- Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the Bank of England’s June meeting minutes

Notícias do Mercado

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the Bank of England’s June meeting minutes

Economic

calendar (GMT0):

00:00 Australia Conference Board Australia

Leading Index April 0.0% -0.1%

00:30 Australia Leading Index April -0.5% +0.1%

08:30 United Kingdom Bank of England Minutes

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) June 7.4 10.0 4.8

11:15 United Kingdom MPC Member Weale Speaks

The U.S.

dollar traded mixed against the most major currencies ahead of the Fed’s

interest decision today. Market participants expect the Fed will cut its

monthly asset purchases by another $10 billion to $35 billion, but the Fed will

keep its interest rate unchanged until 2015.

The U.S.

currency was still supported by the yesterday’s better-than expected U.S.

consumer inflation. The consumer price index in the U.S. rose 0.4% in May,

exceeding expectations for a 0.2% gain, after a 0.3% increase in April.

The euro increased

against the U.S. dollar in the absence of any major economic reports in the

Eurozone.

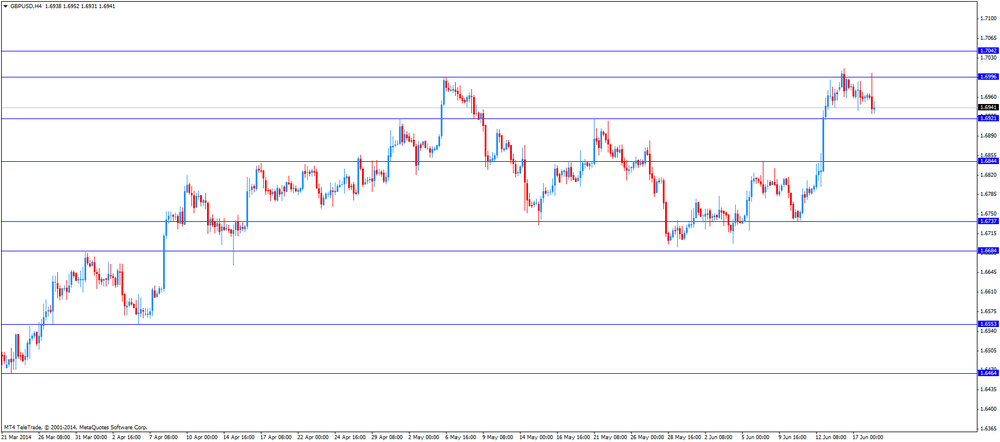

The British

pound traded lower against the U.S. dollar after the Bank of England’s June

meeting minutes. The BoE’s monetary policy committee voted unanimously to leave

interest rates unchanged at their record low of 0.5% and quantitative easing at

£375bn.

The Bank of

England policymakers were surprised that markets had not saw a higher chance of

an interest rate hike in 2014. But there are still concerns over interest hike

this year. The BoE said interest rise could reduce production capacity and it is

difficult to revoke the decision.

The Swiss

franc traded higher against the U.S. dollar. Credit Suisse ZEW indicator declined

to 4.8 points in June from 7.4 in May, missing expectations for an increase to

10.0 points.

The

Canadian dollar traded mixed against the U.S. dollar ahead of the wholesale sales

in Canada. The wholesale sales in Canada should climb 0.3% in April, after a 0.4%

decline in March.

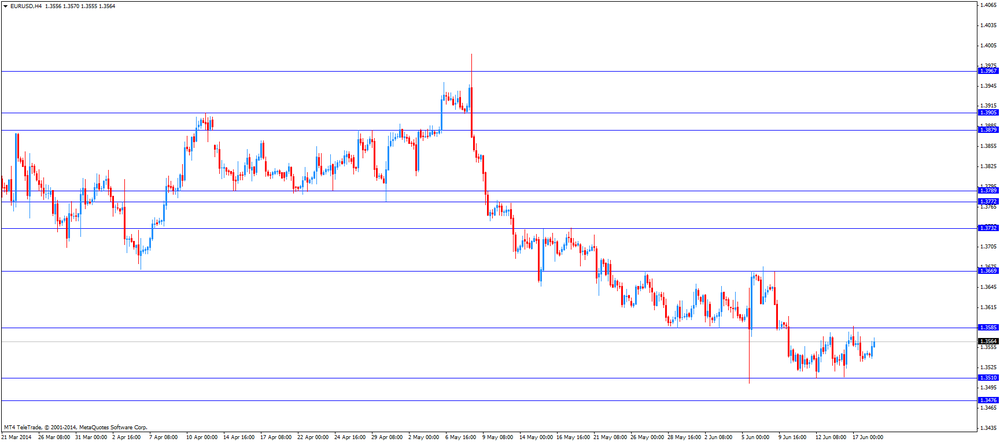

EUR/USD:

the currency pair increased to $1.3570

GBP/USD:

the currency pair declined to $1.6931

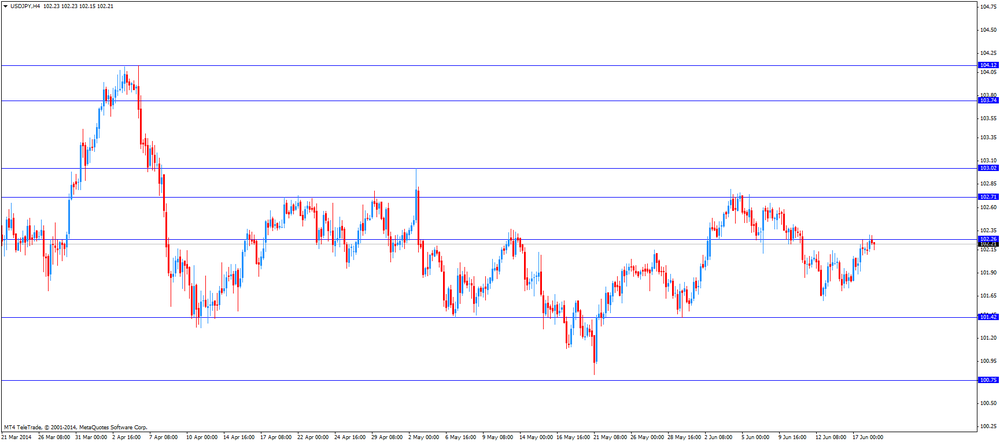

USD/JPY:

the currency pair fell to Y102.15

The most

important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m April -0.4%

+0.3%

12:30 U.S. Current account, bln Quarter

I -81 -96

17:30 United Kingdom MPC Member Andy Haldane Speaks

18:00 U.S. FOMC Economic

Projections

18:00 U.S. FOMC Statement

18:00 U.S. Fed Interest Rate

Decision

0.25% 0.25%

18:00 U.S. FOMC QE Decision

45 35

18:30 U.S. Federal Reserve Press

Conference

22:45 New Zealand GDP q/q

Quarter I +0.9% +1.2%

22:45 New Zealand GDP y/y

Quarter I +3.1% +3.7%