- Foreign exchange market. European session: the euro rose against the U.S. dollar in quiet trade

Notícias do Mercado

Foreign exchange market. European session: the euro rose against the U.S. dollar in quiet trade

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Industrial Production (YoY) (Finally) May +0.8% +0.8% +1.0%

04:30 Japan Industrial Production (MoM) (Finally) May +0.5% +0.5% +0.7%

06:00 France Bank holiday

09:00 Eurozone Industrial production, (MoM) May +0.7% +0.3% -1.1%

09:00 Eurozone Industrial Production (YoY) May +1.4% +1.1% +0.5%

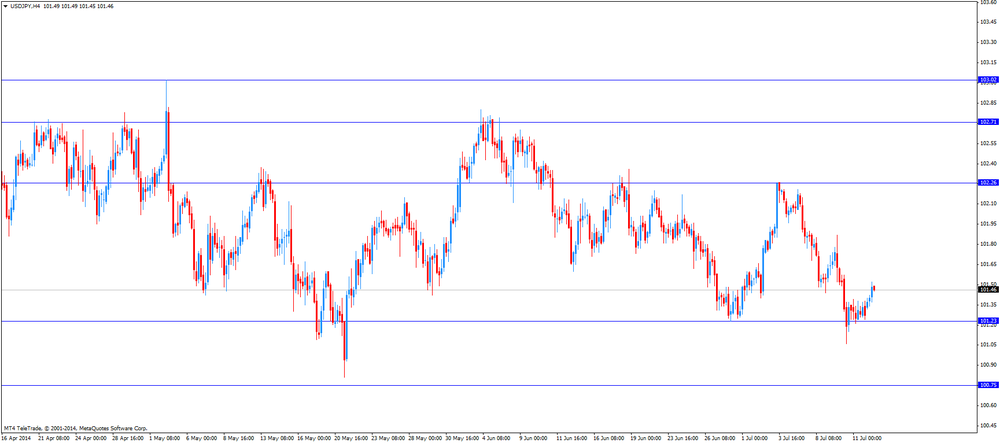

The U.S. dollar traded mixed against the most major currencies in quiet trade. No major economic reports will be released in the U.S. on Monday. Markets participants are awaiting the congressional testimony by Federal Reserve Chair Janet Yellen on Tuesday and Wednesday. They expect to hear new information on when the Fed could start to increase its interest rate.

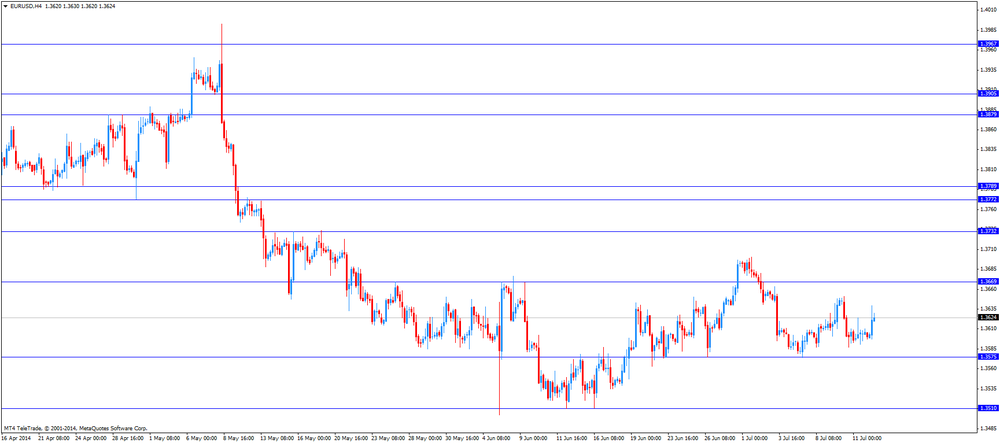

The euro rose against the U.S. dollar ahead of testimony by European Central Bank President Mario Draghi later in the day. The euro strengthened after Portugal's central bank eased market fears over the financial health of Banco Espirito Santo.

Eurozone's industrial production declined 3.3% in May, missing expectations for a 0.3% gain, after a 0.7% increase in April. April's figure was revised down from a 0.8 gain.

On a yearly basis, Eurozone's industrial production climbed 0.5% in May, missing expectations for a 1.1% rise, after a 1.4% gain in April.

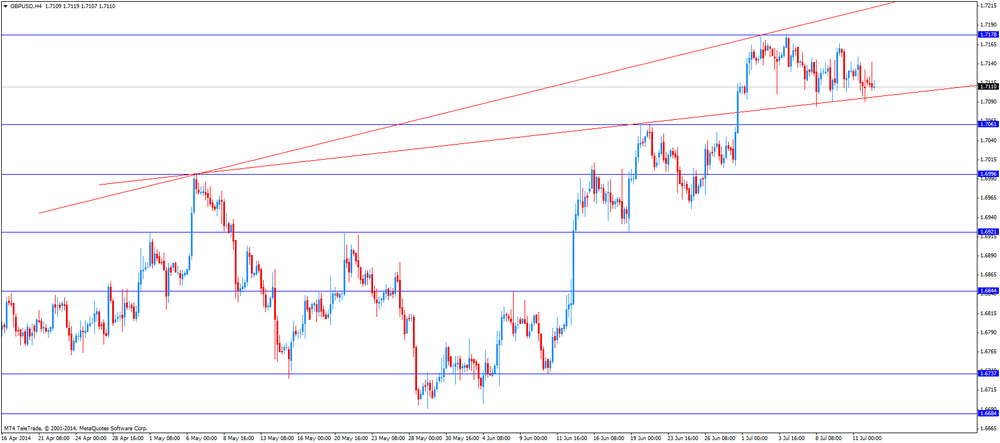

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

EUR/USD: the currency increased to $1.3639

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair was up to Y101.52

The most important news that are expected (GMT0):

17:30 Eurozone ECB President Mario Draghi Speaks

23:01 United Kingdom BRC Retail Sales Monitor y/y June +0.5%