- Foreign exchange market. Asian session: Friday’s weaker-than-expected U.S. economic data and escalating violence in Iraq weighed on markets

Notícias do Mercado

Foreign exchange market. Asian session: Friday’s weaker-than-expected U.S. economic data and escalating violence in Iraq weighed on markets

Economic

calendar (GMT0):

03:20 Australia RBA Assist Gov Kent Speaks

05:00 Japan BoJ monthly economic report June

The U.S.

dollar traded mixed against the most major currencies. Friday’s

weaker-than-expected U.S. economic data and escalating violence in Iraq weighed

on markets. The U.S. producer price index decreased 0.2% in May, missing

expectations for a 0.1% increase, after a 0.6 rise in April. The U.S. producer price index excluding food

and energy declined 0.1% in May, missing expectation for a 0.2% rise, after a

0.5% gain in April.

Reuters/Michigan

consumer sentiment index for the U.S. fell to 81.2 in June from 81.9 in May,

missing expectations for a rise to 83.2.

The

violence in Iraq could lead to disruptions in the oil supplies in OPEC’s

second-biggest oil producer. U.S. president Barack Obama warned to use air

strikes to help the government in Baghdad.

The New

Zealand dollar traded higher against the U.S dollar due to the Friday’s weaker

economic data from U.S. The Westpac index of consumer sentiment for Q2 declined

to 121.2 from 121.7 the previous quarter.

The

Australian dollar traded higher against the U.S. dollar in the absence of any

economic reports in Australia.

The Reserve

Bank of Australia Assistant Governor Christopher Kent said today that the unemployment

rate in Australia will remain elevated for the next two years. He added moderate

wage growth and better productivity should help the economy. Mr. Kent also

pointed out “a decline in the real exchange rate is one important way in which

the economy can adjust to the decline in the terms of trade”.

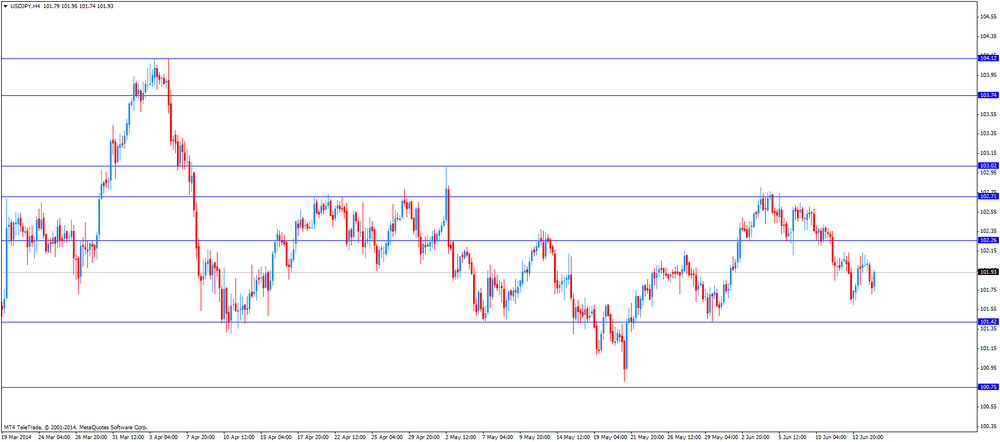

The

Japanese yen increased against the U.S. dollar due to the increasing demand for

safe-haven currency. The increasing demand for safe-haven currency was driven

by escalating violence in Iraq. No economic reports were released in Japan.

The Bank of

Japan (BoJ) released its monthly economic report. The BoJ said Japan's economy

has continued to recover moderately as a trend, but there is a decline in

demand following caused by the consumption tax hike.

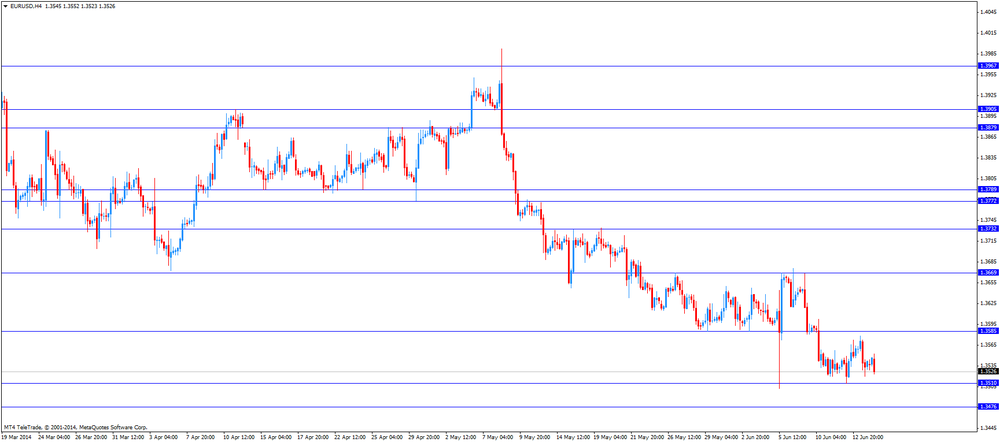

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair traded mixed

USD/JPY:

the currency pair declined to Y101.75

The most

important news that are expected (GMT0):

09:00 Eurozone Harmonized CPI May +0.2% -0.1%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) May +0.5% +0.5%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y May +0.7% +0.7%

12:30 Canada Foreign Securities Purchases April -1.23 4.27

12:30 U.S. NY Fed Empire State manufacturing index June 19.0 15.2

13:00 U.S. Net Long-term TIC Flows April 4.0 41.3

13:00 U.S. Total Net TIC Flows April -126.1

13:15 U.S. Industrial Production (MoM) May -0.6% +0.6%

13:15 U.S. Capacity Utilization May 78.6% 78.9%

14:00 U.S. NAHB Housing Market Index June 45 47