- Foreign exchange market. Asian session: the Australian dollar dropped against the U.S. dollar due to concerns over the violence in Iraq and comments by the Reserve Bank of Australia

Notícias do Mercado

Foreign exchange market. Asian session: the Australian dollar dropped against the U.S. dollar due to concerns over the violence in Iraq and comments by the Reserve Bank of Australia

Economic

calendar (GMT0):

01:30 Australia RBA Meeting's Minutes

01:30 Australia New Motor Vehicle Sales (MoM) May 0.0% 0.3%

01:30 Australia New Motor Vehicle Sales (YoY) May -1.9% -2.0%

05:45 Switzerland SECO Economic Forecasts Quarter III

07:15 Switzerland Producer & Import Prices, m/m May -0.3% 0.0% +0.1%

07:15 Switzerland Producer & Import Prices, y/y May -1.2% -0.8% -0.8%

08:30 United Kingdom Retail Price Index, m/m May +0.4% +0.2% +0.1%

08:30 United Kingdom Retail prices, Y/Y May +2.5% +2.5% +2.4%

08:30 United Kingdom RPI-X, Y/Y May +2.6% +2.5%

08:30 United Kingdom Producer Price Index - Input (MoM) May -1.1% +0.1% -0.9%

08:30 United Kingdom Producer Price Index - Input (YoY) May -5.5% -4.1% -5.0%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.0% +0.1% 0.0%

08:30 United Kingdom Producer Price Index - Output (YoY) May +0.6% +0.8% +1.0%

08:30 United Kingdom HICP, m/m May +0.4% +0.2% -0.1%

08:30 United Kingdom HICP, Y/Y May +1.8% +1.7% +1.5%

08:30 United Kingdom HICP ex EFAT, Y/Y May +2.0% +1.6%

The U.S.

dollar traded higher against the most major currencies. The demand for the U.S.

currency was supported by the violence in Iraq and the yesterday’s better-than

expected economic data.

Concerns

over the violence in Iraq and the resulting possible impact of higher oil

prices on global economic growth weighed on the risk-related currencies.

The NAHB

housing market index in the U.S. increased to 49 in June from 45 in May,

exceeding expectations for a gain to 47.

NY Fed

Empire State manufacturing index increased to 19.3 in June from 19.0 in May,

exceeding expectations from a decline to 15.2.

The New

Zealand dollar declined against the U.S dollar in the absence of any major economic

reports in New Zealand. Concerns over the violence in Iraq weighed on the kiwi.

The

Australian dollar dropped against the U.S. dollar due to concerns over the

violence in Iraq and comments by the Reserve Bank of Australia.

The Reserve

Bank of Australia (RBA) released minutes from its latest meeting. The RBA said

that the current stimulus measures continue to be appropriate and the economic

growth is expected to remain slightly below trend. Australia’s central bank

added inflation in Australia is to remain within the target range of 2% to 3%.

New motor

vehicle sales in Australia increased 0.3% in May, after a flat reading in

April. On a yearly basis, new motor vehicle sales in Australia declined 2.0% in

May, after a 1.9% drop in April.

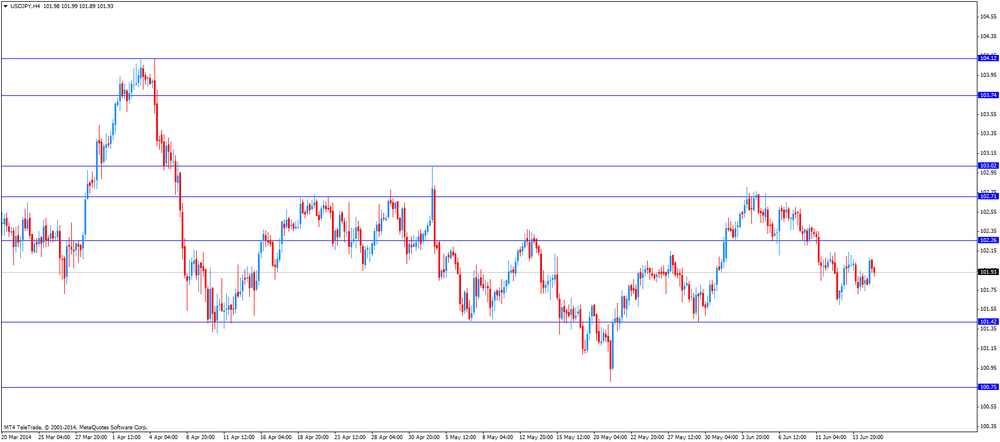

The

Japanese yen traded lower against the U.S. dollar in the absence of any major economic

reports in Japan.

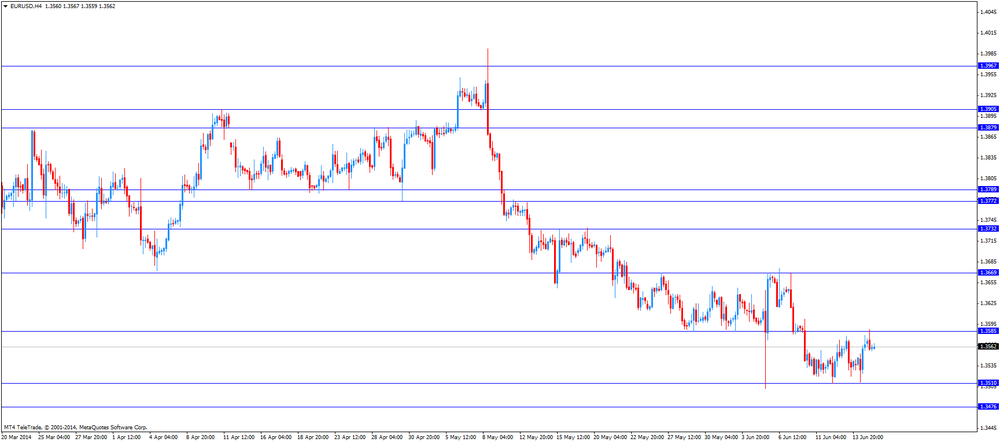

EUR/USD:

the currency pair declined to $1.3560

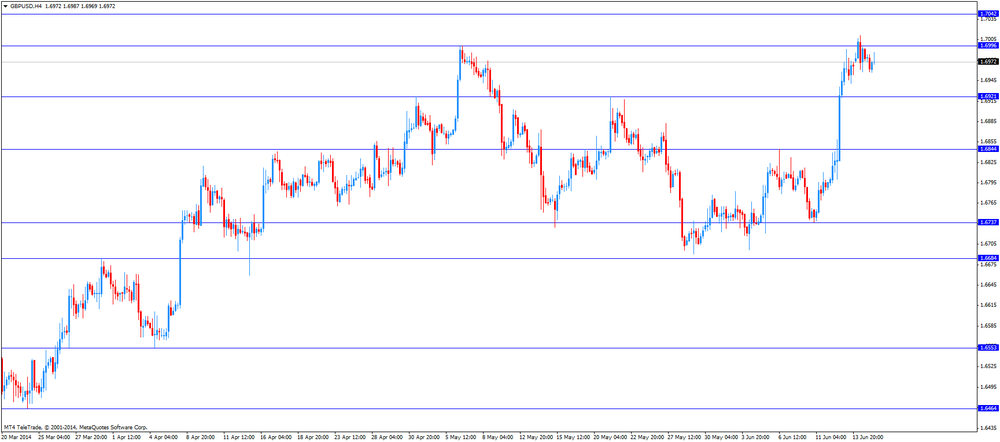

GBP/USD:

the currency pair decreased to $1.6960

USD/JPY:

the currency pair increased to Y102.10

The most

important news that are expected (GMT0):

12:30 U.S. Building Permits, mln May 1.08 1.07

12:30 U.S. Housing Starts, mln May 1.07 1.04

12:30 U.S. CPI, m/m May +0.3% +0.2%

12:30 U.S. CPI, Y/Y May +2.0% +2.0%

12:30 U.S. CPI excluding food and energy, m/m May +0.2% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y May +1.8% +1.8%

22:45 New Zealand Current Account Quarter I -1.43 1.42

23:50 Japan Monetary Policy Meeting Minutes

23:50 Japan Adjusted Merchandise Trade Balance, bln May -808.9 -1100