- European session: the euro fell

Notícias do Mercado

European session: the euro fell

08:00 Switzerland KOF Leading Indicator January 1.95 2.02 1.98

08:55 Germany Unemployment Change January -15 -5 -28

08:55 Germany Unemployment Rate s.a. January 6.9% 6.9% 6.8%

09:30 United Kingdom Net Lending to Individuals, bln December 1.5 1.9 1.7

09:30 United Kingdom Mortgage Approvals December 70.8 72.5 71.6

10:00 Eurozone Business climate indicator January 0.2 Revised From 0.27 0.34 0.19

10:00 Eurozone Economic sentiment index January 100.4 Revised From 100.0 101.0 100.9

10:00 Eurozone Industrial confidence January -3.4 -3.0 -3.9

13:00 Germany CPI, m/m (Preliminary) January +0.4% -0.4% -0.6%

13:00 Germany CPI, y/y (Preliminary) January +1.4% +1.5% +1.3%

Euro fell against the U.S. dollar despite the strong data on the labor market in Germany sentiment in the eurozone economy . German unemployment fell in January, more than forecast , as companies were more confident in the strength of Europe's largest economy . Number of people out of work fell by a seasonally adjusted 28,000 to 2.93 million , after falling by 19,000 in December , reported the Federal Labour Agency . Economists had forecast a drop of 5000 . Adjusted unemployment rate was 6.8 percent, almost unchanged from December , and remained near the minimum of twenty years . Unemployment fell by 16,000 in West Germany and 12,000 in the eastern part .

In turn, in the euro area level of economic confidence rose ninth consecutive month in January , data showed on Thursday a survey from the European Commission .

Economic sentiment index rose to 100.9 in January from 100.4 in the previous month . But at the same time the reading was slightly lower than expected level of 101.

Confidence in industry fell unexpectedly by 0.5 to -3.9 in January , as a consequence of the management worsened assessment of stocks of finished products. The result was predicted to improve to -3.0 . Confidence in the services sector grew by 1.9 points to 2.3 , resulting in improved estimates of expected demand and past business situation , while the assessment of the past demand has not changed much .

In addition , consumer confidence has improved markedly to 11.7 , being in accordance with a preliminary estimate , compared with 13.5 in December. The increase was primarily due to improved expectations about future unemployment and the general economic situation . The result was above its long-term average for the first time since July 2011 . Confidence in the retail sector increased to -3.4 -5 , due to improvements in all of its three components, namely the present and expected business situation and the assessment of stocks.

Meanwhile , confidence in the construction sector fell strongly to -30.1 from -26.4 as a result of a marked deterioration in ratings portfolio managers orders and deteriorating employment expectations . In January, the business climate indicator for the euro area almost unchanged at 0.19 compared to 0.20 in December. Economists had expected the result 0.34. Production expectations leaders , their assessment of past production, and general and export order book remained broadly unchanged . At the same time , the level of stocks of finished products was evaluated more negatively .

The British pound fell against the dollar after the number of approved applications for mortgage loans in the UK in December rose less than forecast , but this figure was the highest in the last six years. These are the data published by the Bank of England on Thursday .

The number of permits for house purchase rose to 71,638 in December from a revised 70,820 in November. Economists had expected the figure to rise to 72,500 by November initial 70,758 .

The latter figure is the highest since January 2008 , when the number of mortgage approvals was 71,999 .

Loans secured by housing increased by 1.7 billion pounds , while economists expected an increase of 1.2 billion pounds .

Consumer loans increased by 0.6 billion pounds , while economists had expected growth to 0.7 billion pounds.

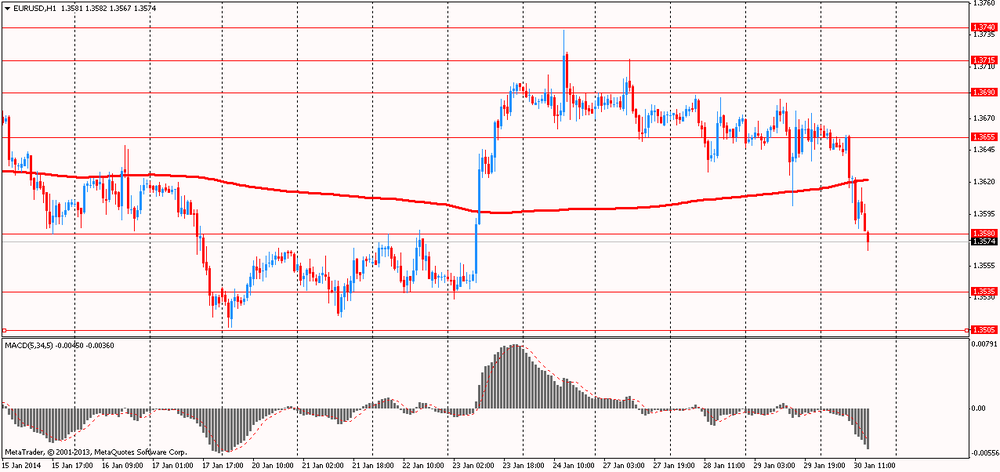

EUR / USD: during the European session, the pair fell to $ 1.3582

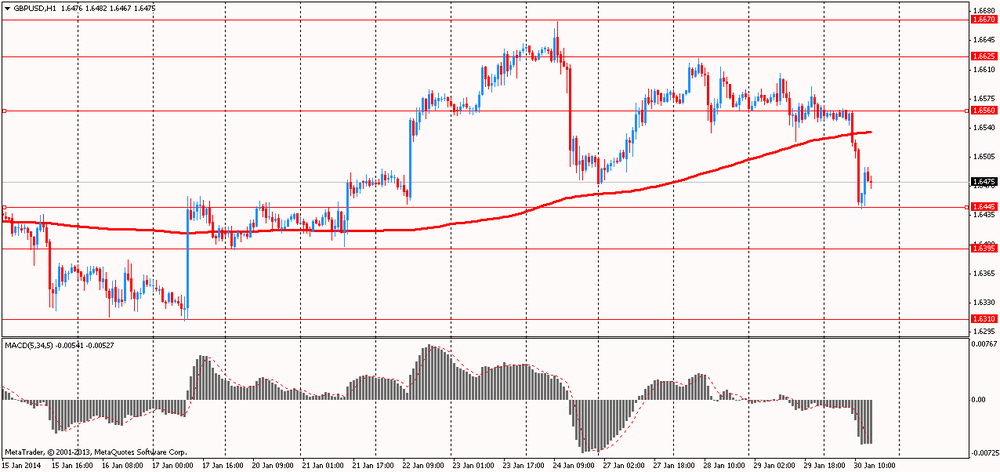

GBP / USD: during the European session, the pair fell to $ 1.6443

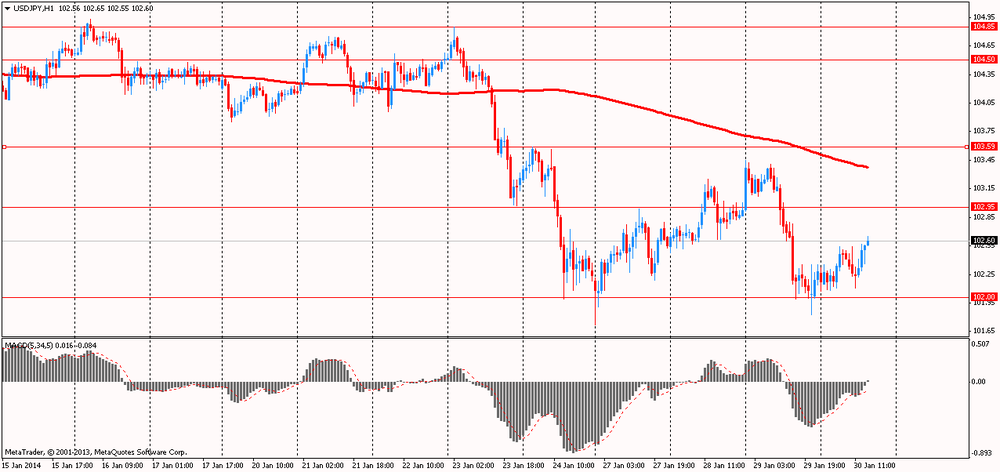

USD / JPY: during the European session, the pair rose to Y102.65

In the U.S. at 13:30 GMT will be released preliminary data on changes in GDP , the GDP price index , the index of personal consumption expenditures , the main index of personal consumption expenditures for the 4th quarter , in 15:00 GMT - the change in volume of pending home sales for December. At 21:45 New Zealand will present the trade balance (for 12 months , from the beginning of the year ) , the balance of foreign trade in December. At 23:00 GMT a speech control RBNZ Graham Wheeler . At 23:30 GMT , Japan will release the change in the volume of expenditure of households , CPI , consumer price index excluding prices for fresh food , the consumer price index excluding prices for food and energy in December , Tokyo CPI , CPI Tokyo prices excluding fresh food , Tokyo CPI excluding prices for food and energy in January . At 23:50 GMT , Japan is to publish preliminary data on industrial production in December.