- European session: the euro rose

Notícias do Mercado

European session: the euro rose

The euro rose against the dollar , supported by statements of ECB head Mario Draghi, who in an interview with Der Spiegel said that there is no need to further reduce the basic interest rate . According to the newspaper , according to M.Dragi , crisis is not over , but there are many encouraging signals. ECB lowered its key interest rate by 0.25 percentage points - to a record low of 0.25 % per annum , stating concerns about an "extended period " of low inflation in the eurozone.

Draghi said that he sees no signals deflation , adding that the situation in the euro zone is different from the situation in Japan . Among the positive signals for the European economy - economic growth in some countries , the reduction of trade imbalances between countries in the region , as well as the reduction of budget deficits , said M.Dragi .

According to him , the pace of improvement in the region exceeded the expectations of the ECB.

Eurozone economic recovery that began in the second quarter of this year after a prolonged recession , almost petered out in the third quarter against the background of a sudden contraction of the French GDP and reduce Italy's GDP . In the second quarter Eurozone GDP rose by 0.3 % in the third - only 0.1 %.

Meanwhile, recent signals of the European economy are more positive. Thus, the growth of business activity in the manufacturing sector and the eurozone consumer confidence in December exceeded expectations . In addition to further reduce the base rate of the ECB has other tools to stimulate growth, in particular , to provide banks with another portion of long-term loans .

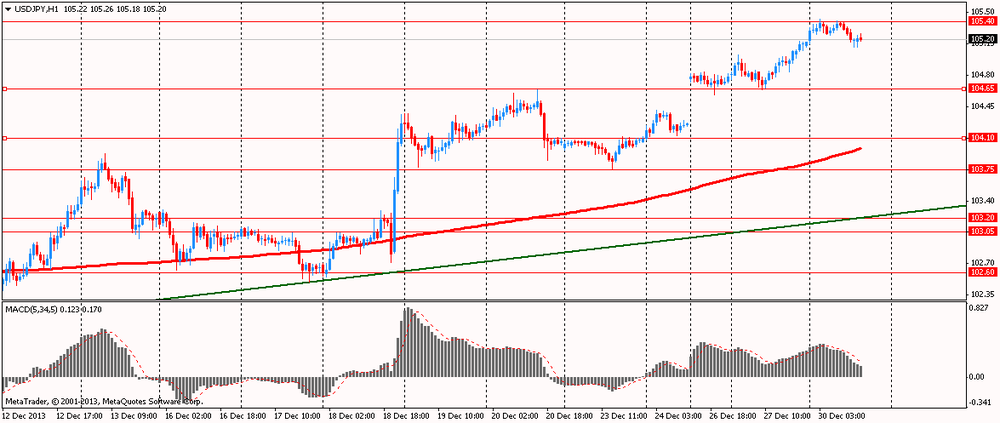

The Japanese yen has weakened substantially against the U.S. dollar and the euro , while the USD / JPY pair rose earlier to a new five-year highs Y105.42. Although many investors in the market see no reason for concern about downside risks to the U.S. dollar , they also point to the risks associated with a favorable scenario for the U.S. dollar , which include a potential rise in interest rates in the U.S. and change policies Japanese Prime Minister Shinzo Abe . Nevertheless , investors believe that the probability of these risks materializing is very low .

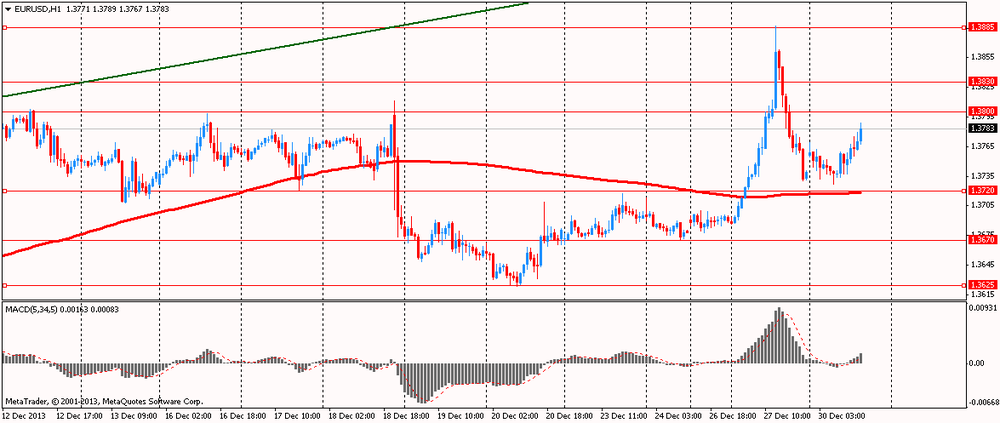

EUR / USD: during the European session, the pair rose to $ 1.3781

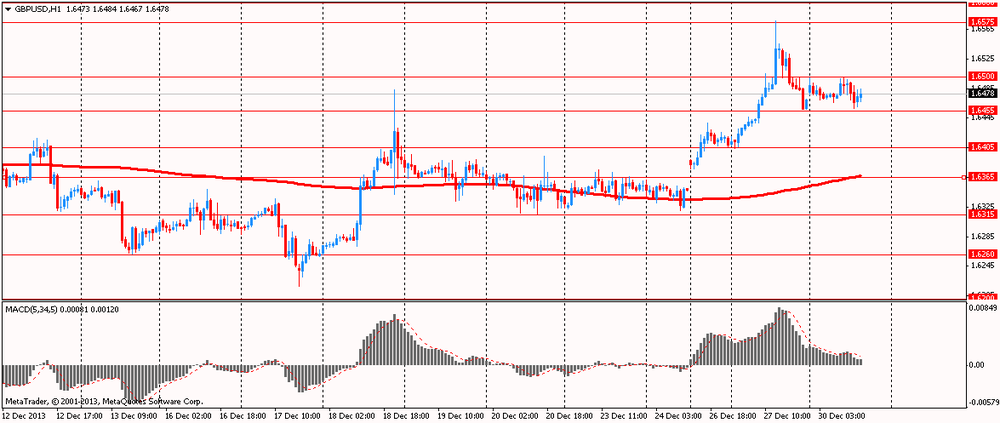

GBP / USD: during the European session, the pair rose to $ 1.6500 , then back up to $ 1.6458

USD / JPY: during the European session, the pair fell to Y105.11

At 15:00 GMT the U.S. will release the change in the volume of pending home sales for November.