- Оil advanced for a second day

Notícias do Mercado

Оil advanced for a second day

West Texas

Intermediate oil advanced for a second day as U.S. durable goods orders gained

more than forecast in May and on expectations that crude stockpiles fell last

week.

Prices

increased as much as 1 percent as bookings for goods meant to last at least

three years climbed 3.6 percent, the Commerce Department said in

Crude

supplies probably dropped 1.75 million barrels to 392.4 million in the week

ended June 21 as refiners boosted gasoline production to meet rising demand,

the survey showed.

Refineries

probably operated at 89.6 percent of capacity as of June 21, up 0.3 percentage

point from the prior week. That would be the highest level since Dec. 28.

The Energy

Information Administration is scheduled to release its weekly petroleum report

at 10:30 a.m. tomorrow.

Demand for

gasoline rose 2.2 percent in the week ended June 14 to 8.84 million barrels a

day, the EIA, the Energy Department’s statistical arm, said last week. Total

petroleum consumption increased 2.8 percent to 18.4 million.

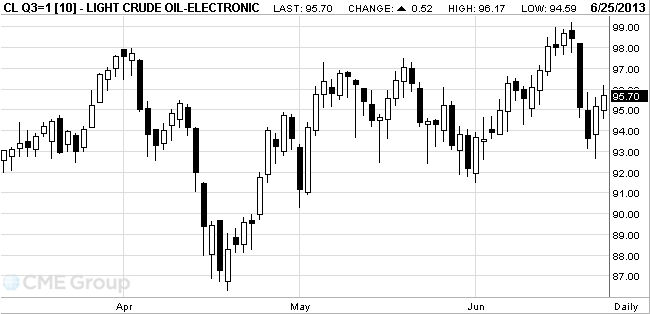

WTI for

August delivery climbed 53 cents, or 0.6 percent, to $95.71 a barrel at 11:37

a.m. on the New York Mercantile Exchange. The volume of all futures traded was

74 percent higher than the 100-day average. Prices have slipped 1.6 percent

this quarter, curbing their gains in 2013 to 4.2 percent.

Brent for

August settlement increased 67 cents, or 0.7 percent, to $101.83 a barrel on

the London-based ICE Futures Europe exchange. Volume was 17 percent below the

100-day average. Brent’s premium to WTI widened to as much as $6.35 a barrel

from yesterday’s $5.98, the least since January 2011.