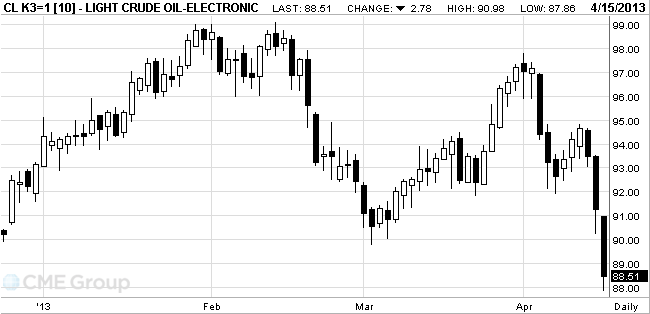

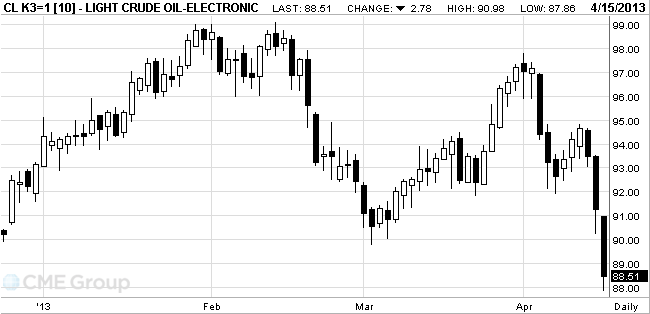

West Texas

Intermediate crude fell to the lowest level this year as China’s economic growth

unexpectedly lost momentum, raising concern that demand from the world’s

second-biggest oil-consuming country will slow.

Prices

broke below $90 as China’s

first-quarter gross domestic product increased 7.7 percent from a year earlier,

the National Bureau of Statistics reported in Beijing. That’s less than the 8 percent

forecast in a survey of economists and the 7.9 percent expansion in the fourth

quarter. China’s

oil use was the least in five months in March, statistics bureau data showed. Commodities

tumbled, led by metals and energy.

China’s first-quarter growth was lower

than all except two of the 41 analyst estimates in the survey. They ranged from

7.5 percent to 8.3 percent. Chinese GDP expanded 7.8 percent in 2012, the least

since 1999.

China used 9.76 million barrels of oil in

2011, according to BP Plc (BP/)’s Statistical Review of World Energy, behind

only the U.S.

in terms of oil consumption.

China’s apparent oil demand in March grew

2.7 percent from a year earlier to 9.77 million barrels a day, according to

statistics bureau data compiled by Bloomberg. That’s down from February’s 10.2

million and is the lowest level since October.

Slower

economic growth “translates into weaker oil demand growth, but we think

development there is still pretty energy intensive,” Walker said.

Oil also

fell as manufacturing in the New York

region expanded less than projected in April. The Federal Reserve Bank of New York’s general

economic index dropped to 3.1 this month from 9.2 in March. Readings exceeding zero signal expansion in New York, northern New Jersey

and southern Connecticut.

WTI for May

delivery falling to $87.86, the lowest intraday level since Dec. 19. The volume

of all futures traded was almost double the 100-day average.

Brent for

May settlement, which expires today, fell $2.58, or 2.5 percent, to $100.53 a

barrel on the London-based ICE Futures Europe exchange after dropping to

$100.41 a barrel, the least since July. Volume was 34 percent above the 100-day

average. The more actively traded June contract slid $2.35, or 2.3 percent, to

$100.69.