose by 326,000 barrels.

This data added to concerns over the global oil supply.

The EIA downgraded its crude oil price forecasts. It expects West Texas Intermediate to be $49 per barrel in 2015, $6 lower than the previous estimate, and $54 per barrel in 2016, $8 per barrel lower than the previous estimate.

Concerns over a slowdown in the Chinese economy also weighed on oil prices.

WTI crude oil for September delivery traded in the range between $40.21 and $41.22 a barrel on the New York Mercantile Exchange.

Brent crude oil for October decreased to $46.71 a barrel on ICE Futures Europe.

-

17:24

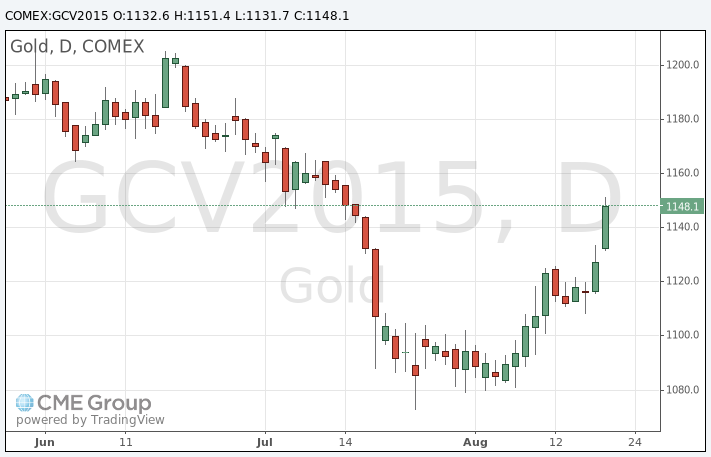

Gold price hits 5-week high after the release of the weaker-than-expected U.S. initial jobless claims data

Gold price hits 5-week high after the release of the weaker-than-expected U.S. initial jobless claims data. The number of initial jobless claims in the week ending August 15 in the U.S. rose by 4,000 to 277,000 from 273,000 in the previous week. The previous week's reading was revised down from 274,000.

Analysts had expected the number of initial jobless claims to be 272,000.

Earlier, gold price rose on the latest Fed's monetary policy meeting minutes. Fed officials agreed at the July monetary policy meeting that the economy is approaching the point when the central bank needs to increase interest rates, but they were concerned about the weak inflation and a slowdown in the global economy.

October futures for gold on the COMEX today increased to 1151.40 dollars per ounce.

-

10:59

International Monetary Fund will not change its benchmark currency basket until October 2016

The International Monetary Fund (IMF) said on Wednesday that it will not change its benchmark currency basket until October 2016. The IMF plans to decide in November whether to include the yuan in its Special Drawing Rights basket or not.

The yuan should be "freely usable" or widely used to make international payments and widely traded in foreign exchange markets to be included in the basket.

China's central bank devaluated the yuan several times this month.

-

10:22

Saudi Arabia’s oil exports increase to 7.37 million barrels a day in June

According to data on the website of the Joint Organizations Data Initiative (JODI), Saudi Arabia's oil exports increased to 7.37 million barrels a day in June from 6.94 million barrels in May.

Oil production climbed to 10.564 million barrels daily from 10.3 million, exceeding a previous all-time high set in 1980.

Oil refineries used 2.1 million barrels a day in June, down from 2.4 million barrels in May.

Saudi Arabia is the world's biggest oil producer and exporter.

-

09:01

Oil prices declined

West Texas Intermediate futures for September delivery plunged to $40.90 (-0.90%), while Brent crude fell to $46.85 (-0.66%) after the U.S. Energy Information Administration reported a surprise increase of 2.6 million barrels in crude supplies for the week ended August 14. Gasoline supplies fell 2.7 million barrels, while distillate stockpiles rose by 600,000 barrels. US crude production fell 47,000 barrels to 9.348 million barrels a day last week. However U.S. output is still likely to be the highest since 1972.

The EIA also lowered its price expectations for West Texas Intermediate (WTI) by $6 per barrel to $49 for 2015, and by $8 per barrel to $54 in 2016. Revisions were based on concerns over economic growth in emerging markets, ample supply, rising inventories worldwide and prospects of additional exports from Iran.

-

08:36

Gold climbed on Fed Meeting Minutes

Gold advanced to $1,139.00 (+0.98%) after minutes of the Federal Reserve's latest meeting shifted investors' expectations for a rate hike to December from September. The minutes signaled that Fed policymakers were still cautious about the U.S. economy and its readiness to withstand higher rates.

Bullion prices approached a five-week high in Asia trade as probability of a rate hike in the U.S. in September declined releasing some pressure off the non-interest-bearing precious metal.

-

00:32

Commodities. Daily history for Aug 19’2015:

(raw materials / closing price /% change)

Oil 40.55 -0.61%

Gold 1,133.60 +0.51%

-