- Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar after the solid economic data from Australia and despite the weaker-than-expected economic data from China

Notícias do Mercado

Foreign exchange market. Asian session: the Australian dollar traded higher against the U.S. dollar after the solid economic data from Australia and despite the weaker-than-expected economic data from China

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia New Motor Vehicle Sales (MoM) September -1.6% +2.9%

00:30 Australia New Motor Vehicle Sales (YoY) September -3.5% +0.8%

01:30 China PPI y/y September -1.2% -1.4% -1.8%

01:30 China CPI y/y September +2.0% +1.7% +1.6%

04:30 Japan Industrial Production (YoY) (Finally) August -0.7% -0.7% -3.3%

04:30 Japan Industrial Production (MoM) (Finally) August -1.5% -1.5% -1.9%

06:00 Germany CPI, y/y (Finally) September +0.8% +0.8% +0.8%

06:00 Germany CPI, m/m (Finally) September 0.0% 0.0% 0.0%

07:00 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom Average earnings ex bonuses, 3 m/y August +0.8% Revised From +0.7% +0.8% +0.9%

08:30 United Kingdom Average Earnings, 3m/y August +0.6% +0.7% +0.7%

08:30 United Kingdom ILO Unemployment Rate August 6.2% 6.1% 6.0%

08:30 United Kingdom Claimant count September -33.2 Revised From -37.2 -34.2 -18.6

08:30 United Kingdom Claimant Count Rate September 2.9% 2.8%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) October -7.7 -12.0 -30.7

The U.S. dollar traded mixed against the most major currencies on comments. No major economic reports were released in the U.S. yesterday. The demand for the greenback was supported by the weak economic data from the U.K. and the Eurozone.

The New Zealand dollar traded mixed against the U.S. dollar in the absence of any major market reports from New Zealand.

Chinese economic data was weaker than expected. China's consumer price index declined to 1.6% in September from 2.0% in August, missing expectations for a decline to 1.7%.

China's producer price index dropped to 1.8% in September from a decline of 1.2% in August, missing expectations for a decrease to 1.4%.

The Australian dollar traded higher against the U.S. dollar after the solid economic data from Australia and despite the weaker-than-expected economic data from China. The Westpac consumer confidence in Australia increased 0.9% in October, after a 4.6% fall in September.

New motor vehicle sales in Australia rose 2.9% in September, after a 1.6% decline in August. August's figure was revised up from a 1.8% decrease.

The Japanese yen traded mixed against the U.S. dollar. Japan's industrial production declined 1.9% in August, after a 1.5% drop in July. Analysts had expected a 1.5% decrease.

Japanese Economics Minister Akira Amari said in parliament that the government does not want to intentionally weaken the yen, and any negative impact from rising import prices should be closely monitored.

EUR/USD: the currency pair traded mixed

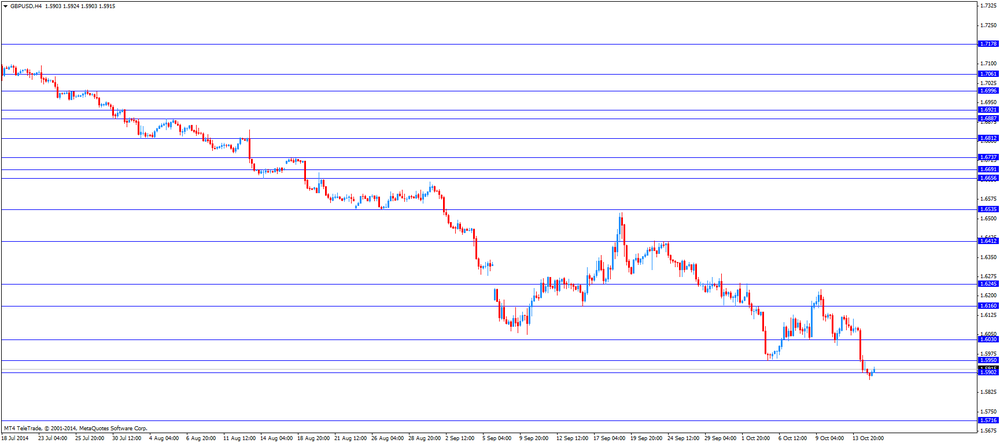

GBP/USD: the currency pair traded mixed

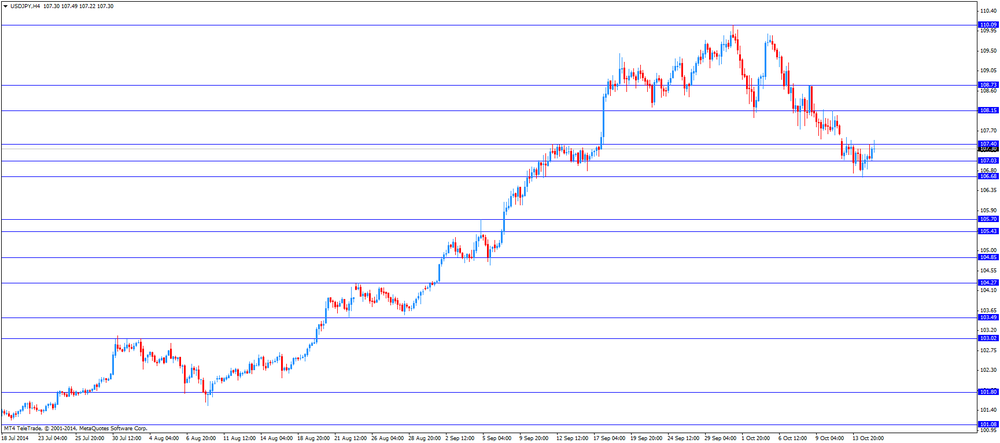

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. PPI, m/m September 0.0% +0.1%

12:30 U.S. Retail sales September +0.6% -0.1%

12:30 U.S. Retail sales excluding auto September +0.3% +0.2%

12:30 U.S. PPI, y/y September +1.8% +1.7%

12:30 U.S. PPI excluding food and energy, m/m September +0.1% +0.1%

12:30 U.S. PPI excluding food and energy, Y/Y September +1.8% +1.7%

12:30 U.S. NY Fed Empire State manufacturing index September 27.5 20.3

14:00 U.S. Business inventories August +0.4% +0.4%

18:00 Eurozone ECB President Mario Draghi Speaks

18:00 U.S. Fed's Beige Book

21:30 New Zealand Business NZ PMI September 56.5