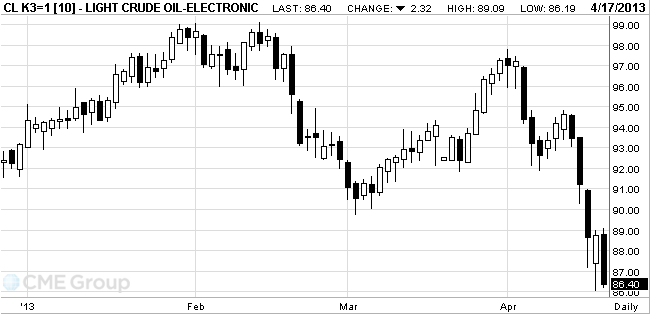

- Oil dropped

Notícias do Mercado

Oil dropped

West Texas

Intermediate oil tumbled for the fourth time in five days as

Prices

dropped as much as 2.2 percent after the Energy Information Administration said

output climbed to 7.2 million barrels a day, the most since July 1992, and

gasoline and diesel demand decreased. Crude output gained 0.4 percent in the

week ended April 12, the EIA, the Energy Department’s statistical arm,

reported. Gasoline consumption dropped for a second week to 8.38 million

barrels a day. Demand for distillate fuels, including diesel and heating oil,

tumbled 5.9 percent to 3.63 million barrels a day.

Crude

stockpiles decreased 1.23 million barrels to 387.6 million last week, the EIA

said. They were at the highest level since July

Oil

extended losses as the Standard & Poor’s 500 Index slid a day after the

biggest rally in three months and the dollar strengthened against the euro.

BNP Paribas

reduced its 2013 forecasts for Brent and WTI to reflect the price drop in the

first quarter. It trimmed its 2013 Brent estimate to $108 a barrel from $115

and WTI to $95 from $100, while advising investors to bet on a rebound in the

second half of the year.

WTI for May delivery fell to $86.06 a barrel on the New York Mercantile Exchange.

Brent for

June settlement slipped $1.99, or 2 percent, to $97.92 a barrel on the London-based

ICE Futures Europe exchange. The contract touched $97.85, the lowest intraday

level since July 11.