- Oil rose

Notícias do Mercado

Oil rose

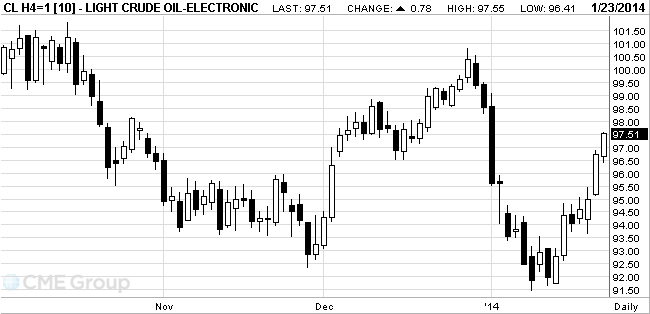

The cost of oil brand West Texas Intermediate rose to three-week high after a government report showed that U.S. inventories of distillates fell as demand rose.

Commercial crude oil inventories in the United States (excluding strategic reserves ) for the week ending January 17 , increased by 1 million barrels , or 0.3 % - to 351.2 million barrels , according to a weekly review of the country's Ministry of Energy .

Analysts believed that oil reserves will grow by only 588,000 barrels. Oil reserves increased for the first time since November.

While total gasoline inventories increased by 2.1 million barrels , or 0.9 %, to 235.3 million barrels . Distillate inventories decreased by 3.2 million barrels , or 2.6 % - to 120.7 million barrels .

The cost of oil is growing against the depreciation of the dollar after the publication of a series of statistical data from the United States .

The dollar index ( dollar to a basket of six currencies of countries - major trade partners of the U.S. ) fell by 0.74 % to 80.59 points.

Investors pay attention to data on the U.S. housing market . Number of home sales in the secondary market in December increased by 1 % compared to November - to 4.87 million. Data were worse than analysts' forecasts , which expect that the number of transactions amounts to 4.99 million.

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 97.79 per barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture fell 42 cents , or 0.4 percent, to $ 107.85 a barrel on the London exchange ICE Futures Europe.