- European session: the euro and the pound are in the range

Notícias do Mercado

European session: the euro and the pound are in the range

06:00 Germany Current Account April 20.2 13.0 17.6

06:00 Germany Trade Balance April 17.6 16.5 17.7

06:45 France Trade Balance, bln April -4.7 -4.4 -4.5

07:00 Switzerland Foreign Currency Reserves May 436.1 440.0 441.4

08:30 United Kingdom Consumer Inflation Expectations Quarter II +3.6% +3.6%

08:30 United Kingdom Trade in goods April -9.2 -8.8 -8.2

10:00 Germany Industrial Production s.a. (MoM) April +1.2% 0.0% +1.8%

10:00 Germany Industrial Production (YoY) April -2.5% -0.8% +1.0%

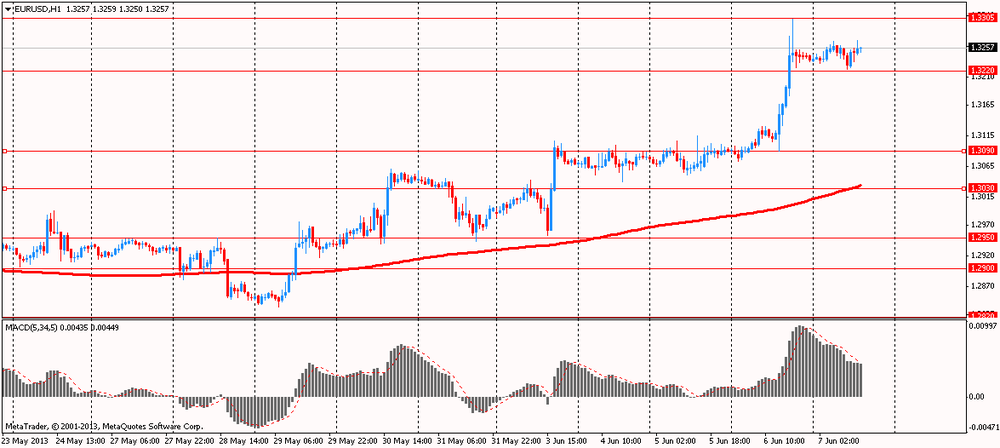

The euro exchange rate is kept in the range, disregarding block statistics on the trade balance and industrial production in Germany.

Data from the Federal Statistical Office of Germany has shown that the growth of German exports gained momentum in April, which is further evidence of recovery in Europe's largest economy. Reported exports of Germany in April rose by 1.9% compared with March, while imports increased by 2.3%. Both figures are adjusted for seasonal variations and the number of working days. These data suggest that the increase in global demand benefit the companies in the country, in addition, domestic demand is also increasing.

Data from the Ministry of Economy of Germany showed that industrial production in Germany exceeded expectations in April, thanks to the activity in the construction sector. This is another proof of the accelerating pace of recovery of economic growth in Europe's largest economy. According to the data, industrial production in Germany in April increased for the third consecutive month, up 1.8% compared with March. Economists had expected the index to remain unchanged from the previous month. Manufacturing output increased by 1.5% compared with March, adjusted for seasonal variations and the number of working days. Production in the construction sector jumped 6.7% after a decline in the winter.

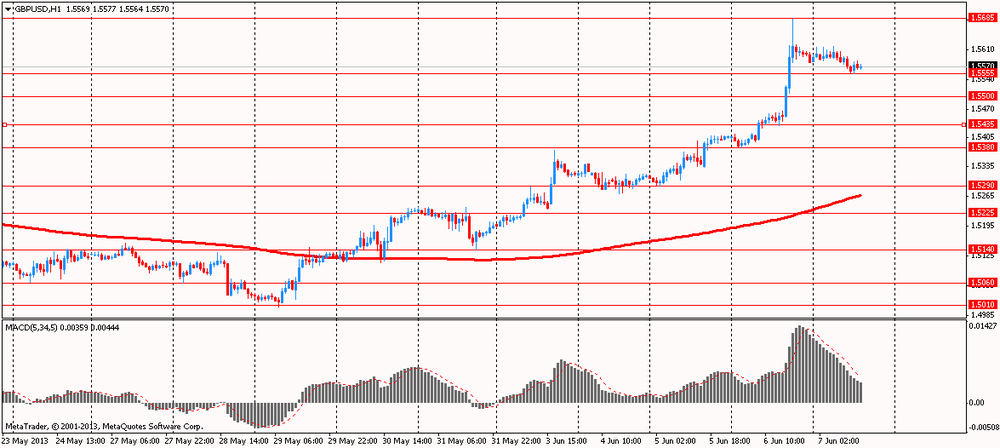

The pound also traded without a trend. According to the data, the UK trade deficit was 8.2 billion pounds (12.8 billion dollars), compared to 9.2 billion pounds in the previous month. Economists had forecast a deficit reduction to 8.8 billion pounds. Improving the balance of foreign trade in the UK in April was due to the reduction in imports by 1.3 billion pounds, rather than export growth. In April, exports of the UK fell by 400 million feet.

The yen continues to strengthen after Finance Minister Taro Aso that while interventions in the domestic currency market are planned. The Minister said that in the near future, he does not intend to intervene in the foreign exchange market to counter the recent restoration of the Japanese currency. It's a rare occasion when a representative of the Japanese authorities to publicly rule out intervention after the sharp appreciation of the currency. "I've been following it, but does not intend to intervene or take action in the near future just because of this" - Aso said at a press conference after a regular cabinet meeting, when asked about the sharp rise in the Japanese currency before the start of today's session.

EUR / USD: during the European session, the pair is trading in the range of $ 1.3223 - $ 1.3270

GBP / USD: during

the European session, the pair is trading in the range of $ 1.5555

- $ 1.5620

USD / JPY: during

the European session, the pair fell to Y95.28

At 12:30 GMT in Canada will the unemployment rate, change in the number of employees, change in the number of full-time and part-time jobs in May, the change in labor productivity for the 1st quarter. At 12:30 GMT the U.S. will release the unemployment rate, change in the number of employed in non-agricultural sector, changes in the number of employees in the private sector of the economy, changes in the number of employees in the manufacturing sector of the economy, change in average hourly wages, the total revision of employment for 2 months in May.