- WTI crude heads for third weekly gain

Notícias do Mercado

WTI crude heads for third weekly gain

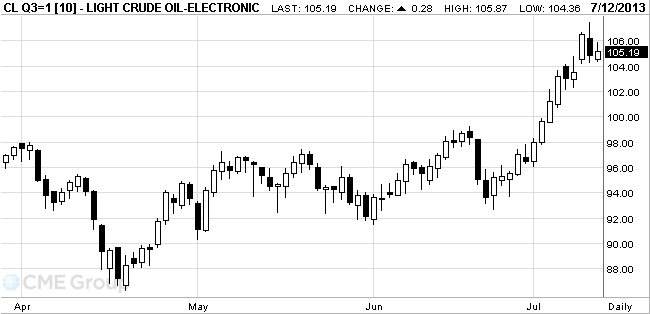

West Texas Intermediate crude was little changed, heading for a third weekly increase, as U.S. corporate earnings topped analysts’ estimates and as U.S. inventories tumbled. Prices erased an early advance as the euro weakened against the dollar.

The U.S. dollar has returned to growth after the recession of the previous day, as investors were cautious before the publication of China's GDP.

The dollar exchange rate fluctuations repeats U.S. yields since Federal Reserve Chairman Ben Bernanke said in June that the U.S. economy is strong enough to reduce the amount of central bank could buy up bonds from the current $ 85 billion a month. On Monday, bond yields reached a 23-month high, but fell sharply after Bernanke said Wednesday that the need for super soft policy of the central bank to continue in the near future.

The market is also waiting for the report on China's GDP in the second quarter, which will be published on Monday. The median forecast of analysts, GDP growth slowed slightly to 7.5 percent.

Oil prices on Wednesday rose by 2.9%, after official data showed a sharp decline in U.S. oil inventories and rising Refinery utilization. On Thursday, many market participants took profits after the rise in oil prices by 10.3% this month.

According to data released on Wednesday, the U.S. Department of Energy, the oil reserves in the U.S. for the past two weeks decreased by 20.2 million barrels as refinery capacity utilization rate increased to above 16 million barrels a day, which is an 8-year high in the last two week. Oil reserves are now well below the levels recorded in the previous year, the first time since March 2012.

According to data published by the weekly Department of Energy, oil WTI at Cushing terminal fell by 5.4% in the week June 29 - July 5.

WTI crude for August delivery slipped 3 cents to $104.88 a barrel at 10:50 a.m. on the New York Mercantile Exchange. The volume of all futures traded was 15 percent above the 100-day average for the time of day. The August contract was 42 cents more than the September one.

Brent oil for August settlement gained 40 cents, or 0.4 percent, to $108.13 a barrel on the London-based ICE Futures Europe exchange. The volume of all futures traded was 12 percent below the 100-day average.

The European benchmark grade traded at a $3.25 premium to WTI contract. The spread dropped to $1.99 on July 10, the narrowest differential based on closing prices since November 2010.