- Asian session: The euro declined

Notícias do Mercado

Asian session: The euro declined

00:01 United Kingdom BRC Retail Sales Monitor y/y October +0.7% +1.1% +0.8%

01:45 China HSBC Services PMI October 52.4 52.6

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

03:30 Australia RBA Rate Statement

07:45 Japan BOJ Governor Haruhiko Kuroda Speaks

The euro declined versus the yen before European Central Bank President Mario Draghi speaks today ahead of a policy meeting this week as traders weigh the prospects for monetary stimulus in the region. European Union Economic and Monetary Affairs Commissioner Olli Rehn will release economic growth forecasts for the region in Brussels today. The ECB meets on Nov. 7, with 65 of 68 economists surveyed by Bloomberg News predicting policy makers will hold the key rate at a record-low 0.5 percent. Bank of America Corp., UBS AG and Royal Bank of Scotland Group Plc forecast a cut.

The yen advanced versus its 16 major peers as regional equities erased gains, boosting haven demand.

The dollar fell for a second day against Japan’s currency before a report predicted to show an expansion in U.S. services slowed last month, weighing on expectations the Federal Reserve will move to reduce stimulus. The Institute for Supply Management’s U.S. non-manufacturing index probably dropped to a four-month low of 54 in October, from 54.4 the previous month, according to the median forecast in a Bloomberg survey before today’s report. A reading above 50 indicates expansion.

The Australian dollar dropped after the Reserve Bank said the currency is “uncomfortably high.” “The Australian dollar, while below its level earlier in the year, is still uncomfortably high,” Governor Glenn Stevens said in a statement. “A lower level of the exchange rate is likely to be needed to achieve balanced growth in the economy.”

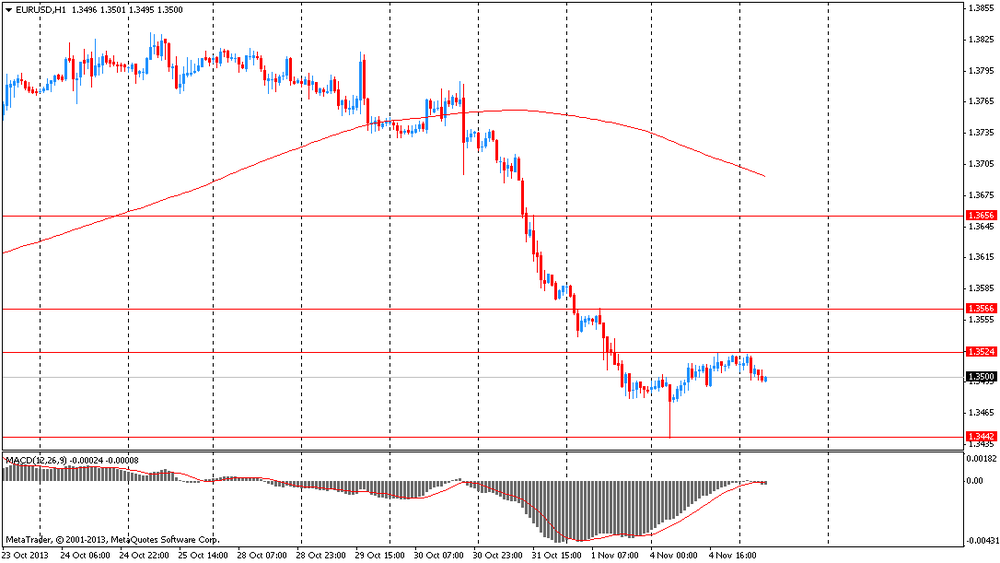

EUR / USD: during the Asian session the pair traded in the range of $ 1.3495-25

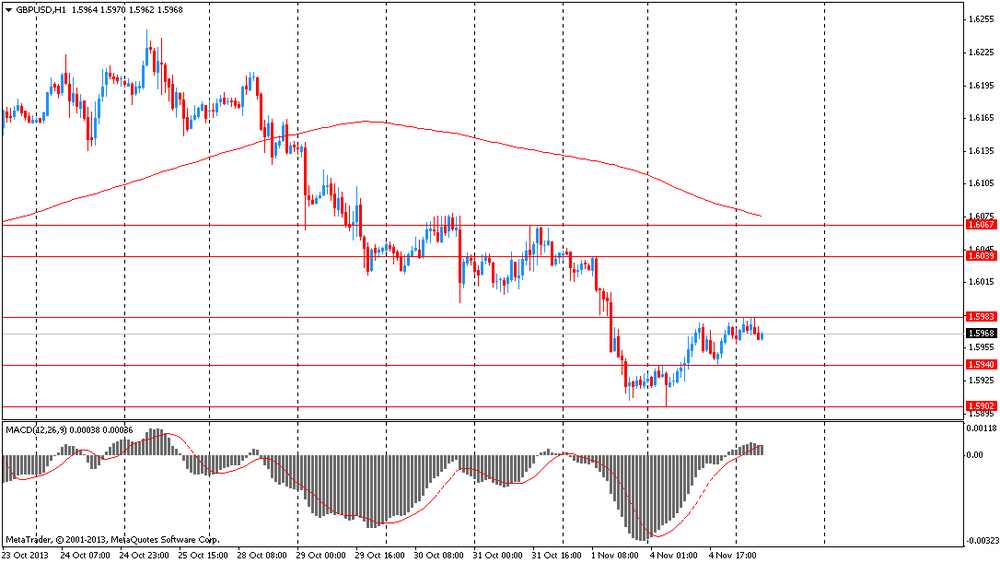

GBP / USD: during the Asian session, the pair traded in the range of $ 1.5960-85

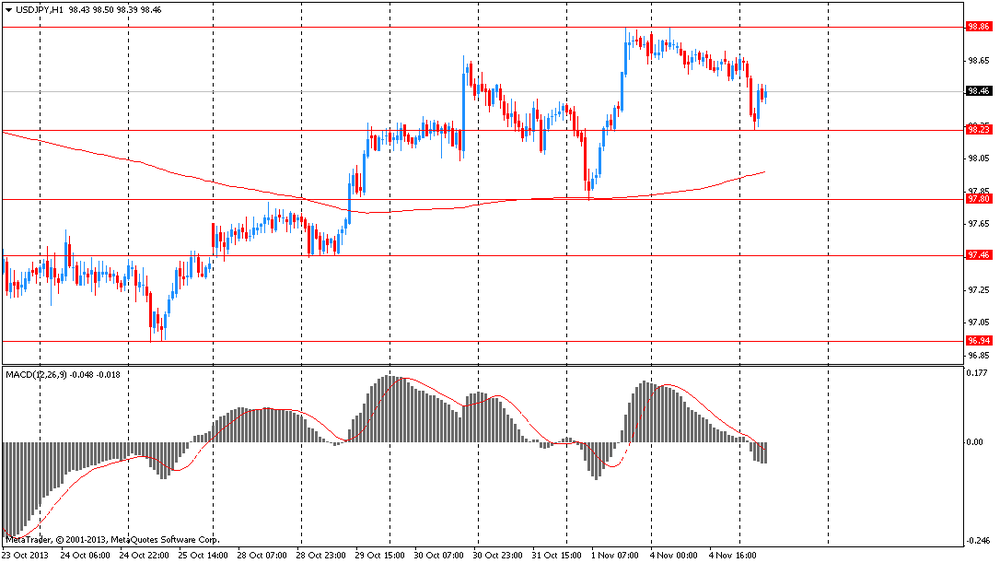

USD / JPY: during the Asian session the pair fell to Y98.25

The European calendar gets underway at 0800GMT, with the release of the Spanish unemployment data for October. The PMI manufacturing data released Monday saw the employment index fall to the lowest levels since April. At 1000GMT, the EMU September PPI data will be published. PPI is seen up 0.2% on month, down 0.8% on year. Also due Tuesday are the EU's own "Autumn Economic Forecasts." The only UK data scheduled for release comes at 0928GMT, with the release of the October CIPS/Markit Services PMI numbers. However, the data is unlikely to impact on Thursday's BOE policy decision, with both rates, QE and forward guidance left unchanged.