- Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies

Notícias do Mercado

Foreign exchange market. European session: the U.S. dollar traded mixed against the most major currencies

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence September +3.8% -4.6%

05:30 France Non-Farm Payrolls (Finally) Quarter II +0.1% +0.1% +0.1%

06:45 France Industrial Production, m/m July +1.2% Revised From +1.3% -0.4% +0.2%

06:45 France Industrial Production, y/y July -0.4% +0.1%

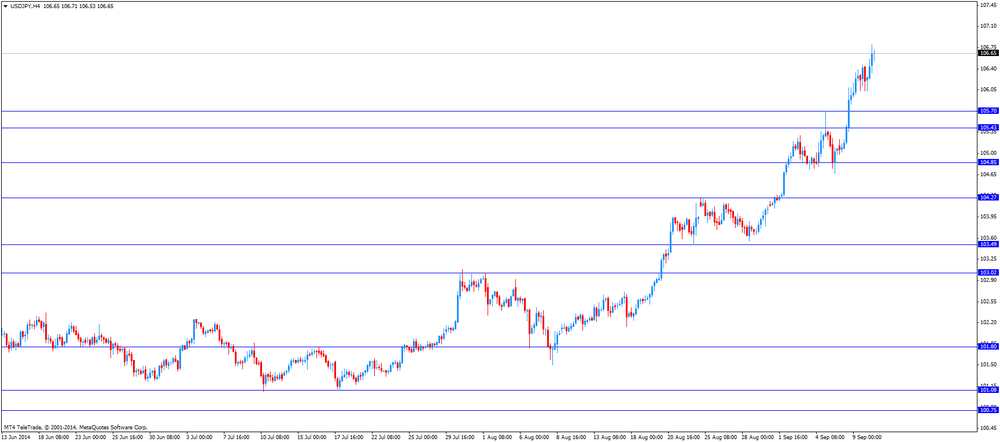

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by Monday's San Francisco Federal Reserve research report. The report showed that investors were underestimating the start of interest rate hike by the Fed. Market participants have concerns the Fed may raise its interest rate sooner than expected.

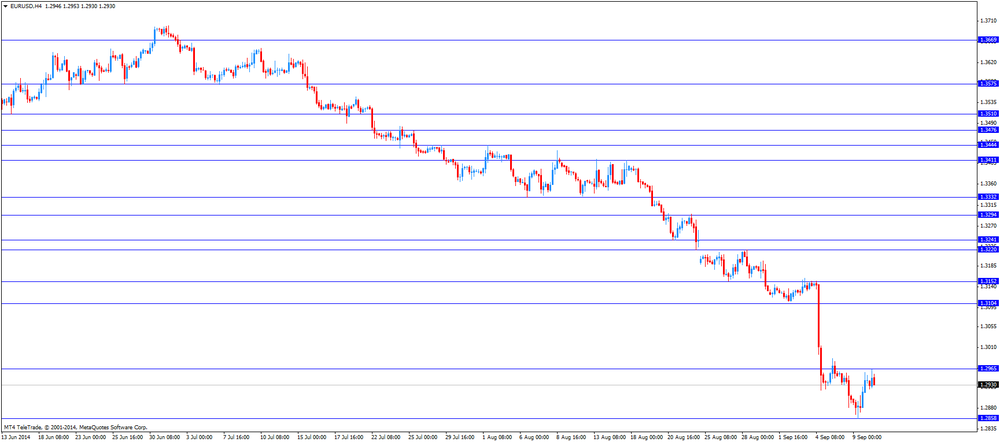

The euro traded mixed against the U.S. dollar. France's industrial production rose 0.2% in July, beating forecasts of a 0.4% decline, after a 1.2% rise in June. June's figure was revised down from a 1.3% gain.

On a yearly basis, France's industrial production climbed 0.1% in July, after a 0.4% drop in June.

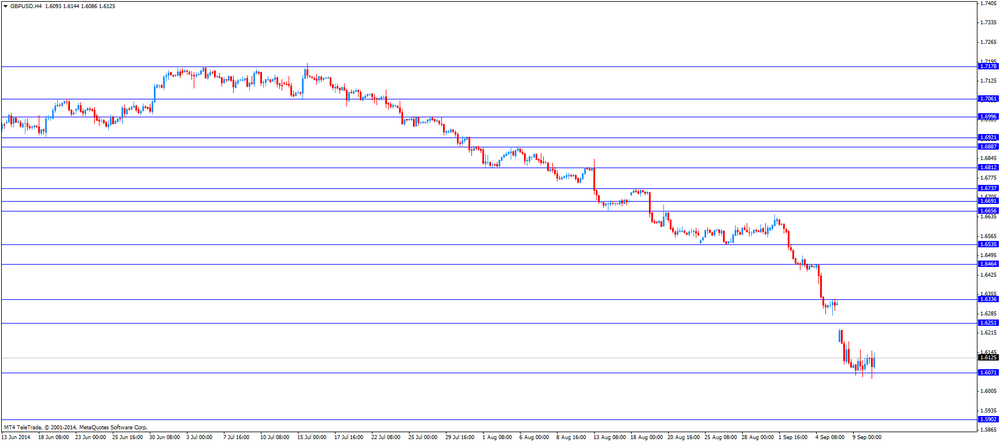

The British pound traded mixed against the U.S. dollar. A weekend Scotland's independence poll still weighed on the pound. The poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

The Bank of England Governor Mark Carney will speak before Parliament's Treasury committee later in the day.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y106.80

The most important news that are expected (GMT0):

13:45 United Kingdom Inflation Report Hearings

21:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:50 Japan BSI Manufacturing Index Quarter III -13.9% -10.3%