- Foreign exchange market. European session: the euro fell against the U.S. dollar after the release of the disappointing economic data in the Eurozone

Notícias do Mercado

Foreign exchange market. European session: the euro fell against the U.S. dollar after the release of the disappointing economic data in the Eurozone

Economic

calendar (GMT0):

00:00 Japan BOJ Governor Haruhiko Kuroda

Speaks

00:30 Australia Leading Index March 0.0% -0.5%

01:00 New Zealand ANZ Business Confidence May 64.8 53.5

01:30 Australia Construction Work Done Quarter I -1.1%

-0.3% +0.3%

05:45 Switzerland Gross Domestic Product (QoQ) Quarter

I +0.2%

+0.5% +0.5%

05:45 Switzerland Gross Domestic Product (YoY) Quarter I

+1.7% +2.1% +2.0%

06:00 Switzerland UBS Consumption Indicator April 1.84 1.72

06:45 France Consumer spending April +0.4%

+0.5% -0.3%

06:45 France Consumer spending, y/y April -1.2% -0.5%

07:55 Germany Unemployment Change May -25 -14 24

07:55 Germany Unemployment Rate s.a. May 6.7% 6.7%

6.7%

08:00 Eurozone M3 money supply, adjusted y/y

April +1.1% +1.2%

+0.8%

08:00 Eurozone Private Loans, Y/Y April -2.2% -2.1%

-1.8%

10:00 United Kingdom CBI retail sales volume balance May 30 36 16

The U.S.

dollar traded higher against the most major currencies. The U.S. currency was

still boosted by the better-than-expected U.S. economic data, published on

Tuesday. U.S. durable goods orders rose 0.8% in April, after a 2.9% gain in

March. The U.S. consumer confidence index climbed to 83.0 in May, from 81.7 in

April.

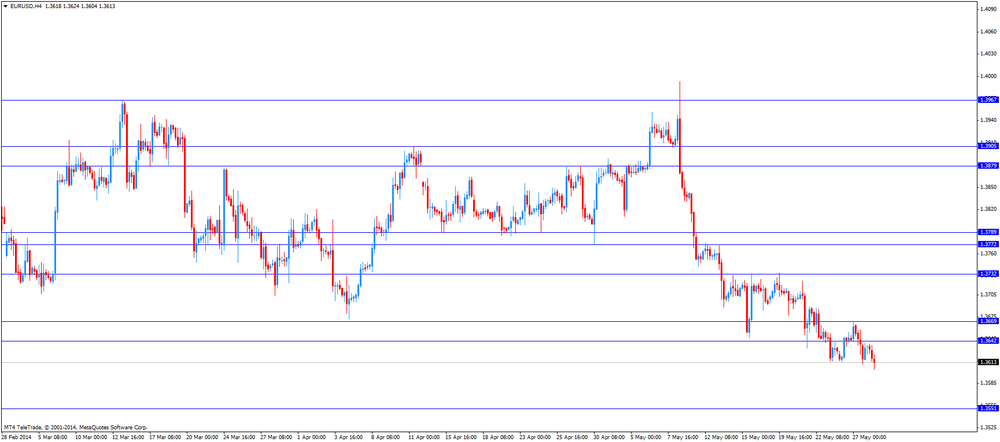

The euro

fell against the U.S. dollar after the release of the disappointing economic

data in the Eurozone. The number of people unemployed in Germany surged by

24,000 this month to 2.905 million. That was the largest increase in five years

in May. Analysts had expected a decline by 14,000.

The German

unemployment rate remained unchanged at 6.7%. This figure was expected by

analysts.

Consumer

spending in France fell 0.3% in April, after a 0.4% gain in March. Analysts had

expected a 0.5 increase. On a yearly basis, consumer spending in France dropped

0.5% in April, after a 1.2% fall in March.

Adjusted M3

money supply in the Eurozone climbed 0.8% in April, after a 1.1% increase in

March. Analysts had forecasted a 1.2% gain.

Private

loans in the Eurozone declined 1.8% in April (March: -2.2%), beating

expectations of a 2.1% fall.

Expectations

for further stimulus measures by the European Central Bank continued to weigh

on the euro.

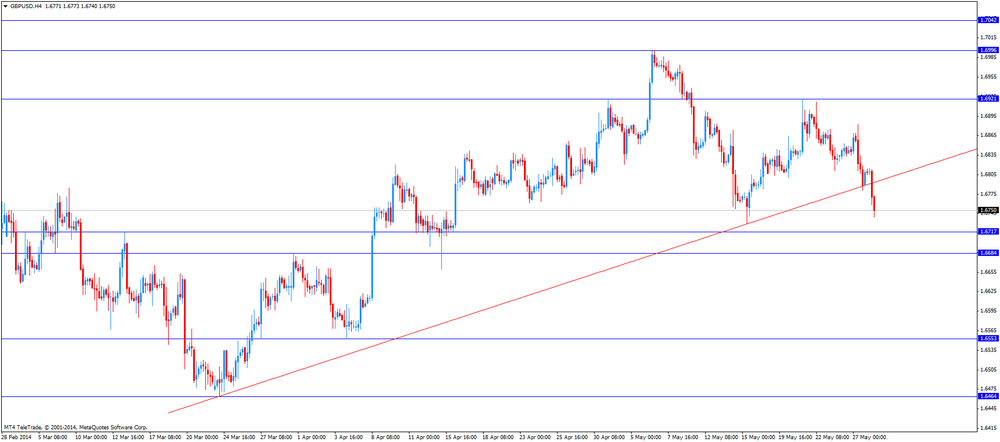

The British

pound hits 2.5-week lows against the U.S. dollar due to the

weaker-than-expected U.K. retail sale volumes. The Confederation of British

Industry released the U.K. retail sale volumes on Wednesday. The U.K. retail

sale volumes dropped unexpectedly in May. The CBI retail sales volume balance

was +16 in May, from +30 in April. It means that retail sales volume climbed in

May from last year.

The Swiss

franc traded lower against the U.S. dollar. Switzerland's gross domestic

product climbed 0.5% in the first quarter (Q4 2013: +0.2%), meeting analysts’

expectations.

On a yearly

basis, Switzerland's gross domestic product rose 2.0% in the first quarter (Q4

2013: +1.7%), missing analysts’ expectations of a 2.1% gain.

EUR/USD:

the currency pair declined to $1.3604

GBP/USD:

the currency pair dropped to $1.6740

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

23:50 Japan Retail sales, y/y April +11.0%

-3.2%