- Foreign exchange market. Asian session: the New Zealand dollar declined against the U.S dollar after the Reserve Bank of New Zealand's interest rate decision

Notícias do Mercado

Foreign exchange market. Asian session: the New Zealand dollar declined against the U.S dollar after the Reserve Bank of New Zealand's interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia Consumer Inflation Expectation September +3.1% +3.5%

01:30 Australia Unemployment rate August 6.4% 6.3% 6.1%

01:30 Australia Changing the number of employed August -4.1 +15.2 +121.0

01:30 China PPI y/y August -0.9% -1.1% -1.2%

01:30 China CPI y/y August +2.3% +2.2% +2.0%

02:00 China New Loans August 385 710

06:00 Germany CPI, m/m (Finally) August 0.0% 0.0% 0.0%

06:00 Germany CPI, y/y (Finally) August +0.8% +0.8% +0.8%

06:45 France CPI, m/m August -0.3% +0.4% +0.5%

06:45 France CPI, y/y August +0.5% +0.5% +0.5%

08:00 Eurozone ECB Monthly Report

The U.S. dollar traded mixed to higher against the most major currencies on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

The New Zealand dollar declined against the U.S dollar after the Reserve Bank of New Zealand's interest rate decision. The Reserve Bank of New Zealand (RBNZ) kept its interest rate unchanged at 3.50%. This decision was widely expected by analysts.

The RBNZ Governor Graeme Wheeler said the strength of the kiwi is still "unjustified and unsustainable". He added that the central bank expects further significant depreciation.

Mr. Wheeler signalled that he will wait with future interest rates.

The Australian dollar traded higher against the U.S. dollar after the better-than-expected labour market data from Australia. Australia's economy added 121,000 jobs in August, beating expectations for a gain of 15,200 jobs, after a decline of 4,100 jobs in July. July's figure was revised down from a 300 drop.

Australia's unemployment rate fell to 6.1% in August from 6.4% in July, beating forecasts for a decrease to 6.3%.

The Melbourne Institute's inflation expectations for Australia in the next 12 months climbed to 3.5% in August from 3.1% in July.

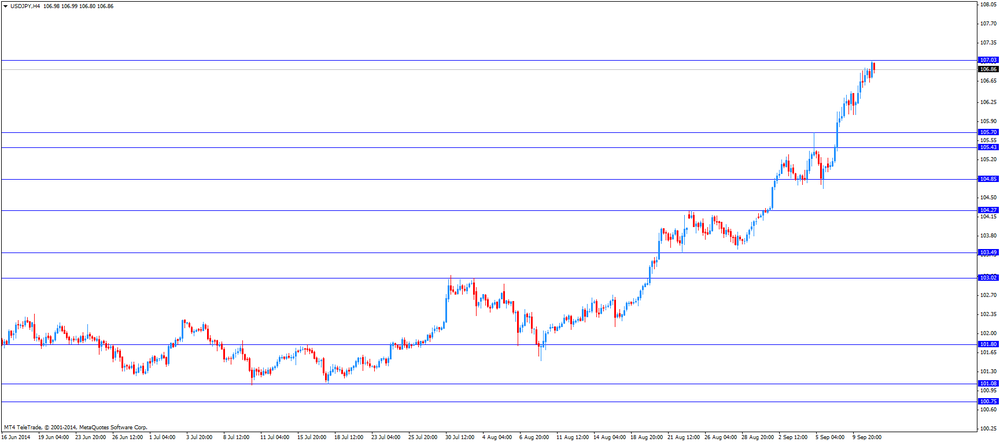

The Japanese yen fell against the U.S. dollar as the Bank of Japan (BoJ) Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

The BSI manufacturing index climbed to a seasonally adjusted annual rate of 12.7 in the third quarter from a decline of 13.9% in the previous quarter. Analysts had expected the index to increase to -10.3.

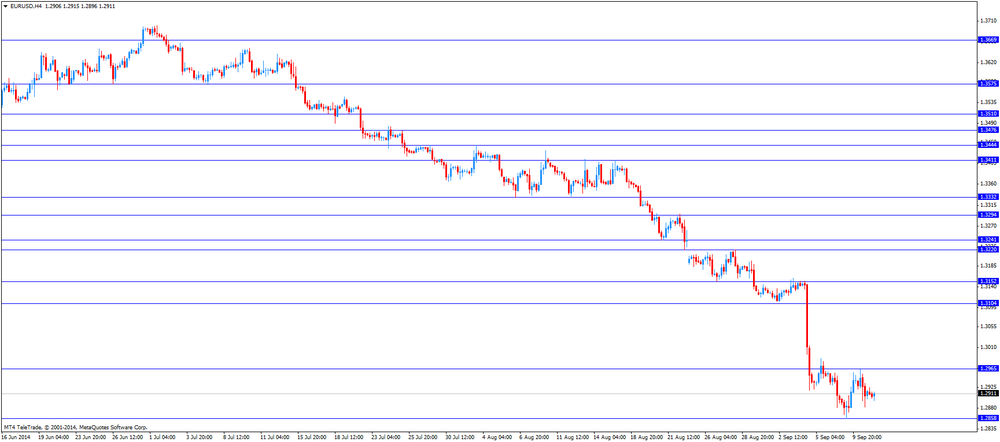

EUR/USD: the currency pair fell to $1.2901

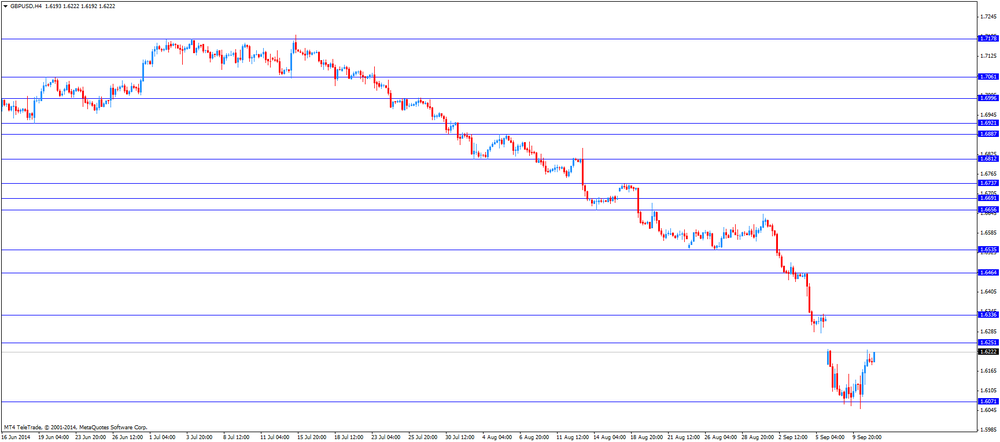

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose Y107.03

NZD/USD: the currency pair declined to $0.8177

The most important news that are expected (GMT0):

12:30 Canada New Housing Price Index July +0.2% +0.2%

12:30 U.S. Initial Jobless Claims September 302 306

22:30 New Zealand Business NZ PMI August 53.0