- Foreign exchange market. European session: the euro traded higher against the U.S. dollar in the absence of any major economic reports in the Eurozone

Notícias do Mercado

Foreign exchange market. European session: the euro traded higher against the U.S. dollar in the absence of any major economic reports in the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 France Bank holiday

08:30 United Kingdom GDP, q/q (Revised) Quarter II +0.8% +0.8% +0.8%

08:30 United Kingdom GDP, y/y (Revised) Quarter II +3.1% +3.1% +3.2%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the economic data from the U.S. Yesterday's disappointing the number of initial jobless claims in the U.S. weighed on the greenback. The number of initial jobless claims in the week ending August 9 rose by 21,000 to 311,000 from 290,000 in the previous week.

The euro traded higher against the U.S. dollar in the absence of any major economic reports in the Eurozone.

The British pound traded mixed against the U.S. dollar after the better-than-expected UK GDP. The UK gross domestic product grew at annual rate of 3.2% in the second quarter, exceeding expectations for a 3.1% gain, after a 3.1% rise in the first quarter. That was the fastest pace since the end of 2007.

On a monthly basis, the UK GDP increased 0.8% in the second quarter, in line with expectations, after a 0.8% rise in the first quarter.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian manufacturing shipments. The Canadian manufacturing shipments are expected to climb 0.5% in June, after a 1.6% gain in May.

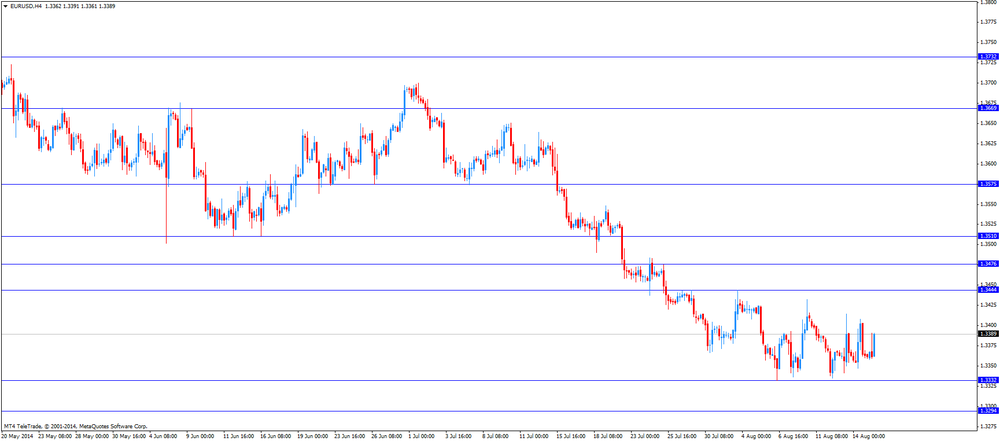

EUR/USD: the currency pair rose to $1.3391

GBP/USD: the currency pair traded mixed

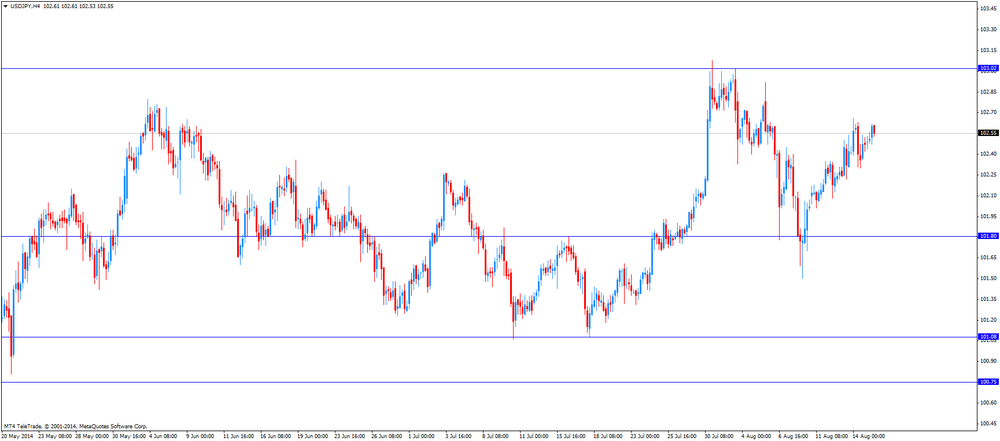

USD/JPY: the currency pair increased to Y102.62

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) June +1.6% +0.5%

12:30 U.S. PPI, m/m July +0.4% +0.1%

12:30 U.S. PPI, y/y July +1.9% +1.8%

12:30 U.S. PPI excluding food and energy, m/m July +0.2% +0.2%

12:30 U.S. PPI excluding food and energy, Y/Y July +1.8% +1.6%

12:30 U.S. NY Fed Empire State manufacturing index August 25.6 20.3

13:00 U.S. Total Net TIC Flows June 19.4 27.3

13:00 U.S. Net Long-term TIC Flows June 35.5

13:15 U.S. Industrial Production (MoM) July +0.2% +0.3%

13:15 U.S. Capacity Utilization July 79.1% 79.2%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) August 81.3 82.7