- Foreign exchange market. Asian session: the U.S. dollar traded slightly higher against the most major currencies due to concerns over the banking sectors in Southern European countries

Notícias do Mercado

Foreign exchange market. Asian session: the U.S. dollar traded slightly higher against the most major currencies due to concerns over the banking sectors in Southern European countries

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans May 0.0% -0.4% 0.0%

06:00 Germany CPI, m/m (Finally) June +0.3% +0.3% +0.3%

06:00 Germany CPI, y/y (Finally) June +0.9% +1.0% +1.0%

The U.S. dollar traded slightly higher against the most major currencies due to concerns over the banking sectors in Southern European countries. Especially, there are growing concerns over the financial health of Porugal's Espirito Santo Financial Group. Espirito Santo Financial Group is the largest lender in Portugal.

The New Zealand dollar traded mixed near 3-year highs against the U.S dollar. The food price index in New Zealand jumped 1.4% in June, after a 0.6% rise in May. On an annual basis, food prices in New Zealand increased 1.2% in June, after a 1.8% gain in May.

The monthly increase was driven by fresh vegetables and higher meat prices. The price of vegetables rose 8.9%. Poultry prices surged 9.9%.

The Australian dollar traded slightly lower against the U.S. dollar after home loans data from Australia. The number of home loans in Australia remained unchanged flat in May, beating expectations for a 0.4% decline.

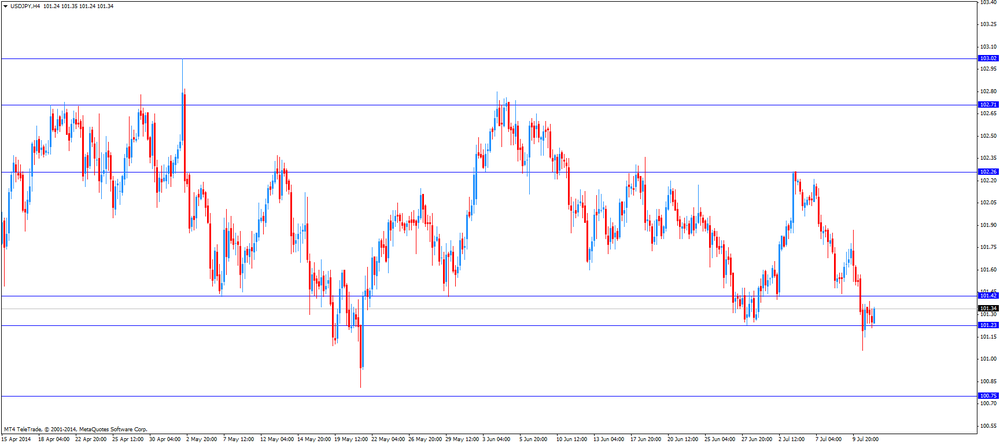

The Japanese yen traded higher against the U.S. dollar due to increasing demand for safe-haven yen. The yen was supported by concerns over the banking sectors in Southern European countries.

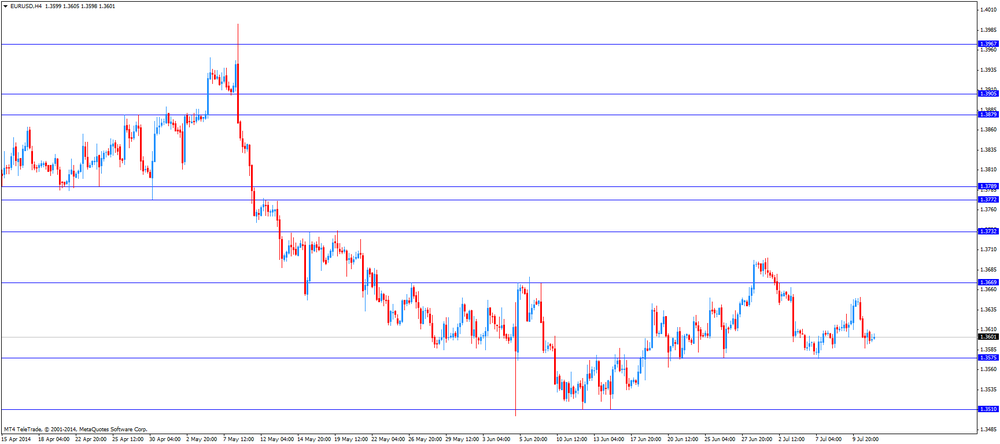

EUR/USD: the currency pair declined to $1.3595

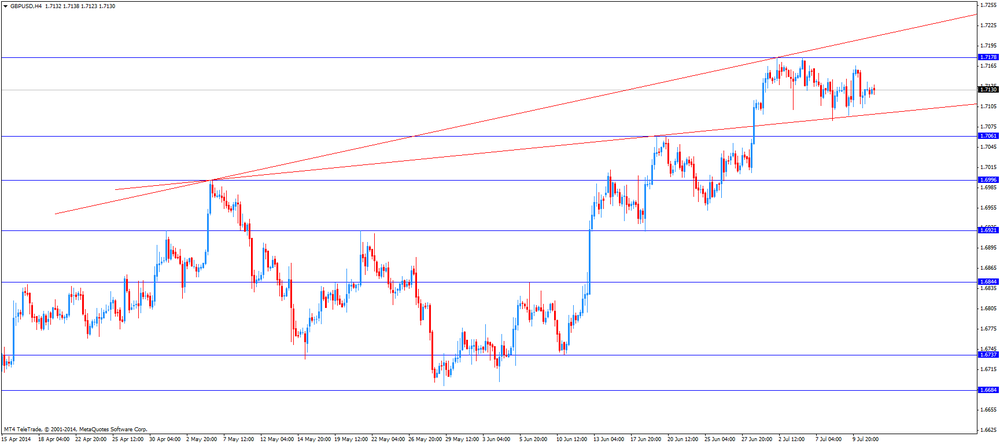

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair decreased to Y101.21

The most important news that are expected (GMT0):

12:30 Canada Employment June +25.8 +26.2

12:30 Canada Unemployment rate June 7.0% 7.0%

18:00 U.S. Federal budget June -130.0 79.0