Noticias del mercado

-

22:13

US stocks fell

US stock indicators fell Tuesday amid falling commodity prices and weak reporting the world's largest retailer Wal-Mart Stores.

Raw materials continued to fall in price, with the strongest fall in the copper price, and oil. Negative dynamics support concerns that China's economic growth will continue to slow down, and the oil market remain significant excess supply.

Chinese stocks fell again amid falling yuan against the dollar, sparking new fears that Beijing may devalue the national currency more than the central bank is assured.

Meanwhile, the positive statistical data from the US housing market kept falling indices. Housing starts continued to rise in July, helped by a surge in single-family homes sector bookmarks. This was reported in the statement of the Ministry of Commerce. According to data seasonally adjusted bookmarks of new homes rose in July by 0.2% in the previous month, reaching an annual rate of 1 206 thousand. Units. The last value is the highest since October 2007. Adding that this was the third time in four months, when the index reached a new record high since the recession began.

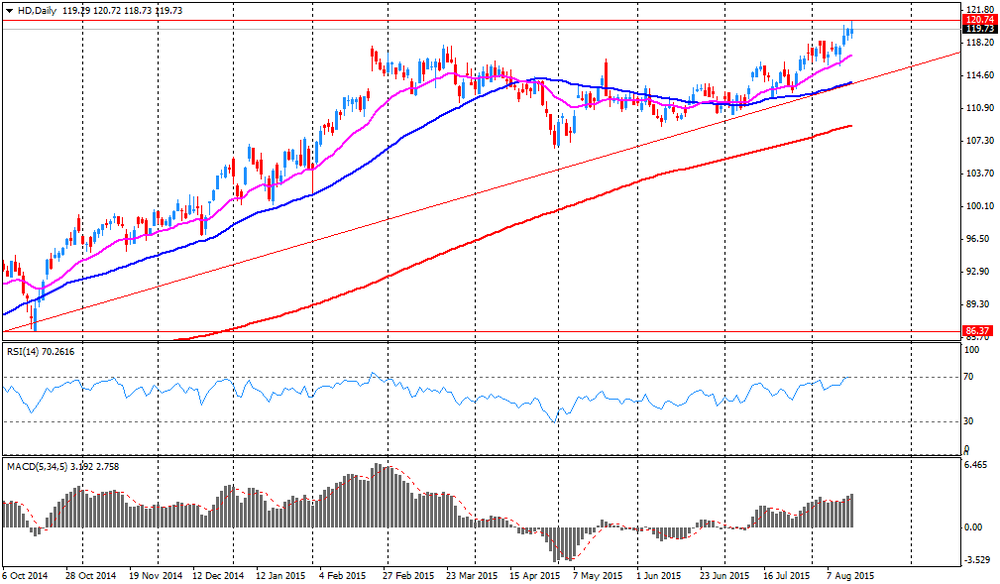

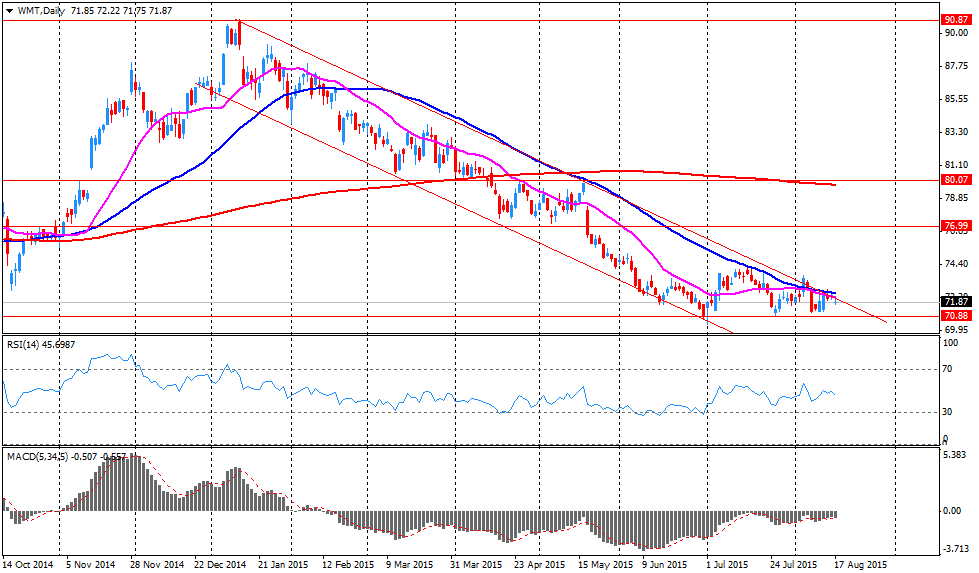

Most components of the index finished trading DOW minus (20 of 30). Outsider shares in Wal-Mart Stores Inc. (WMT, -3.48%). More rest up shares The Home Depot, Inc. (HD, + 2.79%).

All sectors of the index S & P closed in the red. Most conglomerates sector fell (-1.1%).

The stock price of Home Depot Inc. It grew by 2.8%. The largest US chain of stores for home goods increased its net profit in the 2nd fiscal quarter of 2015 by 9% and improved annual forecast as high demand for property increases the cost of Americans for goods for repair.

However, Wal-Mart's capitalization declined by 3.5%. US retailer has not justified forecasts of the market in terms of net profits last finkvartale and downgraded the outlook for the year as a whole due to the unfavorable impact of currency fluctuations.

-

21:00

DJIA 17494.01 -51.17 -0.29%, NASDAQ 5059.36 -32.33 -0.64%, S&P 500 2095.00 -7.44 -0.35%

-

20:21

American focus: the dollar rose

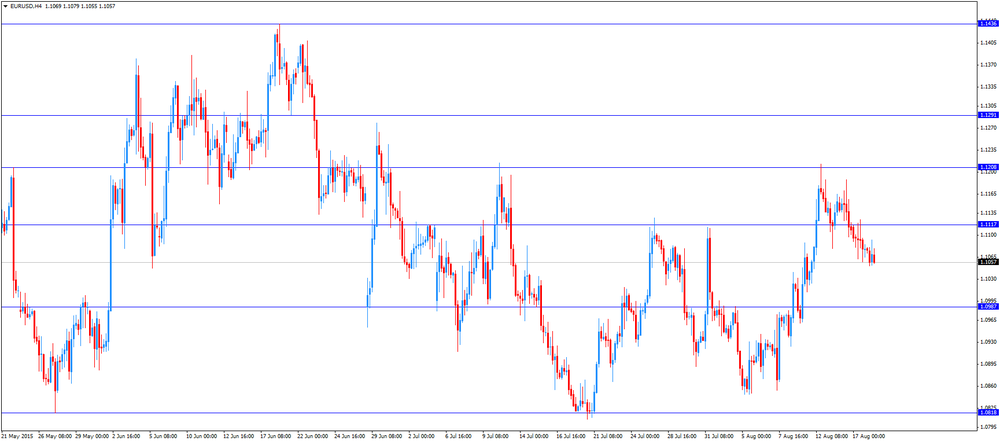

The US dollar rose against the euro after the publication of strong housing data that raised expectations of market participants regarding economic growth.

Nevertheless, the dollar continues to trade in a narrow range against other major currencies, as investors have largely refrained from taking action in anticipation of US data for July and the publication of minutes of the meeting of the Federal Reserve System. It is expected that these events will give investors guidance on the timing of raising short-term interest rates the Fed.

Investors continue to hope that the strong US data will force the Fed to raise interest rates to a level close to zero. Such a step the central bank will reflect positively on the dollar. Rising interest rates in the US will support assets denominated in US dollars, which will make the US currency more attractive for investors.

Housing starts continued to rise in July, helped by a surge in single-family homes sector bookmarks. This was reported in the statement of the Ministry of Commerce.

According to data seasonally adjusted bookmarks of new homes rose in July by 0.2% in the previous month, reaching an annual rate of 1 206 thousand. Units. The last value is the highest since October 2007. Adding that this was the third time in four months, when the index reached a new record high since the recession began.

The Ministry of Commerce also said that construction of single-family housing, which make up almost two-thirds of the market, jumped by 12.8%, reaching the highest level since December 2007. Meanwhile, bookmarks multifamily housing, including apartments and condominiums fell by 17% in June. With regard to construction permits, their number decreased by 16.3% to 1,119 thousand. Units. Economists had expected housing tab was 1190 thousand. Units against 1,204 thousand. In June (revised 1174 thousand.), While the number of building permits is at the level of 1232 thousand. Compared to 1337 thousand. In June (revised 1343 thousand. ).

It is worth emphasizing, housing starts is still low by historical standards, although there are signs of increasing demand. The data showed that compared to July of last year Bookmarks homes rose by 10.1%, while the number of permits increased by 7.5%.

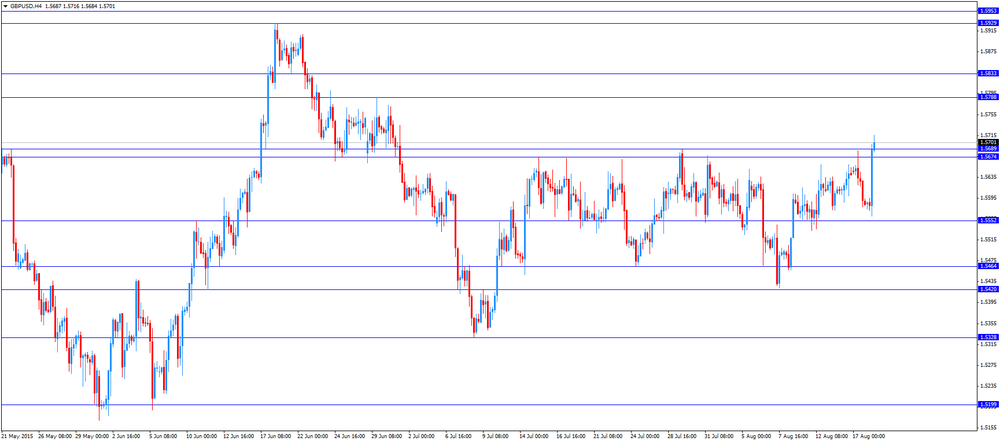

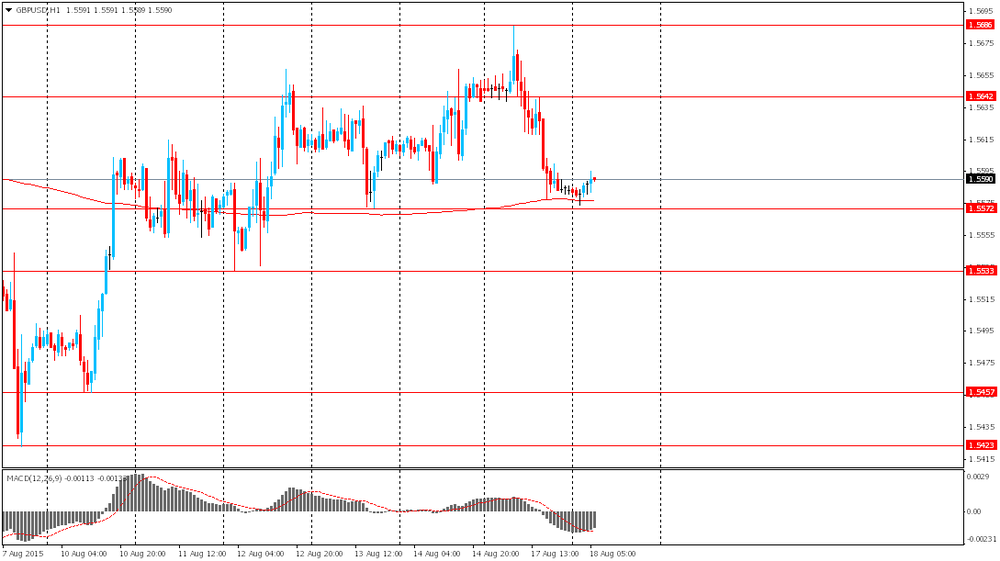

The pound rose substantially against the US dollar, peaking on July 1, after a report showed that consumer prices in the UK rose unexpectedly in July. Data provided by the Office for National Statistics showed that consumer prices rose in July by 0.1 percent year on year. Recall that in June, prices remained unchanged. Economists had expected inflation to remain zero in July after a slight increase in May and fall below zero for the first time since 1960 in April. On a monthly basis, inflation fell by 0.2 percent, which was slightly less than the forecast of -0.3 per cent. "A slight annual increase is mainly due to the smaller reduction in prices for clothing in July compared with the same period last year - said the expert ONS Richard Campbell. - Meanwhile, prices for food and fuel have continued to fall, which helped to contain future rise in inflation" Also, the data showed that the underlying rate of inflation, which excludes prices of energy, food, alcohol and tobacco, rose to 1.2 percent in July (the most significant annual growth in February), compared with 0.8 percent in June. Policy of the Bank of England are increasingly looking at this figure to estimate the time of the first rate increase in seven years. The ONS also reported that producer prices fell by 1.6 percent in annual terms, compared with economists' forecasts at 1.5 percent. We remind investors have recently revised the initial expectations the Bank of England rate hike after last month only one of the members of the Monetary Policy voted in favor of raising interest rates.

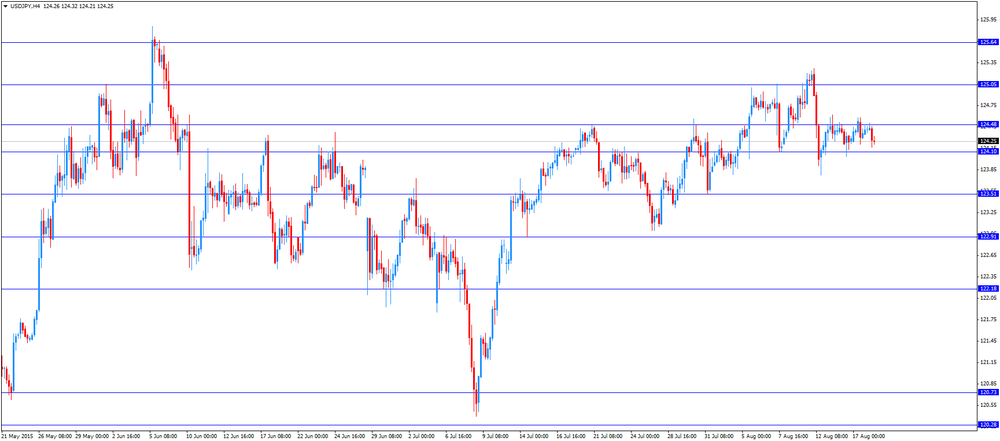

The yen strengthened slightly against the dollar, updating yesterday's high against the backdrop of risk aversion because of another collapse of Chinese stocks. Today, Shanghai Composite Index fell more than 6%, despite a large injection of liquidity into the financial system by the central bank of China, which signals a raise concerns in Beijing about capital outflows after the recent weakening of the yuan. Analysts fear that the weak yuan a negative impact on earnings of exporters in Europe and especially in Germany.

Support for the yen also had comments advisor Japanese Prime Minister E. Honda, who said that at this stage the economy is not in need of expansion incentives. According to him, "the negative effect of increasing the sales tax is extinguished, but the rate of increase in wages fall short of expectations, while more expensive food. He added that the Bank of Japan should expand the policy easing if inflation expectations decline, noting that the Japanese economy will require 3-3.5 trillion. yen to support the growth of consumption and prevent further economic contraction.

-

18:12

WSE: Session Results

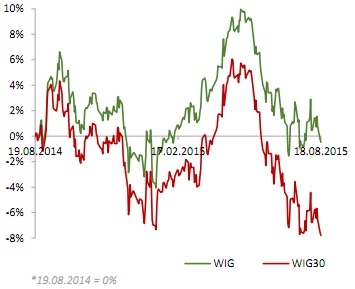

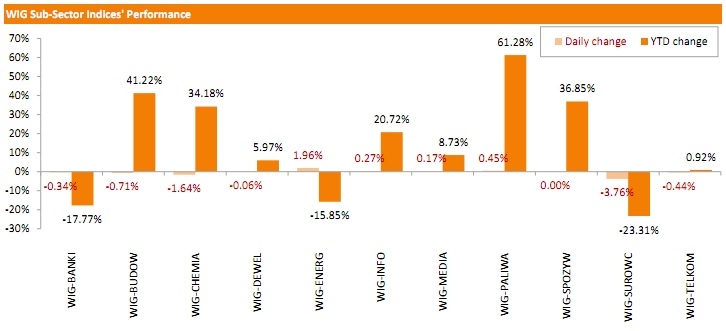

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, fell by 0.27%. Sector-wise, materials (-3.76%) fared the worst, while utilities sector (+1.96%) was the best-performer.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.27%. Within the WIG30 Index components, KGHM (WSE: KGH) recorded the biggest daily decline, slumping 3.98% on concerns over future demand for copper from China, the world's largest consumer of the metal. It was followed by BOGDANKA (WSE: LWB), HANDLOWY (WSE: BHW) and GRUPA AZOTY (WSE: ATT), which sank by 2.18%-3.41%. On the other side of the ledger, PGE (WSE: PGE), LOTOS (WSE: LTS) and TAURON PE (WSE: TPE) topped the gainers, rebounding by 2.92%, 2.67% and 2.21% respectively after a few consecutive sessions of losses.

-

18:01

European stocks close: stocks closed lower in the absence of any major economic reports from the Eurozone

Stock indices closed lower in the absence of any major economic reports from the Eurozone.

The German parliament will vote on the third Greek bailout programme on Wednesday. The Eurogroup approved the third Greek bailout programme on Friday.

German Finance Minister Wolfgang Schaeuble said on Monday that he is confident that the International Monetary Fund (IMF) will take part in a new bailout for Greece.

Greece eased capital controls. Greeks can now transfer up to €500 abroad. Parents can transfer €8,000 to their children studying abroad to cover tuition fees and other expenses, up from €5,000.

Greeks now can open bank accounts for debt repayments. Withdrawals are still limited to €420 a week.

The Greek imposed capital controls on June 29.

Total number of employed persons increased by 0.4% to 42.8 million in the second quarter from a year ago, after a 0.6% rise in the first quarter. The rise was mainly driven by the rise in the service sector.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.1% in July from 0.0% in June, exceeding expectations for a flat reading.

The increase was driven by a smaller decline in clothing prices.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices fell 0.2% in July, beating expectations for a 0.3% drop, after a flat reading in June.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.2% in July from 0.8% the month before.

The consumer price inflation is below the Bank of England's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,526.29 -24.01 -0.37 %

DAX 10,915.92 -24.41 -0.22 %

CAC 40 4,971.25 -13.58 -0.27 %

-

18:00

European stocks closed: FTSE 6526.29 -24.01 -0.37%, DAX 10915.92 -24.41 -0.22%, CAC 40 4971.25 -13.58 -0.27%

-

17:49

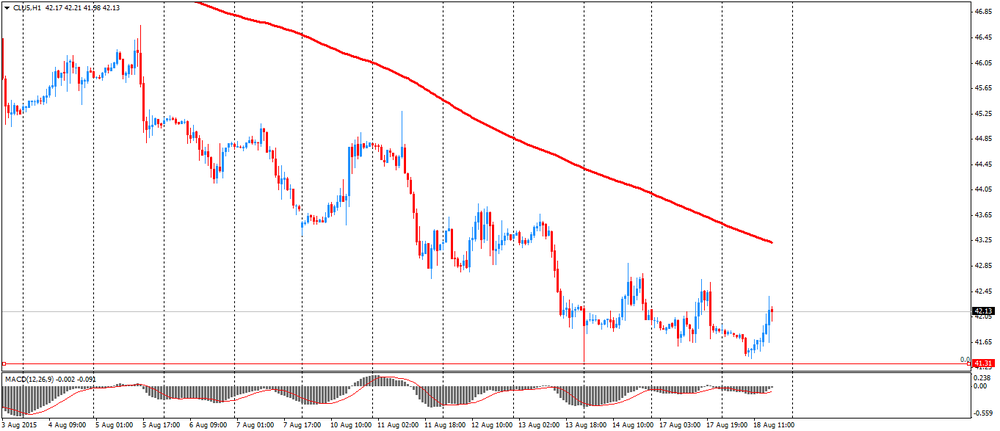

Oil prices rise after the recent drop

Oil prices rebounded from the recent drop. Concerns over the global oil oversupply and concerns over a slowdown in China's economy weighed on oil prices. Chinese stocks slid more than 6% on Tuesday. Market participants speculate on that China's central bank could devaluate the yuan again.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for September delivery rose $42.43 a barrel on the New York Mercantile Exchange.

Brent crude oil for September decreased to $48.54 a barrel on ICE Futures Europe.

-

17:27

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed on Tuesday, weighed down by a 6% slump in Chinese shares and Wal-Mart's (WMT.N) weaker-than-expected quarterly results. Wal-Mart shares fell as much as 3.2% to a nearly 2-1/2 year low of $69.58 and were the biggest drag on the Dow Jones industrial average. Chinese stocks plunged again as the yuan weakened against the dollar, re-igniting fears that Beijing may be intent on a deeper devaluation of the currency despite the central bank's reassurances.

Most of Dow stocks in negative area (17 of 30). Top looser - Wal-Mart Stores Inc. (WMT, -3.12%). Top gainer - The Home Depot, Inc. (HD, +3.26).

Almost all of S&P index sectors also in negative area. Top looser - Conglomerates (-0.8%). Top gainer - Healthcare (+0,3%).

At the moment:

Dow 17509.00 +5.00 +0.03%

S&P 500 2097.75 -1.50 -0.07%

Nasdaq 100 4559.00 -5.75 -0.13%

10 Year yield 2,18% +0,03

Oil 42.64 +0.23 +0.54%

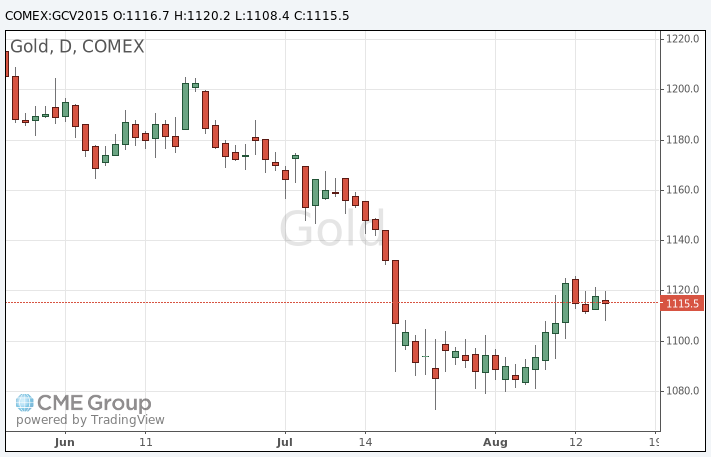

Gold 1115.20 -3.20 -0.29%

-

17:25

Gold price drops after the better-than-expected U.S. housing starts data

Gold dropped after the better-than-expected U.S. housing starts data. Housing starts in the U.S. rose 0.2% to 1.206 million annualized rate in July from a 1,204 million pace in June, beating expectations for a decline to 1.190 million. It was the highest level since October 2007.

The increase was driven by an increase in starts of single-family homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. dropped 16.3% to 1.119 million annualized rate in July from a 1.337 million pace in June. Analysts had expected building permits to decline to 1.232 million units.

These figures added to speculation on that the Fed will start raising its interest rate in September.

Market participants are awaiting the release of the latest Fed's monetary policy minutes on Wednesday.

October futures for gold on the COMEX today increased to 1108.40 dollars per ounce.

-

16:55

Greek government eases capital controls

Greece eased capital controls. Greeks can now transfer up to €500 abroad.

Parents can transfer €8,000 to their children studying abroad to cover tuition fees and other expenses, up from €5,000.

Greeks now can open bank accounts for debt repayments. Withdrawals are still limited to €420 a week.

The Greek imposed capital controls on June 29.

-

16:09

People’s Bank of China injected 120 billion yuan into market

The People's Bank of China (PBoC) injected 120 billion yuan ($18.77 billion) into market by offering seven-day reverse repurchase agreements on Tuesday. This cash injection was the biggest of its kind since January 28, 2014.

The reason for this injection could be the decision to boost liquidity. Liquidity has tightened due to the yuan depreciation.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E522mn), $1.1050(E369mn), $1.1100(E260mn), $1.1200(E304mn)

USD/JPY: Y124.25($299mn), Y125.00($439mn), Y125.50($536mn)

GBP/USD: $1.5850(Gbp237mn)

USD/CHF: Chf0.9775($400mn)

EUR/CHF: Chf1.0750(E306mn)

AUD/USD: $$0.7350(A$196mn), $0.7365-70(A$330mn), $0.7400(A$309mn), $0.7450(A$726mn)

NZD/USD: 0.6450(NZ$100mn), $0.6510(NZ$303mn)

USD/CAD: C$1.3010($330mn), C$1.3250($115mn)

-

15:42

Moody's expects G20 GDP to rise 2.7% this year

Moody's Investors Service released its quarterly report on Tuesday. The agency expects G20 GDP to rise 2.7% this year, increasing to around 3% in 2016, compared to 2.9% in 2014. Moody's added that 2015-16 growth forecasts "are still below the G20's average growth rate before the financial crisis".

According to the report, the downward risks for 2015-2016 forecasts are "correction in Chinese equity and property prices, a disorderly response to the US Federal Reserve's anticipated policy tightening and a Greek exit from the euro area".

Moody's forecast the Chinese economy to grow 6.8% this year and 6.5% in 2016.

The U.S. economy is expected to expand 2.4% in 2015 and 2.8% in 2016.

Eurozone's economy is expected to grow 1.5% in both 2015 and 2016.

Moody's forecasts the Brent oil price to average $57 a barrel in 2016, higher than the 2015 average of $55.

-

15:29

Before the bell: S&P futures -0.17%, NASDAQ futures -0.21%

U.S. stock-index futures pared declines as new-home construction climbed in July to the highest level in almost eight years, offsetting a selloff in commodities that weighed on raw-materials producers.

Global Stocks:

Nikkei 20,554.47 -65.79 -0.32%

Hang Seng 23,474.97 -339.68 -1.43%

Shanghai Composite 3,749.12 -244.54 -6.12%

FTSE 6,524.98 -25.32 -0.39%

CAC 4,986.91 +2.08 +0.04%

DAX 10,954.97 +14.64 +0.13%

Crude oil $41.91 (+0.10%)

Gold $1116.20 (-0.20%)

-

15:21

Spain’s trade deficit widens to €2.05 billion in June

Spain's Economy Ministry released its trade data on Tuesday. The trade deficit widened to €2.05 billion in June from €1.48 billion in June a year ago.

Exports rose at an annual rate of 7.8% in June, while imports jumped 9.8%.

In the first half of 2015, the trade deficit totalled €11.5 billion, down 3.4% from the same period of 2014.

Exports increased 4.9% in the first half, while imports gained 4.2%.

-

15:15

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Microsoft Corp

MSFT

47.02

+0.02%

15.5K

Facebook, Inc.

FB

93.95

+0.02%

76.2K

ALTRIA GROUP INC.

MO

55.68

+0.02%

0.5K

Starbucks Corporation, NASDAQ

SBUX

57.84

+0.17%

5.4K

Home Depot Inc

HD

121.30

+1.34%

119.3K

AT&T Inc

T

34.23

0.00%

1.8K

Hewlett-Packard Co.

HPQ

28.61

0.00%

228.7K

Chevron Corp

CVX

83.20

-0.04%

5.3K

Deere & Company, NYSE

DE

94.14

-0.04%

1.1K

FedEx Corporation, NYSE

FDX

164.89

-0.05%

0.1K

Exxon Mobil Corp

XOM

78.69

-0.10%

2.2K

JPMorgan Chase and Co

JPM

68.00

-0.10%

0.3K

Google Inc.

GOOG

660.19

-0.10%

0.1K

Goldman Sachs

GS

202.29

-0.14%

0.5K

Pfizer Inc

PFE

35.45

-0.14%

0.2K

The Coca-Cola Co

KO

41.29

-0.15%

0.2K

Yandex N.V., NASDAQ

YNDX

12.47

-0.16%

7.0K

3M Co

MMM

148.95

-0.19%

0.2K

Travelers Companies Inc

TRV

107.50

-0.19%

1.7K

Tesla Motors, Inc., NASDAQ

TSLA

254.50

-0.19%

10.8K

Procter & Gamble Co

PG

75.37

-0.21%

4.5K

Citigroup Inc., NYSE

C

57.65

-0.21%

11.5K

Visa

V

74.24

-0.23%

1.1K

Cisco Systems Inc

CSCO

28.75

-0.26%

2.1K

General Electric Co

GE

26.13

-0.31%

6.3K

Amazon.com Inc., NASDAQ

AMZN

533.58

-0.31%

7.0K

Johnson & Johnson

JNJ

99.55

-0.32%

1.1K

Apple Inc.

AAPL

116.75

-0.35%

177.8K

Barrick Gold Corporation, NYSE

ABX

7.84

-0.38%

2.1K

Twitter, Inc., NYSE

TWTR

28.94

-0.41%

1.1K

Verizon Communications Inc

VZ

47.31

-0.44%

2.2K

Ford Motor Co.

F

14.61

-0.48%

3.7K

International Business Machines Co...

IBM

155.51

-0.51%

0.5K

Intel Corp

INTC

28.92

-0.55%

0.5K

General Motors Company, NYSE

GM

31.40

-0.66%

0.5K

McDonald's Corp

MCD

99.99

-0.67%

12.5K

Walt Disney Co

DIS

108.29

-0.70%

19.1K

Caterpillar Inc

CAT

77.97

-0.72%

1.4K

ALCOA INC.

AA

9.34

-0.95%

22.7K

Yahoo! Inc., NASDAQ

YHOO

35.65

-1.23%

10.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.01

-2.25%

99.0K

Wal-Mart Stores Inc

WMT

70.10

-2.52%

528.6K

-

15:00

Company News: Home Depot (HD) issued better than expected report and raised guidance for FY16

Company reported Q2 profit of $1.71 per share versus $1.69 consensus. Revenues rose 16.6% to $27.83 bln versus $24.69 bln consensus.

Company raised guidance for FY16: for EPS to $5.31-5.36 from $5.24-5.27 versus $5.29 consensus; for revenues to to $87.5-88.1 bln (+5.2-6.0% y/y from +4.2-4.8% prior) versus $86.99 bln consensus

HD rose to $121.00 (+1.09%) on the premarket.

-

14:58

Housing starts in the U.S. hit the highest level since October 2007

The U.S. Commerce Department released the housing market data on Tuesday. Housing starts in the U.S. rose 0.2% to 1.206 million annualized rate in July from a 1,204 million pace in June, beating expectations for a decline to 1.190 million. It was the highest level since October 2007.

June's figure was revised up from 1.174 million units.

The increase was driven by an increase in starts of single-family homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. dropped 16.3% to 1.119 million annualized rate in July from a 1.337 million pace in June. June's figure was revised down from 1.343 million.

Analysts had expected building permits to decline to 1.232 million units.

Starts of single-family homes rose 12.8% in July. Building permits for single-family homes were down 1.9%.

Starts of multifamily buildings dropped 17.0% in July. Permits for multi-family housing slid 31.8%.

-

14:49

Company News: Wal-Mart (WMT) issued downside guidance

Company reported Q2 profit of $1.08 per share versus $1.12 consensus. Revenues were $119.33 bln (unchanged from the year-ago) versus $119.13 bln consensus.

Company expected EPS for Q3 of $0.93-1.05 versus $1.08 consensus.

Company issued downside guidance for FY16, lowers EPS to $4.40-4.70 from $4.70-5.05 versus $4.76 consensus.

WMT fell to $69.92 (-2.77%) on the premarket.

-

14:38

House prices in the U.K. increase 0.4% in June

The Office for National Statistics released its house price inflation data for the U.K. on Tuesday. House prices in the U.K. rose a seasonally adjusted 0.4% in June, after a 0.8% increase in May.

On a yearly basis, house prices climbed 5.7% in June, after a 5.6% gain in May.

The annual rise was driven by gains in the East and the South East.

-

14:30

U.S.: Building Permits, July 1119 (forecast 1232)

-

14:30

U.S.: Housing Starts, July 1206 (forecast 1190)

-

14:15

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after release of the UK inflation data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (MoM) July 3.8% -1.3%

01:30 Australia New Motor Vehicle Sales (YoY) July 4.0% 3.7%

01:30 Australia RBA Meeting's Minutes

08:30 United Kingdom Retail Price Index, m/m July 0.2% -0.1% -0.1%

08:30 United Kingdom Retail prices, Y/Y July 1% 1% 1%

08:30 United Kingdom Producer Price Index - Input (MoM) July -1.8% Revised From -1.3% -1.9% -0.9%

08:30 United Kingdom Producer Price Index - Input (YoY) July -13.1% Revised From -12.6% -12.7% -12.4%

08:30 United Kingdom Producer Price Index - Output (MoM) July -0.1% Revised From 0% -0.1% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) July -1.6% Revised From -1.5% -1.5% -1.6%

08:30 United Kingdom HICP, m/m July 0.0% -0.3% -0.2%

08:30 United Kingdom HICP, Y/Y July 0.0% 0% 0.1%

08:30 United Kingdom HICP ex EFAT, Y/Y July 0.8% 1.2%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. housing market data. Housing starts in the U.S. are expected to climb to 1.190 million units in July from 1.174 million units in June.

The number of building permits is expected to fall to 1.232 million units in July from 1.344 million units in June.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The German parliament will vote on the third Greek bailout programme on Wednesday. The Eurogroup approved the third Greek bailout programme on Friday.

German Finance Minister Wolfgang Schaeuble said on Monday that he is confident that the International Monetary Fund (IMF) will take part in a new bailout for Greece.

Total number of employed persons increased by 0.4% to 42.8 million in the second quarter from a year ago, after a 0.6% rise in the first quarter. The rise was mainly driven by the rise in the service sector.

The British pound traded higher against the U.S. dollar after release of the UK inflation data. The U.K. consumer price index rose to 0.1% in July from 0.0% in June, exceeding expectations for a flat reading.

The increase was driven by a smaller decline in clothing prices.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices fell 0.2% in July, beating expectations for a 0.3% drop, after a flat reading in June.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.2% in July from 0.8% the month before.

The consumer price inflation is below the Bank of England's 2% target.

EUR/USD: the currency pair fell to $1.1079

GBP/USD: the currency pair climbed to $1.5716

USD/JPY: the currency pair declined to Y124.17

The most important news that are expected (GMT0):

12:30 U.S. Housing Starts July 1174 1190

12:30 U.S. Building Permits July 1343 1232

-

13:45

Orders

EUR/USD

Offers 1.1080-85 1.1100 1.1120-25 1.1150 1.1180 1.1200 1.2220 1.1245 1.1265 1.1285 1.1300

Bids 1.1050 1.1020 1.1000 1.0985 1.0965 1.0950 1.0930 1.0900

GBP/USD

Offers 1.5700-10 1.5730 1.5750 1.5780 1.5800

Bids 1.5545-50 1.5525-30 1.5500 1.5485 1.5465 1.5450 1.5430 1.5400-05

EUR/GBP

Offers 0.7120 0.7135 0.7150-55 0.7180-85 0.7200 0.7230 0.7250

Bids 0.7085-90 0.7050 0.7030-35 0.7020 0.7000 0.6985 0.6965 0.6950

EUR/JPY

Offers 138.00 138.30 138.50 138.85 139.00 139.30 139.50

Bids 137.50 137.25 137.00 136.80 136.50 136.00

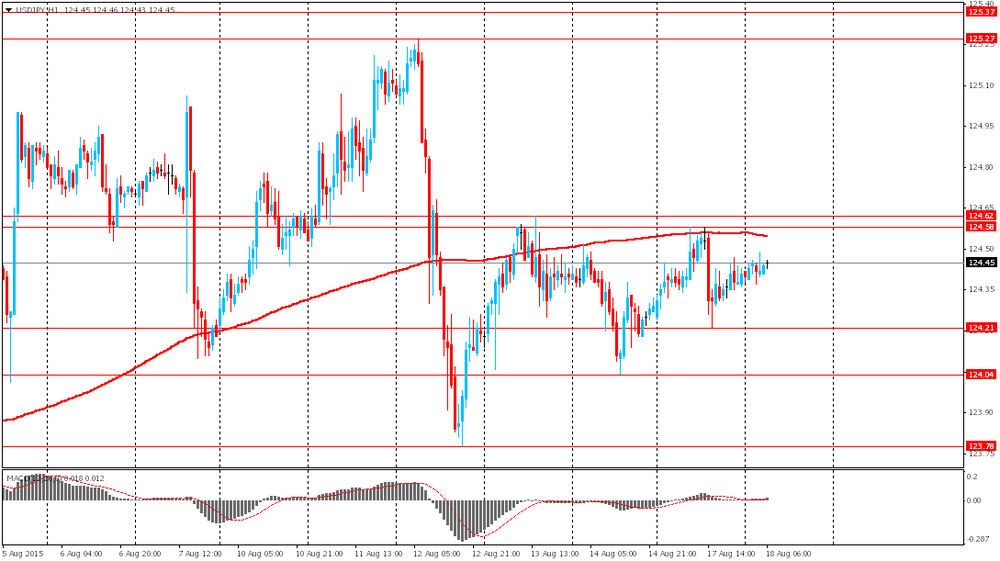

USD/JPY

Offers 124.50 124.65 124.80 125.00 125.20-25 125.50 125.75 126.00

Bids 124.20 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7365 0.7385 0.7400 0.7425 0.7450

Bids 0.7320 0.7300 0.7285 0.7260 0.7300 0.7280 0.7250

-

12:01

European stock markets mid session: stocks traded little changed in the absence of any major economic reports from the Eurozone

Stock indices traded little changed in the absence of any major economic reports from the Eurozone.

The German parliament will vote on the third Greek bailout programme on Wednesday. The Eurogroup approved the third Greek bailout programme on Friday.

German Finance Minister Wolfgang Schaeuble said on Monday that he is confident that the International Monetary Fund (IMF) will take part in a new bailout for Greece.

Total number of employed persons increased by 0.4% to 42.8 million in the second quarter from a year ago, after a 0.6% rise in the first quarter. The rise was mainly driven by the rise in the service sector.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.1% in July from 0.0% in June, exceeding expectations for a flat reading.

The increase was driven by a smaller decline in clothing prices.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices fell 0.2% in July, beating expectations for a 0.3% drop, after a flat reading in June.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.2% in July from 0.8% the month before.

The consumer price inflation is below the Bank of England's 2% target.

Current figures:

Name Price Change Change %

FTSE 100 6,519.54 -30.76 -0.47 %

DAX 10,933.08 -7.25 -0.07 %

CAC 40 4,973.37 -11.46 -0.23 %

-

11:38

August’s Reserve Bank of Australia monetary policy meeting: the accommodative monetary policy was appropriate

The Reserve Bank of Australia (RBA) released its minutes from August monetary policy meeting on Tuesday. The RBA said that the accommodative monetary policy was appropriate.

The central bank added that "the Australian economy had been adjusting to the shift in activity in the resources sector from the investment to the production phase", driven by falls in key commodity prices and the depreciation of the Australian dollar.

The RBA noted that the depreciation of the Australian dollar lead to a slight upward revision to the forecast for inflation, which "was expected to remain consistent with the target over the forecast period".

"The further depreciation of the Australian dollar was expected to impart stimulus to the economy through stronger net exports," the central bank said.

The RBA kept unchanged its interest rate at 2.00% in August.

-

11:19

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E522mn), $1.1050(E369mn), $1.1100(E260mn), $1.1200(E304mn)

USD/JPY: Y124.25($299mn), Y125.00($439mn), Y125.50($536mn)

GBP/USD: $1.5850(Gbp237mn)

USD/CHF: Chf0.9775($400mn)

EUR/CHF: Chf1.0750(E306mn)

AUD/USD: $$0.7350(A$196mn), $0.7365-70(A$330mn), $0.7400(A$309mn), $0.7450(A$726mn)

NZD/USD: 0.6450(NZ$100mn), $0.6510(NZ$303mn)

USD/CAD: C$1.3010($330mn), C$1.3250($115mn)

-

11:10

Total number of employed persons in Germany increases by 0.4% in the second quarter

Destatis released its employment data on Tuesday. Total number of employed persons increased by 0.4% to 42.8 million in the second quarter from a year ago, after a 0.6% rise in the first quarter.

The rise was mainly driven by the rise in the service sector.

On a quarterly basis, the number of employed persons rise 0.9% in the second quarter.

-

10:55

-

10:44

UK consumer price inflation is up to 0.1% in July

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.1% in July from 0.0% in June, exceeding expectations for a flat reading.

The increase was driven by a smaller decline in clothing prices.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices fell 0.2% in July, beating expectations for a 0.3% drop, after a flat reading in June.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.2% in July from 0.8% the month before.

The Retail Prices Index remained unchanged at 1.0% in July, in line with expectations.

The consumer price inflation is below the Bank of England's 2% target.

-

10:30

United Kingdom: Retail Price Index, m/m, July -0.1% (forecast -0.1%)

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , July -1.6% (forecast -1.5%)

-

10:30

United Kingdom: HICP, Y/Y, July 0.1% (forecast 0%)

-

10:30

United Kingdom: Producer Price Index - Input (YoY) , July -12.4% (forecast -12.7%)

-

10:30

United Kingdom: Producer Price Index - Input (MoM), July -0.9% (forecast -1.9%)

-

10:30

United Kingdom: Retail prices, Y/Y, July 1% (forecast 1%)

-

10:30

United Kingdom: HICP, m/m, July -0.2% (forecast -0.3%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, July 1.2%

-

10:30

United Kingdom: Producer Price Index - Output (MoM), July -0.1% (forecast -0.1%)

-

10:17

Rightmove: U.K. house prices drop 0.8% in August

According to property tracking website Rightmove, the average asking price for a house in the U.K. declined by 0.8% to 292,284 pounds in August. The average asking price rose 0.1% in July.

The decline was driven by falls in prices in the East of England, the South East, London, the East Midlands and the South West.

On a yearly basis, house prices in the U.K. climbed 6.4% in August, after a 5.1% increase in July.

-

10:08

German Finance Minister Wolfgang Schaeuble is confident that the International Monetary Fund will take part in a new bailout for Greece

German Finance Minister Wolfgang Schaeuble said on Monday that he is confident that the International Monetary Fund (IMF) will take part in a new bailout for Greece.

"I am sure that the IMF, whose role we have described as indispensable, will take part in this programme," he said.

German finance minister called existing loan terms "very generous"

The German parliament will vote on the third Greek bailout programme on Wednesday. Some lawmakers wanted to be sure the IMF would take part.

-

08:26

Gold steady ahead of Fed Meeting Minutes release

Gold is currently at $1,117.40 (-0.09%) as a stronger U.S. dollar limited gains generated by weak U.S. manufacturing data. NY Fed Empire State manufacturing index fell to -14.92 in August, compared to 3.86 in July. The new orders sub-index, which fell to its lowest level since November 2010, was the biggest contributor to this drop.

Investors remain focused on U.S. interest rates. Strong employment growth and improving retail sales argue in favor of an imminent rate increase. The Federal Reserve will publish its latest Meeting Minutes tomorrow. Market participants expect to see clues on policymakers' intentions.

-

08:23

Global Stocks: Asian stocks declined despite gains in U.S. equities

Major U.S. stock indices declined at the beginning of Monday session as NY Fed Empire State manufacturing index dropped to -14.92 in August. However later on the indices rebounded and ended higher.

The Dow Jones Industrial Average rose 67.78 points, or 0.4%, to 17545.18. The S&P 500 gained 10.90 points, or 0.5%, to 2102.44. The Nasdaq Composite added 43.46 points, or 0.9%, to 5091.70.

This morning in Asia Hong Kong Hang Seng declined 0.08%, or 19.54 points, to 23,795.11. China Shanghai Composite Index fell 1.46%, or 58.34 points, to 3,935.33. The Nikkei lost 0.16%, or 33.59 points, to 20,586.67.

Gains in U.S. equities failed to support Asian stocks, which declined ahead of Fed Meeting Minutes release. Investors need to assess probability of a rate hike in September.

Japanese stocks traded mixed amid lack of new factors after Japan GDP data was published on Monday.

-

08:22

Options levels on tuesday, August 18, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1149 (4472)

$1.1120 (1575)

$1.1094 (548)

Price at time of writing this review: $1.1054

Support levels (open interest**, contracts):

$1.1015 (2100)

$1.0993 (2430)

$1.0966 (2430)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 84187 contracts, with the maximum number of contracts with strike price $1,1300 (6773);

- Overall open interest on the PUT options with the expiration date September, 4 is 117077 contracts, with the maximum number of contracts with strike price $1,0500 (7878);

- The ratio of PUT/CALL was 1.39 versus 1.38 from the previous trading day according to data from August, 17

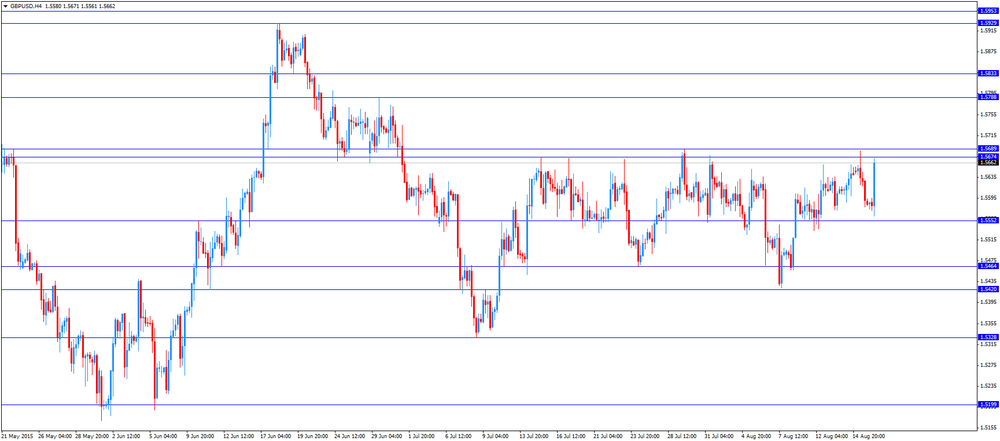

GBP/USD

Resistance levels (open interest**, contracts)

$1.5802 (2356)

$1.5704 (2082)

$1.5608 (2824)

Price at time of writing this review: $1.5577

Support levels (open interest**, contracts):

$1.5494 (2592)

$1.5397 (1736)

$1.5299 (2293)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 29136 contracts, with the maximum number of contracts with strike price $1,5600 (2824);

- Overall open interest on the PUT options with the expiration date September, 4 is 34113 contracts, with the maximum number of contracts with strike price $1,5500 (2592);

- The ratio of PUT/CALL was 1.17 versus 1.21 from the previous trading day according to data from August, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:19

Foreign exchange market. Asian session: the sterling traded in a narrow range

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia New Motor Vehicle Sales (MoM) July 3.8% -1.3%

01:30 Australia New Motor Vehicle Sales (YoY) July 4.0% 3.7%

01:30 Australia RBA Meeting's Minutes

The U.S. dollar traded in a narrow range after it had advanced against the euro and the sterling as investors focused on monetary policies and interest rates of central banks. New data will be closely watched by investors, who need to see new signs of improvements in the U.S. economy. U.S. consumer price index and Fed Meeting Minutes will be published on Wednesday.

The pound traded in a narrow range ahead of inflation and retail sales data. According to a median forecast, the index of retail price fell by 0.1% in July compared to a 0.2% increase in June. This report may weigh on the GBP.

The Australian dollar slightly advanced after the Reserve Bank of Australia published minutes of its latest meeting. The central bank noted positive changes in the economy helped by a weaker AUD.

EUR/USD: the pair fluctuated within $1.1070-80 in Asian trade

USD/JPY: the pair traded within Y124.35-50

GBP/USD: the pair traded within $1.5575-95

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Retail Price Index, m/m July 0.2% -0.1%

08:30 United Kingdom Retail prices, Y/Y July 1% 1%

08:30 United Kingdom Producer Price Index - Input (MoM) July -1.3% -1.9%

08:30 United Kingdom Producer Price Index - Input (YoY) July -12.6% -12.7%

08:30 United Kingdom Producer Price Index - Output (MoM) July 0% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) July -1.5% -1.5%

08:30 United Kingdom HICP, m/m July 0.0% -0.3%

08:30 United Kingdom HICP, Y/Y July 0.0% 0%

08:30 United Kingdom HICP ex EFAT, Y/Y July 0.8%

12:30 U.S. Housing Starts July 1174 1190

12:30 U.S. Building Permits July 1343 1232

20:30 U.S. API Crude Oil Inventories August -0.85

22:45 New Zealand PPI Input (QoQ) Quarter II -1.1%

22:45 New Zealand PPI Output (QoQ) Quarter II -0.9%

23:50 Japan Trade Balance Total, bln July -69.0 -56.7

-

04:06

Nikkei 225 20,602.94 -17.32 -0.08 %, Hang Seng 23,932.4 +117.75 +0.49 %, Shanghai Composite 3,972.04-21.6 54 %

-

03:31

Australia: New Motor Vehicle Sales (YoY) , July 3.7%

-

03:30

Australia: New Motor Vehicle Sales (MoM) , July -1.3%

-

00:32

Commodities. Daily history for Aug 17’2015:

(raw materials / closing price /% change)

Oil 41.88 +0.02%

Gold 1,116.90 -0.13%

-

00:31

Stocks. Daily history for Aug 17’2015:

(index / closing price / change items /% change)

Nikkei 225 20,620.26 +100.81 +0.49 %

Hang Seng 23,814.65 -176.38 -0.74 %

S&P/ASX 200 5,367.66 +11.12 +0.21 %

Shanghai Composite 3,994.37 +29.04 +0.73 %

FTSE 100 6,550.3 -0.44 -0.01 %

CAC 40 4,984.83 +28.36 +0.57 %

Xetra DAX 10,940.33 -44.81 -0.41 %

S&P 500 2,102.44 +10.90 +0.52 %

NASDAQ Composite 5,091.7 +43.46 +0.86 %

Dow Jones 17,545.18 +67.78 +0.39 %

-

00:30

Currencies. Daily history for Aug 17’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1078 -0,27%

GBP/USD $1,5583 -0,36%

USD/CHF 0,9783 +0,25%

USD/JPY Y124,41 +0,10%

EUR/JPY Y137,82 -0,23%

GBP/JPY Y193,87 -0,27%

AUD/USD $0,7370 -0,09%

NZD/USD $0,6570 +0,55%

USD/CAD C$1,3083 -0,07%

-

00:00

Schedule for today, Tuesday, Aug 18’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia New Motor Vehicle Sales (MoM) July 3.8%

01:30 Australia New Motor Vehicle Sales (YoY) July 4.0%

01:30 Australia RBA Meeting's Minutes

08:3 United Kingdom Retail Price Index, m/m July 0.2% -0.1%

08:30 United Kingdom Retail prices, Y/Y July 1% 1%

08:30 United Kingdom Producer Price Index - Input (MoM) July -1.3% -2%

08:30 United Kingdom Producer Price Index - Input (YoY) July -12.6% -12.8%

08:30 United Kingdom Producer Price Index - Output (MoM) July 0% -0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) July -1.5% -1.5%

08:30 United Kingdom HICP, m/m July 0.0% -0.3%

08:30 United Kingdom HICP, Y/Y July 0.0% 0%

08:30 United Kingdom HICP ex EFAT, Y/Y July 0.8%

12:30 U.S. Housing Starts July 1174 1196

12:30 U.S. Building Permits July 1343 1237

20:30 U.S. API Crude Oil Inventories August -0.85

22:45 New Zealand PPI Input (QoQ) Quarter II -1.1%

22:45 New Zealand PPI Output (QoQ) Quarter II -0.9%

23:50 Japan Trade Balance Total, bln July -69.0 -56.7

-