- Oil climbed to the highest level in three weeks

Notícias do Mercado

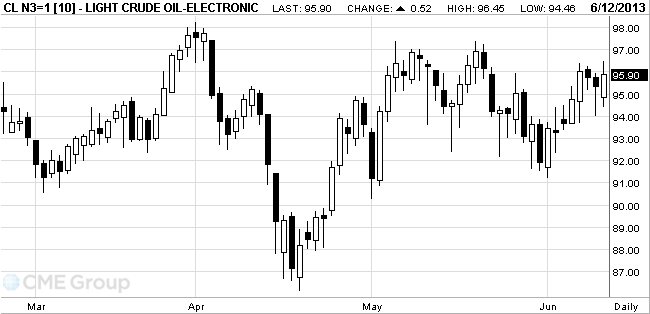

Oil climbed to the highest level in three weeks

West Texas Intermediate crude climbed to the highest level in three weeks.

Growth in oil futures did not prevent the data on the increase in stocks of crude oil from the U.S. Department of Energy. Crude oil inventories rose 2.52 million barrels compared to the expected decline of 0.5 million increase in gasoline stocks totaled 2.75 million barrels, is expected 0.5 million

Today, the International Energy Agency (IEA) reported that the consumption of oil in China this year is likely to be slightly less than previously estimated, with demand for oil in the country this year, seems to grow by 3, 8%.

Changing the outlook for demand in China is important for world oil markets, as the country is the second largest consumer of oil and is highly dependent on its imports. In January, the PRC government has reported that about 56% of its oil comes into the country as a result of imports.

In 2013, China's oil consumption will increase by 365,000 barrels per day, which is 3.8% more than last year. At the same time, this forecast by 15,000 barrels a day lower than forecast a month ago, according to a recent report by the IEA.

On Tuesday, the U.S. Department of Energy lowered its forecast for growth in oil demand in China in 2013 to 420,000 barrels per day. Now the Office predict growth in China is 4.1%, whereas in the past month, was expected to grow by 4.4%.

WTI for July delivery rose 89 cents, or 0.9 percent, to $95.38 a barrel at 11:26 a.m. on the New York Mercantile Exchange. Earlier, it touched $96.45, the most since May 21 on an intraday basis. The volume of all futures traded was 4.2 percent below the 100-day average for the time of day.

Brent for July settlement rose 94 cents, or 0.9 percent, to $103.90 a barrel on the London-based ICE Futures Europe exchange. Volume was 4.8 percent above the 100-day average for the time of day. Brent's premium to WTI widened by 5 cents to $7.63 a barrel.