- Foreign exchange market. European session: the British pound traded higher against the U.S. dollar as a Wednesday Scotland's independence poll showed 53% said "no" to independence

Notícias do Mercado

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar as a Wednesday Scotland's independence poll showed 53% said "no" to independence

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia Consumer Inflation Expectation September +3.1% +3.5%

01:30 Australia Unemployment rate August 6.4% 6.3% 6.1%

01:30 Australia Changing the number of employed August -4.1 +15.2 +121.0

01:30 China PPI y/y August -0.9% -1.1% -1.2%

01:30 China CPI y/y August +2.3% +2.2% +2.0%

02:00 China New Loans August 385 710

06:00 Germany CPI, m/m (Finally) August 0.0% 0.0% 0.0%

06:00 Germany CPI, y/y (Finally) August +0.8% +0.8% +0.8%

06:45 France CPI, m/m August -0.3% +0.4% +0.5%

06:45 France CPI, y/y August +0.5% +0.5% +0.5%

08:00 Eurozone ECB Monthly Report

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims in the U.S. The number of initial jobless claims in the U.S. is expected to rise by 4,000 to 306,000.

The greenback remained supported on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

The euro traded higher against the U.S. dollar. German consumer price index remained flat in August.

French consumer price index climbed 0.5% in August, exceeding expectations for a 0.4% increase, after a 0.3% decline in July.

The British pound traded higher against the U.S. dollar as a Wednesday Scotland's independence poll showed 53% said "no" to independence.

Comments by the Bank of England Governor Mark Carney also supported the pound. Mark Carney said on Wednesday that the central bank could start to hike its interest rate in the coming months.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian new housing price index. The Canadian new housing price index is expected to increase 0.2% in July.

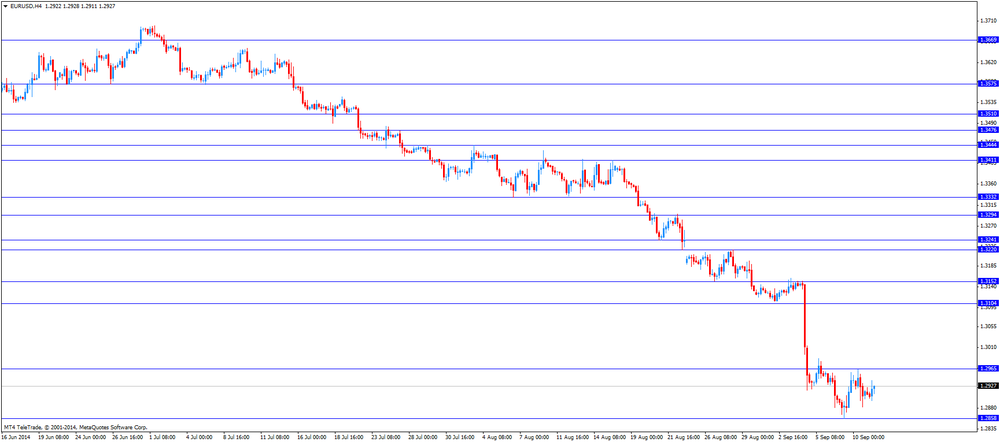

EUR/USD: the currency pair increased to $1.2939

GBP/USD: the currency pair rose to $1.6263

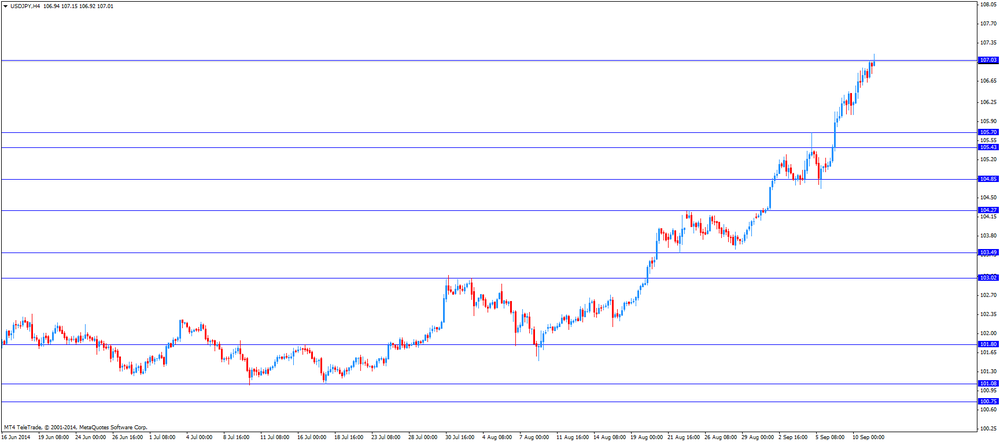

USD/JPY: the currency pair climbed to Y107.15

The most important news that are expected (GMT0):

12:30 Canada New Housing Price Index July +0.2% +0.2%

12:30 U.S. Initial Jobless Claims September 302 306

22:30 New Zealand Business NZ PMI August 53.0