- European session: the major currencies in a narrow range

Notícias do Mercado

European session: the major currencies in a narrow range

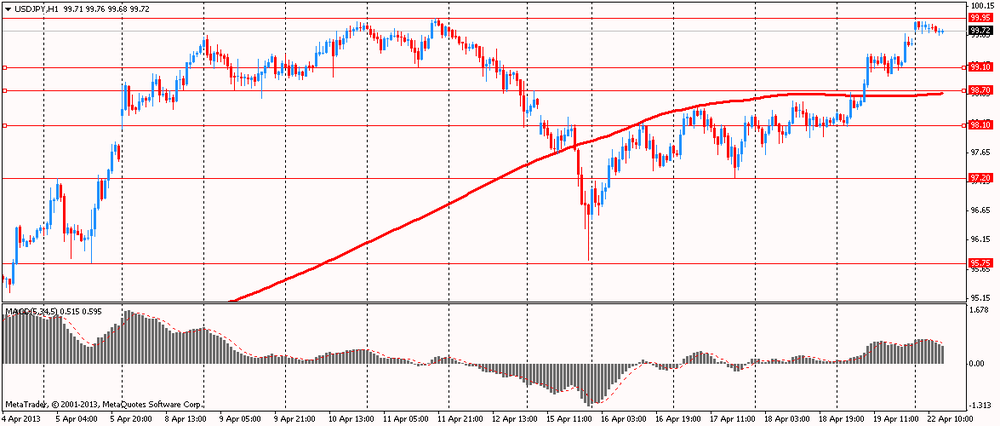

The yen continues to trade in the region of 100 yen to the dollar after the representatives of the G20 did not criticize the actions over the soft monetary policy of the Bank of Japan. Moreover, the head of the Central Bank Haruhiko Kuroda has already hinted about expanding the monetary stimulus at the second meeting under his leadership, which will take place this week.

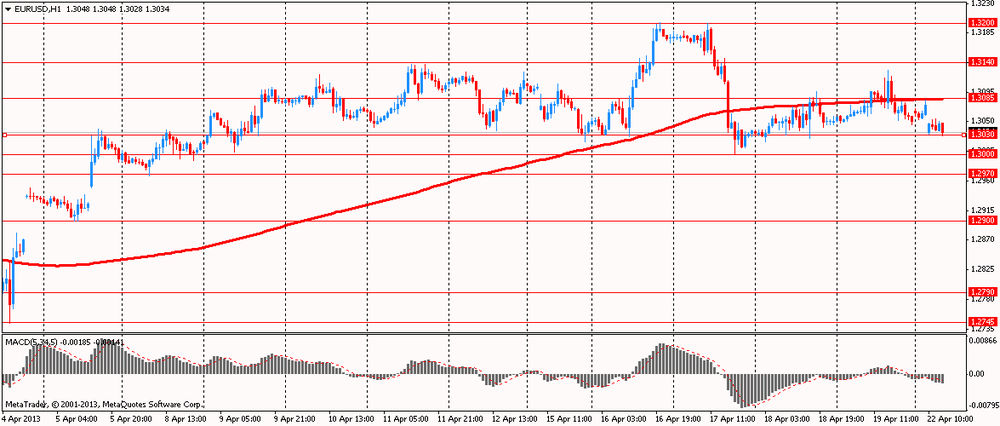

Euro fell back from progress made at the beginning of the session maksimov against the U.S. dollar after the current president of Italy, Giorgio Napolitano, was re-elected for a second term. 87-year-old Napolitano agreed to once again participate in the elections, after parliament failed to elect the fifth attempt of his successor. On the eve of the Italian center-left leader Pier Luigi Bersani said he would step down as chairman of the Democratic Party, unless the parliament will elect a new president. Bersani, previously regarded as the most likely candidate for the post of prime minister, said the refusal of the leadership in the party, after the parliament did not support his proposed two candidates for the presidency.

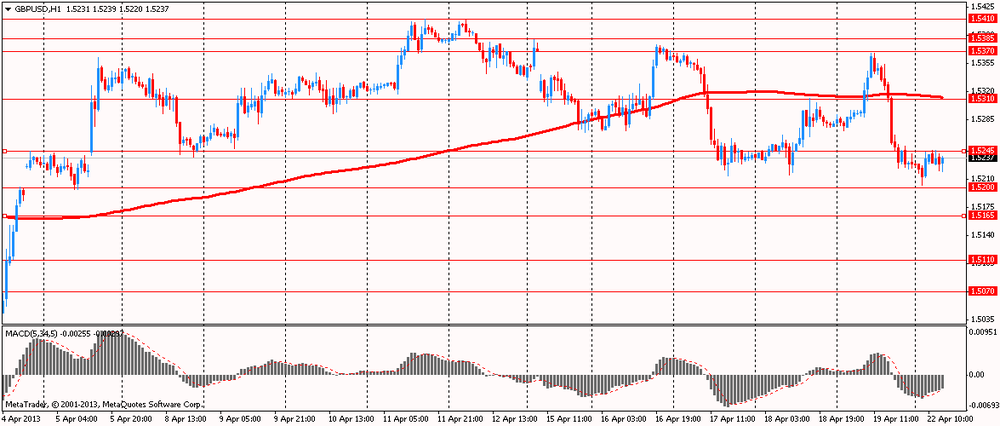

The pound was trading without a definite trend. Recall that the international rating agency Fitch Ratings downgraded the sovereign rating by one notch the UK - with the highest possible "AAA" to "AA +". The rating outlook - "stable," the agency said. Two months ago, a similar rating action taken agency Moody's Investors Service, the credit rating worsening the UK to "Aa1".

EUR / USD: during the European session, the pair fell to $ 1.3036

GBP / USD: during the European session, the pair rose to $ 1.5246

USD / JPY: during the European session, the pair retreated to Y99.66

At 12:30 GMT the U.S. will report on the index of economic activity from the Chicago Fed in March. At 14:00 GMT Eurozone will publish an indicator of consumer confidence for April. At 14:00 GMT the United States will sales in the secondary market in March.