- Foreign exchange market. European session: the euro traded lower against the U.S. dollar, but recovered a part of its losses

Notícias do Mercado

Foreign exchange market. European session: the euro traded lower against the U.S. dollar, but recovered a part of its losses

Economic

calendar (GMT0):

05:00 Japan Leading Economic Index April 107.1 106.2

106.6

05:00 Japan Coincident Index April 114.5 111.1

06:00 Germany Trade Balance April 14.8 14.3

17.7

06:00 Germany Industrial Production s.a. (MoM) April -0.5% +0.4%

+0.2%

06:00 Germany Industrial Production (YoY) April +3.0% +1.8%

06:00 Germany Current Account April 19.5 18.4

06:45 France Trade Balance, bln April -4.9 -5.0 -3.9

07:00 Switzerland Foreign Currency Reserves April 438.9 444.4

07:15 Switzerland Consumer Price Index (MoM) May +0.1% +0.2%

+0.3%

07:15 Switzerland Consumer Price Index (YoY) May 0.0% +0.1%

+0.2%

08:30 United Kingdom Consumer Inflation Expectations Quarter II +2.8% +2.6%

The U.S.

dollar traded mixed against the most major currencies ahead of the U.S. jobs

market data. The unemployment rate in the U.S. should increase to 6.4% in May,

after 6.3% in April.

The number

of additional jobs in the private sector should climb by 218,000 jobs in May,

after 288,000 jobs in April.

The euro traded

lower against the U.S. dollar, but recovered a part of its losses. Market participants seemed to be unimpressed by

the stimulus measures by the European Central Bank.

German

economic data was released. Germany's trade surplus climbed to €17.7 billion in

April from €15.0 billion in March. March’s figure was revised up from a surplus

of €14.8 billion. Analysts had expected Germany’s trade surplus to increase to

€15.2 billion.

German

industrial production rose 0.2% in April, missing expectations for a 0.4% gain,

after a 0.5% decline in March. On a yearly basis, the industrial production in

Germany increased 1.8% in April, after a 3.0% rise in March.

Germany’s

current account surplus declined to €18.4 billion in April from €19.5 billion

in March.

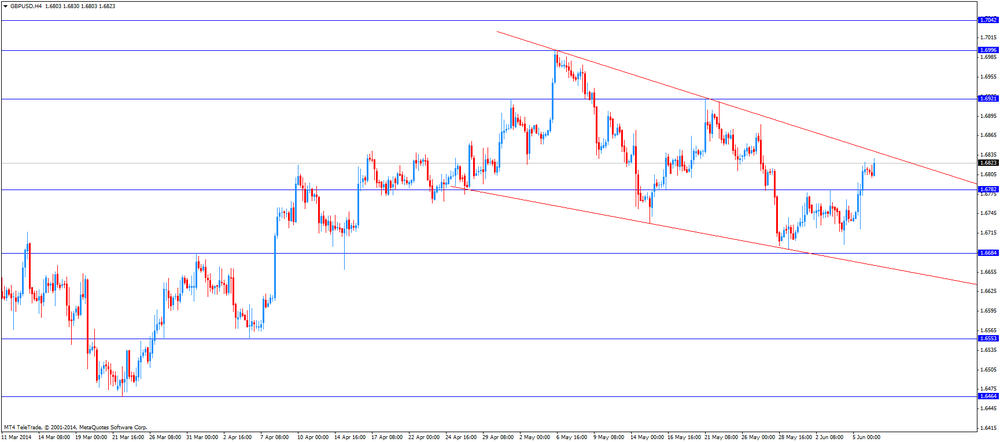

The British

pound traded mixed against the U.S. dollar. The U.K. trade deficit rose to

£8.92 billion in April, from £8.29 billion in March. March’s figure was revised

up from a deficit of £8.48 billion. Analysts had expected the U.K. trade

deficit to increase to £8.65 billion.

The U.K. consumer

inflation expectations declined to 2.6% from 2.8%.

The Swiss

franc traded mixed against the U.S. dollar. Switzerland’s consumer price index climbed

0.3% in May, exceeding expectations for a 0.2% gain, after a 0.1% rise in April.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian labour market data. The unemployment rate in the Canada should remain unchanged at 6.9% in May.

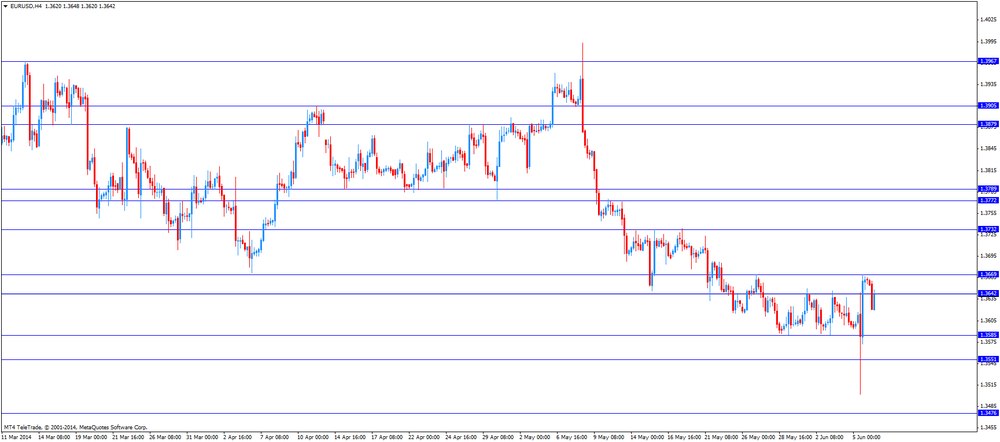

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair traded mixed

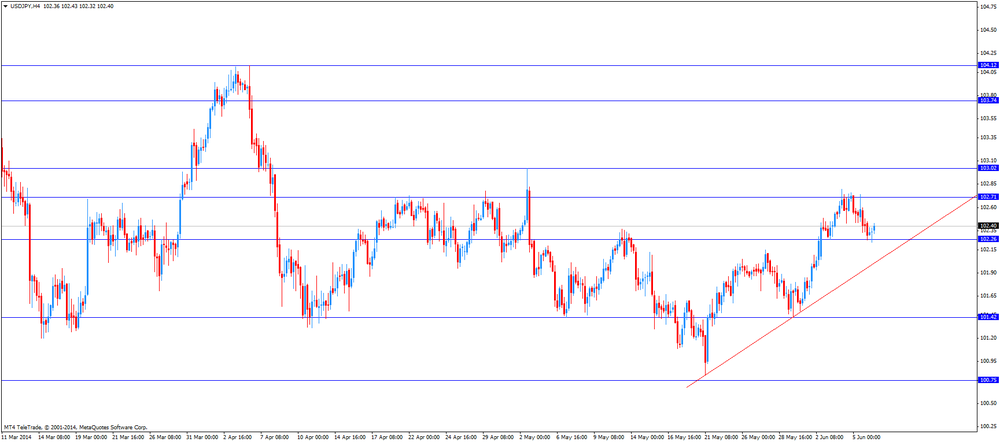

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

12:30 Canada

Labor Productivity

Quarter I +1.0% +0.7%

12:30 Canada

Employment

May -28.9 +12.3

12:30 Canada

Unemployment rate May 6.9% 6.9%

12:30 U.S.

Average hourly earnings May 0.0% +0.2%

12:30 U.S.

Nonfarm Payrolls

May 288 219

12:30 U.S.

Unemployment Rate May 6.3% 6.4%