Noticias del mercado

-

22:01

U.S.: Total Net TIC Flows, June -110.3

-

22:00

U.S.: Net Long-term TIC Flows , June 103.1

-

21:01

DJIA 17534.93 57.53 0.33%, NASDAQ 5086.49 38.26 0.76%, S&P 500 2101.03 9.49 0.45%

-

20:20

American focus: the dollar fluctuates

The US dollar fluctuates against the euro after the release of mixed US data. Business activity producers of New York in August fell for the third time in five months, reaching its lowest level since 2009. This is evidenced by a report released Monday by the Federal Reserve Bank of New York. Reported Fed manufacturing index in New York in August fell to -14.9 from 3.86 in July. Economists expected the index to 5. Values above zero indicate expanding activity.

As reported by the Federal Reserve Bank of New York, demand continued to decline. The new orders index fell to -15.7 from -3.50 in July. Unfilled orders, however, in August rose to -4.5 to -7.45 in July. Shipments index fell to -13.8 from 7.88 in the previous month, while the index of inventories fell sharply to -17.3 from -8.51 in July.

In addition, self-builders in the market of newly built single-family homes rose in August by 1 point, reaching 61 points, the highest level since November 2005. Meanwhile, adding that the latest update was in line with forecasts. This was reported by the National Association of Home Builders / Wells Fargo.

"That confidence builders was near the mark of 60 points for three consecutive months, it indicates that in the sector of buildings family homes recorded a slow but steady progress - said NAHB Chairman Tom Woods. - Nevertheless, we continue to see, builders encounter difficulties in access to land and resources. "

"Today's report is consistent with our forecast, which assumes a gradual strengthening of trust in 2015. - Said NAHB Chief Economist David Crowe." The improvement in the labor market should support market growth at a moderate pace during the rest of the year. "

Two of the three components HMI showed an increase in August. The component that measures current conditions of sales, rose by one point to 66, and the index of sales expectations for the next six months remained at 70 points. Meanwhile, the component measuring the traffic of customers rose by two points to 45.

Considering the three-month moving average for regional assessments HMI, the indices in the West and Midwest rose three points to 63 and 58, respectively. Meanwhile, the index for the South rose by 2 points to 63 points, while the index for the Northeast remained at 46.

The Canadian dollar strengthened against the US currency against the background of investment data. The amount of Canadian securities held in the holding of foreign investors in June rose, while Canadian investors bought more foreign securities. On Monday news agency Statistics Canada.

In June net purchases of Canadian securities by foreign investors amounted to 8.51 billion Canadian dollars against the net sales of $ 5.46 billion Canadian dollars in May. Canadian investors, in turn, in June acquired foreign securities to 8.57 billion Canadian dollars.

The agency Statistics Canada noted that this resulted in a net outflow of funds from the economy of this country in June of 60 million Canadian dollars.

Monthly data on securities transactions are an indicator of attitudes of global investors to the Canadian economy, as well as allow us to judge the opinion of Canadian investors about the prospects for the world.

The sharp fall in oil prices, which is an important source of Canada's exports negatively affected the country's economy. Canada's GDP this year declined for five consecutive months. The Bank of Canada responded by two cuts key interest rate, which currently amounts to 0.5%.

The most active foreign investors in June invested in money market instruments: net purchases here reached a record 12.04 billion Canadian dollars.

Canadian investors in June increased the amount of foreign securities in its holding primarily due to purchases of non-US debt. In general, investment in June was partially offset by a decline in US Treasury securities, which are in keeping Canadian investors.

Net purchases of foreign stocks by Canadian investors in June amounted to 4.43 billion Canadian dollars.

-

18:00

European stocks closed: FTSE 6556.00 5.26 0.08%, DAX 10952.08 -33.06 -0.30%, CAC 40 4990.37 33.90 0.68%

-

18:00

European stocks close: stocks closed mixed on news that the Eurogroup approved the third Greek bailout programme on Friday

Stock indices closed mixed on news that the Eurogroup approved the third Greek bailout programme on Friday. The programme totals €86 billion. The Greece could get €26 billion in the first tranche from the third bailout programme. €13 billion will be used to cover the debt repayment and an additional €10 billion will be used to bolster capitalisation levels of Greek banks. The Greek government will get €3 billion for the implementation of fiscal and structural reforms.

German Chancellor Angela Merkel said in an interview on ZDF television Sunday that she is confident that the International Monetary Fund (IMF) will take part in a new bailout for Greece. Merkel noted that the Greek burden could be eased by extending the maturities on its debt and reducing interest rates.

Meanwhile, the economic data from the Eurozone was positive. Eurozone's unadjusted trade surplus jumped to €26.4 billion in June from €18.8 billion in May.

Exports rose at an annual rate of 12.0% in June, while imports increased at 7.0%.

The German Bundesbank released its monthly economic report on Monday. The central bank said that Germany's economy is expected to expand in the second half of the year, supported by rising consumption and growing exports.

The country's economy is expected to benefit from real income rises, the Eurozone's recovery, a weaker euro and foreign demand, according to the report.

The Bundesbank pointed out that Greek economy will gradually recover, supported by the bailout programme, tourism income and investments.

Germany's central bank expressed concerns over the economic growth in China.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,550.3 -0.44 -0.01 %

DAX 10,940.33 -44.81 -0.41 %

CAC 40 6,550.3 -0.44 -0.01 %

-

17:59

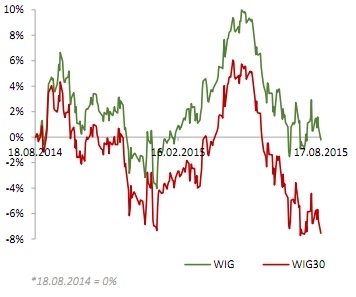

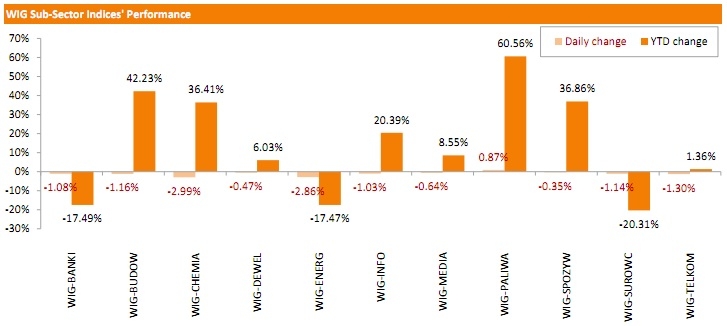

WSE: Session Results

Polish equities continued to slide on Monday with the broad marker measure, the WIG Index, dropping a further 0.94%. Sector-wise, oil and gas sector (+0.87%) was sole gainer within the WIG Index, while chemicals (-2.99%) and utilities (-2.86%) lagged behind.

Large-cap stocks slipped by 1.06% as measured by the WIG30 Index. Most index constituents posted declines, led by TAURON PE (WSE: TPE), which fell by 4.80%, and followed by GRUPA AZOTY (WSE: ATT), PGE (WSE: PGE), SYNTHOS (WSE: SNS) and MBANK (WSE: MBK), which dropped by 3.18%-4.64%. On the other side of the ledger, CCC (WSE: CCC) and PKN ORLEN (WSE: PKN) were the top performers, gaining 1.99% and 1.83% respectively.

-

17:49

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes slightly rose on Monday although data showed a surprise fall in manufacturing activity in the state of New York in August. The market was also weighed down by oil prices, which fell toward six-year lows as data showed Japan's economy, the world's third-biggest oil consumer, contracted in the second quarter. The New York Fed's Empire State general business conditions index tumbled from 3.86 in July to -14.92 in August due to steep drops in new orders and shipments. Economists polled by Reuters had expected the index to rise to 5 this month. A reading above zero indicates expansion.

Most of Dow stocks in positive area (21 of 30). Top looser - Chevron Corporation (CVX, -2.58%). Top gainer - The Walt Disney Company (DIS, +1.42).

S&P index sectors mixed. Top looser - Conglomerates (-0.8%). Top gainer - Healthcare (+0,5%).

At the moment:

Dow 17466.00 +27.00 +0.15%

S&P 500 2091.75 +2.25 +0.11%

Nasdaq 100 4543.75 +12.00 +0.26%

10 Year yield 2,16% -0,04

Oil 42.56 +0.06 +0.14%

Gold 1118.20 +5.50 +0.49%

-

17:41

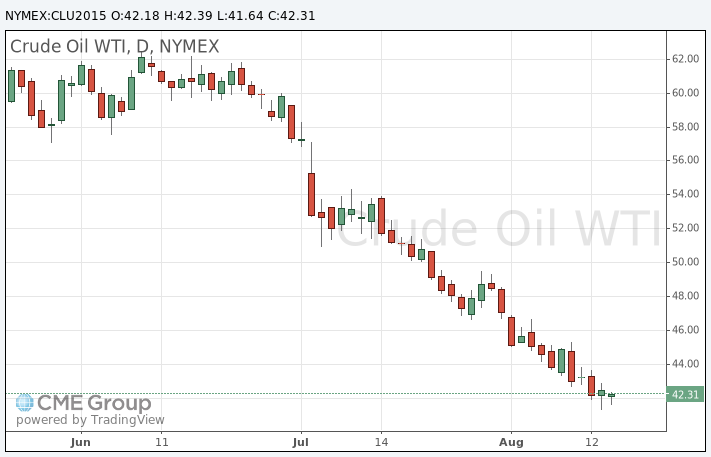

Oil prices stabilised after declining earlier

Oil prices stabilised after declining earlier. Oil prices dropped on the weak GDP data from Japan and on concerns over the global oil glut. Japan's GDP declined by 0.4% in the second quarter, beating expectations for a 0.5% fall, after a 1.1% rise in the first quarter.

Business spending fell 0.1% in the second quarter, while private consumption dropped 0.8%.

Exports dropped at an annual rate of 16.5% in the second quarter.

On a yearly basis, Japan's economy shrank 1.6% in the second quarter, beating forecasts of 1.9% decline, after a 3.9% rise in the first quarter.

Concerns over the global oil glut grew as the number of U.S. active oil rigs rose last week. The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 2 rigs to 672 last week. It was the fourth consecutive increase.

Combined oil and gas rigs remained unchanged at 884.

WTI crude oil for September delivery was trading in the range between $41.64 - 42.57 a barrel on the New York Mercantile Exchange.

Brent crude oil for September decreased to $49.15 a barrel on ICE Futures Europe.

-

17:25

Gold price rises after the weaker-than-expected NY Fed Empire State manufacturing index

Gold rose after the weaker-than-expected U.S. economic data. The NY Fed Empire State manufacturing index plunged to -14.92 in August from 3.86 in July, missing expectations for an increase to 5.0. It was the lowest level since April 2009.

News that China increased its gold reserve in July also supported gold price. China's gold reserve climbed 1.16% to 1,677.3 tonnes in July from 1,658 tonnes in June, according to data from the People's Bank of China (PBoC).

The channels were domestic scrap gold, production storage and trade in domestic and overseas markets.

October futures for gold on the COMEX today increased to 1121.80 dollars per ounce.

-

16:31

European Central Bank purchases €10.2 billion of government bonds last week

The European Central Bank (ECB) purchased €10.2 billion of government bonds under its quantitative-easing program last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.41 billion of covered bonds, and €332 million of asset-backed securities.

-

16:20

NAHB housing market index climbs to 61 in August, the highest level since November 2005

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Monday. The NAHB housing market index rose to 61 in August from 60 in July, in line with expectations. It was the highest level since November 2005.

A level above 50.0 is considered positive, below indicates a negative outlook.

The increase was driven by a rise in two of three components of the index. The buyer traffic subindex rose two points to 45 in August, the current sales conditions subindex climbed one point to 66, while the subindex measuring sales expectations in the next six months remained unchanged at 70.

"We continue to hear that builders face difficulties accessing land and labour," the NAHB Chairman Tom Woods said.

The NAHB Chief Economist David Crowe noted that there is "a gradual strengthening of the single-family housing sector in 2015".

"Job and economic gains should keep the market moving forward at a modest pace throughout the rest of the year," he said.

-

16:00

U.S.: NAHB Housing Market Index, August 61 (forecast 61)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E565mn), $1.1000(E1.3bn), $1.1100(E490mn), $1.1150(E408mn)

USD/JPY: Y125.00($817mn)

EUR/JPY: Y136.00(E175mn)

GBP/USD: $1.5500(Gbp217mn), $1.5525(Gbp168mn), $1.5725(GBP101mn)

AUD/USD: $$0.7300(A$1.2bn), $0.7400(A$662mn), $0.7435(A$150mn)

AUD/JPY: Y91.80(A$106mn), Y92.30(A$121mn)

NZD/USD: 0.6550(NZ$100mn), $0.6700(NZ$373mn)

USD/CAD: C$1.3000($125mn), C$1.3020($350mn)

-

15:41

German Chancellor Angela Merkel is confident that the International Monetary Fund will take part in a new bailout for Greece

German Chancellor Angela Merkel said in an interview on ZDF television Sunday that she is confident that the International Monetary Fund (IMF) will take part in a new bailout for Greece.

"I have no doubt that what Mrs. Lagarde said will then become reality," she said.

Merkel noted that the Greek burden could be eased by extending the maturities on its debt and reducing interest rates.

The German parliament will vote on the third bailout programme on Wednesday.

-

15:32

U.S. Stocks open: Dow -0.32%, Nasdaq -0.33%, S&P -0.34%

-

15:26

Before the bell: S&P futures -0.38%, NASDAQ futures -0.29%

U.S. stock-index futures fell as manufacturing in the New York area fell in August.

Global Stocks:

Nikkei 20,620.26 +100.81 +0.49%

Hang Seng 23,814.65 -176.38 -0.74%

Shanghai Composite 3,994.37 +29.04 +0.73%

FTSE 6,518.97 -31.77 -0.48%

CAC 4,942.95 -13.52 -0.27%

DAX 10,871.73 -113.41 -1.03%

Crude oil $41.89 (-1.41%)

Gold $1122.90 (+0.87%)

-

15:10

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

UnitedHealth Group Inc

UNH

121.05

+0.02%

0.1K

Walt Disney Co

DIS

107.23

+0.07%

2.5K

Johnson & Johnson

JNJ

98.89

+0.08%

1.7K

Nike

NKE

114.54

+0.16%

0.6K

McDonald's Corp

MCD

99.43

+0.16%

0.2K

General Motors Company, NYSE

GM

31.54

+0.16%

3.8K

Wal-Mart Stores Inc

WMT

72.50

+0.17%

0.3K

Home Depot Inc

HD

119.98

+0.19%

5.6K

Boeing Co

BA

145.90

+0.56%

0.2K

Twitter, Inc., NYSE

TWTR

29.39

+1.14%

65.9K

Barrick Gold Corporation, NYSE

ABX

7.85

+2.21%

19.4K

Tesla Motors, Inc., NASDAQ

TSLA

256.75

+5.59%

198.5K

Visa

V

74.22

0.00%

0.3K

Caterpillar Inc

CAT

78.49

0.00%

0.2K

Pfizer Inc

PFE

35.32

0.00%

1.8K

JPMorgan Chase and Co

JPM

67.88

-0.01%

5.5K

The Coca-Cola Co

KO

41.24

-0.02%

0.7K

Apple Inc.

AAPL

115.94

-0.02%

202.9K

AT&T Inc

T

34.02

-0.09%

2.1K

3M Co

MMM

148.12

-0.11%

1.6K

Microsoft Corp

MSFT

46.95

-0.11%

2.9K

Exxon Mobil Corp

XOM

78.25

-0.14%

1.0K

Procter & Gamble Co

PG

75.50

-0.16%

2.2K

Starbucks Corporation, NASDAQ

SBUX

57.00

-0.18%

4.2K

Facebook, Inc.

FB

94.24

-0.19%

28.6K

American Express Co

AXP

80.75

-0.20%

1.0K

Chevron Corp

CVX

84.75

-0.20%

1.3K

Ford Motor Co.

F

14.75

-0.20%

3.1K

International Business Machines Co...

IBM

155.40

-0.22%

0.3K

Google Inc.

GOOG

655.70

-0.22%

0.3K

General Electric Co

GE

26.02

-0.23%

13.1K

Verizon Communications Inc

VZ

47.38

-0.23%

3.5K

Intel Corp

INTC

28.95

-0.24%

2.4K

Amazon.com Inc., NASDAQ

AMZN

530.20

-0.25%

0.4K

Citigroup Inc., NYSE

C

57.30

-0.50%

3.5K

Yahoo! Inc., NASDAQ

YHOO

36.06

-0.50%

3.1K

ALCOA INC.

AA

9.35

-0.64%

18.1K

Cisco Systems Inc

CSCO

28.65

-1.31%

16.7K

Yandex N.V., NASDAQ

YNDX

12.65

-1.33%

2.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.87

-1.60%

8.1K

-

15:00

NY Fed Empire State manufacturing index drops to -14.92 in August, the lowest level since April 2009

The New York Federal Reserve released its survey on Monday. The NY Fed Empire State manufacturing index plunged to -14.92 in August from 3.86 in July, missing expectations for an increase to 5.0. It was the lowest level since April 2009.

The decline was driven by a drop in the new orders and shipments index. The new orders index dropped to -15.70 in August from -3.50 in July, while the shipments index slid to -13.79 from 7.88.

The general business conditions expectations index for the next six months rose to 33.64 in August from 27.04 in July.

The price-paid index decreased to 7.27 in August from 7.45 in July.

The index for the number of employees fell to 1.82 in August from 3.19 last month.

-

14:51

Foreign investors add C$8.51 billion of Canadian securities in June

Statistics Canada released foreign investment figures on Monday. Foreign investors added C$8.51 billion of Canadian securities in June, after a sale of C$5.46 billion in May.

May's figure was revised down from a sale of C$5.45 billion.

Canadian investors purchased C$8.6 billion of foreign securities in June, all non-US instruments.

-

14:48

Upgrades and downgrades before the market open

Upgrades:

JPMorgan Chase (JPM) upgraded to Outperform from Mkt Perform at Keefe Bruyette, target $77

Downgrades:

Cisco Systems (CSCO) downgraded to Equal-Weight from Overweight at Morgan Stanley, target $30

Other:

Tesla Motors (TSLA) target raised to $465 from $280 at Morgan Stanley

-

14:38

Bundesbank’s monthly report: Germany’s economy is expected to expand in the second half of the year

The German Bundesbank released its monthly economic report on Monday. The central bank said that Germany's economy is expected to expand in the second half of the year, supported by rising consumption and growing exports.

The country's economy is expected to benefit from real income rises, the Eurozone's recovery, a weaker euro and foreign demand, according to the report.

The Bundesbank pointed out that Greek economy will gradually recover, supported by the bailout programme, tourism income and investments.

Germany's central bank expressed concerns over the economic growth in China.

"The risks of a stronger economic slowdown remains high. The decision of the Chinese central bank to allow the yuan to depreciate against the U.S. dollar can be seen as evidence of the uncertainty," the Bundesbank said.

-

14:30

Canada: Foreign Securities Purchases, June 8.51

-

14:30

U.S.: NY Fed Empire State manufacturing index , August -14.92 (forecast 5)

-

14:19

Fitch Ratings expects the Eurozone’s economy to expand around 1.6% in 2015-2017

Fitch Ratings said on Monday that it expects the Eurozone's economy to expand around 1.6% in 2015-2017, driven by a weaker euro, low oil prices, rising confidence, ultra-loose monetary policy and improved credit conditions. The agency added that high debt and structural weaknesses will weigh on the recovery.

Fitch noted that medium-term growth prospects for the economic growth in the Eurozone "are generally weak".

-

14:04

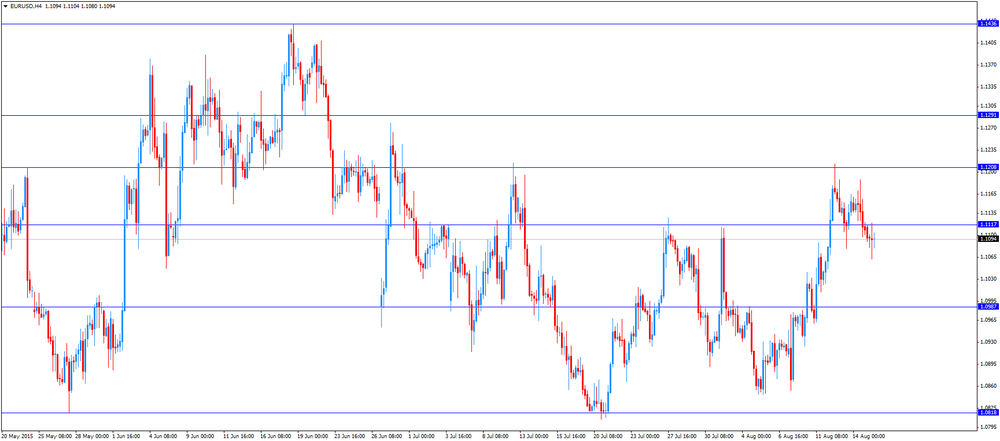

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the Eurozone’s trade data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:15 Switzerland Retail Sales Y/Y June -1.8% -0.9%

07:15 Switzerland Retail Sales (MoM) June -1.4% 1.4%

09:00 Eurozone Trade balance unadjusted June 19.02 Revised From 18.8 26.4

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The NY Fed Empire State manufacturing index is expected to rise to 5.00 in August from 3.86 in July.

The NAHB housing market index is expected to climb to 61 in August from 60 in July.

The euro traded mixed against the U.S. dollar after the release of the Eurozone's trade data. Eurozone's unadjusted trade surplus jumped to €26.4 billion in June from €18.8 billion in May.

Exports rose at an annual rate of 12.0% in June, while imports increased at 7.0%.

The Eurogroup approved the third Greek bailout programme on Friday. The programme totals €86 billion. The Greece could get €26 billion in the first tranche from the third bailout programme. €13 billion will be used to cover the debt repayment and an additional €10 billion will be used to bolster capitalisation levels of Greek banks. The Greek government will get €3 billion for the implementation of fiscal and structural reforms.

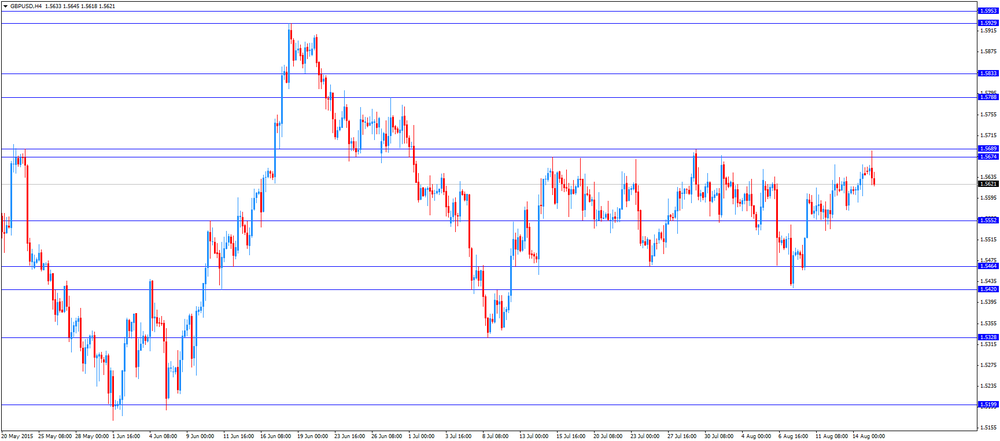

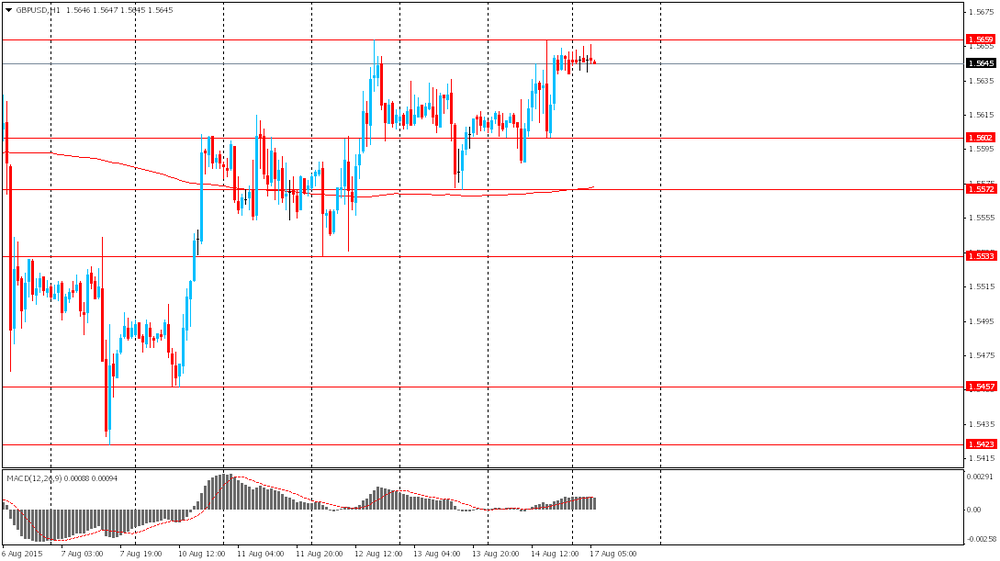

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian economic data.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair decreased to $1.5618

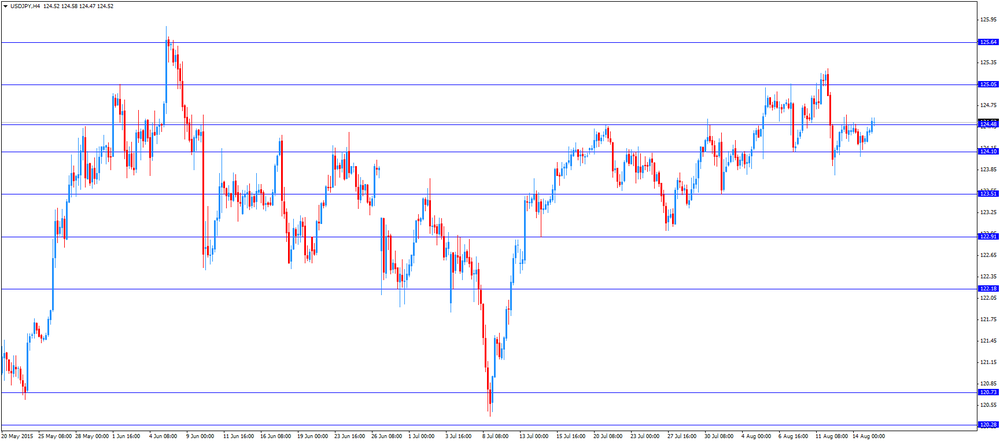

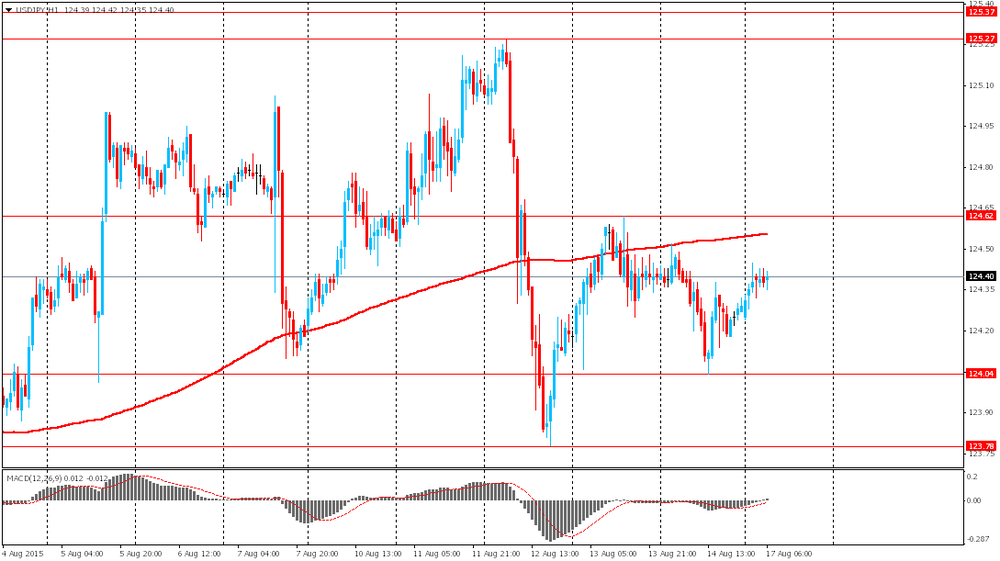

USD/JPY: the currency pair rose to Y124.58

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases June -5.45

12:30 U.S. NY Fed Empire State manufacturing index August 3.86 5

14:00 U.S. NAHB Housing Market Index August 60 61

20:00 U.S. Net Long-term TIC Flows June 93.0

20:00 U.S. Total Net TIC Flows June 115

-

14:00

Orders

EUR/USD

Offers 1.1085 1.1100 1.1120-25 1.1150 1.1180 1.1200 1.2220 1.1245 1.1265 1.1285 1.1300

Bids 1.1050 1.1020 1.1000 1.0985 1.0965 1.0950 1.0930 1.0900

GBP/USD

Offers 1.5685 1.5700-10 1.5730 1.5750 1.5780 1.5800

Bids 1.5630 1.5600 1.5580 1.5550 1.5525-30 1.5500 1.5485 1.5465 1.5450

EUR/GBP

Offers 0.7100 0.7125 0.7155 0.7180-85 0.7200 0.7230 0.7250

Bids 0.7050 0.7030-35 0.7020 0.7000 0.6985 0.6965 0.6950

EUR/JPY

Offers 138.00 138.30 138.50 138.85 139.00 139.30 139.50

Bids 137.60 137.45 137.25 137.00 136.80 136.50

USD/JPY

Offers 124.65 124.80 125.00 125.20-25 125.50 125.75 126.00

Bids 124.35 124.20 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7400 0.7425 0.7450 0.7480 0.7500

Bids 0.7350 0.7335 0.7320 0.7300 0.7285 0.7260 0.7300 0.7280 0.7250

-

12:00

European stock markets mid session: stocks traded mixed on news the Eurogroup approved the third Greek bailout programme

Stock indices traded mixed on news that the Eurogroup approved the third Greek bailout programme on Friday. The programme totals €86 billion. The Greece could get €26 billion in the first tranche from the third bailout programme. €13 billion will be used to cover the debt repayment and an additional €10 billion will be used to bolster capitalisation levels of Greek banks. The Greek government will get €3 billion for the implementation of fiscal and structural reforms.

Meanwhile, the economic data from the Eurozone was positive. Eurozone's unadjusted trade surplus jumped to €26.4 billion in June from €18.8 billion in May.

Exports rose at an annual rate of 12.0% in June, while imports increased at 7.0%.

Current figures:

Name Price Change Change %

FTSE 100 6,577.61 +9.28 +0.14 %

DAX 6,548.28 -2.46 -0.04 %

CAC 40 4,979.43 +22.96 +0.46 %

-

11:43

China's gold reserve climbs 1.16% in July

China's gold reserve climbed 1.16% to 1,677.3 tonnes in July from 1,658 tonnes in June, according to data from the People's Bank of China (PBoC).

The channels were domestic scrap gold, production storage and trade in domestic and overseas markets.

China has the fifth largest gold reserve worldwide, according to the World Gold Council.

-

11:27

Swiss retail sales rise 1.4% in June

The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland declined at an annual rate of 0.9% in June, after a 1.8% drop in May.

Sales of food, beverages and tobacco fell at an annual rate of 0.6% in June, while non-food sales rose 0.6%.

On a monthly basis, retail sales rose by 1.4% in June, after a 1.4% decrease in May.

Sales of food, beverages and tobacco were up 0.6% in June, while non-food sales climbed 2.3%.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E565mn), $1.1000(E1.3bn), $1.1100(E490mn), $1.1150(E408mn)

USD/JPY: Y125.00($817mn)

EUR/JPY: Y136.00(E175mn)

GBP/USD: $1.5500(Gbp217mn), $1.5525(Gbp168mn), $1.5725(GBP101mn)

AUD/USD: $$0.7300(A$1.2bn), $0.7400(A$662mn), $0.7435(A$150mn)

AUD/JPY: Y91.80(A$106mn), Y92.30(A$121mn)

NZD/USD: 0.6550(NZ$100mn), $0.6700(NZ$373mn)

USD/CAD: C$1.3000($125mn), C$1.3020($350mn)

-

11:14

Eurozone's unadjusted trade surplus soars to €26.4 billion in June

Eurostat released its trade data for the Eurozone on Monday. Eurozone's unadjusted trade surplus jumped to €26.4 billion in June from €18.8 billion in May.

Exports rose at an annual rate of 12.0% in June, while imports increased at 7.0%.

-

11:00

Eurozone: Trade balance unadjusted, June 26.4

-

10:57

Japan’s final GDP shrinks 0.4% in the second quarter

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Sunday. Japan's GDP declined by 0.4% in the second quarter, beating expectations for a 0.5% fall, after a 1.1% rise in the first quarter. The first quarter figure was revised up from a 1.0% increase.

Business spending fell 0.1% in the second quarter, while private consumption dropped 0.8%.

Exports dropped at an annual rate of 16.5% in the second quarter.

On a yearly basis, Japan's economy shrank 1.6% in the second quarter, beating forecasts of 1.9% decline, after a 3.9% rise in the first quarter.

-

10:44

Bank of England’s Monetary Policy Committee Member Kristin Forbes: if the BoE wait too long before starting to raise interest rates, it will have a negative impact on the country’s recovery

The Bank of England's (BoE) Monetary Policy Committee Member Kristin Forbes wrote in a column in The Telegraph that if the BoE wait too long before starting to raise interest rates, it will have a negative impact on the country's recovery.

"Interest rates will need to be increased well before inflation hits our 2 per cent target. Waiting too long would risk undermining the recovery, especially if interest rates then need to be increased faster than the gradual path which we expect," she wrote.

-

10:37

European Central Bank Executive Board Member Benoît Coeuré: the central bank could add further stimulus measures if there was a fundamental change in the economic situation

The European Central Bank (ECB) Executive Board Member Benoît Coeuré said in an interview on Friday that the central bank could add further stimulus measures "if there was a fundamental change in the economic situation or the monetary stance was materially altered because of developments in the markets-for example, in the event of a sharp increase in long-term bond yields".

He noted that the economy in the Eurozone slowly improved.

-

10:18

International Monetary Fund expects the Chinese economy to expand 6.8% this year

The International Monetary Fund (IMF) said on Friday that it expects the Chinese economy to expand 6.8% this year and 6.3% in 2016.

"China is transitioning to a new normal, with slower yet safer and more sustainable growth," the IMF noted.

China's economy grew 7.4% last year.

The IMF pointed out that China should prepare for slower growth in the medium term.

-

10:11

Number of active U.S. rigs rises by 2 rigs to 672 last week

The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 2 rigs to 672 last week. It was the fourth consecutive increase.

Combined oil and gas rigs remained unchanged at 884.

-

09:17

Switzerland: Retail Sales (MoM), June 1.4%

-

09:16

Switzerland: Retail Sales Y/Y, June -0.9%

-

08:57

Oil prices dropped sharply

West Texas Intermediate futures for September delivery dropped to $41.97 (-1.25%), while Brent crude fell to $48.60 (-1.20%) after the latest data had shown the number of drilling rigs in the U.S. increased last week.

In addition to oversupply issues the devaluation of the yuan by China's central bank led to the weakening of other emerging market currencies thus making imports of oil more expensive for corresponding economies.

Citigroup Inc lowered its crude oil price outlook citing such negative factors as robust supply from OPEC and doubtful demand growth in Asia as China's economic growth slows and Japan GDP contracts.

-

08:39

Gold rebounded further

Gold climbed to $1,117.70 (+0.45%) as contraction of Japanese economy renewed demand for safe haven even after the yuan stopped falling. Last week the metal climbed 1.9% amid China's surprise yuan devaluation.

Nevertheless Fed interest rates remain key fundamentals for bullion. Minutes of the Fed's July 28-29 meeting due on Wednesday should shed some light on the bank's plan to raise rates for the first time in nearly a decade. Recent data on employment and retail sales argue for a rate hike in September.

-

08:14

Global Stocks: U.S. indices gained

Major U.S. stock indices advanced on Friday after several sessions of sharp swings.

Investors continued assessing the yuan devaluation. On Wednesday and Thursday stocks fluctuated much, but ended little changed. This means that investors are not sure how exactly this affects U.S. companies.

On Friday the Dow Jones industrial average climbed 69.15 points, or 0.4%, to 17477.40. The S&P 500 gained 8.15 points, or 0.4%, to 2091.54. The Nasdaq Composite rose 14.68 points, or 0.3%, to 5048.24. For the past week indices rose by 0.6%, 0.7% and 0.1% respectively.

This morning in Asia Hong Kong Hang Seng fell 0.99%, or 236.82 points, to 23,754.21. China Shanghai Composite Index declined 0.12%, or 4.73 points, to 3,960.61. The Nikkei added 0.25%, or 52.24 points, to 20,571.69.

Asian stocks outside Japan traded lower as the yuan stopped declining.

Japanese stocks climbed as Japan Q2 GDP data showed a smaller-than-expected contraction. The index fell by 0.4% in the second quarter compared to a 1% gain reported previously. Nevertheless the reading was better than a decline of 0.5% expected by economists. On an annualized basis Japanese economy contracted by 1.6% vs -1.9% expected.

-

08:09

Foreign exchange market. Asian session: the sterling climbed

The pound rose against the U.S. dollar as weak consumer confidence data offset a favorable producer price report. Market volatility, which was caused by actions by the People's Bank of China, faded and investors focused on searching for clues on probability of a Fed rate hike in September. Market participants will also eye a report on UK consumer inflation. The corresponding index is expected to stay unchanged on a y/y basis in July amid falling oil prices and a stronger pound.

The euro weakened against the greenback despite positive news on Greece. On Friday finance ministers of the single currency area agreed to help Greece with €86 billion in the coming three years. The first tranche of €26 billion may be provided on August 19.

The yen fell slightly. Partly this decline was caused by the country's Q2 GDP report. Japanese economy contracted by 0.4% in the second quarter compared to a 1% gain reported previously. Nevertheless the reading was better than a decline of 0.5% expected by economists. On an annualized basis Japanese economy fell by 1.6% vs -1.9% expected.

A 0.8% decline in consumer spending contributed to this contraction.

EUR/USD: the pair declined to $1.1080 in Asian trade

USD/JPY: the pair rose to Y124.45

GBP/USD: the pair traded within $1.5640-55

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:15 Switzerland Retail Sales Y/Y June -1.8%

07:15 Switzerland Retail Sales (MoM) June -1.4%

09:00 Eurozone Trade balance unadjusted June 18.8

12:30 Canada Foreign Securities Purchases June -5.45

12:30 U.S. NY Fed Empire State manufacturing index August 3.86 5

14:00 U.S. NAHB Housing Market Index August 60 61

20:00 U.S. Net Long-term TIC Flows June 93.0

20:00 U.S. Total Net TIC Flows

-

06:55

Options levels on monday, August 17, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1241 (3064)

$1.1196 (3545)

$1.1155 (1574)

Price at time of writing this review: $1.1087

Support levels (open interest**, contracts):

$1.1055 (2250)

$1.1008 (4225)

$1.0945 (7272)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 84478 contracts, with the maximum number of contracts with strike price $1,1300 (7174);

- Overall open interest on the PUT options with the expiration date September, 4 is 116781 contracts, with the maximum number of contracts with strike price $1,0500 (7888);

- The ratio of PUT/CALL was 1.38 versus 1.38 from the previous trading day according to data from August, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (2026)

$1.5804 (2091)

$1.5707 (2047)

Price at time of writing this review: $1.5645

Support levels (open interest**, contracts):

$1.5593 (928)

$1.5496 (2558)

$1.5398 (1753)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 28354 contracts, with the maximum number of contracts with strike price $1,5600 (2830);

- Overall open interest on the PUT options with the expiration date September, 4 is 34211 contracts, with the maximum number of contracts with strike price $1,5500 (2558);

- The ratio of PUT/CALL was 1.21 versus 1.22 from the previous trading day according to data from August, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:09

Nikkei 225 20,646.3 +126.85 +0.62 %, Hang Seng 23,845.29 -145.74 -0.61 %, Shanghai Composite 3,943.76 -21.57 -0.54 %

-

01:52

Japan: GDP, q/q, Quarter II -0.4% (forecast -0.5%)

-

01:51

Japan: GDP, y/y, Quarter II -1.6% (forecast -1.9%)

-

00:31

Commodities. Daily history for Aug 14’2015:

(raw materials / closing price /% change)

Oil 42.18 -0.75%

Gold 1,113.20 +0.04%

-

00:29

Stocks. Daily history for Aug 14’2015:

(index / closing price / change items /% change)

Nikkei 225 20,519.45 -76.10 -0.37 %

Hang Seng 23,991.03 -27.77 -0.12 %

S&P/ASX 200 5,356.54 -31.33 -0.58 %

Shanghai Composite 3,965.64 +11.08 +0.28 %

FTSE 100 6,550.74 -17.59 -0.27 %

CAC 40 4,956.47 -30.38 -0.61 %

Xetra DAX 10,985.14 -29.49 -0.27 %

S&P 500 2,091.54 +8.15 +0.39 %

NASDAQ Composite 5,048.24 +14.68 +0.29 %

Dow Jones 17,477.4 +69.15 +0.40 %

-

00:24

Currencies. Daily history for Aug 14’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1108 -0,41%

GBP/USD $1,5639 +0,17%

USD/CHF Chf0,9759 0,00%

USD/JPY Y124,29 -0,09%

EUR/JPY Y138,14 -0,43%

GBP/JPY Y194,39 +0,10%

AUD/USD $0,7377 +0,23%

NZD/USD $0,6534 -0,47%

USD/CAD C$1,3092 +0,24%

-