- Oil rose

Notícias do Mercado

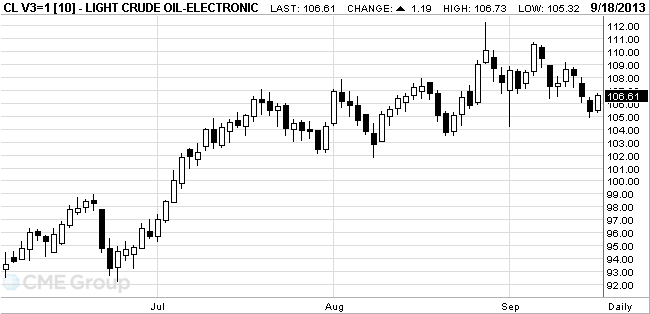

Oil rose

West Texas

Intermediate crude advanced after a government report showed that

Futures

rose after the Energy Information Administration said nationwide stockpiles

dropped 4.37 million barrels to 355.6 million. A 1.2 million-barrel decline was

projected in a Bloomberg survey. Inventories at

WTI crude

for October delivery increased 98 cents, or 0.9 percent, to $106.40 a barrel at

10:42 a.m. on the New York Mercantile Exchange. The contract traded at $105.74

before the release of the report at 10:30 a.m. in

Brent oil

for November settlement rose 32 cents, or 0.3 percent, to $108.51 a barrel on

the London-based ICE Futures Europe exchange. The European benchmark grade’s

premium to WTI slipped to as little as $2.70 a barrel, the narrowest gap since

Aug. 19, as some supplies returned in Libya and concern that a U.S.-led attack

on Syria would affect Middle East exports waned.