- Oil dropped for a fourth day

Notícias do Mercado

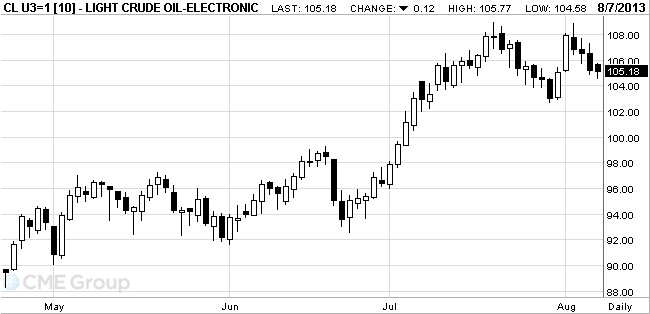

Oil dropped for a fourth day

West Texas

Intermediate crude dropped for a fourth day after a government report showed

inventories of gasoline and distillate fuels unexpectedly increased.

Futures

fell as much as 0.7 percent. The Energy Information Administration said

gasoline inventories rose 135,000 barrels to 223.6 million last week. Stockpiles

were forecast to decrease 500,000 barrels, according to the median of 11

analyst estimates in a Bloomberg survey. Distillate supplies, which include

diesel and heating oil, gained 469,000 barrels to 126.5 million. They were

estimated to remain unchanged from the prior week, the survey showed.

Inventories

of crude oil fell 1.32 million barrels to 363.3 million, the department said. Supplies

were forecast to slide 1.5 million barrels. They surged to 397.6 million on May

24, the most since 1931, according to the EIA, the Energy Department’s

statistical unit.

Crude

production rose 0.2 percent to 7.56 million barrels a day last week, the

highest level since December 1989, the EIA said. Output has surged as the

combination of horizontal drilling and hydraulic fracturing, or fracking, has

unlocked supplies trapped in shale formations in the central part of the

country.

WTI crude

for September delivery fell 28 cents, or 0.3 percent, to $105.02 a barrel at

10:48 a.m. on the New York Mercantile Exchange. The contract traded at $105.43

before the release of the EIA report at 10:30 a.m. in

Brent oil

for September settlement dropped 60 cents, or 0.6 percent, to $107.58 a barrel

on the ICE Futures Europe exchange. Volume was 18 percent above the 100-day

average. The European benchmark grade traded at a $2.56 premium to WTI, down

from $2.88 yesterday.