Noticias del mercado

-

22:32

US stocks closed

The rout in emerging assets knocked the Standard & Poor's 500 Index out of its seven-month trading range and gave U.S. equities their biggest drop in 18 months amid intensifying concern that global growth is slowing.

The selloff in currencies from Kazakhstan to Thailand roiled stocks around the world, wiping out year-to-date gains in U.S. equities and sending British shares into a correction. Investors sought the safety of gold and Treasuries as the S&P 500 breached a key technical level that it's been above since March.

Investor anxiety over emerging markets is increasing as the Federal Reserve considers the timing of higher interest rates. Slower global economic growth may cause the central bank to delay a move, as minutes released yesterday showed officials are concerned about stubbornly low inflation caused in part by the commodities rout.

Selling today was heaviest in some of the bull market's biggest winners. Netflix Inc. lost 7.8 percent, while media stocks sank as Walt Disney Co. tumbled 6 percent amid an analyst downgrade. Bank of America Corp. and Citigroup Inc. slumped more than 2.5 percent to pace declines among the largest banks.

The Philadelphia Stock Exchange Semiconductor Index sank 3.8 percent to bring its drop from a June high to more than 20 percent, the common definition of a bear market. The Nasdaq Biotechnology Index extended losses from a July peak to 12 percent, meeting the definition of a correction.

The Fed minutes indicated officials saw the conditions for higher rates almost fulfilled, though the gathering took place before China's currency move on Aug. 11. Three rounds of Fed bond purchases and seven years of near-zero interest rates have helped the S&P 500 rally more than 200 percent from its bear-market low.

Data today indicated that a measure of the economic outlook for the next three to six months declined, while purchases of previously owned U.S. homes unexpectedly rose in July to the highest level since February 2007.

Futures show traders see a 34 percent probability the Fed will raise its benchmark rate at its Sept. 16-17 meeting, based on the assumption that the effective fed funds rate will average 0.375 percent after the first increase. That's down from about 50 percent before release of the Fed minutes on Wednesday.

The MSCI Emerging Markets Index slid 1.2 percent to the lowest level since 2009. Shares in Shanghai dropped 3.4 percent even as the central bank takes steps to support markets. Hong Kong's Hang Seng China Enterprises Index fell 2.3 percent toward a 10-month low.

-

21:00

DJIA 17057.67 -291.06 -1.68%, NASDAQ 4898.68 -120.37 -2.40%, S&P 500 2043.79 -35.82 -1.72%

-

18:44

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell more than 1% on Thursday morning, pushing the Dow and the S&P into the red for the year, after the Federal Reserve highlighted global growth concerns and as Walt Disney dragged down consumer discretionary stocks. The Dow Jones industrial average fell to a more than six-month low, while the Nasdaq composite and the S&P 500 fell to their lowest in more than a month. The Fed, in minutes of its latest meeting released on Wednesday, continued to express broad concerns about lagging inflation even as the job market improved further. The comments led traders to scale back bets that rates would be raised in September.

Almost all Dow stocks in negative area (27 of 30). Top looser - The Walt Disney Company (DIS, -5.12%). Top gainer - The Procter & Gamble Company (PG, +0.70).

Almost all S&P index sectors also in negative area. Top looser - Utilities (-1.8%). Лидером роста является Services (+0,1%).

At the moment:

Dow 17076.00 -209.00 -1.21%

S&P 500 2049.00 -23.75 -1.15%

Nasdaq 100 4417.50 -86.25 -1.92%

10 Year yield 2,09% -0,03

Oil 41.33 +0.06 +0.15%

Gold 1150.50 +22.60 +2.00%

-

18:29

WSE: Session Results

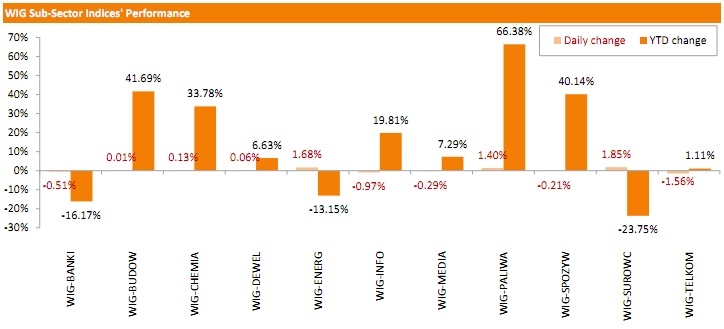

Polish equity market closed higher on Thursday. The broad market measure, the WIG Index, rose by 0.11%. Within the index performance was mixed, with materials (+1.85%) outperforming and telecommunications (-1.56%) lagging.

The large-cap stocks' measure, the WIG30 Index, added 0.27%. Within the WIG30 Index components, BOGDANKA (WSE: LWB) led the gainers pack with a 4.11% advance. The stock was lifted by 2Q15 earnings report that was better than expected. It was followed by TAURON PE (WSE: TPE), which continued to rebound, up 3.54%, despite reported lower than consensus second quarter results. Other major outperformers were PKN ORLEN (WSE: PKN), PGE (WSE: PGE) and EUROCASH (WSE: EUR), surging by 2.22%, 2.18% and 1.89% respectively. On the other side of the ledger, ALIOR (WSE: ALR) posted the largest daily drop, down 3.56%. The bank revealed quarterly results that were generally in line with consensus estimates. LOTOS (WSE: LTS), HANDLOWY (WSE: BHW), GTC (WSE: GTC) and ORANGE POLSKA (WSE: OPL) also posted notable declines, sliding down 1.89%-2.42%.

-

18:00

European stocks closed: FTSE 6367.89 -35.56 -0.56%, DAX 10432.19 -249.96 -2.34%, CAC 40 4783.55 -100.55 -2.06%

-

18:00

European stocks close: stocks closed lower on worries over the global slowdown

Stock indices closed lower on worries over the global slowdown. The Chinese stocks traded lower today, adding to concerns over a slowdown in the Chinese economy.

The Fed released its latest minutes on Wednesday. Fed officials agreed at the July monetary policy meeting that the economy is approaching the point when the central bank needs to increase interest rates, but they were concerned about the weak inflation and a slowdown in the global economy.

The European Stability Mechanism (ESM) has approved the €26 billion first tranche of the third bailout for Greece on Thursday. The ESM said that it transferred €13 billion immediately.

Greece has repaid €3.2 billion to the European Central Bank (ECB) after receiving the first tranche.

According to two Greek government officials, Greek Prime Minister Alexis Tsipras plans to announce his resignation on Thursday evening to clear the way for national elections. It is unclear when elections will be held. September or early October are the possible dates.

German PPI producer prices were flat in July, after a 0.1% decline in June.

On a yearly basis, German PPI dropped 1.3% in July, after a 1.4% fall in June.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 0.1% in July, missing expectations for a 0.4% rise, after a 0.1% decline in June. June's figure was revised up from a 0.2% fall.

The slower growth was partly driven by higher sales of electrical appliances, furniture and other household goods.

Sales of household goods climbed 3.6% in July, while sales at department stores rose 1.6%.

Food sales fell 0.2% in July, while sales of clothing and footwear slid 1.5%.

On a yearly basis, retail sales in the U.K. climbed 4.2% in July, missing forecasts of 4.4% increase, after a 4.2% rise in June. June's figure was revised up from a 4.0% gain.

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance rose to -1% in August from -10% in July, beating expectations for -10%.

The increase was driven by a rise in export order book balance. The export order book balance increased to -8% in August from -17% in July.

The balance for output volumes for the next three months was +14% in August.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,367.89 -35.56 -0.56 %

DAX 10,432.19 -249.96 -2.34 %

CAC 40 4,783.55 -100.55 -2.06 %

-

17:35

Greek government officials: Greek Prime Minister Alexis Tsipras plans to announce his resignation on Thursday evening

According to two Greek government officials, Greek Prime Minister Alexis Tsipras plans to announce his resignation on Thursday evening to clear the way for national elections. It is unclear when elections will be held. September or early October are the possible dates.

-

17:07

President of the Supervisory Council at the European Central Bank Danièle Nouy: the stress test next year will include fewer banks

The President of the Supervisory Council at the European Central Bank (ECB), Danièle Nouy, said on Thursday that the stress test next year will include fewer banks.

"We will have another stress test next year in 2016. There will be fewer banks," Nouy noted.

She estimated that the stress test will include about 50 or 60 banks.

-

16:57

U.S. leading economic index drops 0.2% in July

The Conference Board released its leading economic index for the U.S. on Thursday. The leading economic index dropped by 0.2% in July, missing expectations a 0.2% gain, after a 0.6% increase in June.

Seven of the ten indicators rose.

The Conference Board economist Ataman Ozyildirim said that the index is still pointing to moderate economic growth for the rest of the year.

"Current conditions, measured by the coincident economic index, have been rising moderately but steadily, driven by rising employment and income, and even industrial production has improved in recent months," he noted.

-

16:41

Philadelphia Federal Reserve Bank’s manufacturing index jumps to 8.3 in August

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index increased to 8.3 in August from 5.7 in July, exceeding expectations for a rise to 7.0.

A reading above zero indicates expansion.

The increase was partly driven by a rise in shipments. The shipments index jumped 16.7 in August from 4.4 in July.

The new orders index decreased to 5.8 in August from 7.1 in July.

The prices paid index slid to 6.2 in August from 20.2 in July, while the prices received index were down to -4.9 from 1.7.

The number of employees index rose to 5.3 in August from -0.4 last month.

According to the report, the future general activity index rose to 43.1 in August from 41.5 in July.

-

16:25

U.S. existing homes sales rise 2.0% in July

The National Association of Realtors released existing homes sales figures in the U.S. on Thursday. Sales of existing homes rose 2.0% to a seasonally adjusted annual rate of 5.59 million in July from 5.48 million in June. It was the highest level since February 2007.

June's figure was revised down from 5.49 million units.

Analysts had expected an increase to 5.44 million units.

"The creation of jobs added at a steady clip and the prospect of higher mortgage rates and home prices down the road is encouraging more households to buy now. As a result, current homeowners are using their increasing housing equity towards the downpayment on their next purchase," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers declined to 28% in July, their lowest share since January.

Yun noted that "declining affordability could begin to slowly dampen demand".

-

16:02

Federal Reserve Bank of San Francisco President John Williams: a reduction in house prices could lead to a drop in gross domestic product

Federal Reserve Bank of San Francisco President John Williams warned on Thursday that a reduction in house prices could lead to a drop in gross domestic product.

"Monetary policy actions have sizable and significant effects on house prices in advanced economies. A typical estimate is that a 1% loss in the gross domestic product is associated with a 4% reduction in house prices. This implies a very costly trade-off of using monetary policy to affect house prices when macroeconomic and financial stability goals are in conflict," he noted.

"If the housing sector and the overall economy are both booming, then tighter monetary policy may serve to both reduce the risks to the financial system and keep economic activity from exceeding desired levels," Williams added.

-

15:42

European Central Bank Governing Council member Ewald Nowotny: there is no currency war worldwide

The European Central Bank (ECB) Governing Council member Ewald Nowotny said on Thursday that there is no currency war worldwide.

"There is no way of currency wars. I don't see this happening, in any case not in Europe but also don't see this worldwide," he said. Nowotny added that the central bank's asset buying programme should help to boost the economy in the Eurozone.

He pointed out that the ECB will continue its asset buying programme until September 2016 as there are no signals pointing to the end.

-

15:37

U.S. Stocks open: Dow -1.05%, Nasdaq -0.99%, S&P -0.90%

-

15:29

Greece’s current account surplus declines to €1.0 billion in June

The Bank of Greece released its current account data on Thursday. Greece's current account surplus fell to €1.0 billion in June from €1.3 billion in June last year.

The Greek deficit on trade in goods and services widened to €1.298 billion in June from €1.275 billion in June last year.

The deficit on primary income rose to €256.2 million in June from EUR 156.4 million in June last year, while the surplus on secondary income narrowed to €188.7 million from €277.4 million.

The capital account surplus declined to €133.2 million from €407.2 million last year.

-

15:29

Before the bell: S&P futures -0.43%, NASDAQ futures -0.45%

Stocks dropped around the world as Kazakhstan became the latest country to abandon control of its currency, signaling growing strain facing emerging economies.

Global Stocks:

Nikkei 20,033.52 -189.11 -0.94%

Hang Seng 22,757.47 -410.38 -1.77%

Shanghai Composite 3,665.58 -128.53 -3.39%

FTSE 6,402.69 -0.76 -0.01%

CAC 4,844.09 -40.01 -0.82%

DAX 10,634.9 -47.25 -0.44%

Crude oil $40.78 (-0.05%)

Gold $1140.80 (+1.16%)

-

15:14

CBI industrial order books balance increases to -1% in August

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance rose to -1% in August from -10% in July, beating expectations for -10%.

The increase was driven by a rise in export order book balance. The export order book balance increased to -8% in August from -17% in July.

The balance for output volumes for the next three months was +14% in August.

"While the rebound in manufacturers' total order books is encouraging, many firms are still struggling in overseas markets. On the one hand, the strength of Sterling and cheaper energy are reducing factory input costs, but the strong pound is also hitting export prices and margins hard. With only 4% of the UK's exports going to China, the country's slowdown is not a direct cause of concern for our manufacturers, but it will make life harder for our firms in exposed sectors like metals and commodities," the CBI director of economics Rain Newton-Smith said.

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

ALCOA INC.

AA

09.14

+0.33%

35.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.95

+2.26%

35.5K

Barrick Gold Corporation, NYSE

ABX

08.12

+2.78%

60.4K

United Technologies Corp

UTX

98.09

-0.12%

1.1K

Yandex N.V., NASDAQ

YNDX

11.87

-0.34%

7.6K

Exxon Mobil Corp

XOM

75.95

-0.37%

12.6K

Chevron Corp

CVX

80.60

-0.38%

6.1K

Johnson & Johnson

JNJ

98.85

-0.46%

22.1K

American Express Co

AXP

80.57

-0.47%

0.5K

Wal-Mart Stores Inc

WMT

68.25

-0.47%

3.1K

McDonald's Corp

MCD

100.60

-0.49%

1.8K

The Coca-Cola Co

KO

40.58

-0.49%

4.4K

General Electric Co

GE

25.60

-0.51%

11.7K

Verizon Communications Inc

VZ

47.20

-0.51%

2.0K

Nike

NKE

114.35

-0.53%

1.2K

Apple Inc.

AAPL

114.38

-0.55%

247.6K

Procter & Gamble Co

PG

73.70

-0.57%

4.5K

ALTRIA GROUP INC.

MO

54.49

-0.58%

2.1K

AMERICAN INTERNATIONAL GROUP

AIG

62.55

-0.59%

3.0K

Google Inc.

GOOG

656.94

-0.60%

0.9K

AT&T Inc

T

34.15

-0.61%

6.2K

Caterpillar Inc

CAT

76.94

-0.61%

4.4K

Amazon.com Inc., NASDAQ

AMZN

529.60

-0.62%

9.5K

Intel Corp

INTC

28.18

-0.63%

24.0K

UnitedHealth Group Inc

UNH

122.44

-0.63%

0.3K

International Business Machines Co...

IBM

152.95

-0.64%

0.4K

E. I. du Pont de Nemours and Co

DD

52.80

-0.66%

0.2K

Microsoft Corp

MSFT

46.30

-0.67%

3.9K

Ford Motor Co.

F

14.67

-0.68%

37.3K

General Motors Company, NYSE

GM

31.40

-0.73%

3.1K

Home Depot Inc

HD

121.83

-0.76%

2.7K

Hewlett-Packard Co.

HPQ

27.52

-0.79%

6.0K

Boeing Co

BA

141.55

-0.82%

0.5K

Merck & Co Inc

MRK

59.15

-0.85%

0.3K

Facebook, Inc.

FB

94.49

-0.86%

46.7K

Pfizer Inc

PFE

34.96

-0.88%

2.1K

Cisco Systems Inc

CSCO

27.55

-0.90%

3.9K

JPMorgan Chase and Co

JPM

66.98

-0.92%

12.0K

Citigroup Inc., NYSE

C

56.47

-0.93%

3.5K

Starbucks Corporation, NASDAQ

SBUX

57.02

-0.99%

6.3K

Goldman Sachs

GS

198.94

-1.00%

1.1K

Twitter, Inc., NYSE

TWTR

27.29

-1.16%

35.1K

Yahoo! Inc., NASDAQ

YHOO

34.77

-1.19%

2.9K

Tesla Motors, Inc., NASDAQ

TSLA

252.00

-1.27%

7.3K

HONEYWELL INTERNATIONAL INC.

HON

103.50

-1.47%

1.8K

Visa

V

73.23

-1.57%

0.6K

Walt Disney Co

DIS

104.11

-2.20%

65.2K

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Walt Disney (DIS) downgraded to Mkt Perform from Outperform at Bernstein

Downgrades:

Other:

American Express (AXP) initiated with a Hold at Evercore ISI, target $81

-

14:49

Initial jobless claims rise by 4,000 to 277,000 in the week ending August 15

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending August 15 in the U.S. rose by 4,000 to 277,000 from 273,000 in the previous week. The previous week's reading was revised down from 274,000.

Analysts had expected the number of initial jobless claims to be 272,000.

Jobless claims remained below 300,000 the 16th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 24,000 to 2,254,000 in the week ended August 08.

-

14:38

Canada’s wholesale sales rise 1.3% in June

Statistics Canada released wholesale sales figures on Thursday. Wholesale sales increased 1.3% in June, exceeding expectations for a 1.0% rise, after a 0.9% drop in May. May's figure was revised up from a 1.0% decrease.

The increase was driven by higher sales in the motor vehicle and parts subsector. Sales of automobiles and parts jumped 3.0% in June.

Sales in the machinery, equipment and supplies subsector rose 1.3% in June, sales in the personal and household goods subsector increased 2.2%, while sales in the food, beverage and tobacco subsector was up 1.2%.

Sales rose in five of the seven subsectors.

Inventories climbed by 1.1% in June.

-

12:03

European stock markets mid session: stocks traded lower on worries over the global slowdown

Stock indices traded lower on worries over the global slowdown. The Chinese stocks traded lower today, adding to concerns over a slowdown in the Chinese economy.

The Fed released its latest minutes on Wednesday. Fed officials agreed at the July monetary policy meeting that the economy is approaching the point when the central bank needs to increase interest rates, but they were concerned about the weak inflation and a slowdown in the global economy.

The European Stability Mechanism (ESM) has approved the €26 billion first tranche of the third bailout for Greece on Thursday. The ESM said that it transferred €13 billion immediately.

Greece has repaid €3.2 billion to the European Central Bank (ECB) after receiving the first tranche.

German PPI producer prices were flat in July, after a 0.1% decline in June.

On a yearly basis, German PPI dropped 1.3% in July, after a 1.4% fall in June.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 0.1% in July, missing expectations for a 0.4% rise, after a 0.1% decline in June. June's figure was revised up from a 0.2% fall.

The slower growth was partly driven by higher sales of electrical appliances, furniture and other household goods.

Sales of household goods climbed 3.6% in July, while sales at department stores rose 1.6%.

Food sales fell 0.2% in July, while sales of clothing and footwear slid 1.5%.

On a yearly basis, retail sales in the U.K. climbed 4.2% in July, missing forecasts of 4.4% increase, after a 4.2% rise in June. June's figure was revised up from a 4.0% gain.

Current figures:

Name Price Change Change %

FTSE 100 6,381.82 -21.63 -0.34 %

DAX 10,579.96 -102.19 -0.96 %

CAC 40 4,841.9 -42.20 -0.86 %

-

11:38

European Stability Mechanism approves the €26 billion first tranche of the third bailout for Greece

The European Stability Mechanism (ESM) has approved the €26 billion first tranche of the third bailout for Greece on Thursday. The ESM said that it transferred €13 billion immediately.

"I am relieved that after intense negotiations with the Greek government and approval by our members, all conditions are now in place to make this disbursement in time," said ESM Managing Director Klaus Regling.

Greece has repaid €3.2 billion to the European Central Bank (ECB) after receiving the first tranche.

-

11:12

German producer prices are flat in July

Destatis released its producer price index (PPI) for Germany on Thursday. German PPI producer prices were flat in July, after a 0.1% decline in June.

On a yearly basis, German PPI dropped 1.3% in July, after a 1.4% fall in June.

PPI excluding energy sector fell by 0.3% year-on-year in July.

Energy prices plunged 4.1% in July.

Consumer non-durable goods prices fell 1.5% in June, intermediate goods sector prices decreased by 0.6%, and capital goods prices increased 0.8%, while durable consumer goods sector prices rose 1.3%.

-

10:59

International Monetary Fund will not change its benchmark currency basket until October 2016

The International Monetary Fund (IMF) said on Wednesday that it will not change its benchmark currency basket until October 2016. The IMF plans to decide in November whether to include the yuan in its Special Drawing Rights basket or not.

The yuan should be "freely usable" or widely used to make international payments and widely traded in foreign exchange markets to be included in the basket.

China's central bank devaluated the yuan several times this month.

-

10:53

UK retail sales rise 0.1% in July

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 0.1% in July, missing expectations for a 0.4% rise, after a 0.1% decline in June. June's figure was revised up from a 0.2% fall.

The slower growth was partly driven by higher sales of electrical appliances, furniture and other household goods.

Sales of household goods climbed 3.6% in July, while sales at department stores rose 1.6%.

Food sales fell 0.2% in July, while sales of clothing and footwear slid 1.5%.

On a yearly basis, retail sales in the U.K. climbed 4.2% in July, missing forecasts of 4.4% increase, after a 4.2% rise in June. June's figure was revised up from a 4.0% gain.

-

10:37

Swiss trade surplus rises to CHF3.74 billion in July

The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus climbed to CHF3.74 billion in July from CHF3.51 billion in the previous month. June's figure was revised down from a surplus of CHF3.58 billion.

Exports dropped 1.7% in July, while imports were down 2.5%.

On a yearly basis, exports fell 7.4% in July, while imports decreased 8.3%.

-

10:11

Fed’s July monetary policy meeting minutes: no clear signal of when the Fed will start raising its interest rate

The Fed released its July monetary policy meeting minutes on Wednesday. There was no clear signal of when the Fed will start raising its interest rate, but there were doubts about the interest rate hike in September.

"Most judged that the conditions for policy firming had not yet been achieved, but they noted that conditions were approaching that point. Participants observed that the labour market had improved notably since early this year, but many saw scope for some further improvement," the minutes said.

Fed officials were concerned about the pace of inflation. According to the minutes, "almost all members indicating that they would need to see more evidence that economic growth was sufficiently strong and labour markets conditions had firmed enough for them to feel reasonably confident" that inflation would return to the Fed's 2% target over the medium term.

Several members were concerned over the situation in China.

"While the recent Chinese stock market decline seemed to have had limited implications to date for the growth outlook in China, several participants noted that a material slowdown in Chinese economic activity could pose risks to the U.S. economic outlook," the minutes said.

Fed officials said that low exports due to the strong U.S. dollar would continue to weigh on economic growth in the second half of 2015.

Some Fed officials "were concerned about the outlook for consumer spending, noting that spending had been disappointing in recent months even though real income had already been boosted by the lower gasoline prices and the improved labour market".

-

08:21

Global Stocks: U.S. and Asian indices declined

Major U.S. stock indices fell on Wednesday with energy companies leading declines amid lower oil prices. Stocks could have ended the session even lower if not the minutes from the Fed's July meeting, which showed that policymakers were not sure whether it's correct to raise rates in September.

The Dow Jones Industrial Average dropped 162.61 points, or 0.9%, to 17348.73. The S&P 500 declined 17.31 points, or 0.8%, to 2079.61. The Nasdaq Composite fell 40.30 points, or 0.8%, to 5019.05.

This morning in Asia Hong Kong Hang Seng dropped 1.28%, or 296.92 points, to 22,870.93. China Shanghai Composite Index lost 0.72%, or 27.44 points, to 3,766.66. The Nikkei fell 0.75%, or 152.34 points, to 20,070.29.

Japanese stocks fell following declines in U.S. equities. Concerns over China's economy weighed on stocks too.

Meanwhile Chinese stocks continued falling after they dropped 6.1% on Tuesday. Investors are concerned that the government's actions related to macroeconomic regulation will drive attention away from the stock market.

-

04:02

Nikkei 225 20,114.57 -108.06 -0.53 %, Hang Seng 22,880.55 -287.30 -1.24 %, Shanghai Composite 3,742.15 -51.96 -1.37 %

-

00:31

Stocks. Daily history for Aug 19’2015:

(index / closing price / change items /% change)

Nikkei 225 20,222.63 -331.84 -1.61 %

Hang Seng 23,167.85 -307.12 -1.31 %

S&P/ASX 200 5,380.19 +77.04 +1.45 %

Shanghai Composite 3,794.55 +46.38 +1.24 %

FTSE 100 6,403.45 -122.84 -1.88 %

CAC 40 4,884.1 -87.15 -1.75 %

Xetra DAX 10,682.15 -233.77 -2.14 %

S&P 500 2,079.61 -17.31 -0.83 %

NASDAQ Composite 5,019.05 -40.30 -0.80 %

Dow Jones 17,348.73 -162.61 -0.93 %

-