Noticias del mercado

-

17:41

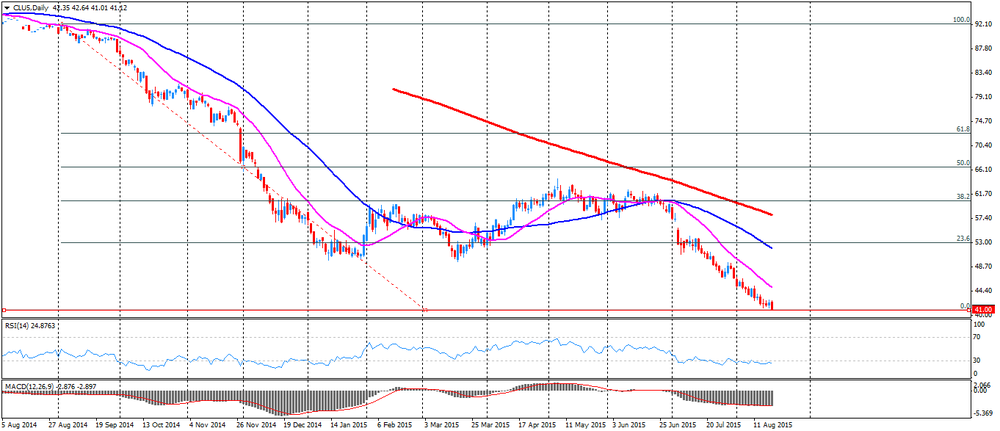

Oil prices decline on the U.S. crude oil inventories data

Oil prices fell on the U.S. crude oil inventories data. U.S. crude inventories increased by 2.62 million barrels to 456.2 million in the week to August 14.

Analysts had expected U.S. crude oil inventories to decline by 0.6 million barrels.

Gasoline inventories fell by 2.7 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, rose by 326,000 barrels.

U.S. crude oil imports increased by 465,000 barrels per day.

Refineries in the U.S. were running at 95.1% of capacity, down from 96.1% the previous week.

This data added to concerns over the global oil supply.

WTI crude oil for September delivery declined $41.06 a barrel on the New York Mercantile Exchange.

Brent crude oil for September decreased to $48.37 a barrel on ICE Futures Europe.

-

17:25

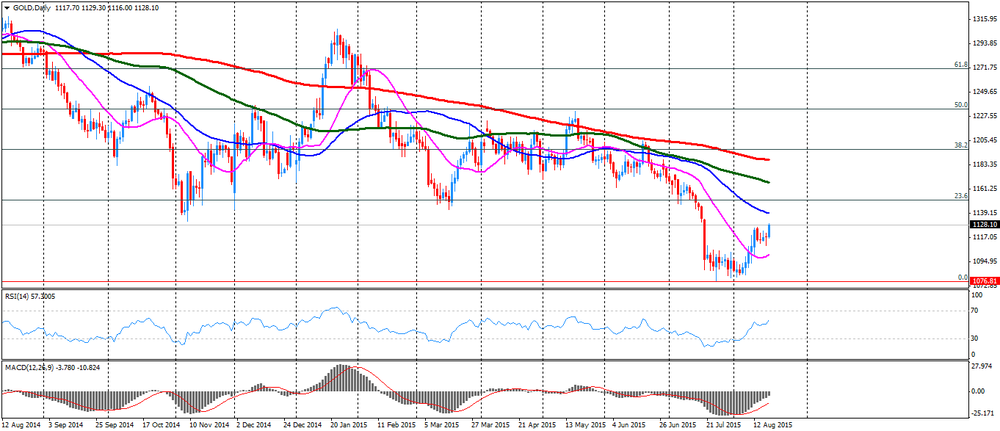

Gold price rise on the U.S. inflation data and concerns over the situation in China

Gold rose on the U.S. inflation data and concerns over the situation in China. China's central bank injected more liquidity into the financial sector to calm market participants.

The U.S. consumer price inflation rose 0.1% in July, missing expectations for a 0.2% increase, after a 0.3% gain in June.

The increase was partly driven by higher gasoline and food prices. Gasoline prices climbed 0.9% in July, while food prices increased 0.2% in July.

On a yearly basis, the U.S. consumer price index increased to 0.2% in July from 0.1% in June, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.1% in July, missing expectations for a 0.2% rise, after a 0.2% increase in June.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged to 1.8% in July.

Market participants are awaiting the release of the latest Fed's monetary policy minutes. The Fed will release its minutes at 18:00 GMT. Market participants will be looking for signs if the Fed will start raising its interest rate in September.

October futures for gold on the COMEX today increased to 1128.70 dollars per ounce.

-

16:57

U.S. crude inventories rise by 2.62 million barrels to 456.2 million in the week to August 14

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 2.62 million barrels to 456.2 million in the week to August 14.

Analysts had expected U.S. crude oil inventories to decline by 0.6 million barrels.

Gasoline inventories fell by 2.7 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, rose by 326,000 barrels.

U.S. crude oil imports increased by 465,000 barrels per day.

Refineries in the U.S. were running at 95.1% of capacity, down from 96.1% the previous week.

-

16:09

People's Bank of China injects $48 billion into banks in July

The People's Bank of China (PBoC) said on Wednesday that it injected $48 billion into China Development Bank and $45 billion into the Export-Import Bank of China last month. The money should strengthen their capital bases support the economy.

-

09:15

Oil prices slid

West Texas Intermediate futures for September delivery fell to $42.87 (-0.58%), while Brent crude declined to $48.67 (-0.29%) ahead of U.S. inventory report, which would help assess demand in the world's top oil consumer.

Global demand can't keep up with robust supply, especially amid slowing economic growth in world's second-biggest consumer China. The U.S. is also likely to enter the lower demand season in September.

-

09:01

Gold steady ahead of Fed Meeting Minutes

Gold is currently at $1,118.20 (+0.12%) as investors await Fed Meeting Minutes to assess probability of a rate hike in September.

Bullion bounced away from a 5-1/2-year low and found some support above $1,100 an ounce after China devalued the yuan in an unexpected move. However analysts believe that prospects of Federal Reserve interest rates are key factors, which determine direction of gold's fluctuations.

The looming rate hike curbs demand for such non-interest-bearing safe-haven assets as gold.

-

01:02

Commodities. Daily history for Aug 18’2015:

(raw materials / closing price /% change)

Oil 42.35 -0.63%

Gold 1,116.80 -0.01%

-