- Foreign exchange market. European session: the British pound rose against the U.S. dollar due to the better-than-expected services PMI

Notícias do Mercado

Foreign exchange market. European session: the British pound rose against the U.S. dollar due to the better-than-expected services PMI

Economic

calendar (GMT0):

01:30 Australia Gross Domestic Product (QoQ) Quarter I +0.8%

+0.9% +1.1%

01:30 Australia Gross Domestic Product (YoY) Quarter I +2.8%

+3.5%

07:48 France Services PMI (Finally) May 49.2 49.2

49.1

07:53 Germany Services PMI (Finally) May 56.4 56.4

56.0

07:58 Eurozone Services PMI May 53.5 53.5

53.2

08:30 United Kingdom Purchasing Manager Index Services May

58.7 58.3 58.6

09:00 Eurozone Producer Price Index, MoM April -0.2% -0.1% -0.1%

09:00 Eurozone Producer Price Index (YoY) May -1.6% -1.2% -1.2%

09:00 Eurozone GDP (QoQ) (Revised) Quarter I +0.2% +0.2% +0.2%

09:00 Eurozone GDP (YoY) (Revised) Quarter I +0.9% +0.9% +0.9%

The U.S.

dollar traded lower against the most major currencies ahead of the release of

several U.S. economic reports.

The euro increased

against the U.S. dollar despite the weaker-than-expected economic data in the

Eurozone. Eurozone’s services purchase managers’ index (PMI) declined to 53.2

in May from 53.5 in April. Analysts had expected that the index remains

unchanged.

Eurozone’s

gross domestic product remained unchanged at 0.2% in the first quarter, meeting

analysts’ expectation.

Eurozone’s

producer price index fell 0.1% in April, after a 0.2% decline in March. This

figure was expected by analysts.

German

final services PMI declined to 56.0 in May from 56.4 in April. Analysts had

expected that the index remains unchanged.

French

final services PMI sank to 49.1 in May from 49.2 in April. Analysts had

expected that the index remains unchanged.

Market

participants expect the European Central Bank will add further stimulus

measures on Thursday. Investors are awaiting the ECB will cut interest rates

and announce measures to boost lending to smaller businesses.

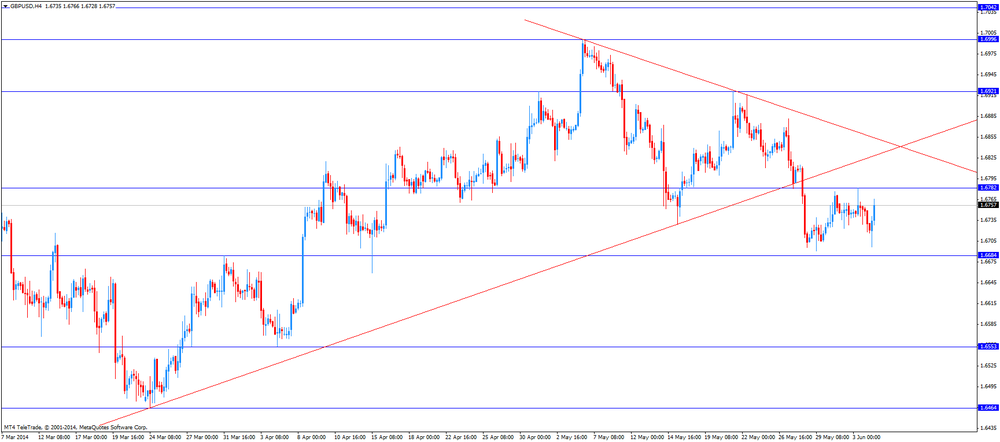

The British

pound rose against the U.S. dollar due to the better-than-expected services PMI.

The U.K. services purchasing managers' index declined to 58.6 in May, from 58.7

in April, but exceeding analysts’ expectations for a decline to 58.3.

The

Canadian dollar traded higher against the U.S. dollar ahead of the Canadian

trade balance data and the Bank of Canada’s interest rate decision. The

Canadian trade balance deficit should be 0.2 billion CAD, after a surplus of

0.1 billion CAD.

Interest

rate in Canada should remain unchanged at 1.00%.

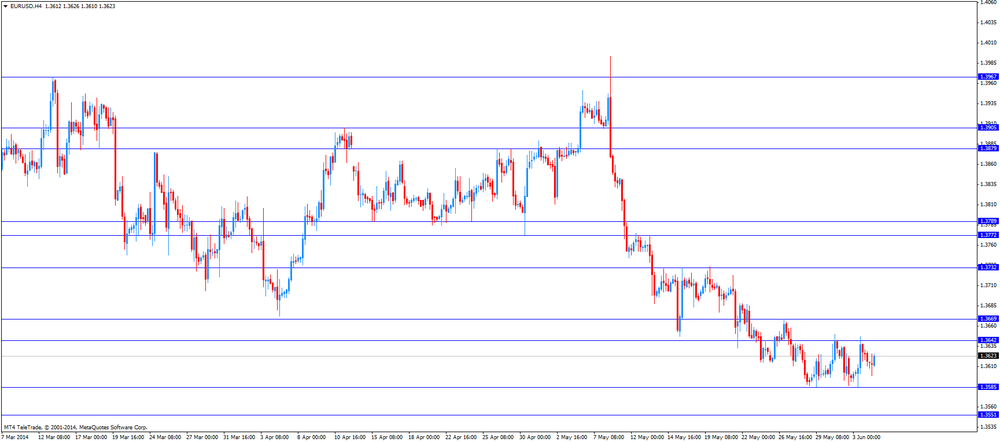

EUR/USD:

the currency pair increased to $1.3626

GBP/USD:

the currency pair climbed to $1.6766

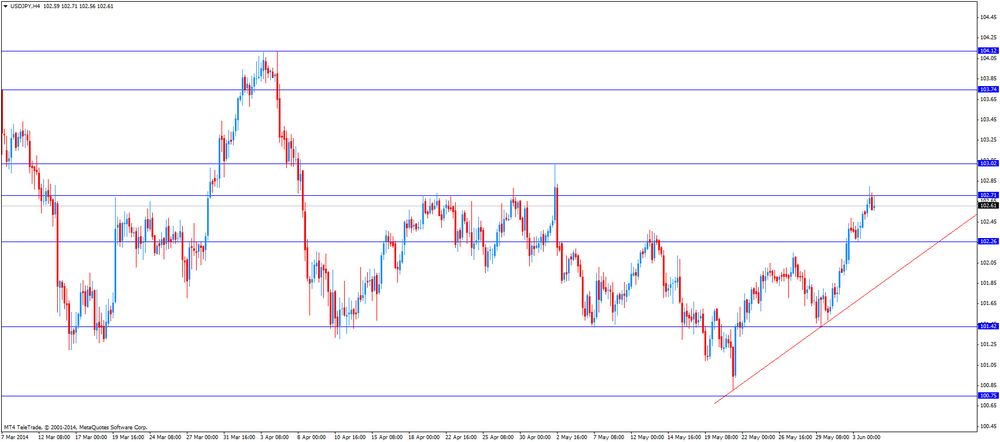

USD/JPY:

the currency pair decreased to Y102.56

The most

important news that are expected (GMT0):

12:00 G7

G7 Meetings

12:15 U.S. ADP Employment Report May 220 217

12:30 Canada Trade balance, billions April 0.1 -0.2

12:30 U.S. International Trade, bln April -40.4 -40.8

12:30 U.S. Nonfarm Productivity, q/q

(Finally) Quarter I -1.7%

-2.2%

14:00 Canada Bank of Canada Rate

1.00% 1.00%

14:00 Canada BOC Rate Statement

14:00 U.S. ISM Non-Manufacturing May

55.2 55.6

18:00 U.S. Fed's Beige Book