- Оil fell

Notícias do Mercado

Оil fell

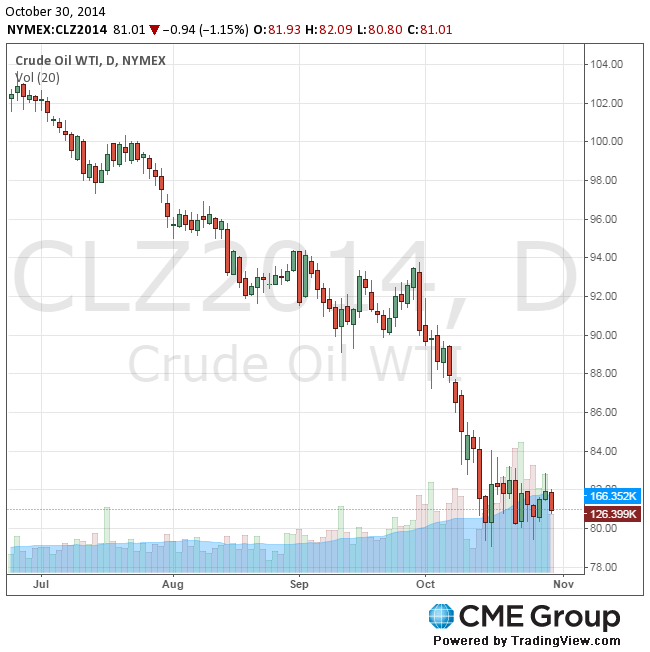

West Texas Intermediate oil fell after the Federal Reserve ended its asset-purchase program and U.S. crude production surged to the highest level since the 1980s. Brent declined in London.

Futures slipped as much as 1.6 percent in New York. The dollar strengthened a second day against the euro after the Fed's announcement, curbing the appeal of commodities priced in the U.S. currency as a store of value. U.S. crude supplies rose for a fourth week as output increased to 8.97 million barrels a day, Energy Information Administration data showed yesterday.

"Yesterday's Fed announcement is pushing the dollar higher, which is putting selling pressure on commodities," Gene McGillian, an analyst and broker at Tradition Energy in Stamford, Connecticut, said by phone. "The supply build yesterday may have been smaller than expected but it was still quite large. Ample supply and economic worry are going to continue to weigh on the market."

WTI for December delivery dropped $1.26, or 1.5 percent, to $80.94 a barrel at 9:59 a.m. on the New York Mercantile Exchange. The volume of all futures traded was 24 percent below the 100-day average for the time of day. Prices have decreased 18 percent this year.

Brent for December settlement declined 96 cents, or 1.1 percent, to $86.16 a barrel on the London-based ICE Futures Europe exchange. Volume was 37 percent lower than the 100-day average. The European benchmark crude traded at $5.22 premium to WTI, compared with $4.92 yesterday.