Noticias del mercado

-

21:00

DJIA 17356.51 -154.83 -0.88%, NASDAQ 5020.73 -38.61 -0.76%, S&P 500 2080.20 -16.72 -0.80%

-

19:40

American focus: the dollar fell

The US dollar fell against the euro and the yen on the eve of the publication of minutes of the last meeting of the Federal Reserve System. Investors are worried that they do not clarify the intentions of the central bank in relation to raising interest rates.

Some investors believe that it is not necessary to pay attention to the minutes of the July meeting of the Operations Committee on open market the US Federal Reserve in connection with the latest developments. Moreover, some market participants fear that the opinion of the Fed has changed under the influence of the sudden devaluation of the yuan by the Chinese authorities last week. Actions Beijing led investors to revise their expectations about the Fed raising rates in September.

However, the minutes of the Fed meeting may clarify some points of the July Fed statement, especially the word about the need to see some further improvement in the labor market before raising interest rates. Investors are also interested in any change in the opinions of members of the Operations Committee on open market the US Federal Reserve with respect to raising rates in September and forecasts about the prospects for the global market. China's stock market crash occurred just at the time when there was a meeting the US Federal Reserve.

Investors bet on further growth of the dollar in anticipation of the Fed raising interest rates, which are at near-zero levels. Higher borrowing costs would increase the attractiveness of the dollar for investors.

More recently, investors cut long positions on the dollar, expecting a clear hint of rising interest rates in September. Market participants continue to hope for further strengthening of the dollar, but the uncertainty about the timing of the first rate hikes the Fed restricts the rate of growth for most of 2015.

Pressure on the dollar was data on US inflation. US consumer prices continued to rise in June, writing while sixth monthly increase in a row. However, the growth rate slowed down compared to June, and was lower than the forecasts of experts. This was reported in the Ministry of Labour.

According to the data, the seasonally adjusted consumer price index rose 0.1% in July, against an increase of 0.3% in the previous month. Meanwhile, the core index, which excludes prices of food and energy, also increased by 0.1% after rising 0.2% in June. Economists had expected the index to grow both at 0.2%.

Compared to last year, overall consumer prices rose by 0.2%. This is a slight increase, but the index recorded its second consecutive monthly increase after remained unchanged from January to May. Basic prices increased by 1.8% compared to July 2014, and since June. Add the annual change in these indicators in line with expectations.

The Swiss franc strengthened against the dollar, reaching the highest level since August 12. Experts note that the franc strengthened with the euro in anticipation of a positive outcome of voting in the Bundestag. As it became known today in the lower house of the German parliament decided to approve the third aid package for Greece. Parliament voted 454 votes to 113 for the program of aid to Greece. It was assumed that its lower house, the Bundestag, approved the program. However, there were concerns that the vote against the party of Chancellor Angela Merkel. Earlier today, the Ministry of Finance of Germany Schaeuble said the Bundestag must approve the agreement by Greece, as it would be irresponsible not to give the country a fresh start. He also noted that "if Greece uses this opportunity or not - in the hands of the Greeks. It is a bargain for Greece and for Europe." "The participation of the IMF in a program of aid to Greece - a prerequisite of the German government. There is no doubt that the IMF will join as soon as the necessary conditions are met," - said Schauble.

-

18:32

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes sharply fell on Wednesday as investors worried about the effect of China's slowing growth ahead of the minutes from the latest U.S. Fed meeting that could give clues regarding the timing of a rate increase. Energy and material stocks were whipsawed by wild swings in the Chinese market for the second day in a row. Chinese stocks reversed sharp declines and ended higher after the central bank injected more funds into the financial system. The roller coaster ride in the market kept commodity prices under pressure, with oil and copper near six-year lows.

All Dow stocks in negative area (30 of 30). Top looser - Chevron Corporation (CVX, -2.71%).

All S&P index sectors also in negative area. Top looser - Basic materials (-2.4%).

At the moment:

Dow 17269.00 -213.00 -1.22%

S&P 500 2069.00 -25.00 -1.19%

Nasdaq 100 4490.00 -54.00 -1.19%

10 Year yield 2,17% -0,03

Oil 41.35 -1.77 -4.10%

Gold 1128.50 +11.60 +1.04%

-

18:00

European stocks closed: FTSE 6408.72 -117.57 -1.80%, DAX 10682.73 -233.19 -2.14%, CAC 40 4889.70 -81.55 -1.64%

-

18:00

European stocks close: stocks closed lower on worries over the situation in China

Stock indices closed lower on worries over the situation in China. China's central bank injected more liquidity into the financial sector to calm market participants.

The German parliament voted for the third Greek bailout programme on Wednesday. 453 voted in favour of the Greek bailout, 113 voted against it, while 18 abstained.

Market participants are awaiting the release of the latest Fed's monetary policy minutes. The Fed will release its minutes at 18:00 GMT. Market participants will be looking for signs if the Fed will start raising its interest rate in September.

Meanwhile, the economic data from the Eurozone was mixed. Eurozone's current account surplus climbed to a seasonally adjusted €25.4 billion in June from €19.1 billion in May.

The surplus was driven by higher surpluses on trade in goods and primary income. The trade surplus rose to €27.2 billion in June from €24.9 billion in May, while primary income increased to €1 billion from €0.8 billion.

The surplus on services declined to €5.7 billion in June from €6.6 billion in May, while the secondary income dropped to €8.4 billion from €13.3 billion.

Eurozone's unadjusted current account surplus soared to €31.1 billion in July from EUR 4.3 billion in May. May's figure was revised up from a surplus of €3.4 billion.

Construction production in the Eurozone decreased 1.9% in June, after a 0.2% rise in May. May's figure was revised down from a 0.3% gain.

Civil engineering output declined 2.7% in June, while production in the building sector dropped 1.6%.

On a yearly basis, construction output fell 2.3% in June, after a 0.2% rise in May. May's figure was revised down from 0.3% increase.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,403.45 -122.84 -1.88 %

DAX 10,682.15 -233.77 -2.14 %

CAC 40 4,884.1 -87.15 -1.75 %

-

17:57

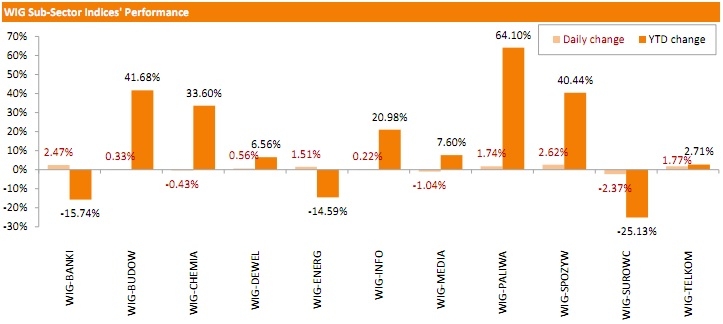

WSE: Session Results

Polish equity market advanced on Wednesday. The broad market measure, the WIG Index, added 1%. From a sector perspective, food sector (+2.62%) and banks (+2.47%) performed best. The worst-performing sectors in the index were materials (-2.37%), media (-1.04%) and chemicals (-0.43%).

The large-cap stocks' measure, the WIG30 Index, rose by 0.94%. Within the WIG30 Index components, TAURON PE (WSE: TPE) led the gainers with a 4.63% advance. PKO BP (WSE: PKO), BZ WBK (WSE: BZW), ORANGE POLSKA (WSE: OPL), ALIOR (WSE: ALR), PKN ORLEN (WSE: PKN) and GTC (WSE: GTC) also recorded solid gains, adding between 2.10% and 3.39%. On the other side of the ledger, KGHM (WSE: KGH) took another plunge, down 3%, hitting a near six-year low. Other major fallers were CYFROWY POLSAT (WSE: CPS), EUROCASH (WSE: EUR) and KERNEL (WSE: KER), losing 1.99%, 1.37% and 1.23% respectively.

-

17:41

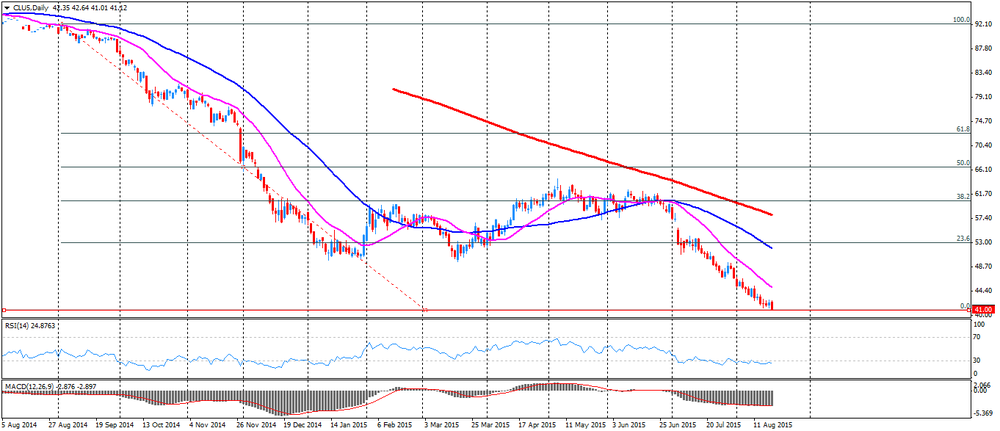

Oil prices decline on the U.S. crude oil inventories data

Oil prices fell on the U.S. crude oil inventories data. U.S. crude inventories increased by 2.62 million barrels to 456.2 million in the week to August 14.

Analysts had expected U.S. crude oil inventories to decline by 0.6 million barrels.

Gasoline inventories fell by 2.7 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, rose by 326,000 barrels.

U.S. crude oil imports increased by 465,000 barrels per day.

Refineries in the U.S. were running at 95.1% of capacity, down from 96.1% the previous week.

This data added to concerns over the global oil supply.

WTI crude oil for September delivery declined $41.06 a barrel on the New York Mercantile Exchange.

Brent crude oil for September decreased to $48.37 a barrel on ICE Futures Europe.

-

17:25

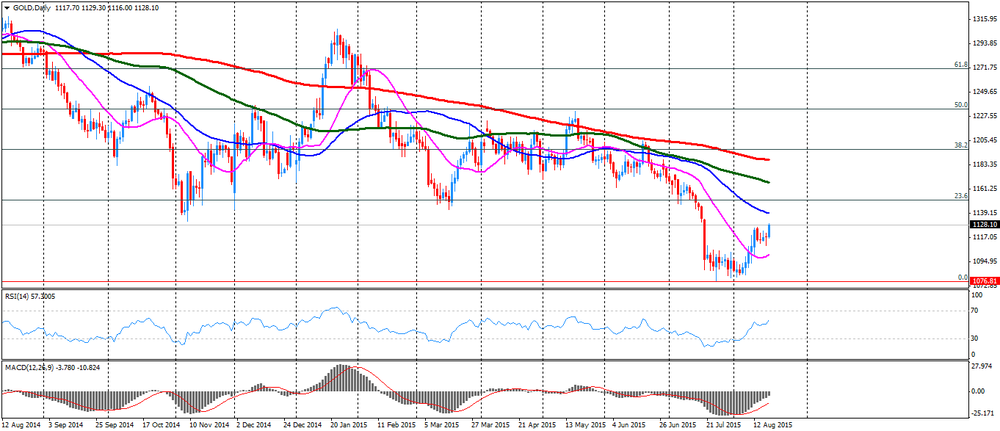

Gold price rise on the U.S. inflation data and concerns over the situation in China

Gold rose on the U.S. inflation data and concerns over the situation in China. China's central bank injected more liquidity into the financial sector to calm market participants.

The U.S. consumer price inflation rose 0.1% in July, missing expectations for a 0.2% increase, after a 0.3% gain in June.

The increase was partly driven by higher gasoline and food prices. Gasoline prices climbed 0.9% in July, while food prices increased 0.2% in July.

On a yearly basis, the U.S. consumer price index increased to 0.2% in July from 0.1% in June, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.1% in July, missing expectations for a 0.2% rise, after a 0.2% increase in June.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged to 1.8% in July.

Market participants are awaiting the release of the latest Fed's monetary policy minutes. The Fed will release its minutes at 18:00 GMT. Market participants will be looking for signs if the Fed will start raising its interest rate in September.

October futures for gold on the COMEX today increased to 1128.70 dollars per ounce.

-

16:57

U.S. crude inventories rise by 2.62 million barrels to 456.2 million in the week to August 14

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories increased by 2.62 million barrels to 456.2 million in the week to August 14.

Analysts had expected U.S. crude oil inventories to decline by 0.6 million barrels.

Gasoline inventories fell by 2.7 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, rose by 326,000 barrels.

U.S. crude oil imports increased by 465,000 barrels per day.

Refineries in the U.S. were running at 95.1% of capacity, down from 96.1% the previous week.

-

16:30

U.S.: Crude Oil Inventories, August 2.62 (forecast -0.6)

-

16:09

People's Bank of China injects $48 billion into banks in July

The People's Bank of China (PBoC) said on Wednesday that it injected $48 billion into China Development Bank and $45 billion into the Export-Import Bank of China last month. The money should strengthen their capital bases support the economy.

-

15:53

St. Louis Fed President James Bullard will back the interest rate hike in September at the Fed's upcoming meeting

St. Louis Fed President James Bullard said in an interview MNI News that he will back the interest rate hike in September at the Fed's upcoming meeting. He fears financial instability, adding that the Fed should be ready to raise its interest rate faster against financial bubbles.

Bullard noted that he is not concerned that inflation and wages remain low. He pointed out that inflation will increase as the economy expands and oil prices stabilise.

Bullard is not a voting member of the Federal Open Market Committee this year.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E337mn), $1.1000(E812mn), $1.1040(E611mn), $1.1100(E271mn), $1.1150(E154mn)

USD/JPY: Y123.00($385mn), Y124.00($528mn), Y124.50($355mn), Y125.00($315mn), Y126.00($727mn)

EUR/JPY: Y136.75(E317mn), Y137.00(E233mn), Y137.50(E350mn)

GBP/USD: $1.5475(Gbp520mn), $1.5500(Gbp226mn), $1.5700(Gbp135mn)

USD/CHF: Chf0.9800($480mn)

AUD/USD: $0.7250(A$$$0.7295(A$280mn), $0.7360(A$254mn)

USD/CAD: C$1.3050($398mn), C$1.3100($133mn), C$1.3150($200mn), C$1.3185($191mn)

-

15:32

U.S. Stocks open: Dow -0.73%, Nasdaq -0.48%, S&P -0.55%

-

15:29

Before the bell: S&P futures -0.31%, NASDAQ futures -0.21%

U.S. index futures fell as a selloff in emerging markets fueled concern global growth is slowing at the same time the Federal Reserve considers the path for higher interest rates.

Global Stocks:

Nikkei 20,222.63 -331.84 -1.61%

Hang Seng 23,167.85 -307.12 -1.31%

Shanghai Composite 3,794.55 +46.38 +1.24%

FTSE 6,465.81 -60.48 -0.93%

CAC 4,925.7 -45.55 -0.92%

DAX 10,773.49 -142.43 -1.30%

Crude oil $42.30 (-0.73%)

Gold $1120.60 (+0.32%)

-

15:27

German parliament votes for the third Greek bailout programme

The German parliament voted for the third Greek bailout programme on Wednesday. 453 voted in favour of the Greek bailout, 113 voted against it, while 18 abstained.

63 MPs of Merkel's CDU/CSU party voted against the Greek bailout, while 3 MPs abstained. 60 MPs of Merkel's party voted against the bailout negotiations in July.

-

15:15

Bank of England’ Monetary Policy Committee Member David Miles: interest rate in the U.K. will rise "pretty soon"

The Bank of England' Monetary Policy Committee Member David Miles said in an interview to BBC Newsnight on late Tuesday evening that interest rate in the U.K. will rise "pretty soon".

"I don't think it's anything to worry about, it's a sign of health," he said. Miles added that the economy consumer confidence is strong, corporate confidence is pretty strong and the financial system is operating near normal now".

Miles will retire this month.

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Apple Inc.

AAPL

116.55

+0.04%

82.0K

ALTRIA GROUP INC.

MO

55.23

+0.05%

0.3K

Tesla Motors, Inc., NASDAQ

TSLA

261.00

+0.11%

6.1K

Google Inc.

GOOG

658.40

+0.35%

0.7K

Barrick Gold Corporation, NYSE

ABX

7.72

+0.78%

9.9K

Yandex N.V., NASDAQ

YNDX

12.58

+0.96%

0.4K

Cisco Systems Inc

CSCO

28.25

0.00%

45.9K

The Coca-Cola Co

KO

41.30

0.00%

0.6K

Nike

NKE

114.81

-0.01%

1K

FedEx Corporation, NYSE

FDX

165.63

-0.02%

0.1K

General Motors Company, NYSE

GM

31.70

-0.03%

0.4K

3M Co

MMM

147.18

-0.07%

1.0K

Exxon Mobil Corp

XOM

77.84

-0.08%

0.7K

Home Depot Inc

HD

122.65

-0.12%

1.3K

Walt Disney Co

DIS

106.81

-0.12%

10.0K

Procter & Gamble Co

PG

75.00

-0.17%

0.8K

Hewlett-Packard Co.

HPQ

28.34

-0.18%

0.3K

Amazon.com Inc., NASDAQ

AMZN

534.00

-0.19%

3.1K

Intel Corp

INTC

28.85

-0.21%

33.5K

Goldman Sachs

GS

200.70

-0.24%

0.6K

American Express Co

AXP

81.04

-0.25%

1K

International Business Machines Co...

IBM

155.60

-0.26%

1.0K

Merck & Co Inc

MRK

59.50

-0.27%

1.9K

Facebook, Inc.

FB

94.90

-0.28%

53.6K

AT&T Inc

T

34.25

-0.29%

2.1K

AMERICAN INTERNATIONAL GROUP

AIG

63.52

-0.30%

0.3K

Starbucks Corporation, NASDAQ

SBUX

57.65

-0.31%

4.4K

Wal-Mart Stores Inc

WMT

69.25

-0.33%

6.5K

General Electric Co

GE

25.98

-0.35%

1.5K

Microsoft Corp

MSFT

47.10

-0.36%

0.1K

Yahoo! Inc., NASDAQ

YHOO

35.56

-0.36%

51.2K

Twitter, Inc., NYSE

TWTR

28.19

-0.39%

63.7K

Citigroup Inc., NYSE

C

57.32

-0.40%

3.5K

Ford Motor Co.

F

14.77

-0.40%

0.5K

Pfizer Inc

PFE

35.37

-0.42%

0.3K

Boeing Co

BA

143.96

-0.44%

0.1K

JPMorgan Chase and Co

JPM

67.90

-0.45%

0.8K

Caterpillar Inc

CAT

78.45

-0.47%

1.4K

McDonald's Corp

MCD

100.28

-0.48%

19.5K

Chevron Corp

CVX

83.00

-0.53%

0.9K

ALCOA INC.

AA

9.21

-0.65%

32.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.83

-0.91%

33.0K

-

14:57

U.S. consumer price inflation rises 0.1% in July

The U.S. Labor Department released consumer price inflation data on Wednesday. The U.S. consumer price inflation rose 0.1% in July, missing expectations for a 0.2% increase, after a 0.3% gain in June.

The increase was partly driven by higher gasoline and food prices. Gasoline prices climbed 0.9% in July, while food prices increased 0.2% in July.

On a yearly basis, the U.S. consumer price index increased to 0.2% in July from 0.1% in June, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.1% in July, missing expectations for a 0.2% rise, after a 0.2% increase in June.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged to 1.8% in July.

These inflation figures could support the Fed's decision to start raising interest rates this year.

-

14:55

Upgrades and downgrades before the market open

Upgrades:

Google (GOOGL, GOOG) upgraded to Overweight from Neutral at Atlantic Equities, target raised from $650 to $825 for GOOGL and from $560 to $825 for GOOG

Barrick Gold (ANX) upgraded to Neutral from Underperform at Macquarie

Downgrades:

Other:

Home Depot (HD) target raised to $136 from $130 at Argus

Wal-Mart (WMT) target lowered to $73 from $80 at Barclays

Hewlett-Packard (HPQ) target lowered to $40 from $43 at Monness Crespi & Hardt

-

14:41

Federal Reserve Bank of Minneapolis President Narayana Kocherlakota: the Fed should wait with the first interest rate hike

Federal Reserve Bank of Minneapolis President Narayana Kocherlakota wrote in The Wall Street Journal on Wednesday that the Fed should wait with the first interest rate hike.

"Tightening monetary policy when inflation is projected to be so low is a step in the wrong direction," he wrote.

Kocherlakota added that the Fed should ease its monetary policy as inflation remains low.

-

14:30

U.S.: CPI excluding food and energy, Y/Y, July 1.8% (forecast 1.8%)

-

14:30

U.S.: CPI, Y/Y, July 0.2% (forecast 0.2%)

-

14:30

U.S.: CPI excluding food and energy, m/m, July 0.1% (forecast 0.2%)

-

14:30

U.S.: CPI, m/m , July 0.1% (forecast 0.2%)

-

14:23

Greek industrial turnover slides 13.4% in June

The Hellenic Statistical Authority released its industrial turnover data for Greece on Wednesday. Greek overall turnover index slid 13.4% year-on-year in June, after a 4.2% drop in May.

Domestic market turnover fell at an annual rate of 6.2% in June, while foreign market turnover plunged by 22.2%.

Turnover in the manufacturing sector declined at an annual rate of 13.9% in June, while mining and quarrying turnover dropped by 33.3%.

-

14:17

Italy’s current account surplus climbs to €3.53 billion in June

The Bank of Italy released its current account data on Wednesday. Italy's current account surplus climbed to €3.53 billion in June from €2.60 billion in June last year.

The goods trade surplus increased to €4.85 billion in June from €3.85 billion in June last year. The services trade balance declined to a surplus of €651 million from €906 million.

The capital account surplus decreased to €156 million in June from €298 million last year, while the financial account balance turned to a deficit of €3.18 billion from a surplus of €1.8 billion.

-

14:08

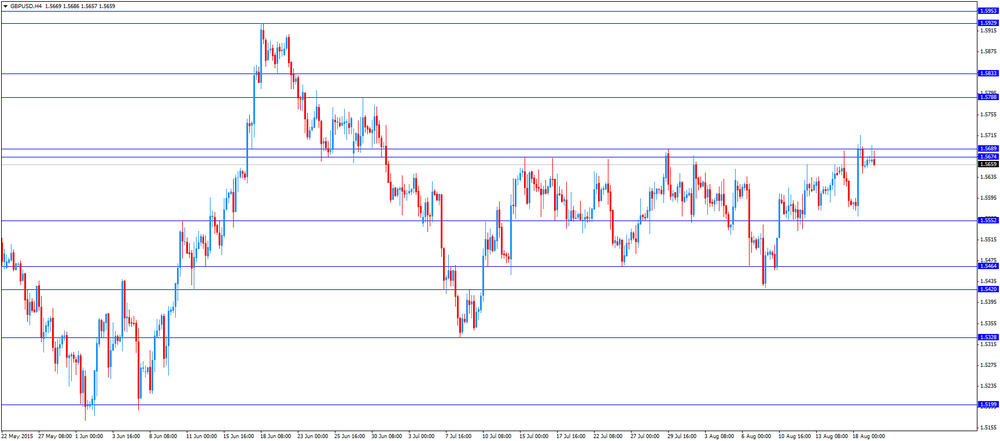

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite news that the German parliament voted for the Greek bailout

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan All Industry Activity Index, m/m June -0.5% 0.3%

08:00 Eurozone Current account, unadjusted, bln June 4.3 Revised From 3.4 31.1

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. inflation data. The U.S. consumer price inflation is expected to rise to 0.2% in July from 0.1% in June.

The U.S. consumer price index excluding food and energy is expected to remain unchanged at 1.8% in July.

The Fed will release its latest monetary policy minutes at 18:00 GMT. Market participants will be looking for signs if the Fed will start raising its interest rate in September.

The euro traded lower against the U.S. dollar despite news that the German parliament voted for the Greek bailout.

Meanwhile, the economic data from the Eurozone was mixed. Eurozone's current account surplus climbed to a seasonally adjusted €25.4 billion in June from €19.1 billion in May.

The surplus was driven by higher surpluses on trade in goods and primary income. The trade surplus rose to €27.2 billion in June from €24.9 billion in May, while primary income increased to €1 billion from €0.8 billion.

The surplus on services declined to €5.7 billion in June from €6.6 billion in May, while the secondary income dropped to €8.4 billion from €13.3 billion.

Eurozone's unadjusted current account surplus soared to €31.1 billion in July from EUR 4.3 billion in May. May's figure was revised up from a surplus of €3.4 billion.

Construction production in the Eurozone decreased 1.9% in June, after a 0.2% rise in May. May's figure was revised down from a 0.3% gain.

Civil engineering output declined 2.7% in June, while production in the building sector dropped 1.6%.

On a yearly basis, construction output fell 2.3% in June, after a 0.2% rise in May. May's figure was revised down from 0.3% increase.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K:

EUR/USD: the currency pair fell to $1.1029

GBP/USD: the currency pair declined to $1.5657

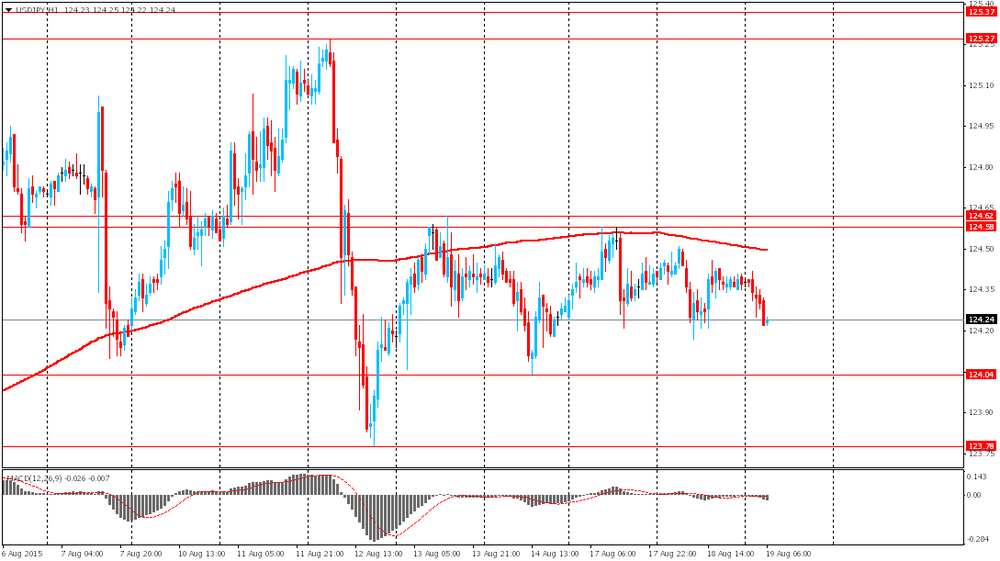

USD/JPY: the currency pair rose to Y124.36

The most important news that are expected (GMT0):

12:30 U.S. CPI, m/m July 0.3% 0.2%

12:30 U.S. CPI, Y/Y July 0.1% 0.2%

12:30 U.S. CPI excluding food and energy, m/m July 0.2% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y July 1.8% 1.8%

18:00 U.S. FOMC meeting minutes

-

13:45

Orders

EUR/USD

Offers 1.1085 1.1100 1.1120-25 1.1150 1.1180 1.1200 1.2220 1.1245 1.1265 1.1285 1.1300

Bids 1.1045-50 1.1020 1.1000 1.0985 1.0965 1.0950 1.0930 1.0900

GBP/USD

Offers 1.5685 1.5700 1.5720 1.5735 1.5750 1.5780 1.5800 1.5825-30 1.5860

Bids 1.5645-50 1.5625 1.5600 1.5545-50 1.5525-30 1.5500 1.5485 1.5465 1.5450

EUR/GBP

Offers 0.7060 0.7090 0.7100 0.7120 0.7135 0.7150-55 0.7180-85 0.7200 0.7230 0.7250

Bids 0.7030-35 0.7020 0.7000 0.6985 0.6965 0.6950

EUR/JPY

Offers 137.60 137.80 138.00 138.30 138.50 138.85 139.00

Bids 137.20-25 137.00 136.80 136.50 136.00

USD/JPY

Offers 124.50 124.65 124.80 125.00 125.20-25 125.50 125.75 126.00

Bids 124.20 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7385 0.7400 0.7425 0.7450

Bids 0.7320 0.7300 0.7285 0.7260 0.7300 0.7280 0.7250

-

12:00

European stock markets mid session: stocks traded lower on worries over the situation in China

Stock indices traded lower on worries over the situation in China. China's central bank injected more liquidity into the financial sector to calm market participants.

The German parliament will vote on the third Greek bailout programme today. Analysts expect that the parliament vote for the bailout for Greece.

Meanwhile, the economic data from the Eurozone was mixed. Eurozone's current account surplus climbed to a seasonally adjusted €25.4 billion in June from €19.1 billion in May.

The surplus was driven by higher surpluses on trade in goods and primary income. The trade surplus rose to €27.2 billion in June from €24.9 billion in May, while primary income increased to €1 billion from €0.8 billion.

The surplus on services declined to €5.7 billion in June from €6.6 billion in May, while the secondary income dropped to €8.4 billion from €13.3 billion.

Eurozone's unadjusted current account surplus soared to €31.1 billion in July from EUR 4.3 billion in May. May's figure was revised up from a surplus of €3.4 billion.

Construction production in the Eurozone decreased 1.9% in June, after a 0.2% rise in May. May's figure was revised down from a 0.3% gain.

Civil engineering output declined 2.7% in June, while production in the building sector dropped 1.6%.

On a yearly basis, construction output fell 2.3% in June, after a 0.2% rise in May. May's figure was revised down from 0.3% increase.

Current figures:

Name Price Change Change %

FTSE 100 6,471.85 -54.44 -0.8 %

DAX 10,796.41 -119.51 -1.1 %

CAC 40 4,926.72 -44.53 -0.9 %

-

11:42

Construction production in the Eurozone falls 1.9% in June

The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone decreased 1.9% in June, after a 0.2% rise in May. May's figure was revised down from a 0.3% gain.

Civil engineering output declined 2.7% in June, while production in the building sector dropped 1.6%.

On a yearly basis, construction output fell 2.3% in June, after a 0.2% rise in May. May's figure was revised down from 0.3% increase.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E337mn), $1.1000(E812mn), $1.1040(E611mn), $1.1100(E271mn), $1.1150(E154mn)

USD/JPY: Y123.00($385mn), Y124.00($528mn), Y124.50($355mn), Y125.00($315mn), Y126.00($727mn)

EUR/JPY: Y136.75(E317mn), Y137.00(E233mn), Y137.50(E350mn)

GBP/USD: $1.5475(Gbp520mn), $1.5500(Gbp226mn), $1.5700(Gbp135mn)

USD/CHF: Chf0.9800($480mn)

AUD/USD: $0.7250(A$$$0.7295(A$280mn), $0.7360(A$254mn)

USD/CAD: C$1.3050($398mn), C$1.3100($133mn), C$1.3150($200mn), C$1.3185($191mn)

-

11:18

Federal Reserve Bank of Dallas names Robert Steven Kaplan as its new president

The Federal Reserve Bank of Dallas named Robert Steven Kaplan as its new president. Kaplan is a former vice chairman of Goldman Sachs Group Inc., and holds a master's degree in business administration from Harvard Business School.

Kaplan replaces Richard Fisher, who retired in March.

-

11:11

Fitch Ratings has upgrades Greece's rating by one notch to 'CCC'

Fitch Ratings has upgraded Greece's Long-term foreign and local currency Issuer Default Ratings (IDRs) by one notch to 'CCC' from 'CC' on Tuesday. The reason for the upgrade was a deal between Greece and its international lenders on the third bailout programme.

"The 14 August agreement reached between Greece and the European Institutions on the framework for a third official bailout programme has reduced the risk of Greece defaulting on its private sector debt obligations," the agency said.

Fitch pointed out that "the political situation in Greece remains unpredictable".

-

10:53

Eurozone’s current account surplus climbs to a seasonally adjusted €25.4 billion in June

The European Central Bank (ECB) released its current account on Wednesday. Eurozone's current account surplus climbed to a seasonally adjusted €25.4 billion in June from €19.1 billion in May.

The surplus was driven by higher surpluses on trade in goods and primary income. The trade surplus rose to €27.2 billion in June from €24.9 billion in May, while primary income increased to €1 billion from €0.8 billion.

The surplus on services declined to €5.7 billion in June from €6.6 billion in May, while the secondary income dropped to €8.4 billion from €13.3 billion.

Eurozone's unadjusted current account surplus soared to €31.1 billion in July from EUR 4.3 billion in May. May's figure was revised up from a surplus of €3.4 billion.

-

10:31

Fitch Ratings affirms Canada's 'AAA' rating

Fitch Ratings has affirmed Canada's long-term foreign and local currency IDRs at 'AAA' on Tuesday. The rating outlook is stable.

"Canada's 'AAA' rating draws support from its advanced, well diversified and high-income economy. Its political stability, strong governance and institutional strengths support the rating. Its overall policy framework remains strong and has delivered steady growth and low inflation," Fitch said.

Fitch noted that falling oil prices since the second half of year 2014 has hit investment in the oil sector.

The agency also said that high levels of household debt and pockets of real estate overvaluation pose risks to Canada's economy, but the risks are manageable.

-

10:22

Japan's trade deficit widens to ¥268.1 billion in July

The Ministry of Finance released its trade data for Japan on the late Tuesday evening. Japan's trade deficit widened to ¥268.1 billion in July from a deficit of ¥70.5 billion in June. June's figure was revised down from a deficit of ¥69.0 billion.

Analysts had expected a deficit of ¥56.7 billion.

The adjusted trade deficit was ¥368.8 billion in July, down from a deficit of ¥283.4 billion in June.

Exports rose 7.6% year-on-year, while imports dropped 3.2%.

Exports to Asia climbed by 6.1% year-on-year, exports to the United States increased by 18.8%, exports to China rose by 4.2%, while exports to the European Union were up 10.0%.

Imports from Asia climbed 7.4% year-on-year, imports from the United States jumped 7.5%, and imports from China gained 13.5%, while imports from the European Union rose 13.5%.

-

10:11

Bloomberg survey: 28% of respondents said the Eurozone’s outlook will improve in the short term

According to a Bloomberg survey, only 28% of respondents said the Eurozone's outlook will improve in the short term, down from 50% in July and 83% in March. More than two-thirds of respondents in expect the outlook to remain unchanged.

The survey was conducted before the release of the Eurozone's GDP data last week.

Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the second quarter, missing expectations for a 0.4% rise, after a 0.4% gain in the first quarter. On a yearly basis, Eurozone's preliminary GDP rose by 1.2% in the second quarter, missing expectations for a 1.3% increase, after a 1.0% gain in the first quarter.

A slowdown in China's economy weighs on the recovery in the Eurozone.

-

10:00

Eurozone: Current account, unadjusted, bln , June 31.1

-

09:15

Oil prices slid

West Texas Intermediate futures for September delivery fell to $42.87 (-0.58%), while Brent crude declined to $48.67 (-0.29%) ahead of U.S. inventory report, which would help assess demand in the world's top oil consumer.

Global demand can't keep up with robust supply, especially amid slowing economic growth in world's second-biggest consumer China. The U.S. is also likely to enter the lower demand season in September.

-

09:01

Gold steady ahead of Fed Meeting Minutes

Gold is currently at $1,118.20 (+0.12%) as investors await Fed Meeting Minutes to assess probability of a rate hike in September.

Bullion bounced away from a 5-1/2-year low and found some support above $1,100 an ounce after China devalued the yuan in an unexpected move. However analysts believe that prospects of Federal Reserve interest rates are key factors, which determine direction of gold's fluctuations.

The looming rate hike curbs demand for such non-interest-bearing safe-haven assets as gold.

-

08:19

Options levels on wednesday, August 19, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1162 (4828)

$1.1133 (3688)

$1.1108 (4487)

Price at time of writing this review: $1.1062

Support levels (open interest**, contracts):

$1.1008 (1601)

$1.0991 (2259)

$1.0961 (3976)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 85299 contracts, with the maximum number of contracts with strike price $1,1200 (7016);

- Overall open interest on the PUT options with the expiration date September, 4 is 116420 contracts, with the maximum number of contracts with strike price $1,0500 (7848);

- The ratio of PUT/CALL was 1.36 versus 1.39 from the previous trading day according to data from August, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (2022)

$1.5804 (2546)

$1.5707 (2124)

Price at time of writing this review: $1.5670

Support levels (open interest**, contracts):

$1.5593 (1033)

$1.5496 (2702)

$1.5398 (2156)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 29630 contracts, with the maximum number of contracts with strike price $1,5600 (2798);

- Overall open interest on the PUT options with the expiration date September, 4 is 34976 contracts, with the maximum number of contracts with strike price $1,5500 (2702);

- The ratio of PUT/CALL was 1.18 versus 1.17 from the previous trading day according to data from August, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:19

Global Stocks: U.S. and Asian indices declined

Major U.S. stock indices declined on Tuesday amid lower commodity prices and a weak earnings report from the world's largest retailer Wal-Mart Stores.

The Dow Jones Industrial Average declined 33.84 points, or 0.2%, to 17511.34. The S&P 500 slid 5.52 points, or 0.3% to 2096.92 (all of its sectors declined). The Nasdaq Composite fell 32.35 points, or 0.6%, to 5059.35.

Wal-Mart shares fell 3.4% after the company reported that its profit fell 15% to $3.48 billion in the second quarter of 2015.

This morning in Asia Hong Kong Hang Seng dropped 1.03%, or 242.21 points, to 23,232.76. China Shanghai Composite Index lost 3.12%, or 116.76 points, to 3,631.40. The Nikkei fell 1.35%, or 278.36 points, to 20,276.11.

Japanese stocks fell following declines in U.S. equities. Investors were also concerned about China's stock market. Declines in Chinese stocks renewed concerns over the country's economic conditions.

Chinese stocks continued falling after they dropped 6.1% yesterday. Investors are concerned that the government's actions related to macroeconomic regulation will drive attention away from the stock market.

-

08:10

Foreign exchange market. Asian session: the greenback traded steadily

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan All Industry Activity Index, m/m June -0.5% 0.3%

The U.S. dollar traded in a narrow range as investors were cautious ahead of July U.S. consumer prices report and release of Fed Meeting Minutes. These data are likely to give investors clues on the timing of a rate increase by the Federal Reserve.

The yen slightly rose against the U.S. dollar. Before the session's beginning the USD/JPY pair was steady due to favorable data on U.S. housing market: seasonally adjusted housing starts rose by 0.2% m/m in July to 1.21 million per year. This is the highest level since October 2007.

Today Japan published its July trade balance report. The deficit expanded to -¥268.1 billion from -¥69.0 in June. Economists expected the deficit to decline to -¥56.7. Exports rose by 7.6% y/y as demand from the U.S. offset sluggish exports to China. Meanwhile imports fell by 3.2% amid low oil prices.

EUR/USD: the pair rose to $1.1050 in Asian trade

USD/JPY: the pair fell to Y124.20

GBP/USD: the pair rose to $1.5675

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Eurozone Current account, unadjusted, bln June 3.4

12:30 U.S. CPI, m/m July 0.3% 0.2%

12:30 U.S. CPI, Y/Y July 0.1% 0.2%

12:30 U.S. CPI excluding food and energy, m/m July 0.2% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y July 1.8% 1.8%

14:30 U.S. Crude Oil Inventories August -1.682 -0.6

18:00 U.S. FOMC meeting minutes

-

06:32

Japan: All Industry Activity Index, m/m, June 0.3%

-

04:03

Nikkei 225 20,456.27 -98.20 -0.5 %, Hang Seng 23,394.2 -80.77 -0.3 %, Shanghai Composite 3,720.88 -27.28 -0.7 %

-

01:52

Japan: Trade Balance Total, bln, July -268.1 (forecast -56.7)

-

01:02

Commodities. Daily history for Aug 18’2015:

(raw materials / closing price /% change)

Oil 42.35 -0.63%

Gold 1,116.80 -0.01%

-

01:01

Stocks. Daily history for Aug 18’2015:

(index / closing price / change items /% change)

Nikkei 225 20,554.47 -65.79 -0.32 %

Hang Seng 23,474.97 -339.68 -1.43 %

S&P/ASX 200 5,303.15 -64.51 -1.20 %

Shanghai Composite 3,748.16 -245.50 -6.15 %

FTSE 100 6,526.29 -24.01 -0.37 %

CAC 40 4,971.25 -13.58 -0.27 %

Xetra DAX 10,915.92 -24.41 -0.22 %

S&P 500 2,096.92 -5.52 -0.26 %

NASDAQ Composite 5,059.35 -32.35 -0.64 %

Dow Jones 17,511.34 -33.84 -0.19 %

-

00:59

Currencies. Daily history for Aug 18’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1026 -0,47%

GBP/USD $1,5658т+0,48%

USD/CHF Chf0,9771 -0,12%

USD/JPY Y124,37 -0,03%

EUR/JPY Y137,14 -0,50%

GBP/JPY Y194,73 +0,44%

AUD/USD $0,7334 -0,49%

NZD/USD $0,6593 +0,35%

USD/CAD C$1,3058 -0,19%

-

00:47

New Zealand: PPI Output (QoQ) , Quarter II -0.2%

-

00:46

New Zealand: PPI Input (QoQ), Quarter II -0.3%

-

00:46

New Zealand: PPI Input (QoQ), Quarter II -0.3%

-

00:01

Schedule for today, Wednesday, Aug 19’2015:

(time / country / index / period / previous value / forecast)

04:30 Japan All Industry Activity Index, m/m June -0.5%

05:00 Japan Leading Economic Index (Finally) June 106.2

05:00 Japan Coincident Index (Finally) June 109.0

08:00 Eurozone Current account, unadjusted, bln June 3.4

12:30 U.S. CPI, m/m July 0.3% 0.2%

12:30 U.S. CPI, Y/Y July 0.1% 0.2%

12:30 U.S. CPI excluding food and energy, m/m July 0.2% 0.2%

12:30 U.S. CPI excluding food and energy, Y/Y July 1.8% 1.8%

14:30 U.S. Crude Oil Inventories August -1.682

18:00 U.S. FOMC meeting minutes

-