- Foreign exchange market. Asian session: the Australian dollar slid against the U.S. dollar after the release of the weak building permits data

Notícias do Mercado

Foreign exchange market. Asian session: the Australian dollar slid against the U.S. dollar after the release of the weak building permits data

Economic

calendar (GMT0):

00:30 Australia MI Inflation Gauge, m/m May +0.4% +0.3%

00:30 Australia MI Inflation Gauge, y/y May +2.8% +2.9%

01:30 Australia Building Permits, m/m April -4.8% +2.1% -5.6%

01:30 Australia Building Permits, y/y April +20.0% +1.1%

01:30 Australia Company Operating Profits Quarter I +1.7% +2.6% +3.1%

06:30 Australia Commodity Prices, Y/Y May -12.6% -12.8%

07:30 Switzerland Manufacturing PMI May 55.8 55.7 52.5

07:48 France Manufacturing PMI (Finally) May 51.2 49.3 49.6

07:53 Germany Manufacturing PMI (Finally) May 54.1 52.9 52.3

07:58 Eurozone Manufacturing PMI (Finally) May 52.5 52.5 52.2

08:30 United Kingdom Purchasing Manager Index Manufacturing May 57.3 57.1 57.0

08:30 United Kingdom Net Lending to Individuals, bln April 2.9 2.7 2.4

08:30 United Kingdom Mortgage Approvals April 67 64 62.9

The U.S.

dollar traded higher against the most major currencies despite Friday's mixed

U.S. economic growth data. The personal spending in the U.S. declined 0.1% in

April, after a 0.9% in March. Analysts had expected a rise of 0.2%.

The

personal income in the U.S. increased 0.3% in April, meeting expectations,

after a 0.5% gain in March.

Reuters/Michigan

consumer sentiment index declined to 81.9 in May, from 82.8 in April. Analysts

had forecasted the index to climb to 82.9.

The New

Zealand dollar traded lower against the U.S dollar. The decline of the kiwi was

driven by the weakness of the Australian dollar. Markets in New Zealand were

closed on Monday for a public holiday.

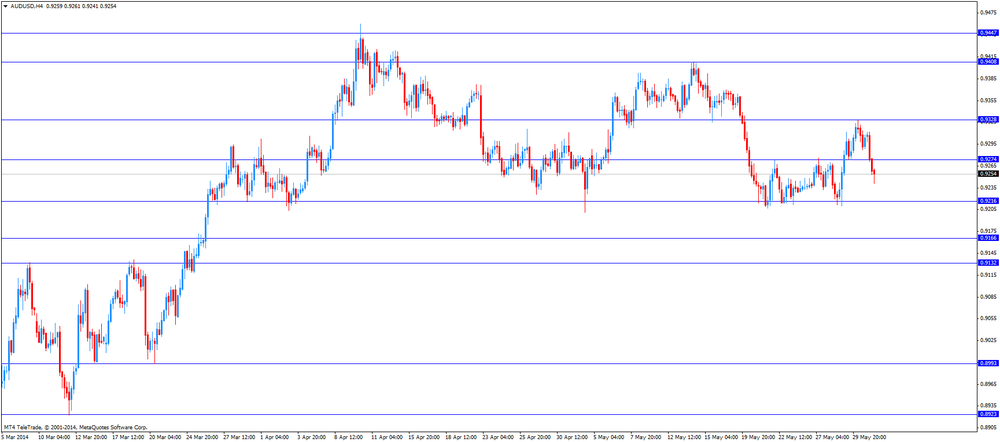

The

Australian dollar slid against the U.S. dollar after the release of the weak building

permits data in Australia. The number of building permits in Australia dropped

5.6% in April, after a decline of 4.8% in March. March’s figure was revised

down to 4.8% from a decrease of 3.5%. Analysts had expected a 2.1% gain. On a

yearly basis, the building permits in Australia rose 1.1% in April, after a

20.0% increase in March.

Company operating

profits in Australia increased 3.1% in the first quarter, after a 1.7% rise the

previous quarter. Analysts had forecasted a 2.6% gain.

AIG manufacturing

index in Australia climbed to 49.2 in May from 44.8 in April.

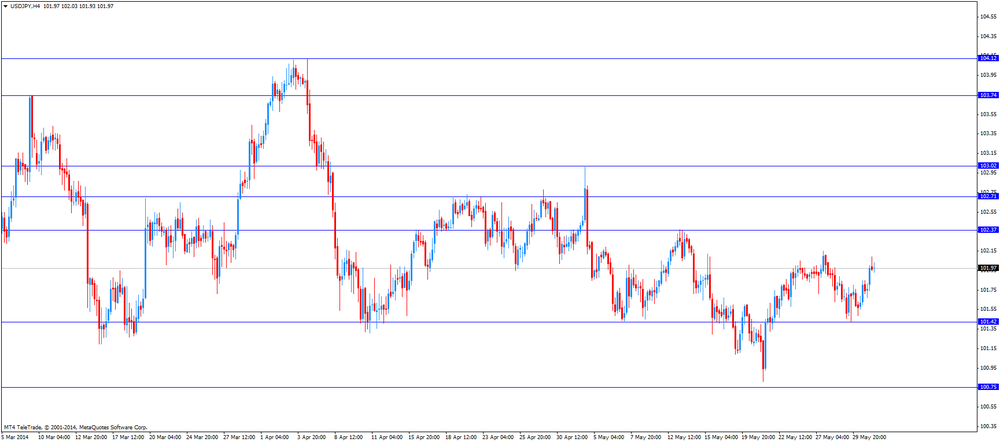

The

Japanese yen declined against the U.S. dollar after release of the

better-than-expected manufacturing purchasing managers' index (PMI) in China. China’s

PMI increased to 50.8 in May, beating expectations of a rise to 50.7 from 50.4

in April.

Capital spending

in Japan climbed 7.4% in the first quarter, after a 4.0% increase the previous

quarter.

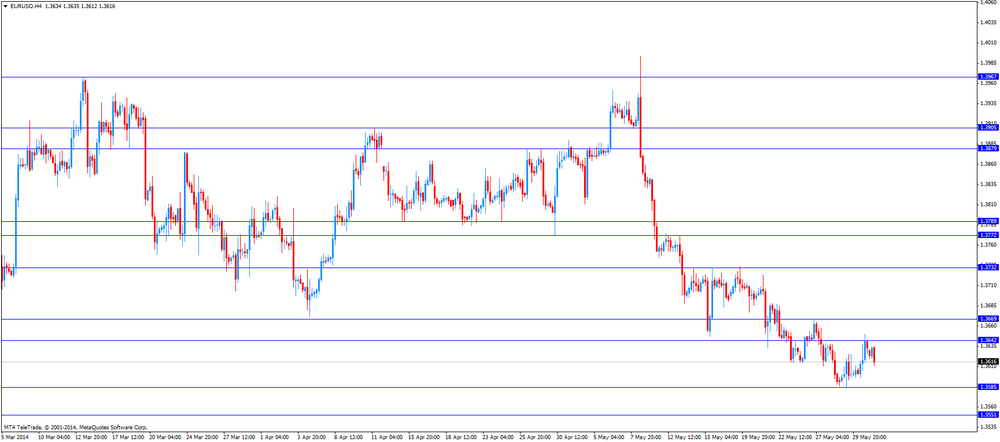

EUR/USD:

the currency pair traded mixed

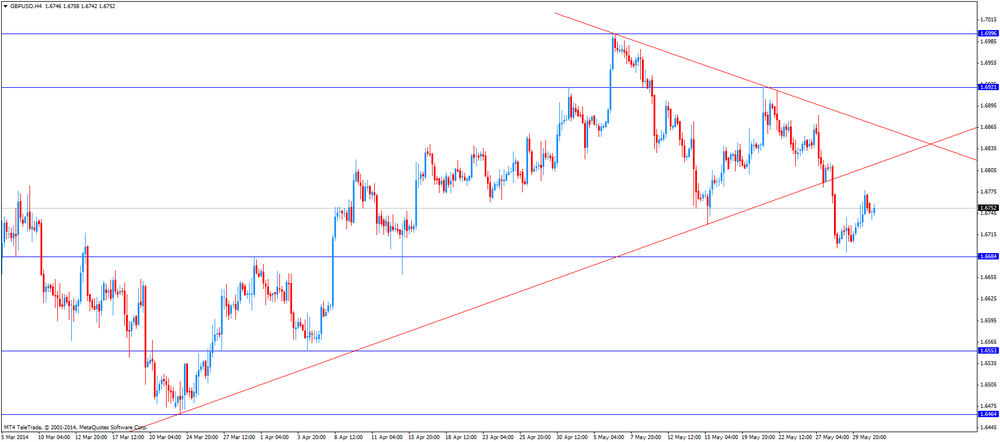

GBP/USD:

the currency pair declined to $1.6735

USD/JPY:

the currency pair climbed to Y102.10

AUD/USD: the currency pair dropped to $0.9258

The most

important news that are expected (GMT0):

12:00 Germany CPI, m/m (Preliminary) May -0.2% +0.1%

12:00 Germany CPI, y/y (Preliminary) May +1.3% +1.1%

14:00 U.S. ISM Manufacturing May 54.9 55.7

23:50 Japan Monetary Base, y/y May +48.5% +51.2%