Noticias del mercado

-

17:49

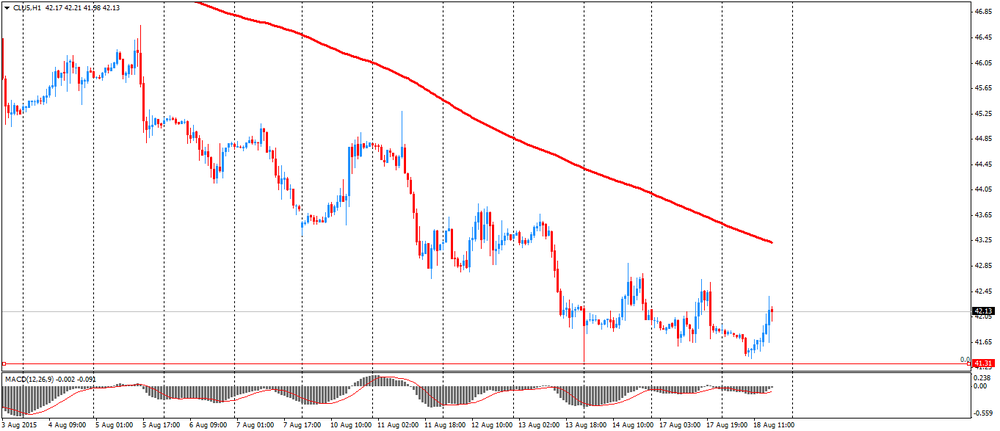

Oil prices rise after the recent drop

Oil prices rebounded from the recent drop. Concerns over the global oil oversupply and concerns over a slowdown in China's economy weighed on oil prices. Chinese stocks slid more than 6% on Tuesday. Market participants speculate on that China's central bank could devaluate the yuan again.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for September delivery rose $42.43 a barrel on the New York Mercantile Exchange.

Brent crude oil for September decreased to $48.54 a barrel on ICE Futures Europe.

-

17:25

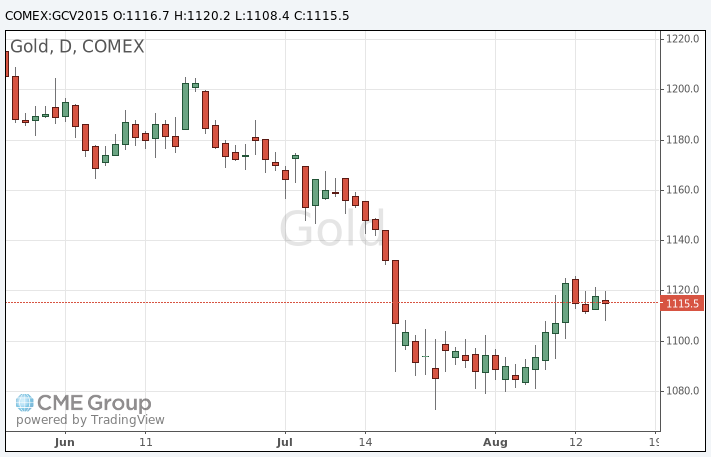

Gold price drops after the better-than-expected U.S. housing starts data

Gold dropped after the better-than-expected U.S. housing starts data. Housing starts in the U.S. rose 0.2% to 1.206 million annualized rate in July from a 1,204 million pace in June, beating expectations for a decline to 1.190 million. It was the highest level since October 2007.

The increase was driven by an increase in starts of single-family homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. dropped 16.3% to 1.119 million annualized rate in July from a 1.337 million pace in June. Analysts had expected building permits to decline to 1.232 million units.

These figures added to speculation on that the Fed will start raising its interest rate in September.

Market participants are awaiting the release of the latest Fed's monetary policy minutes on Wednesday.

October futures for gold on the COMEX today increased to 1108.40 dollars per ounce.

-

16:09

People’s Bank of China injected 120 billion yuan into market

The People's Bank of China (PBoC) injected 120 billion yuan ($18.77 billion) into market by offering seven-day reverse repurchase agreements on Tuesday. This cash injection was the biggest of its kind since January 28, 2014.

The reason for this injection could be the decision to boost liquidity. Liquidity has tightened due to the yuan depreciation.

-

15:42

Moody's expects G20 GDP to rise 2.7% this year

Moody's Investors Service released its quarterly report on Tuesday. The agency expects G20 GDP to rise 2.7% this year, increasing to around 3% in 2016, compared to 2.9% in 2014. Moody's added that 2015-16 growth forecasts "are still below the G20's average growth rate before the financial crisis".

According to the report, the downward risks for 2015-2016 forecasts are "correction in Chinese equity and property prices, a disorderly response to the US Federal Reserve's anticipated policy tightening and a Greek exit from the euro area".

Moody's forecast the Chinese economy to grow 6.8% this year and 6.5% in 2016.

The U.S. economy is expected to expand 2.4% in 2015 and 2.8% in 2016.

Eurozone's economy is expected to grow 1.5% in both 2015 and 2016.

Moody's forecasts the Brent oil price to average $57 a barrel in 2016, higher than the 2015 average of $55.

-

08:26

Gold steady ahead of Fed Meeting Minutes release

Gold is currently at $1,117.40 (-0.09%) as a stronger U.S. dollar limited gains generated by weak U.S. manufacturing data. NY Fed Empire State manufacturing index fell to -14.92 in August, compared to 3.86 in July. The new orders sub-index, which fell to its lowest level since November 2010, was the biggest contributor to this drop.

Investors remain focused on U.S. interest rates. Strong employment growth and improving retail sales argue in favor of an imminent rate increase. The Federal Reserve will publish its latest Meeting Minutes tomorrow. Market participants expect to see clues on policymakers' intentions.

-

00:32

Commodities. Daily history for Aug 17’2015:

(raw materials / closing price /% change)

Oil 41.88 +0.02%

Gold 1,116.90 -0.13%

-