- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the consumer inflation data from the Eurozone

Notícias do Mercado

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the consumer inflation data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:45 New Zealand Current Account Quarter II 1.41 -1.04 -1.06

10:30 United Kingdom Average Earnings, 3m/y July -0.2% +0.5% +0.6%

10:30 United Kingdom Average earnings ex bonuses, 3 m/y July +0.6% +0.7%

10:30 United Kingdom Claimant count August -37.4 Revised From -33.6 -29.7 -37.2

10:30 United Kingdom Claimant Count Rate August 3.0% 2.9%

10:30 United Kingdom ILO Unemployment Rate July 6.4% 6.3% 6.2%

10:30 United Kingdom Bank of England Minutes

11:00 Eurozone Harmonized CPI August -0.7% +0.1%

11:00 Eurozone Harmonized CPI ex EFAT, Y/Y August +0.8% +0.9%

11:00 Eurozone Harmonized CPI, Y/Y (Finally) August +0.3% +0.3% +0.4%

11:00 Switzerland Credit Suisse ZEW Survey (Expectations) September 2.5 -7.7

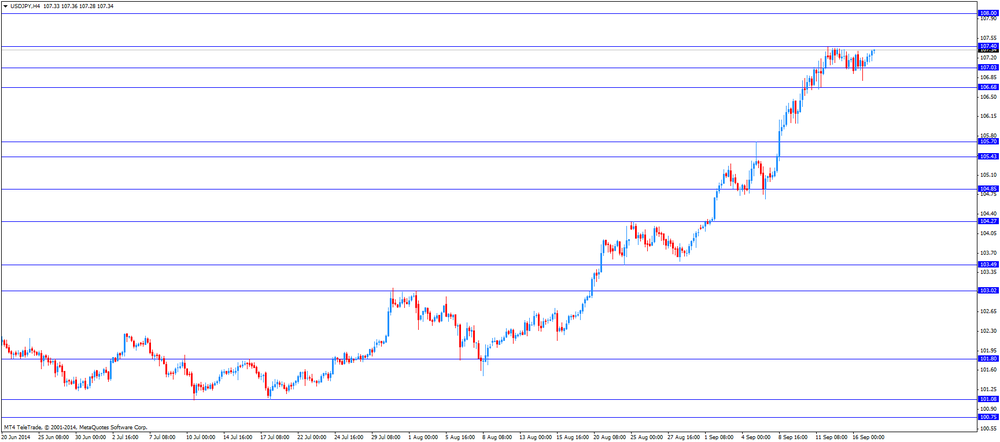

The U.S. dollar traded mixed against the most major currencies ahead of the Fed's interest rate decision. Market participants expect the Fed will cut its asset purchase program by another $10 billion. Market participants also speculate the Fed will start to hike its interest rate sooner than expected.

The U.S. consumer price index is expected to rise 0.1% in August, after a 0.1% increase in July.

The U.S. consumer price index excluding food and energy is expected to climb 0.2% in August, after a 0.1% gain in July.

The NAHB housing market index is expected to increase to 56 in September from 55 in August.

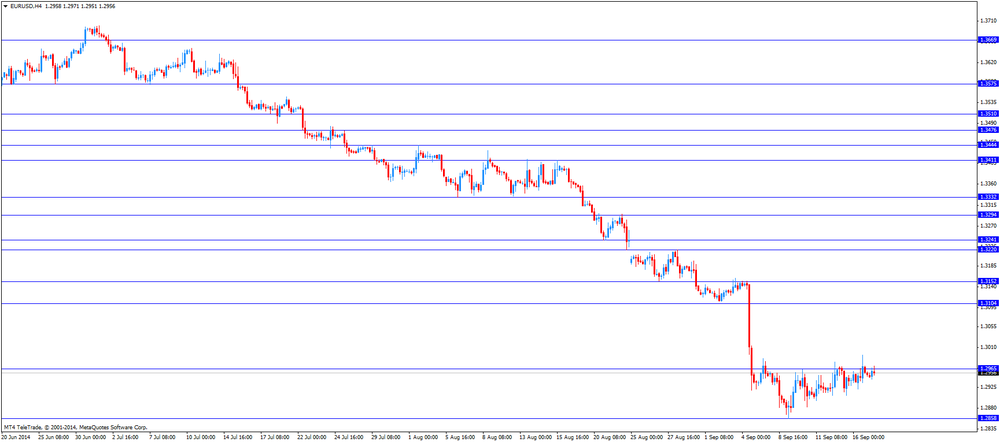

The euro traded mixed against the U.S. dollar after the consumer inflation data from the Eurozone. Eurostat said today consumer price inflation was revised up to an annual rate of 0.4% in August from a preliminary reading of 0.3%.

Eurozone's consumer price index excluding food, energy, alcohol, and tobacco costs increased 0.9% in August.

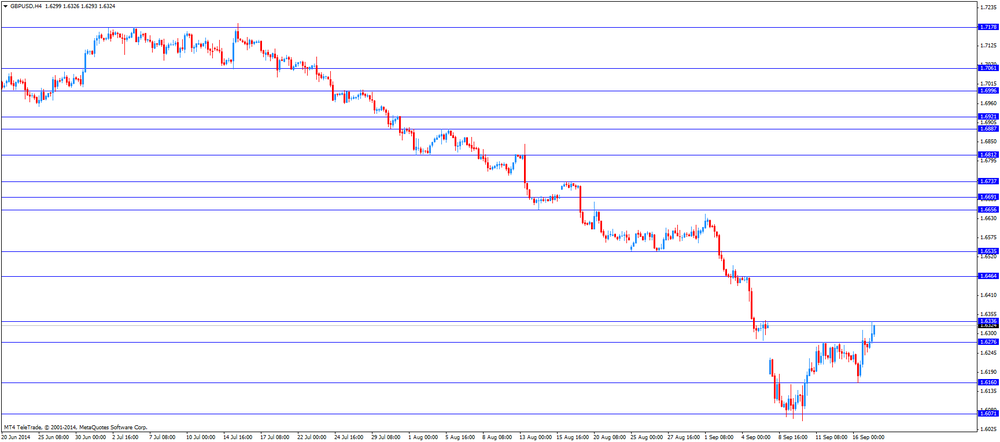

The British pound traded higher against the U.S. dollar after the better-than-expected unemployment rate from the U.K. The unemployment rate in the U.K. fell to 6.2% in July from 6.4% in June, beating expectations for a decline to 6.3%. That was the lowest level since late 2008.

The average earnings index including bonuses increased 0.6% in the three months to July, beating forecast of a 0.5% rise, after a 0.1% decline in the three months to June. June's figure was revised up from a 0.2% drop.

The average earnings index excluding bonuses climbed 0.7% in the three months to July, after a 0.7% gain in the three months to June. June's figure was revised up from a 0.6% increase.

Two members of Bank of England's Monetary Policy Committee, Ian McCafferty and Martin Weale, voted for the second consecutive month to raise interest rates to 0.75% from 0.5%.

Scotland's independence referendum on Thursday continued to weigh on the pound.

The Swiss franc traded mixed against the U.S. dollar. Swiss ZEW Economic Sentiment Index declined to -7.7 in September from 2.5 in August. That was the first negative reading since January 2013.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.6335

USD/JPY: the currency pair increased to Y107.36

The most important news that are expected (GMT0):

14:30 U.S. Current account, bln Quarter II -111 -114

14:30 U.S. CPI, m/m August +0.1% +0.1%

14:30 U.S. CPI, Y/Y August +2.0%

14:30 U.S. CPI excluding food and energy, m/m August +0.1% +0.2%

14:30 U.S. CPI excluding food and energy, Y/Y August +1.9%

16:00 U.S. NAHB Housing Market Index September 55 56

20:00 U.S. FOMC Economic Projections

20:00 U.S. FOMC Statement

20:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

20:00 U.S. FOMC QE Decision 25 15

20:30 U.S. Federal Reserve Press Conference