- Foreign exchange market. Asian session: the Japanese yen traded higher against the U.S. dollar after release of mixed economic data in Japan

Notícias do Mercado

Foreign exchange market. Asian session: the Japanese yen traded higher against the U.S. dollar after release of mixed economic data in Japan

Economic calendar (GMT0):

01:30 Australia Private Sector Credit, m/m April +0.4% +0.4% +0.5%

01:30 Australia Private Sector Credit, y/y April +4.4% +4.6%

05:00 Japan Housing Starts, y/y April -2.9% -8.2% -3.3%

06:00 Germany Retail sales, real adjusted April -0.7% +0.4% -0.9%

06:00 Germany Retail sales, real unadjusted, y/y April -1.9% +3.4%

07:00 Switzerland KOF Leading Indicator May 101.8 102.05 99.8

The U.S. dollar traded lower against the most major currencies after Thursday's weak U.S. economic growth data. The U.S. gross domestic product dropped 1.0% in the first quarter, after a 0.1% rise the previous quarter. Analysts had expected a 0.6% decline. That was the first drop in U.S. GDP since the first quarter of 2011.

The New Zealand dollar traded higher against the U.S dollar after the release of domestic building consents data in New Zealand. The number of new dwellings excluding apartments in New Zealand climbed 2.7% on year. That is the highest level since September 2007.

The building permits in New Zealand increased 1.5% in April, after an 8.3% gain in March.

The Australian dollar was up against the U.S. dollar after the release of the better-than-expected private sector credit data in Australia. The private sector credit data in Australia increased 0.5% in April, from a 0.4% rise in March. Analysts had expected a 0.4% gain. On a yearly basis, the private sector credit data in Australia rose 4.6% in April, from a 4.4% rise in March.

The Japanese yen traded higher against the U.S. dollar after release of mixed economic data in Japan. Japan's core consumer price index excluding fresh food climbed at an annual rate of 3.2% in April, after a 1.3% increase in March. That was the fastest pace since February 1991. Analysts had expected 3.1% rise.

Household spending in Japan declined by an annualized rate of 4.6% in April, after a 7.2% rise in March. Analysts had forecasted a 3.2% decrease.

The industrial production in Japan decreased 2.5% in April, after a 0.7% gain in March. Analysts had expected a 1.9% drop.

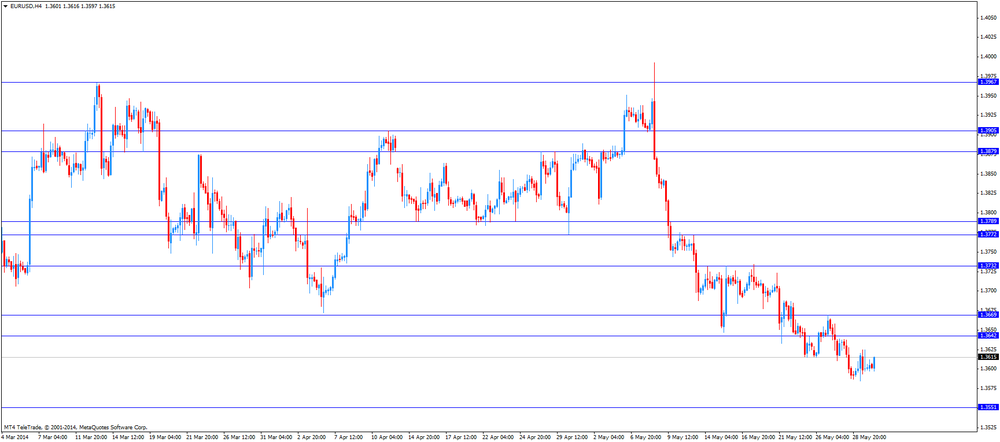

EUR/USD: the currency pair traded mixed

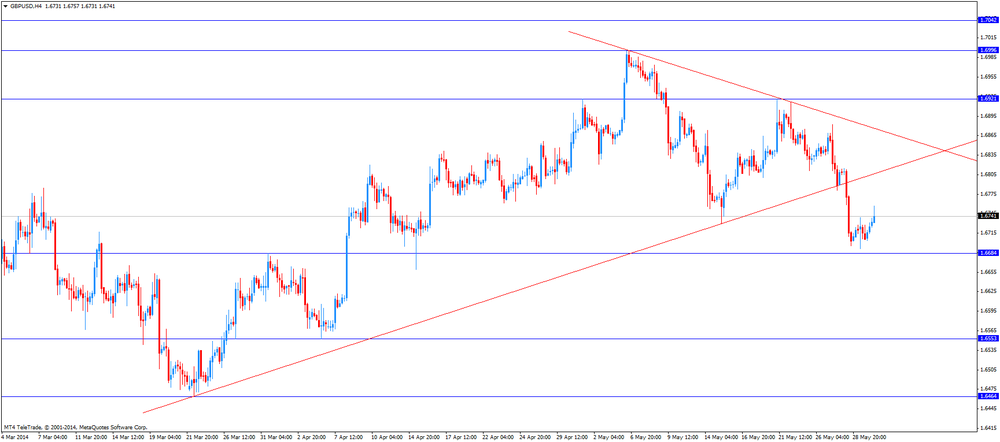

GBP/USD: the currency pair climbed to $1.6740

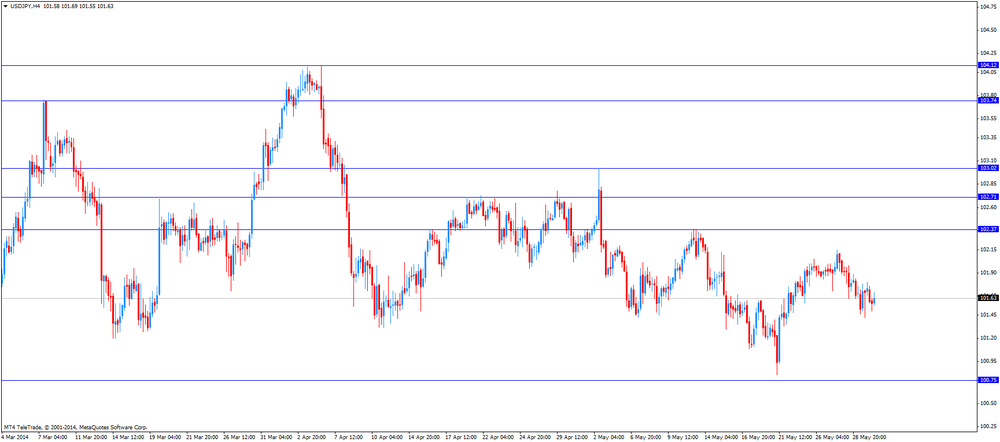

USD/JPY: the currency pair declined to Y101.50

The most important news that are expected (GMT0):

12:30 Canada Raw Material Price Index April +0.6% +1.2%

12:30 Canada GDP (m/m) March +0.2% +0.1%

12:30 U.S. Personal Income, m/m April +0.5% +0.3%

12:30 U.S. Personal spending April +0.9% +0.2%

12:30 U.S. PCE price index ex food, energy, m/m April +0.2% +0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y April +1.2%

13:45 U.S. Chicago Purchasing Managers' Index May 63.0 60.2

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) May 82.8 82.9

21:00 U.S. FOMC Member Charles Plosser Speaks