- Oil pared losses

Notícias do Mercado

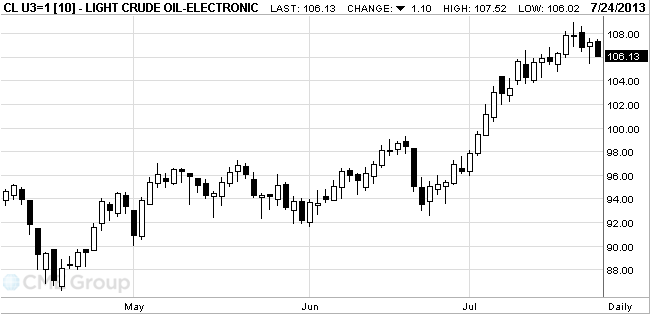

Oil pared losses

West Texas

Intermediate crude pared losses after a

Futures

rebounded after the Energy Information Administration said that supplies

slipped 2.83 million barrels to 364.2 million. Analysts surveyed by Bloomberg

had projected a 2.8 million-barrel decrease. Prices dipped earlier as Chinese

manufacturing contracted more than economists estimated, bolstering concern

that economic growth will slow in the world’s biggest energy-consuming country.

WTI oil for

September delivery slipped 44 cents, or 0.4 percent, to $106.79 a barrel at

10:40 a.m. on the New York Mercantile Exchange. The contract traded at $106.40

before the release of the EIA report at 10:30 a.m. in

Brent crude

for September settlement dropped 83 cents, or 0.8 percent, to $107.59 a barrel

on the London-based ICE Futures Europe exchange. The volume of all futures

traded was 23 percent below the 100-day average. The European benchmark grade

traded at an 80-cent premium to WTI, down from $1.19 yesterday. Brent slid

below the