- Foreign exchange market. Asian session: the U.S. dollar traded lower against the most major currencies after the European Central Bank’ interest rate cut

Notícias do Mercado

Foreign exchange market. Asian session: the U.S. dollar traded lower against the most major currencies after the European Central Bank’ interest rate cut

Economic

calendar (GMT0):

05:00 Japan Leading Economic Index April 107.1 106.2 106.6

05:00 Japan Coincident Index April 114.5 111.1

06:00 Germany Trade Balance April 14.8 14.3 17.7

06:00 Germany Industrial Production s.a. (MoM) April -0.5% +0.4% +0.2%

06:00 Germany Industrial Production (YoY) April +3.0% +1.8%

06:00 Germany Current Account April 19.5 18.4

06:45 France Trade Balance, bln April -4.9 -5.0 -3.9

07:00 Switzerland Foreign Currency Reserves April 438.9 444.4

07:15 Switzerland Consumer Price Index (MoM) May +0.1% +0.2% +0.3%

07:15 Switzerland Consumer Price Index (YoY) May 0.0% +0.1% +0.2%

08:30 United Kingdom Consumer Inflation Expectations Quarter II +2.8% +2.6%

The U.S.

dollar traded lower against the most major currencies after the European

Central Bank’ interest rate cut. The European Central Bank cut its interest rate

to 0.15% from 0.25%. Analysts had expected a cut to 0.1%.

The ECB

also cut its marginal lending to 0.40% from 0.75% and reduced its deposit rate

to -0.10% from 0.0%. The European Central Bank is the world’s first major

central bank to use a negative rate. The deposit rate of -0.10% means that

commercial bank will be charged for holding their reserves. This measure should

spur commercial banks to ramp up lending.

Investors

are awaiting the U.S. jobs market data later in the day.

The New

Zealand dollar increased against the U.S dollar. The kiwi was supported by after

the European Central Bank’ interest rate cut. No economic data was published in

New Zealand.

The Australian

dollar traded lower against the U.S. dollar after the release of the AI

Group/HIA construction index in Australia, but later recovered its losses. The AI

Group/HIA construction index for Australia increased to 46.7 in May from 45.9

in April. The index still remained in contractionary territory due to the

weakness in engineering and commercial construction. Figures above 50 indicate

expansion while figures below signal contraction.

The

Japanese yen traded higher against the U.S. dollar after the European Central

Bank’ interest rate cut. Japan’s leading economic index declined to 106.6 in

April from 107.1 in March, but exceeding expectations for a decline to 106.2.

Japan’s coincident

index slid to 111.1 in April from 114.5 in March.

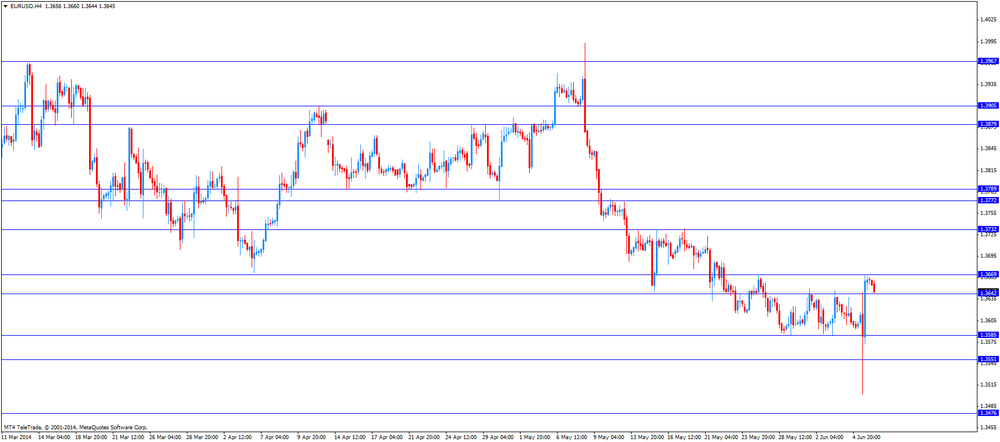

EUR/USD:

the currency pair traded mixed

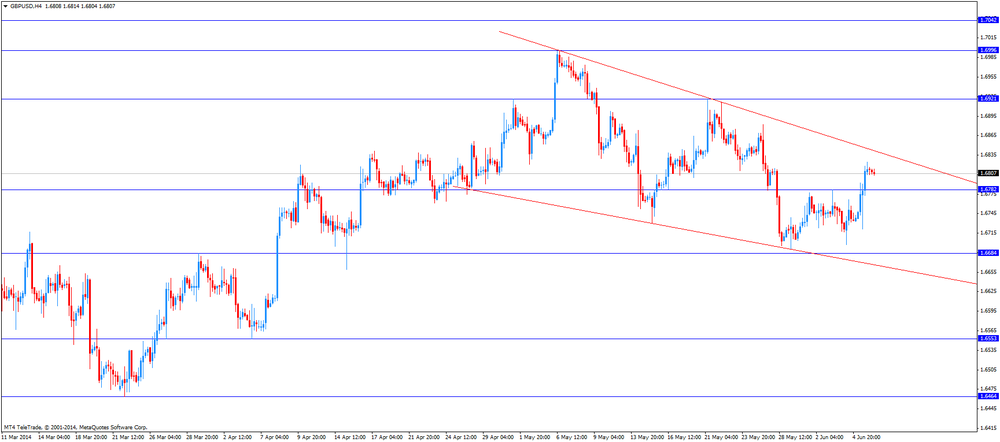

GBP/USD:

the currency pair traded mixed

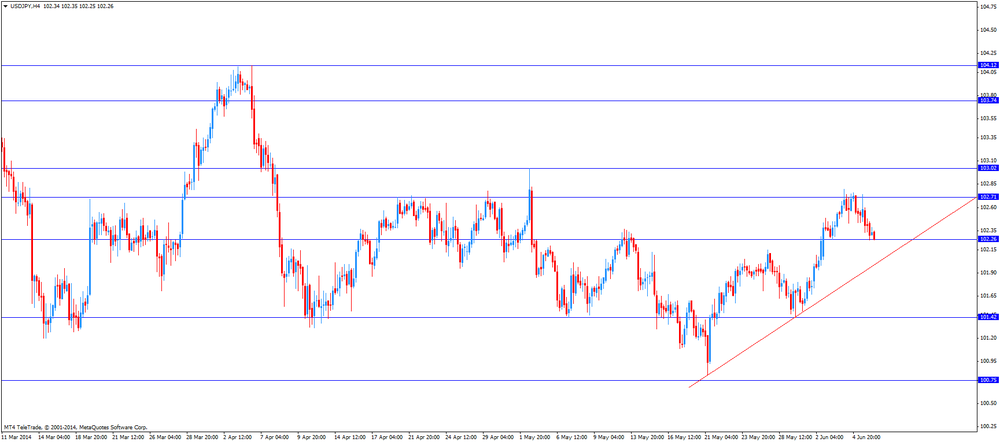

USD/JPY:

the currency pair declined to Y102.25

The most

important news that are expected (GMT0):

12:30 Canada Labor Productivity Quarter I +1.0% +0.7%

12:30 Canada Employment May -28.9 +12.3

12:30 Canada Unemployment rate May 6.9% 6.9%

12:30 U.S. Average hourly earnings May 0.0% +0.2%

12:30 U.S. Nonfarm Payrolls May 288 219

12:30 U.S. Unemployment Rate May 6.3% 6.4%