- European session: the euro rose

Notícias do Mercado

European session: the euro rose

08:15 Switzerland Industrial Production (YoY) Quarter III -1.1% +0.7%

08:48 France Services PMI (Finally) November 48.8 48.8 48.0

08:53 Germany Services PMI (Finally) November 54.5 54.5 55.7

08:58 Eurozone Services PMI (Finally) November 50.9 50.9 51.2

09:00 OPEC OPEC Meetings

09:30 United Kingdom Purchasing Manager Index Services November 62.5 62.1 60.0

10:00 Eurozone Retail Sales (MoM) October -0.6% +0.2% -0.2%

10:00 Eurozone Retail Sales (YoY) October +0.3% +1.0% -0.1%

10:00 Eurozone Household Consumption (QoQ) Quarter III +0.2% +0.1% +0.1%

10:00 Eurozone GDP (QoQ) (Revised) Quarter III +0.1% +0.1% +0.1%

10:00 Eurozone GDP (YoY) (Revised) Quarter III -0.4% -0.4% -0.4%

The euro has recovered from the losses incurred earlier in the session against the dollar , returning to the opening day. Mixed dynamics of the single currency associated with released data on service sector activity , GDP and retail sales .

According to the data , the composite Purchasing Managers Index (PMI) of the eurozone , the monthly index of activity in the manufacturing sector and the service sector in November fell to 51.7 from 51.9 in October. Index value above 50 indicates expanding activity . PMI in the service sector of the eurozone rose to 51.2 compared with a preliminary estimate of 50.9 . These data were better than the preliminary assessment , published last month, but indicate that private sector activity slowed during the month.

Retail sales in the eurozone fell for the second month in a row in October , mainly due to lower sales in the non-food sector, informed by statistical office Eurostat . The volume of retail sales fell by 0.2 percent in October compared with the previous month , after falling 0.6 percent in September . Economists had forecast that sales will grow by 0.2 percent in October .

Eurozone economic growth was moderate in the third quarter, according to a preliminary estimate showed the final data published by Eurostat. Gross domestic product grew by 0.1 percent in the third quarter compared with the previous quarter . Eurozone emerged from the longest recession in the history of the region in the second quarter , with GDP growth of 0.3 percent. On an annual basis , GDP fell by 0.4 percent after a contraction of 0.6 percent in the second quarter . All figures are consistent with the preliminary estimates .

The British pound fell against the dollar after data on service sector activity . Activity in the UK service sector slowed in November , but remained confident , with demand growing strong pace. PMI for the services sector , which includes everything from banks to restaurants, fell to 60.0 in November . This is the lowest value of the index in five months , and it is lower than the 62.5 in October. Economists had expected the November index was 62.1 .

These data came after strong reports on manufacturing and construction sector , published earlier this week , and they can encourage UK Finance Minister George Osborne to do some respite from government spending cuts and tax increases . On Thursday, Osborne will present a new report , which includes government forecasts for the economy and information on the progress in reducing the budget deficit.

EUR / USD: during the European session, the pair fell to $ 1.3566 , and then rose to $ 1.3600

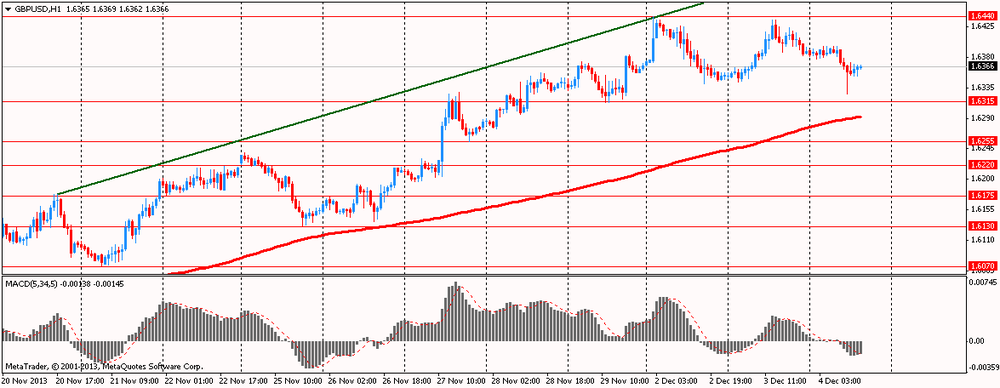

GBP / USD: during the European session, the pair fell to $ 1.6326

USD / JPY: during the European session, the pair rose to Y102.84, and then decreased to Y102.27

At 13:15 GMT the U.S. will release the change in the number of employees from ADP for the 3rd quarter . At 13:30 GMT the United States and Canada, there are data on its trade balance for October. At 15:00 GMT we will know the decision of the Bank of Canada's main interest rate and the accompanying statement will be made the Bank of Canada . In the U.S. at 15:00 GMT will composite index ISM non-manufacturing areas in November , sales in the primary market in September and October , at 15:30 GMT will be published data on crude oil inventories from the Energy Department . At 19:00 GMT Economic Outlook publication held by the Fed regions " Beige Book ."