Noticias del mercado

-

20:20

American focus: the dollar fell

The US dollar weakened, as investors continued to revise their forecasts on the timing of a rate hike by the Federal Reserve System of the USA on the day following the publication of minutes of the July meeting of the central bank.

Investors sold the dollar, ignoring the strong data on applications for unemployment benefits, sales of existing homes and the Philadelphia Fed index, focusing on the signals from the central bank. Minutes of the last meeting of the US Federal Reserve signaled that reducing the likelihood of policy tightening in September. Rising interest rates in the United States will make the dollar more attractive to investors.

Wednesday's reports of last month's meeting of the Operations Committee on the Federal Open Market testified that, according to the expectations of the leaders of the central bank, inflation in the US will be below the target level of 2% to the end of 2017 and then will rise only gradually. Further declines in crude oil prices continue to put pressure on energy prices, the head of the Fed.

The next meeting of the Operations Committee on the Federal Open Market will be held on September 16-17.

Investors have also revised their forecasts on the timing of the Fed raising interest rates after last week, China devalued its currency, to make a revolution in the financial markets and causing a blow to more risky assets, including emerging market currencies and commodity currencies. China's decision also raised the concern about the slowing economy of the country and weakening global inflation. It also lowered the likelihood of tighter monetary policy in the United States against the backdrop of deteriorating global economic outlook.

US Department of Labor said the number of Americans who first applied for unemployment benefits, increased slightly last week but remained at historically low levels, indicating a stable situation on the labor market. According to the report, in the week ended Aug. 15, the number of initial applications for unemployment benefits rose by 4,000 to a seasonally adjusted and reached 277 000. Economists had expected 272,000 new claims. The figure for the previous week was revised up to 273 000 to 274 000. It is worth emphasizing the number of calls remained below the psychological threshold of 300,000 already the 24th week in a row, but the figure is growing fourth. week in a row.

Sales in the secondary market increased significantly by the end of July, reaching the highest levels since the start of the recession, helped by a confident boost in single-family housing sector. It became known from the report of the National Association of Realtors. The data showed that the seasonally adjusted existing home sales rose 2% to $ 5.59 million at the same time. Units. which is the highest value since February 2007. Also add that the volume of sales in June was revised down - to 5.48 million. Units from 5.49 million. Units. Economists had expected sales to fall to 5.44 million. Units. In annual terms, sales in the secondary market increased by 10.3 percent.

As shown by the report, the Philadelphia Fed, in August PMI improved markedly, reaching thus the level of 8.3 points compared with 5.7 points in July. It is worth noting that many economists expect this figure to increase to the level of 7 points.

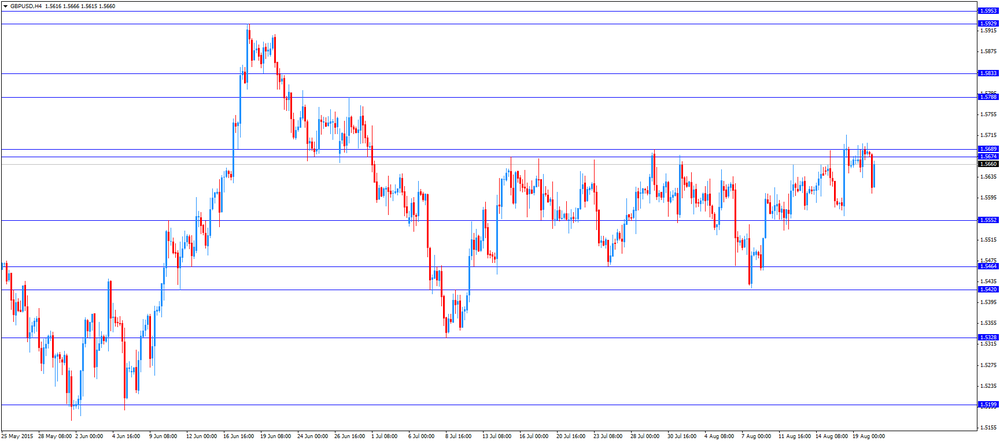

The pound fell sharply earlier against the dollar, approaching to $ 1.5600, which was due to the publication of data on retail sales in Britain, which were worse than expected. However, a strong balance report factory orders helped the British currency to play more than half of the previously lost positions. As previously reported, last month's retail sales in Britain rose slightly, being thus below experts' forecasts, hit by falling sales of motor fuel. According to the data, retail sales rose in July by 0.1 percent compared to the previous month, and increased by 4.2 percent in annual terms. Economists had expected sales to rise 0.4 percent for the month and 4.4 percent per annum. Also add that the figures for June were revised to improve - monthly change was revised down to -0.1 percent from -0.2 percent, while the annual rate to 4.2 percent from 4.0 percent. Meanwhile, the report stated that, excluding fuel sales rose 0.4 percent for the month and 4.3 percent compared to the previous year, in line with expectations. The ONS said that the 2.6 percent drop in sales of motor fuel was partially offset by a 3.6-percent increase in sales of products for the home. Sales of household electrical appliances and furniture increased significantly in the past month, which probably reflects the improvement in the housing market.

-

17:35

Greek government officials: Greek Prime Minister Alexis Tsipras plans to announce his resignation on Thursday evening

According to two Greek government officials, Greek Prime Minister Alexis Tsipras plans to announce his resignation on Thursday evening to clear the way for national elections. It is unclear when elections will be held. September or early October are the possible dates.

-

17:07

President of the Supervisory Council at the European Central Bank Danièle Nouy: the stress test next year will include fewer banks

The President of the Supervisory Council at the European Central Bank (ECB), Danièle Nouy, said on Thursday that the stress test next year will include fewer banks.

"We will have another stress test next year in 2016. There will be fewer banks," Nouy noted.

She estimated that the stress test will include about 50 or 60 banks.

-

16:57

U.S. leading economic index drops 0.2% in July

The Conference Board released its leading economic index for the U.S. on Thursday. The leading economic index dropped by 0.2% in July, missing expectations a 0.2% gain, after a 0.6% increase in June.

Seven of the ten indicators rose.

The Conference Board economist Ataman Ozyildirim said that the index is still pointing to moderate economic growth for the rest of the year.

"Current conditions, measured by the coincident economic index, have been rising moderately but steadily, driven by rising employment and income, and even industrial production has improved in recent months," he noted.

-

16:41

Philadelphia Federal Reserve Bank’s manufacturing index jumps to 8.3 in August

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index increased to 8.3 in August from 5.7 in July, exceeding expectations for a rise to 7.0.

A reading above zero indicates expansion.

The increase was partly driven by a rise in shipments. The shipments index jumped 16.7 in August from 4.4 in July.

The new orders index decreased to 5.8 in August from 7.1 in July.

The prices paid index slid to 6.2 in August from 20.2 in July, while the prices received index were down to -4.9 from 1.7.

The number of employees index rose to 5.3 in August from -0.4 last month.

According to the report, the future general activity index rose to 43.1 in August from 41.5 in July.

-

16:25

U.S. existing homes sales rise 2.0% in July

The National Association of Realtors released existing homes sales figures in the U.S. on Thursday. Sales of existing homes rose 2.0% to a seasonally adjusted annual rate of 5.59 million in July from 5.48 million in June. It was the highest level since February 2007.

June's figure was revised down from 5.49 million units.

Analysts had expected an increase to 5.44 million units.

"The creation of jobs added at a steady clip and the prospect of higher mortgage rates and home prices down the road is encouraging more households to buy now. As a result, current homeowners are using their increasing housing equity towards the downpayment on their next purchase," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers declined to 28% in July, their lowest share since January.

Yun noted that "declining affordability could begin to slowly dampen demand".

-

16:02

Federal Reserve Bank of San Francisco President John Williams: a reduction in house prices could lead to a drop in gross domestic product

Federal Reserve Bank of San Francisco President John Williams warned on Thursday that a reduction in house prices could lead to a drop in gross domestic product.

"Monetary policy actions have sizable and significant effects on house prices in advanced economies. A typical estimate is that a 1% loss in the gross domestic product is associated with a 4% reduction in house prices. This implies a very costly trade-off of using monetary policy to affect house prices when macroeconomic and financial stability goals are in conflict," he noted.

"If the housing sector and the overall economy are both booming, then tighter monetary policy may serve to both reduce the risks to the financial system and keep economic activity from exceeding desired levels," Williams added.

-

16:00

U.S.: Philadelphia Fed Manufacturing Survey, August 8.3 (forecast 7)

-

16:00

U.S.: Existing Home Sales , July 5.59 (forecast 5.44)

-

16:00

U.S.: Leading Indicators , July -0.2% (forecast 0.2%)

-

15:55

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E337mn), $1.1000(E812mn), $1.1040(E611mn), $1.1100(E271mn), $1.1150(E154mn)

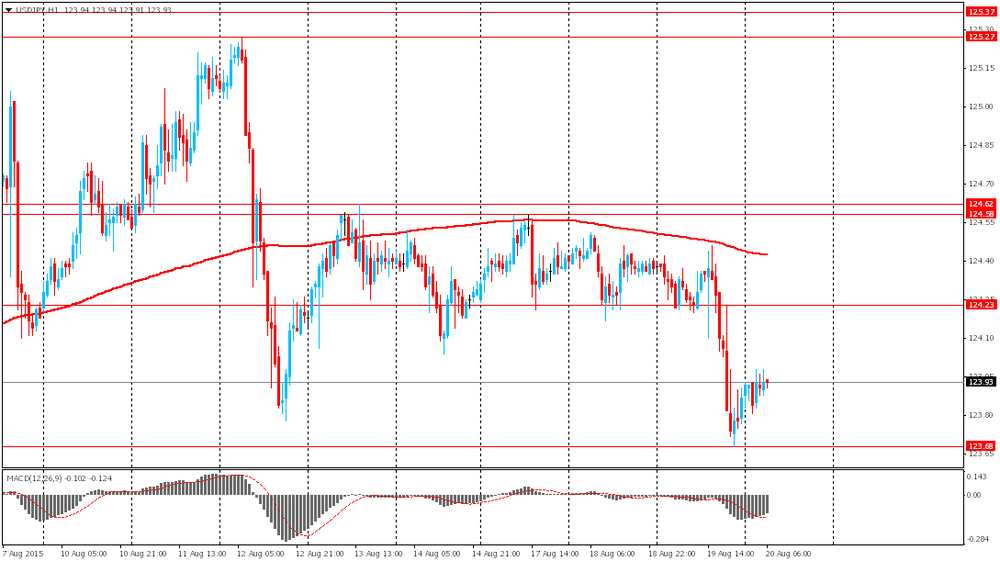

USD/JPY: Y123.00($385mn), Y124.00($528mn), Y124.50($355mn), Y125.00($315mn), Y126.00($727mn)

EUR/JPY: Y136.75(E317mn), Y137.00(E233mn), Y137.50(E350mn)

GBP/USD: $1.5475(Gbp520mn), $1.5500(Gbp226mn), $1.5700(Gbp135mn)

USD/CHF: Chf0.9800($480mn)

AUD/USD: $0.7250(A$$$0.7295(A$280mn), $0.7360(A$254mn)

USD/CAD: C$1.3050($398mn), C$1.3100($133mn), C$1.3150($200mn), C$1.3185($191mn)

-

15:42

European Central Bank Governing Council member Ewald Nowotny: there is no currency war worldwide

The European Central Bank (ECB) Governing Council member Ewald Nowotny said on Thursday that there is no currency war worldwide.

"There is no way of currency wars. I don't see this happening, in any case not in Europe but also don't see this worldwide," he said. Nowotny added that the central bank's asset buying programme should help to boost the economy in the Eurozone.

He pointed out that the ECB will continue its asset buying programme until September 2016 as there are no signals pointing to the end.

-

15:29

Greece’s current account surplus declines to €1.0 billion in June

The Bank of Greece released its current account data on Thursday. Greece's current account surplus fell to €1.0 billion in June from €1.3 billion in June last year.

The Greek deficit on trade in goods and services widened to €1.298 billion in June from €1.275 billion in June last year.

The deficit on primary income rose to €256.2 million in June from EUR 156.4 million in June last year, while the surplus on secondary income narrowed to €188.7 million from €277.4 million.

The capital account surplus declined to €133.2 million from €407.2 million last year.

-

15:14

CBI industrial order books balance increases to -1% in August

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance rose to -1% in August from -10% in July, beating expectations for -10%.

The increase was driven by a rise in export order book balance. The export order book balance increased to -8% in August from -17% in July.

The balance for output volumes for the next three months was +14% in August.

"While the rebound in manufacturers' total order books is encouraging, many firms are still struggling in overseas markets. On the one hand, the strength of Sterling and cheaper energy are reducing factory input costs, but the strong pound is also hitting export prices and margins hard. With only 4% of the UK's exports going to China, the country's slowdown is not a direct cause of concern for our manufacturers, but it will make life harder for our firms in exposed sectors like metals and commodities," the CBI director of economics Rain Newton-Smith said.

-

14:49

Initial jobless claims rise by 4,000 to 277,000 in the week ending August 15

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending August 15 in the U.S. rose by 4,000 to 277,000 from 273,000 in the previous week. The previous week's reading was revised down from 274,000.

Analysts had expected the number of initial jobless claims to be 272,000.

Jobless claims remained below 300,000 the 16th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 24,000 to 2,254,000 in the week ended August 08.

-

14:38

Canada’s wholesale sales rise 1.3% in June

Statistics Canada released wholesale sales figures on Thursday. Wholesale sales increased 1.3% in June, exceeding expectations for a 1.0% rise, after a 0.9% drop in May. May's figure was revised up from a 1.0% decrease.

The increase was driven by higher sales in the motor vehicle and parts subsector. Sales of automobiles and parts jumped 3.0% in June.

Sales in the machinery, equipment and supplies subsector rose 1.3% in June, sales in the personal and household goods subsector increased 2.2%, while sales in the food, beverage and tobacco subsector was up 1.2%.

Sales rose in five of the seven subsectors.

Inventories climbed by 1.1% in June.

-

14:30

U.S.: Continuing Jobless Claims, August 2254 (forecast 2265)

-

14:30

U.S.: Initial Jobless Claims, August 277 (forecast 272)

-

14:30

Canada: Wholesale Sales, m/m, June 1.3% (forecast 1.0%)

-

14:20

Foreign exchange market. European session: the euro traded higher against the U.S. dollar as the European Stability Mechanism (ESM) has approved the first tranche for Greece

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Switzerland Trade Balance July 3.51 Revised From 3.58 3.74

06:45 U.S. FOMC Member Williams Speaks

08:30 United Kingdom Retail Sales (MoM) July -0.1% Revised From -0.2% 0.4% 0.1%

08:30 United Kingdom Retail Sales (YoY) July 4.2% Revised From 4.0% 4.4% 4.2%

10:00 United Kingdom CBI industrial order books balance August -10 -10 -1

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 2,000 to 272,000.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to rise to 7.0 in August from 5.7 in July.

The existing home sales in the U.S. are expected to decrease to 5.44 million units in July from 5.49 million units in June.

Yesterday's release of the Fed's July monetary policy meeting weighed on the greenback. Fed officials agreed at the July monetary policy meeting that the economy is approaching the point when the central bank needs to increase interest rates, but they were concerned about the weak inflation and a slowdown in the global economy.

The euro traded higher against the U.S. dollar as the European Stability Mechanism (ESM) has approved the €26 billion first tranche of the third bailout for Greece on Thursday. The ESM said that it transferred €13 billion immediately.

Greece has repaid €3.2 billion to the European Central Bank (ECB) after receiving the first tranche.

German PPI producer prices were flat in July, after a 0.1% decline in June.

On a yearly basis, German PPI dropped 1.3% in July, after a 1.4% fall in June.

The British pound traded lower against the U.S. dollar after the weaker-than-expected U.K. retail sales data. Retail sales in the U.K. increased 0.1% in July, missing expectations for a 0.4% rise, after a 0.1% decline in June. June's figure was revised up from a 0.2% fall.

The slower growth was partly driven by higher sales of electrical appliances, furniture and other household goods.

Sales of household goods climbed 3.6% in July, while sales at department stores rose 1.6%.

Food sales fell 0.2% in July, while sales of clothing and footwear slid 1.5%.

On a yearly basis, retail sales in the U.K. climbed 4.2% in July, missing forecasts of 4.4% increase, after a 4.2% rise in June. June's figure was revised up from a 4.0% gain.

The CBI industrial order books balance rose to -1% in August from -10% in July, beating expectations for -10%.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian wholesale sales data. Canadian wholesale sales are expected to climb 1.0% in June, after a 1.0% decline in May.

The Swiss franc traded higher against the U.S. dollar. The Swiss trade surplus climbed to CHF3.74 billion in July from CHF3.51 billion in the previous month. June's figure was revised down from a surplus of CHF3.58 billion.

Exports dropped 1.7% in July, while imports were down 2.5%.

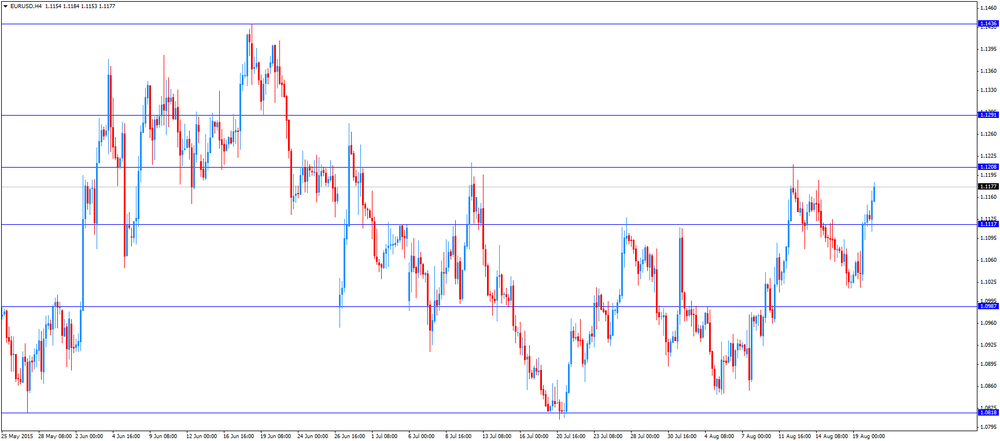

EUR/USD: the currency pair rose to $1.1184

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m June -1.0% 1.0%

12:30 U.S. Initial Jobless Claims August 274 272

14:00 U.S. Existing Home Sales July 5.49 5.44

14:00 U.S. Philadelphia Fed Manufacturing Survey August 5.7 7

14:00 U.S. Leading Indicators July 0.6% 0.2%

17:00 U.S. Jackson Hole Symposium

-

14:00

Orders

EUR/USD

Offers 1.1150 1.1180 1.1200 1.2220 1.1245 1.1265 1.1285 1.1300

Bids 1.1100 1.1080 1.1065 1.1050 1.1020-25 1.1000 1.0985 1.0965 1.0950

GBP/USD

Offers 1.5685 1.5700-05 1.5720 1.5735 1.5750 1.5780 1.5800

Bids 1.5650 1.5635 1.5625 1.5600 1.5545-50 1.5525-30 1.5500

EUR/GBP

Offers 0.7120 0.7135 0.7150-55 0.7185 0.7200

Bids 0.7085 0.7065 0.7050 0.7030-35 0.7020 0.7000

EUR/JPY

Offers 138.30 138.50 138.85 139.00 139.35 139.50

Bids 137.75-80 137.50 137.25-30 137.00 136.80 136.50 136.00

USD/JPY

Offers 124.25 124.50 124.65 124.80 125.00 125.20-25 125.50

Bids 123.75-80 1 123.45-50 123.25-30 123.00 122.85 122.50

AUD/USD

Offers 0.7320 0.7350 0.7370 0.7385 0.7400 0.7425 0.7450

Bids 0.7285 0.7265 0.7250 0.7220 0.7200

-

12:00

United Kingdom: CBI industrial order books balance, August -1 (forecast -10)

-

11:38

European Stability Mechanism approves the €26 billion first tranche of the third bailout for Greece

The European Stability Mechanism (ESM) has approved the €26 billion first tranche of the third bailout for Greece on Thursday. The ESM said that it transferred €13 billion immediately.

"I am relieved that after intense negotiations with the Greek government and approval by our members, all conditions are now in place to make this disbursement in time," said ESM Managing Director Klaus Regling.

Greece has repaid €3.2 billion to the European Central Bank (ECB) after receiving the first tranche.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.25bn), $1.1030-40(E299mn), $1.1050(547mn), $1.1095-1.1100(E1.6bn), $1.1135-55(E878mn), $1.1200(E522mn)

USD/JPY: Y122.50($850mn), Y123.00($700mn), Y123.75($740mn), Y124.00($392mn), Y124.85($810mn), Y125.00($453mn)

GBP/USD: $1.5600(Gbp401mn), $1.5810(Gbp130mn)

EUR/GBP: Gbp0.7025(E233mn), Gbp0.7075(E155mn), Gbp0.7175(E445mn)

AUD/USD: $0.7400(A$249mn)

NZD/USD: $0.6550(NZ$202mn), $0.6690(NZ$467mn)

USD/CAD: C$1.3000($347mn), C$1.3100($105mn), C$1.3150($160mn), C$1.3190($160mn)

-

11:12

German producer prices are flat in July

Destatis released its producer price index (PPI) for Germany on Thursday. German PPI producer prices were flat in July, after a 0.1% decline in June.

On a yearly basis, German PPI dropped 1.3% in July, after a 1.4% fall in June.

PPI excluding energy sector fell by 0.3% year-on-year in July.

Energy prices plunged 4.1% in July.

Consumer non-durable goods prices fell 1.5% in June, intermediate goods sector prices decreased by 0.6%, and capital goods prices increased 0.8%, while durable consumer goods sector prices rose 1.3%.

-

10:59

International Monetary Fund will not change its benchmark currency basket until October 2016

The International Monetary Fund (IMF) said on Wednesday that it will not change its benchmark currency basket until October 2016. The IMF plans to decide in November whether to include the yuan in its Special Drawing Rights basket or not.

The yuan should be "freely usable" or widely used to make international payments and widely traded in foreign exchange markets to be included in the basket.

China's central bank devaluated the yuan several times this month.

-

10:53

UK retail sales rise 0.1% in July

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 0.1% in July, missing expectations for a 0.4% rise, after a 0.1% decline in June. June's figure was revised up from a 0.2% fall.

The slower growth was partly driven by higher sales of electrical appliances, furniture and other household goods.

Sales of household goods climbed 3.6% in July, while sales at department stores rose 1.6%.

Food sales fell 0.2% in July, while sales of clothing and footwear slid 1.5%.

On a yearly basis, retail sales in the U.K. climbed 4.2% in July, missing forecasts of 4.4% increase, after a 4.2% rise in June. June's figure was revised up from a 4.0% gain.

-

10:37

Swiss trade surplus rises to CHF3.74 billion in July

The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus climbed to CHF3.74 billion in July from CHF3.51 billion in the previous month. June's figure was revised down from a surplus of CHF3.58 billion.

Exports dropped 1.7% in July, while imports were down 2.5%.

On a yearly basis, exports fell 7.4% in July, while imports decreased 8.3%.

-

10:31

United Kingdom: Retail Sales (YoY) , July 4.2% (forecast 4.4%)

-

10:30

United Kingdom: Retail Sales (MoM), July 0.1% (forecast 0.4%)

-

10:11

Fed’s July monetary policy meeting minutes: no clear signal of when the Fed will start raising its interest rate

The Fed released its July monetary policy meeting minutes on Wednesday. There was no clear signal of when the Fed will start raising its interest rate, but there were doubts about the interest rate hike in September.

"Most judged that the conditions for policy firming had not yet been achieved, but they noted that conditions were approaching that point. Participants observed that the labour market had improved notably since early this year, but many saw scope for some further improvement," the minutes said.

Fed officials were concerned about the pace of inflation. According to the minutes, "almost all members indicating that they would need to see more evidence that economic growth was sufficiently strong and labour markets conditions had firmed enough for them to feel reasonably confident" that inflation would return to the Fed's 2% target over the medium term.

Several members were concerned over the situation in China.

"While the recent Chinese stock market decline seemed to have had limited implications to date for the growth outlook in China, several participants noted that a material slowdown in Chinese economic activity could pose risks to the U.S. economic outlook," the minutes said.

Fed officials said that low exports due to the strong U.S. dollar would continue to weigh on economic growth in the second half of 2015.

Some Fed officials "were concerned about the outlook for consumer spending, noting that spending had been disappointing in recent months even though real income had already been boosted by the lower gasoline prices and the improved labour market".

-

08:30

Options levels on thursday, August 20, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1210 (4751)

$1.1176 (4413)

$1.1155 (1593)

Price at time of writing this review: $1.1125

Support levels (open interest**, contracts):

$1.1089 (1548)

$1.1050 (2014)

$1.1024 (3883)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 85160 contracts, with the maximum number of contracts with strike price $1,1200 (7221);

- Overall open interest on the PUT options with the expiration date September, 4 is 116320 contracts, with the maximum number of contracts with strike price $1,0500 (7840);

- The ratio of PUT/CALL was 1.37 versus 1.36 from the previous trading day according to data from August, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (2259)

$1.5804 (2584)

$1.5708 (2184)

Price at time of writing this review: $1.5674

Support levels (open interest**, contracts):

$1.5595 (1035)

$1.5497 (2740)

$1.5399 (2156)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 30336 contracts, with the maximum number of contracts with strike price $1,5600 (2791);

- Overall open interest on the PUT options with the expiration date September, 4 is 35315 contracts, with the maximum number of contracts with strike price $1,5500 (2740);

- The ratio of PUT/CALL was 1.16 versus 1.18 from the previous trading day according to data from August, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:17

Foreign exchange market. Asian session: the euro advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

06:00 Switzerland Trade Balance July 3.58 3.74

The euro strengthened against the U.S. dollar amid minutes from the latest meeting of the Federal Reserve. It was also announced that the European Stability Mechanism had approved the third international bailout program for Greece worth up to €86 billion. Greece is supposed to receive first €13 billion by Thursday morning. The first tranche is €26 billion and the country will have it before October 2015.

The greenback retreated as minutes from July Fed meeting showed that policymakers had not agreed on the timing of a liftoff in interest rates. Experts also noted that a stronger dollar could weigh on inflation and economic growth in the U.S.

The yen slightly advanced against the U.S. dollar after it reached a three-week low yesterday amid Fed meeting minutes, which showed no clear signs of intentions to raise interest rates in September.

EUR/USD: the pair rose to $1.1150 in Asian trade

USD/JPY: the pair traded within Y123.80-00

GBP/USD: the pair traded within $1.5675-00

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 U.S. FOMC Member Williams Speaks

08:30 United Kingdom Retail Sales (MoM) July -0.2% 0.4%

08:30 United Kingdom Retail Sales (YoY) July 4.0% 4.4%

10:00 United Kingdom CBI industrial order books balance August -10 -10

12:30 Canada Wholesale Sales, m/m June -1.0% 1.0%

12:30 U.S. Continuing Jobless Claims August 2273 2265

12:30 U.S. Initial Jobless Claims August 274 272

14:00 U.S. Existing Home Sales July 5.49 5.44

14:00 U.S. Philadelphia Fed Manufacturing Survey August 5.7 7

14:00 U.S. Leading Indicators July 0.6% 0.2%

17:00 U.S. Jackson Hole Symposium

22:45 New Zealand Visitor Arrivals July 9.2%

-

08:01

Switzerland: Trade Balance, July 3.74

-

00:31

Currencies. Daily history for Aug 19’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1121 +0,85%

GBP/USD $1,5680 +0,14%

USD/CHF Chf0,9649 -1,26%

USD/JPY Y123,87 -0,40%

EUR/JPY Y137,76 +0,45%

GBP/JPY Y194,23 -0,26%

AUD/USD $0,7348 +0,19%

NZD/USD $0,6598 +0,08%

USD/CAD C$1,3116 +0,44%

-

00:01

Schedule for today, Thursday, Aug 20’2015:

(time / country / index / period / previous value / forecast)

3:00 Japan BoJ Interest Rate Decision 0%

03:00 Japan Bank of Japan Monetary Base Target 275

03:00 Japan BoJ Monetary Policy Statement

06:00 Switzerland Trade Balance July 3.58

06:30 Japan BOJ Press Conference

06:45 U.S. FOMC Member Williams Speaks

08:30 United Kingdom Retail Sales (MoM) July -0.2% 0.4%

08:30 United Kingdom Retail Sales (YoY) July 4.0% 4.4%

10:00 United Kingdom CBI industrial order books balance August -10 -10

12:30 Canada Wholesale Sales, m/m June -1.0% 1.0%

12:30 U.S. Continuing Jobless Claims August 2273 2265

12:30 U.S. Initial Jobless Claims August 274 272

14:00 U.S. Existing Home Sales July 5.49 5.44

14:00 U.S. Philadelphia Fed Manufacturing Survey August 5.7 7

14:00 U.S. Leading Indicators July 0.6% 0.2%

17:00 U.S. Jackson Hole Symposium

22:45 New Zealand Visitor Arrivals July 9.2%

-