- Foreign exchange market. European session: the euro fell against the U.S. dollar after the release of Eurozone’s inflation data

Notícias do Mercado

Foreign exchange market. European session: the euro fell against the U.S. dollar after the release of Eurozone’s inflation data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation September +3.5% 3.4%

02:00 Australia RBA Assist Gov Debelle Speaks

02:00 China New Loans September 703 750 857.2

05:45 Switzerland SECO Economic Forecasts Quarter IV

09:00 Eurozone Harmonized CPI September +0.1% +0.4% +0.4%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) September +0.3% +0.3% +0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y September +0.7% +0.7% +0.8%

09:00 Eurozone Trade Balance s.a. August 12.7 Revised From 12.2 13.5 15.8

10:00 Eurozone ECB's Jens Weidmann Speaks

12:00 U.S. FOMC Member Charles Plosser Speaks

The U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decline by 1,000 to 286,000.

The U.S. industrial production is expected to rise 0.4% in September, after a 0.1% decline in August.

The Philadelphia Fed manufacturing index is expected to decrease to 19.9 in October from 22.5 in September.

The NAHB housing market index is expected to remain unchanged at 59 in October.

The euro fell against the U.S. dollar after the release of Eurozone's inflation data. Eurostat confirmed on Thursday that the consumer price inflation in the Eurozone was at annual rate of 0.3% in September, in line with expectations, down from 0.4% in August. That was the lowest inflation since October 2009.

Eurozone's consumer price index excluding food and energy was at annual rate of 0.8% in September, up from the previous reading of 0.7%. Analysts had expected the consumer price index excluding food and energy to rise 0.7%.

Eurozone's trade surplus climbed to 15.8 billion euros in August from 12.7 billion euros in July. July's figure was revised up from 12.2 billion euros. Analysts had expected the trade surplus to increase to 13.5 billion euros.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar. The State Secretariat for Economics (SECO) lowered its growth forecasts for Switzerland to 1.8% from 2.0% for 2014 and to 2.4% from 2.6% for 2015. The cut was caused by the slowdown in Europe.

The Canadian dollar declined against the U.S. dollar ahead the Canadian economic data. The Canadian manufacturing shipments are expected to decline 1.6% in August, after a 2.5% gain in July.

Foreign securities purchases in Canada are expected to climb by C$4.31 billion in August, after a C$5.30 billion rise in July.

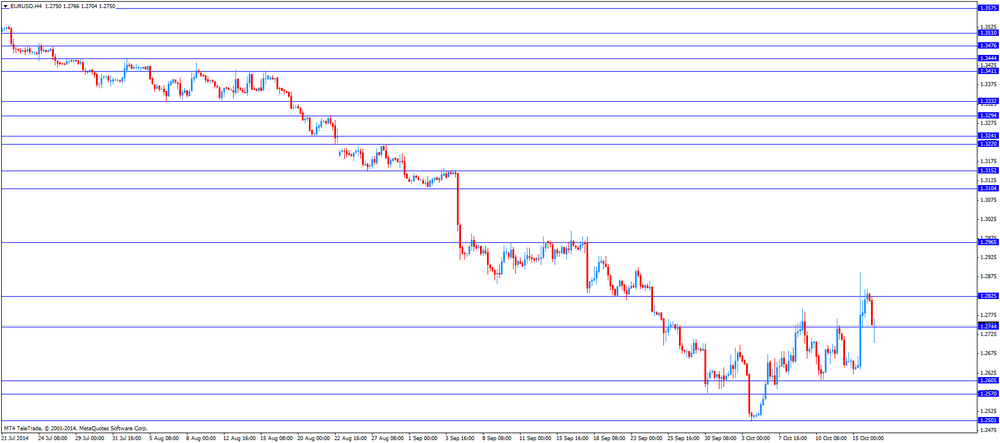

EUR/USD: the currency pair fell to 1.2704

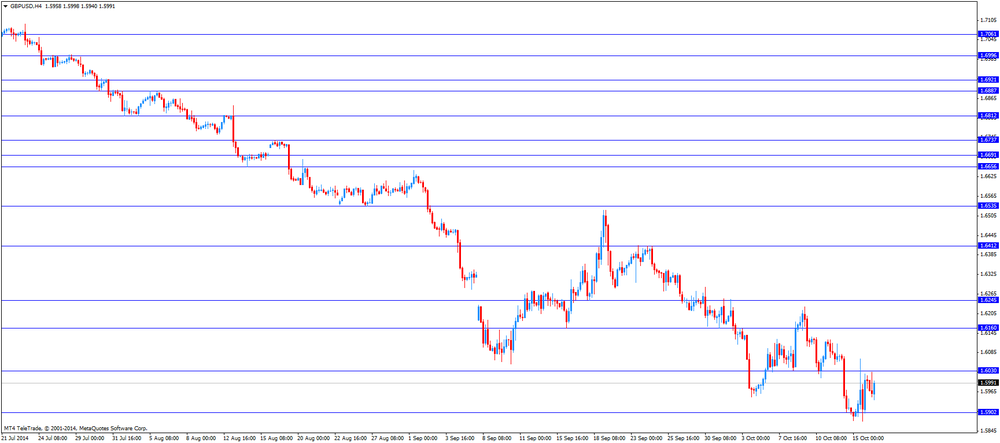

GBP/USD: the currency pair traded mixed

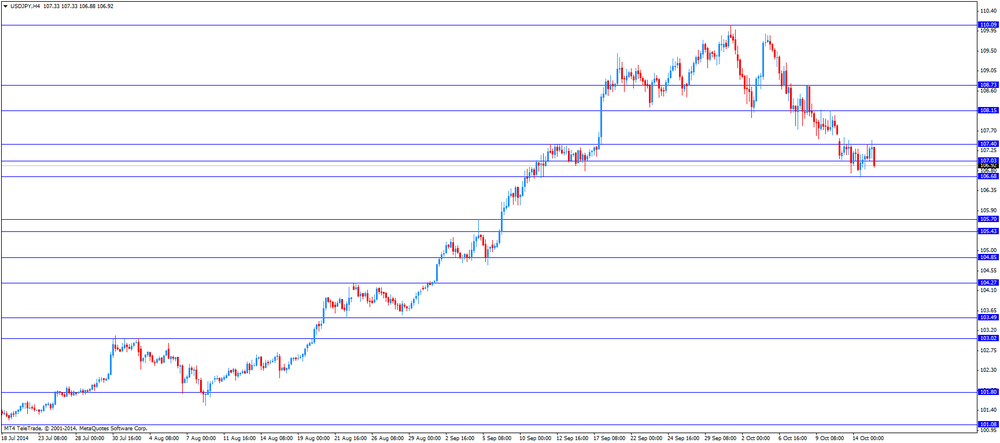

USD/JPY: the currency pair declined to Y105.50

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) August +2.5% -1.6%

12:30 Canada Foreign Securities Purchases July 5.30 4.31

12:30 U.S. Initial Jobless Claims October 287 286

13:15 U.S. Industrial Production (MoM) September -0.1% +0.4%

13:15 U.S. Capacity Utilization September 78.8% 79.0%

14:00 U.S. Philadelphia Fed Manufacturing Survey October 22.5 19.9

14:00 U.S. FOMC Member Narayana Kocherlakota

14:00 U.S. NAHB Housing Market Index October 59 59

20:00 U.S. Net Long-term TIC Flows August -18.6 23.3

20:00 U.S. Total Net TIC Flows August 57.7