- European session: the dollar stabilized

Notícias do Mercado

European session: the dollar stabilized

06:00 Switzerland Trade Balance September 1.85 2.23 2.5

08:10 United Kingdom MPC Member Bean Speaks

08:30 United Kingdom PSNB, bln September 11.5 9.4

The U.S. dollar traded in a narrow range against most major currencies, as market participants are waiting for the publication of data on the number of jobs outside agriculture, as well as official data on unemployment in the United States . It is expected that the figure will be released above the acceptable threshold of 6.5 % of the Federal Reserve System, and therefore Fed QE3 will continue the program in its entirety. Today, after a delay associated with the shutdown in the United States, will be published by the government's employment report . According to the median forecast of analysts in the U.S. economy in the past month has been created 179 thousand jobs , higher than the August figure of 169 thousand, however , it is expected that the official unemployment rate was 7.3 %.

The observed stability of the dollar reflects the reluctance of investors to open large positions before the employment data do not shed light on how much the U.S. Federal Reserve will continue to purchase bonds at the current rate .

The yen continues to fall against most currencies in anticipation of the publication 25 October inflation data, which are likely to be the highest since 2008 . According to the median forecast of economists , the nationwide consumer price index excluding fresh food , last month, will grow by 0.7 % compared with a year earlier. Recall that the measures for promotion of inflation, which applies the Bank of Japan , have accelerated the consumer price index in August, the fastest pace since November 2008 , to 0.8 %.

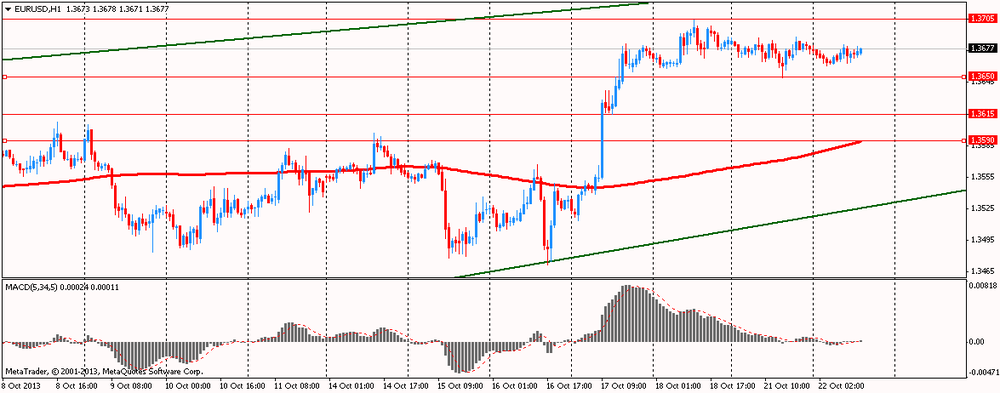

EUR / USD: during the European session, the pair is trading in the range of $ 1.3661 - $ 1.3681

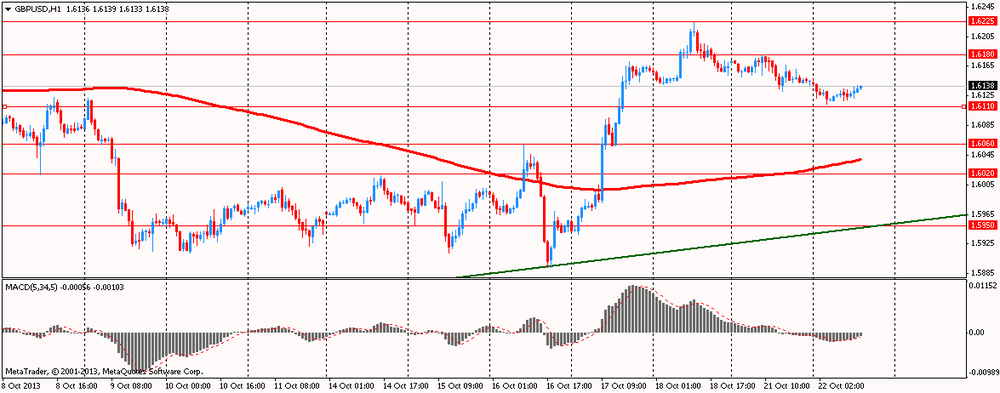

GBP / USD: during the European session, the pair rose to $ 1.6139

USD / JPY: during the European session, the pair rose to Y98.40

At 12:30 GMT in Canada will change in the volume of retail sales , the change in retail sales excluding auto sales for August. At 12:30 GMT the U.S. will release the unemployment rate , change in the number of employed in non-agricultural sector , changes in the number of employees in the private sector of the economy , changes in the number of employees in the manufacturing sector of the economy, change in average hourly wages , the total revision of employment for 2 months in September. At 23:00 GMT Australia will release the index of leading economic indicators from the Conference Board in August.