- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after Eurozone's current account surplus

Notícias do Mercado

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after Eurozone's current account surplus

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:00 Eurozone Current account, adjusted, bln May 21.6 (Revised from 21.5) 24.3 19.5

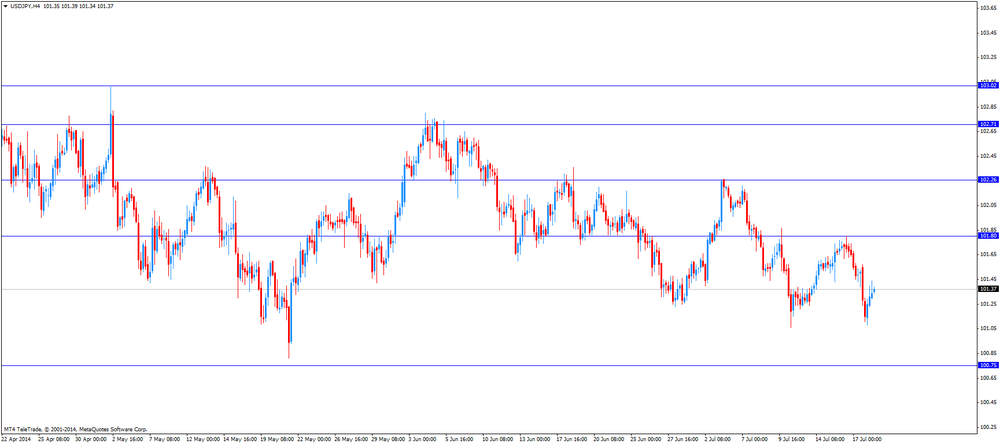

The U.S. dollar traded mixed to higher against the most major currencies ahead of the Reuters/Michigan consumer sentiment index. Analysts expect the index to increase to 83.5 in July from 82.5 in June.

Concerns over tensions in Ukraine and Israel's ground campaign in Gaza weighed on markets.

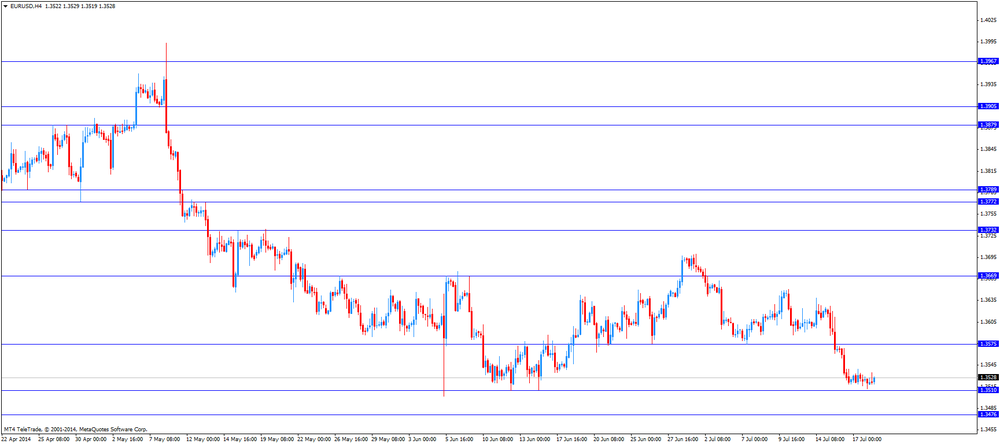

The euro traded mixed against the U.S. dollar after Eurozone's current account surplus. The current account surplus in the Eurozone declined to €19.5 billion in May from €21.6 billion in April, missing expectations for a rise to €24.3 billion. April's figure was revised up from a surplus of €21.5 billion.

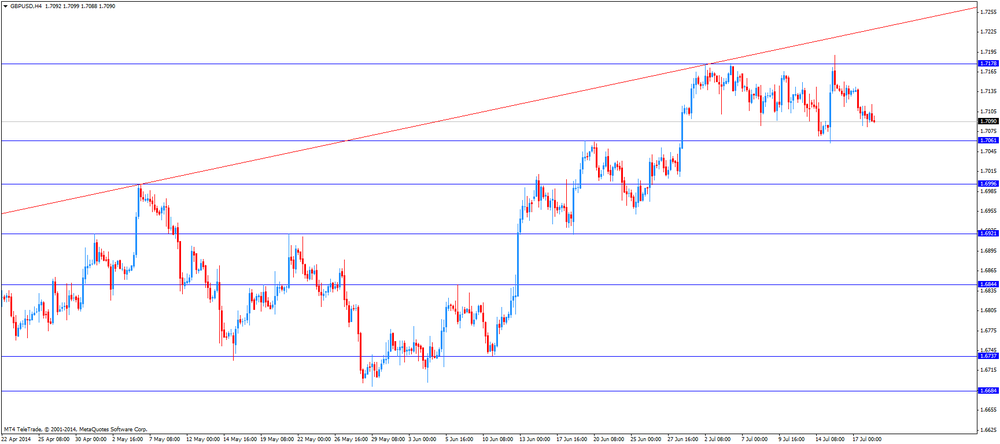

The British pound traded mixed against the U.S. dollar in the absence of any major market reports in the UK.

The Canadian dollar traded mixed against the U.S. dollar ahead consumer inflation data from Canada. Analysts expected the consumer price index to climb 0.4% in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y101.4

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m May +1.2% +0.7%

12:30 Canada Consumer Price Index m / m June +0.5% +0.4%

12:30 Canada Consumer price index, y/y June +2.3%

12:30 Canada Bank of Canada Consumer Price Index Core, m/m June +0.5% +0.4%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y June +1.7%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) July 82.5 83.5

14:00 U.S. Leading Indicators June +0.5% +0.6%