- European session: the euro fell

Notícias do Mercado

European session: the euro fell

08:30 United Kingdom PMI Construction June 50.8 51.3 51.0

09:00 Eurozone Producer Price Index, MoM May -0.6% -0.2% -0.3%

09:00 Eurozone Producer Price Index (YoY) May -0.2% 0.0% -0.1%

09:00 United Kingdom MPC Member Tucker Speaks

09:00 United Kingdom BOE Deputy Governor Andrew Bailey Speaks

The euro fell against the U.S. dollar against the background data on producer prices eurozone, which fell for the third month in succession. Producer prices were down 0.1% year on year, after falling 0.2% in April. Economists had forecast that prices will remain unchanged in May. On a monthly measurement of producer prices fell 0.3% in April after falling by 0.6%. But the rate of decline slightly above the consensus forecast of 0.2%.

Investors are waiting for the ECB meeting on Thursday. It is expected that the Central Bank will showcase a soft tone that will increase the downside risks for the pair. It is expected that Draghi will also mark the recent positive reports on the euro zone, indicating that the long-awaited recovery in the 2nd half of the year.

The British pound down on expectations the Bank of England, which will hold its first meeting led by M. Carney on Thursday.

"The obstacles in the form of cost-saving measures of inflation and recession in the eurozone mean that the Bank of England will have to work hard to support the economic recovery. While we agree with the forecast that the prospects for expanding QE this year declined, Carney can emphasize that the Bank of England is accommodative position. most obvious tool that Carney can use this proactive management, "said Jane Foley, strategist at Rabobank.

Earlier, the pound rose against the dollar after a report showed that activity in the UK construction sector grew in June the second straight month, helped by government initiatives in the housing market. The index of purchasing managers in the construction sector, calculated by Markit and the Chartered Institute of Purchasing & Supply, in June rose to 51.0 against 50.8 in May. As a result of growth in June, the index reached the highest level since May 2012. A reading above 50 indicates an increase in activity, and lower - at its reduction.

The Australian dollar fell against the U.S. dollar after the Reserve Bank of Australia left the door open to lower interest rates in the coming months and said the currency could fall even more. RBA left interest rates unchanged at a record low of 2.75%, but said that the weak inflation gives room for further lowering of the rates if the economy falters.

EUR / USD: during the European session, the pair fell to $ 1.3012

GBP / USD: during the European session, the pair fell to $ 1.5155

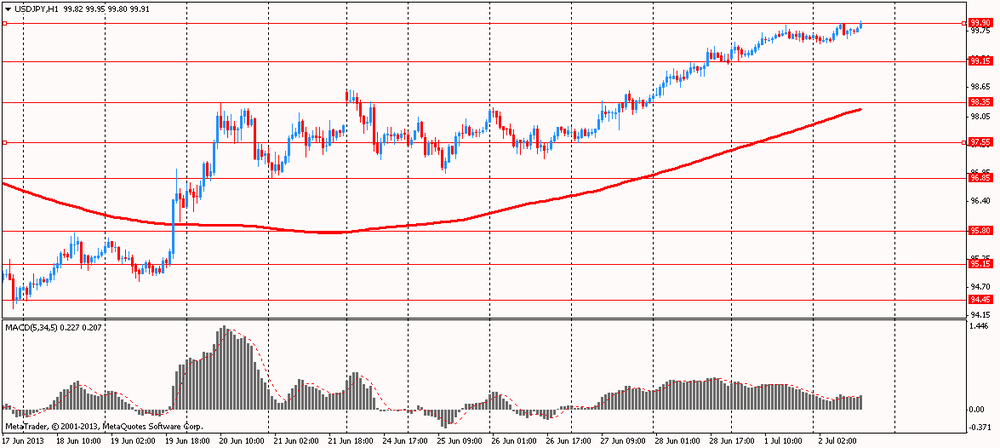

USD / JPY: during the European session, the pair rose to Y99.95

In the U.S., will be released at 14:00 Factory Orders for May, and at 20:30 - changes in stocks of crude oil, according to API. End the day at 23:30 Australia data on the index of activity in the service of the AiG in June.